The 3 must-know news stories of the week and What We Think

- Fed tries to reassure without being reassuring

- Germany, a “bazooka”?

- Swiss National Bank rates close to zero

- Chart of the Week: How China adapted its exports to counter tariffs

Fed tries to reassure without being reassuring …

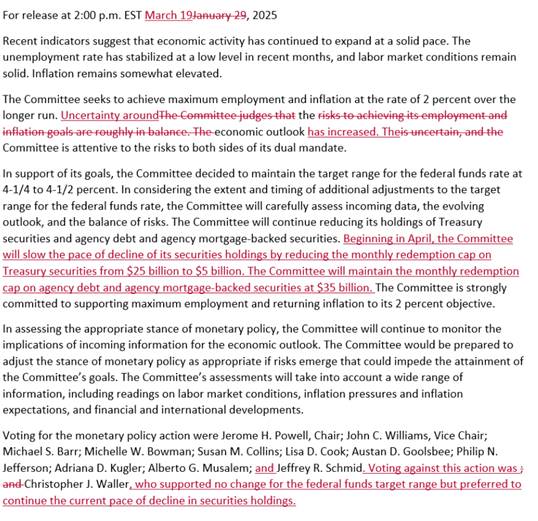

As expected by the markets, the Fed maintained its target range for interest rates unchanged at 4.25/4.50%. The tone adopted by Jerome Powell was marked by considerable caution regarding future monetary policy and the consequences of the Trump administration’s policies. However, he hinted that tariff hikes should mainly have “transitory” effects and that members had incorporated their own perception of this into the upwardly adjusted inflation forecasts. On the other hand, the Fed is modifying its balance sheet policy. It has decided to slow the pace of Quantitative Tightening for the “Treasury securities” segment but not for the “MBS” segment: starting in April, the non-reinvestment of maturing Treasury securities held by the Fed will amount to $5 billion per month, instead of $25 billion per month. The maximum non-reinvestment of MBS remains at $35 billion per month. This decision implies that bond markets would have $180 billion fewer Treasury securities to absorb than previously expected in 2025. According to J. Powell, this adjustment mainly allows the Fed to continue reducing liquidity in circulation (bank reserves are still considered “ample” according to the Fed), but with a reduced risk of triggering episodes of tension as the target level is approached, especially in the event of a debt ceiling increase. It is worth noting that Chris Waller disagrees with the QT decision..

The FOMC statement contains a notable change: it no longer states that risks to the two mandates are balanced but instead mentions that “uncertainty about the economic outlook has increased.” Growth forecasts have been lowered across all horizons (1.7% for 2025, 1.8% for 2026 and 2027), while “core PCE” inflation forecasts have been revised upward for 2025, from 2.5% to 2.8%, but remain unchanged for 2026 and 2027. Jerome Powell repeatedly emphasized that uncertainty has increased significantly. According to him, this has been felt primarily in sentiment surveys rather than in hard data. While Powell acknowledged that the labor market remains resilient, he characterized it by noting that both hiring and layoffs are low and that a deterioration in activity could manifest “fairly quickly.” He stressed that analyzing inflation data this year will be particularly challenging and noted that the probability of a recession has risen but remains low. Data on unemployment claims continue to depict a labor market that is slightly less tight compared to recent years, but not one that is weakening significantly.

Key Changes in the Statement

Our View: During his press conference, Jerome Powell attempted to reassure by delivering several dovish signals, but he emphasized the sharp rise in uncertainty, which could weigh on economic activity and the labor market, while downplaying the potential inflation increase linked to tariff hikes.Even though this is not our central scenario for now, the risk of stagflation in the United States could gradually materialize. Donald Trump appears determined to push long-term rates lower, and paradoxically, current market conditions are reinforcing his position. The cautious stance adopted by the institution persists in an uncertain economic environment. Although markets were reassured by the Fed’s updated economic forecasts, several concerns remain: Inflation forecasts have been significantly revised upward, Growth forecasts have been lowered to 1.5% (compared to 2.1% previously),the risk balance has deteriorated, with an increased likelihood of economic slowdown and rising unemployment.

Jerome Powell nonetheless reminded that tariff hikes should have mainly “transitory” effects. The term “transitory” was previously used in 2022 with questionable credibility. U.S. consumer spending is expected to deteriorate, particularly due to declining confidence indicators. As the effects of Donald Trump’s economic policy decisions become clearer and employment indicators worsen, rate cuts could occur in the second half of the year. This environment should then prove more favorable to U.S. assets. Donald Trump appears determined to push long-term rates lower, and paradoxically, current market conditions are reinforcing his position. We remain underweight on U.S. equities, but we are also lowering our tactical view on global equities, which could suffer from an acceleration of Donald Trump’s trade policy decisions.

Germany, a “bazooka”?

Historic week in the Bundestag. German deputies have adopted, by a two-thirds majority (513 votes in favor, 207 against), the constitutional reform proposed by conservative Friedrich Merz and supported by the Social Democrats (SPD) as well as the Greens. This vote, which marks a major turning point, authorizes the partial lifting of the “debt brake” and unlocks massive public investments. For the future conservative chancellor, this is a significant step forward: “The decision we are making today for the defense of our country is nothing less than the first major step toward a new European defense community.” This reform, dubbed the “budgetary bazooka” by Friedrich Merz, marks a departure from several decades of fiscal orthodoxy. Germany, often seen as a champion of budgetary rigor, will now have significant leeway to finance an ambitious investment and modernization program.

At the heart of this plan is the creation of a special €500 billion fund over twelve years, dedicated to German infrastructure. Roads, bridges, railways, energy networks, hospitals, and daycare centers — the scope is particularly broad. The 16 Länder are not left out: they will now be allowed to incur debt up to 0.35% of GDP (compared to the previous requirement of near-balanced budgets) and will also receive €100 billion of the total €500 billion for their own projects. To win over the Greens, the conservatives and the SPD agreed to allocate €100 billion specifically for climate initiatives. The aim is to accelerate the energy transition alongside investments in transport and defense. The reform primarily affects the well-known “debt brake” rule, enshrined in the German Constitution since 2009. As it stands, this mechanism limits borrowing opportunities to 0.35% of GDP per year. The text adopted in the Bundestag introduces four major changes:

- Partial exemption for defense spending: All defense expenditures exceeding 1% of GDP are now excluded from debt constraints.

- €500 billion special fund: These new borrowings will be spread over twelve years, financing a wide range of infrastructure projects.

- Greater flexibility for the Länder: They will now be allowed to present cumulative deficits of up to 0.35% of GDP.

- Broader definition of defense: A significant portion of spending (around €17 billion per year) can now be reclassified under the “defense” category. This effectively frees up additional budgetary space within the federal budget.

For Berlin, the issue is strategic. Germany is accelerating its rearmament, with an announced ambition to gradually increase its defense spending to nearly 3% or 3.5% of its GDP in the coming years. Ultimately, this would amount to approximately €1.5 trillion invested in the military and defense-related infrastructure. “This is a paradigm shift in defense policy that lies ahead,” emphasized Friedrich Merz, stressing the priority given to equipment orders that are “as European as possible.” The reform must still pass the Bundesrat, the upper house representing the 16 Länder, where a two-thirds majority is again required. However, Bavaria, a regional heavyweight, joined the project earlier this week, which should facilitate the text’s adoption on Friday. Markus Söder, Bavarian Minister-President and leader of the CSU, confirmed that Bavaria would provide its support after reaching a compromise with its local ally, the Free Voters party. This “big bazooka” budget marks a turning point for the eurozone’s largest economy. By investing heavily in its infrastructure and defense, Germany is demonstrating its intent to strengthen its sovereignty while supporting growth. It remains to be seen to what extent Berlin will be willing to take a further step in terms of financial solidarity at the European level, especially after breaking a long-standing taboo on the national front.

German Yields

Our View: In the bond markets, the announcement of this German policy shift has already pushed 10-year Bund yields higher by 40 to 50 basis points. We believe that the rapid rise in yields following Germany’s announcement of its intention to ease the debt brake was exaggerated. The 10-year yield should initially stabilize around 2.6%. The positive economic impacts will take time to materialize, and the risk of disappointment may encourage a pullback in yields from recent highs. We are now positive on German sovereign rates in particular. Additionally, in a portfolio allocation, high-quality European sovereign assets provide meaningful diversification and insurance against a potential U.S. recession risk.Even if inflation is revised slightly upward, this is unlikely to deter the ECB from its rate-cutting trajectory. We believe this outcome is positive for confidence in German assets throughout the year. Greater political stability and the absence of political bargaining by certain parties to maintain government cohesion are reassuring signs for sound budget deficit management. Merz’s stance will continue to benefit German equities overall, particularly industrial and defense stocks. European and Chinese markets have posted solid performances since the start of the year. We remain confident in the continued positive momentum in European markets through 2025, supported by the gradual implementation of stimulus plans and interest rate cuts. ( see :https://news.banquerichelieu.com/en/2025/03/20/in-germany-a-budgetary-bazooka-paves-the-way-for-a-paradigm-shift-in-europe/)

However, in the short term, some uncertainties could emerge:

- The ECB’s anticipated rate cuts are now largely priced into the markets. In this context, Christine Lagarde’s rhetoric could take a more restrictive (“hawkish”) tone due to the potential inflationary impact of the German plan.

- The German stimulus plan is nearly finalized, and part of investors’ enthusiasm is already reflected in asset valuations.

- Since the European plan was unveiled without major surprises, it did not serve as a significant catalyst for the markets.

On the trade front, the European response to Donald Trump’s protectionist measures could reignite certain tensions. Finally, a ceasefire in Ukraine could be a potential positive factor for equity markets. However, for now, discussions seem to be stalling. Although we continue to believe that European equities should outperform tactically, we are now more cautious regarding the momentum of global equities. We recommend taking advantage of rising European bond yields to reposition accordingly.

Swiss National Bank Rates Close to Zero

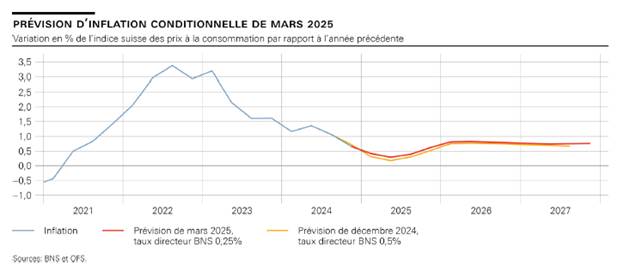

The Swiss National Bank (SNB) has lowered its key interest rate by 25 basis points, bringing it down to 0.25%. “The monetary policy easing decided upon allows the Swiss National Bank to ensure that monetary conditions remain appropriate given the low inflationary pressure and the increased risks of downward inflation revisions. The SNB will continue to closely monitor the situation and will adjust its monetary policy if necessary to ensure that inflation remains within the price stability range in the medium term.” Inflation fell to 0.3% in February, largely due to the drop in electricity prices in January. Overall, inflation continues to be driven mainly by the rising cost of Swiss services. The new conditional inflation forecast remains within the price stability range. On an annual average, it stands at 0.4% for 2025, 0.8% for 2026, and 0.8% for 2027. This forecast assumes the key interest rate will remain constant at 0.25% throughout the forecast period. Inflationary pressure remains relatively high in many economies. However, it is less pronounced than it was just a few quarters ago. As a result, several central banks have once again lowered their key rates.

In its baseline scenario, the Swiss National Bank (SNB) assumes that global economic growth will remain moderate over the coming quarters. Inflationary pressure is expected to continue to ease gradually in the next few quarters, particularly in Europe. However, the situation could change rapidly and significantly, particularly regarding trade policy and geopolitics. The introduction of trade barriers could thus slow global growth. In Switzerland, growth proved solid in the fourth quarter of 2024. The services sector and certain segments of the industry recorded positive developments. Unemployment continued its slight increase, while capacity utilization in the economy remained normal. The SNB forecasts GDP growth of between 1% and 1.5% for 2025. Domestic demand will likely benefit from rising real wages and the easing of monetary policy. Conversely, moderate economic conditions abroad are expected to weigh on foreign trade. In this context, unemployment is expected to rise slightly further. For 2026, the SNB projects GDP growth of around 1.5%.

Our View: Switzerland’s economic outlook has become significantly more uncertain. Given the rising uncertainties surrounding trade policy and geopolitics, the primary risk still stems from developments abroad. Unlike its counterparts, the SNB has continued its monetary easing despite the increasing uncertainty related to the trade war. The central bank justified this decision — which was anticipated by a majority of investors — by citing weak inflation and growing risks that it may continue to decline. Although its president, Mr. Schlegel, stated that following this rate cut — which will have an expansionary effect — the likelihood of further monetary easing is now lower, we anticipate an additional 25 bp rate cut (to 0%) in June. Weak inflation is being sustained by the strength of the Swiss franc, which reduces imported inflation, while domestic inflation has slowed significantly since September. The governor once again did not rule out the possibility of foreign exchange market interventions. However, we believe SNB officials will prioritize an additional rate cut to encourage Swiss franc depreciation. Indeed, relying on foreign exchange interventions risks placing Switzerland on the U.S. list of currency manipulators, a designation Switzerland faced during Donald Trump’s first term. In this context, the Swiss franc is expected to depreciate against the euro. Our year-end target is 0.99.

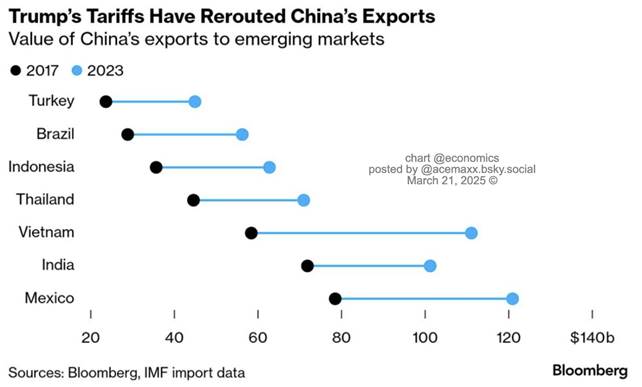

Chart of the Week: How China Adapted Its Exports to Counter Tariffs