The 3 must-know news stories of the week and What We Think

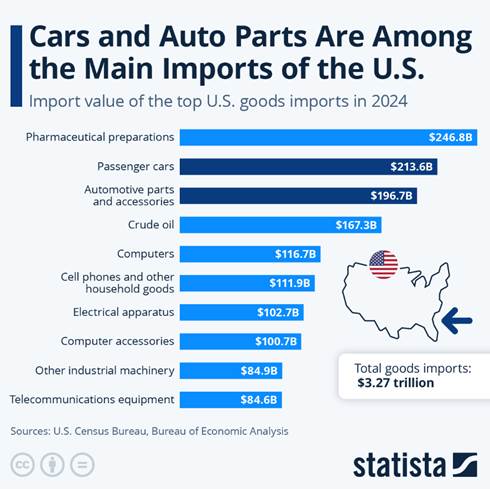

- Trump hits hard: automobiles soon to be taxed at 25% in the United States

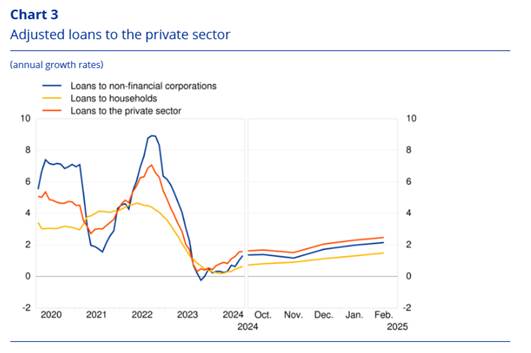

- Eurozone: credit continues to pick up

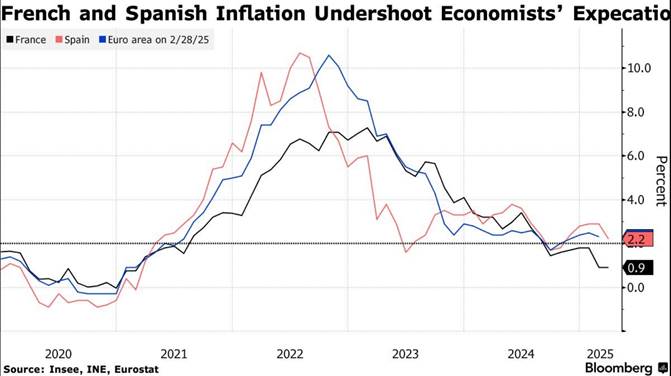

- Good news: inflation is falling in the Eurozone

Chart of the week: U.S. imports by sector

Trump hits hard: automobiles soon to be taxed at 25% in the United States

The news sent shockwaves through the global automotive industry. Starting April 3, all vehicles imported into the United States will be subject to a 25% tariff. This major protectionist shift is triggering a chain reaction in foreign capitals. The announcement came on Wednesday. Donald Trump confirmed the imposition of across-the-board tariffs on cars and light trucks from abroad. This protectionist clampdown is part of a broader offensive against trade deficits. On April 2, Trump is expected to announce a series of “reciprocal” tariffs targeting the main contributors to this deficit. The new automobile taxes will be added to those already imposed on steel, aluminum, and certain Mexican, Canadian, and Chinese products. The main supplier countries—Mexico, Japan, South Korea, Canada, and Germany—see this move as a direct affront. In 2024, U.S. automotive imports reached $474 billion, including $220 billion for passenger cars alone. These partners, historically close to Washington, say they are ready to retaliate.

In Brussels, Ursula von der Leyen denounced the decision as “bad for business, worse for consumers.” In Ottawa, Canadian Prime Minister Mark Carney called it “a direct attack” on Canadian workers. “We will defend our economy—together,” he declared.

The same combative tone echoed in Tokyo. Japanese Prime Minister Shigeru Ishiba warned that “all options” were on the table. Seoul, for its part, promised an emergency response by April to support an already weakened auto industry. From Tokyo, Brazilian President Lula slammed the trade policy as “harmful to all” and announced his intention to bring the matter before the WTO to contest the surcharges imposed on Brazilian steel.

For Trump, these tariffs are a tool to reindustrialize America and fund the tax breaks promised to his voters. But economists are concerned about a boomerang effect on American consumers: rising prices, fewer choices, and production under strain. “These tariffs will drive up production costs and reduce the diversity of supply. The entire U.S. auto ecosystem could suffer, including employment,” warned Jennifer Safavian, president of Autos Drive America, which represents foreign automakers operating in the United States. In a message posted on Truth Social, D. Trump threatened to further raise tariffs if the European Union and Canada coordinated their response.

Our View: As we wrote in the aftermath of the elections, Trump is implementing his agenda forcefully, with little regard for disruptions in the financial markets. His back-and-forth approach undermines the confidence of economic agents and forces central banks to adjust their strategies.

The president has a relatively narrow window of opportunity and is in a hurry:

- His slim majority in the House of Representatives forces him to make deep spending cuts and find significant additional revenue.

- The midterm elections will take place in November 2026, and he must demonstrate the positive effects of his policies on American households—especially in terms of purchasing power and confidence—by the beginning of next year, even at the cost of short-term deterioration.

The date of April 2 is drawing intense attention. The Trump administration’s protectionist measures have multiplied since the start of the year: 25% tariffs on products from Mexico and Canada, an increase from 10% to 25% on steel and aluminum, a 25% hike on the automotive industry, increases on certain Chinese goods… This escalation has been and will continue to be punctuated by partial suspensions and threats against the European Union. U.S. trade partners are now openly considering retaliatory measures. All of this adds to short-term uncertainty.

The American exception—its engine, which had been running at a faster pace than Europe—could slow down more quickly than expected. The retaliation to Donald Trump’s protectionist measures could reignite certain tensions. We remain negative on equities in the short term. U.S. consumption is likely to deteriorate, notably due to declining confidence indicators. As the effects of Donald Trump’s economic policy decisions become clearer and labor market indicators worsen, rate cuts could be seen in the second half of the year. This environment should prove more favorable for U.S. assets.

Eurozone: Credit Continues to Pick Up

Business loans on the rise, solid mortgage lending, and a recovery in the money supply: the latest data released by the ECB confirm a slow but real improvement in financing conditions in the eurozone. Enough to raise hopes for an economic spring—without, however, pushing the central bank into a rate-cutting cycle just yet. Credit continues its rebound in the eurozone. According to figures published Thursday by the European Central Bank, the annual growth rate of total credit to residents rose to +1.7% in February, up from +1.6% in January and +1% in December. These are modest numbers, but they reflect a more favorable momentum for activity. In absolute terms, this represents an additional €48 billion in February. Private sector loans remain the most dynamic, with a year-on-year increase of +2.3%, compared to +2.1% in January. In contrast, loans to public administrations fell by €15 billion, continuing a downward trend that began almost two years ago.

On the business side, signs of improvement are increasing. In February, outstanding loans rose by €14 billion—twice as much as in January. Annual growth now stands at +2.2%, compared to +2% the previous month. Medium- to long-term loans (between 1 and 5 years) are driving the trend, with an additional €6 billion, while short-term loans rose by €4 billion. Among the major eurozone economies, France stands out: business loans there increased by +2.9% year-on-year. In contrast, Italy recorded a contraction of -2%. For households, Spain leads the way (+2.3%), while France lags behind (+0.4%). Household lending remains stable and solid. In February, loans rose by €15 billion, the same pace as in the previous two months. Most of this growth comes from mortgages (+€14 billion), while consumer credit rose by just €1 billion. Total outstanding household debt reached €6.956 trillion, up +1.5% year-on-year.

Monetary indicators confirm the recovery. The M3 aggregate, which includes all available liquidity, accelerated to +4% in February, up from +3.8% in January. Deposits from households and businesses grew by around +3.4 to +3.5%, while investments in non-monetary funds surged to +8.5%. Term deposits slowed to +2%, a sign that savers are turning away from these now less rewarding products. This trend could signal the beginning of a decline in the eurozone savings rate. The momentum is underway, but the engine remains fragile.

Our View: Following Germany’s historic fiscal shift, Europe is beginning to regain control over the future trajectory of its industrial and defense sectors—and its economy. The political climate has significantly improved across Europe, particularly in Germany, where the CDU/CSU’s victory and the adoption of Friedrich Merz’s fiscal stimulus plan have restored confidence. This month marks a historic turning point for Germany. German lawmakers passed, with a two-thirds majority, the constitutional reform spearheaded by conservative leader Friedrich Merz. This vote, a major turning point, allows for a partial suspension of the “debt brake” and unlocks massive public investment. The reform—nicknamed the fiscal “bazooka” by Merz—turns the page on decades of fiscal orthodoxy. Germany, long seen as a champion of budgetary discipline, will now have significant fiscal leeway to fund an ambitious program of investment and modernization. Over the longer term, these measures are expected to have a ripple effect across the entire eurozone. Consensus forecasts a rebound in European growth in 2026, particularly in Germany (+1.5%), France (+1%), Italy (+0.9%), and Spain (+1.9%). In 2025, the recovery will remain modest (0.8% growth in the eurozone), with Europe continuing to lag behind the United States. Notably, Spain remains the dynamic outlier, outperforming the other major continental economies. In the short term, trade tensions could undermine the positive impact of recent announcements. Still, the conditions are in place for a more robust (albeit still mild) recovery, supported by stimulus plans, gradual disinflation, and a more accommodative ECB.

Good News: Inflation Is Falling in the Eurozone

The first national inflation figures for March in Europe were released this Friday, in France and Spain, providing an early indication ahead of the eurozone-wide data expected next week. The inflation trend remains favorably oriented in both Spain and France. The key issue is still the confirmation of a slowdown in service prices, according to the preliminary French data. Inflation in March came in well below forecasts in two of the eurozone’s largest economies, while consumer expectations for price increases remained moderate. The ECB has cut interest rates six times since June, as price pressures appear to be easing due to more modest wage increases.

In France, inflation held steady at 0.9% in March, below the 1.1% forecast. In Spain, the figure dropped to 2.2% from 2.9%, well under the projected 2.6%. These figures suggest that the overall eurozone number, expected on April 1, could also come in below expectations and approach the ECB’s 2% target faster than anticipated. While a large-scale trade war with the United States could disrupt inflation expectations, the ECB has reaffirmed that the primary impact would be on growth. “The effect would be fundamentally on economic activity,” said ECB Vice President Luis de Guindos. Regarding inflation, a trade war would have a negative effect: a tariff is a tax on imported goods, but in the medium term, reduced economic activity would somewhat offset this initial impact. Consumers also appear relatively unconcerned about the impact of geopolitical tensions on prices. The ECB’s survey indicates moderating perceptions of inflation and stable price expectations from consumers.

Last month had already delivered positive signals in this direction, but the slowdown in the services component must continue in the coming months, as some ECB officials—such as Isabel Schnabel—have made it a condition for further monetary easing. While the March cut in key interest rates was a shared decision among ECB members, the path forward is less consensual. In recent weeks, the debate within the European institution has intensified, and the question of a pause in monetary easing is now dividing opinions: some members argue for greater caution given the uncertain context and inflation risks stemming from Trump’s policies. Pierre Wunsch, Governor of the National Bank of Belgium, believes the ECB should consider holding rates steady at the April meeting, while his colleague and Vice President, Luis de Guindos, prefers to keep options open.

Our View: The price momentum appears to have reached a turning point, moving from 2.8% in January to 2.7% in February. Core inflation is also continuing its slow decline. This month, the Governing Council of the European Central Bank approved another rate cut (the sixth in the current cycle and the fifth in a row), reducing the deposit facility rate from 2.75% to 2.50%. At the same time, the Frankfurt institution released new three-year economic projections, revising down its growth forecast for 2025. In both cases, these announcements do not yet factor in the latest fiscal plans under discussion in Germany and at the European level. The general mood is one of a more cautious ECB, concerned about “high uncertainty.” Fiscal policy aimed at investment must be supported by a monetary policy that allows for it. If the fiscal plans are adopted, their multiplier effect will be very gradual. Wage growth in the eurozone has slowed, supporting the ECB’s plans to continue lowering interest rates as inflation eases. As we anticipated, the data reinforce the ECB’s assumption that wage increases should now decelerate, having adjusted in recent years to the inflation surge. This should, in time, lead to a decline in service-sector inflation. We expect two more rate cuts (in April and July), followed by a pause, with a 2% target for the deposit facility rate. If the situation were to deteriorate, additional cuts could follow. To offset the rise in long-term rates with fiscal spending, the ECB is likely to continue lowering short-term rates to restore an upward slope in the yield curve, thereby encouraging credit issuance and supporting economic recovery. The next meeting on April 17 will be key to assessing any shift in stance. The conditions are in place for a more robust (albeit still modest) recovery, supported by stimulus plans, gradual disinflation, and a more accommodative ECB. Earlier this year, we made the decision to overweight eurozone sovereign bonds, in light of the rate increases that were driven largely by fears of contagion from the U.S. Given current yield levels, we remain positive on eurozone fixed-income assets. We are particularly positive on German sovereign yields. Moreover, in a portfolio allocation context, high-quality European sovereign assets provide genuine diversification and protection against a potential U.S. recession.