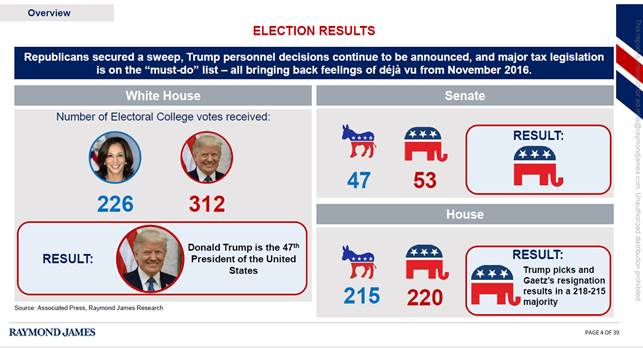

As we wrote in the aftermath of the election, Trump is implementing his agenda in a forceful manner, with little regard for the turmoil in the financial markets. His to-ing and fro-ing is reducing the confidence of economic agents, and forcing central banks to adapt their strategies.

The president has a small window of opportunity and is in a hurry:

- His narrow majority in the House of Representatives forced him to make massive spending cuts and find substantial additional revenue.

- The mid-term elections will take place in November 2026, and he must demonstrate at the start of the next year the positive effects of his policies for the American household in terms of purchasing power and confidence, even if it means creating a sharp short-term downturn.

US economy under pressure: risk of stagflation?

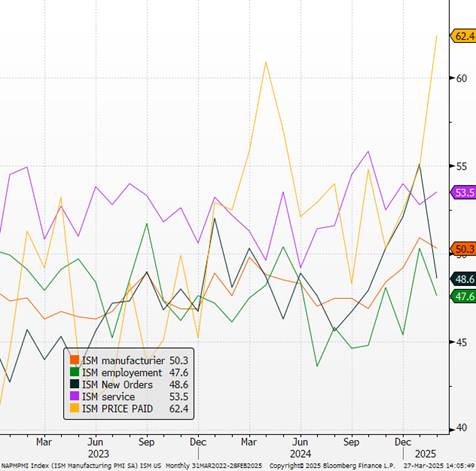

Long the engine of global growth, the US economy is now giving rise to fresh concerns. Recent figures point to a slowdown in consumption and a major disruption to investment due to Donald Trump’s aggressive and unbridled tariff policy. We expect annual US growth to fall to just 1.6%. It should be noted that the US economy’s resilience in 2024 means that we have a growth assumption for 2025 of 1%. A recession is therefore out of the question in raw figures for the year, but the trend is definitely negative. Economic indicators are mixed. The ISM manufacturing index was still at 54 in February, a sign of strong expansion, before slowing sharply in March to 49.7. Conversely, the services sector rebounded, illustrating the volatility of soft data.

ISM US indicators

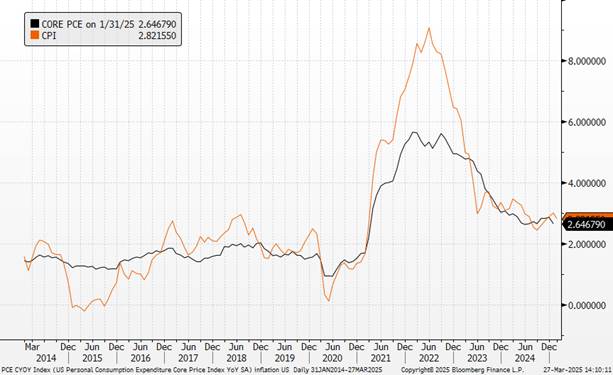

Consumers, for their part, are gradually cutting back on spending, and businesses are increasingly sensitive to rising customs duties. Unusual weather conditions have only exacerbated this climate of uncertainty, dampening demand for leisure activities in certain regions. On the inflation front, the data published for February showed a slight downturn: headline inflation stood at 2.8%, while core inflation (excluding energy and food) also fell to 3.1%. However, these figures do not yet include the impact of a new wave of tariffs, nor that of the dollar’s recent fall. The Federal Reserve is keeping its key rates unchanged at 4.50%. Jerome Powell is concerned about the prevailing uncertainty. His tone was very cautious about the future of monetary policy and the consequences of the Trump administration’s policies. He did suggest, however, that the tariff hikes would mainly have “transitory” effects, and that the members had incorporated their own perceptions on this subject into the upwardly adjusted inflation forecasts. The FOMC statement contains one notable change: it no longer states that the risks on both mandates are balanced, but that “uncertainty about the economic outlook has increased.” For him, this was first felt in opinion surveys and not yet in hard numbers. While Powell did stress that the labor market was resilient, he characterized it by the fact that hiring and firing were low, and that a deterioration in activity could be reflected “fairly quickly”. Jobless claims data continue to show a slightly less tight labor market than in recent years, but not one that is weakening significantly. During his press conference, Jerome Powell tried to reassure by sending out several dovish signals, but he insisted on the sharp rise in uncertainty, likely to penalize activity and the labor market, while downplaying the possible rise in inflation linked to tariff hikes. Even if it’s not our central scenario at the moment, in the United States, the probability of a stagflation scenario is increasing.

US inflation

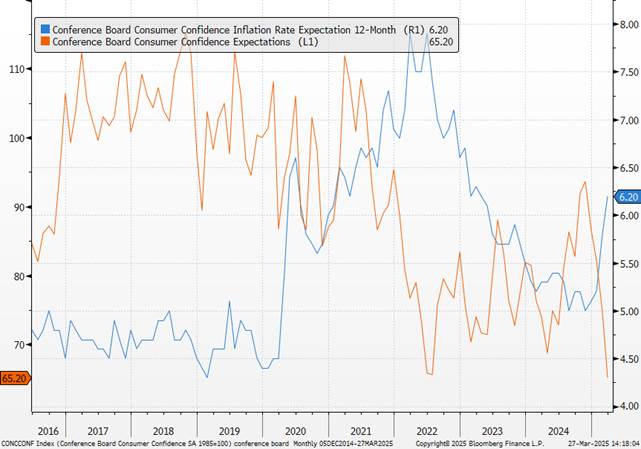

The FED’s wait-and-see stance illustrates an uncertain economic context. However, Jerome Powell reiterated that the inflationary effects of tariff hikes are likely to be mainly “transitory”, with imports accounting for only 15% of US consumption. The term “transitory” has already been used in 2022, with questionable credibility. US consumption is set to deteriorate, not least because of the downturn in confidence indicators. The latest publication from the conference board is fairly symptomatic of the current situation: fear of a return to inflation and falling growth.

Conference Board

On the trade front, the April 2 date is the focus of attention. The Trump administration’s protectionist measures have multiplied since the beginning of the year: tariffs of 25% on products from Mexico and Canada, an increase from 10% to 25% on steel and aluminum, a 25% hike on the automotive industry, increases on certain Chinese goods… This escalation is and will be punctuated by partial suspensions and threats against the European Union. The United States’ trading partners no longer hesitate to consider retaliatory measures. All of this contributes to blurring short-term visibility. The American exception, its driving force, which was operating at a faster pace than Europe, could run out of steam sooner than expected.

Europe: An inflection point?

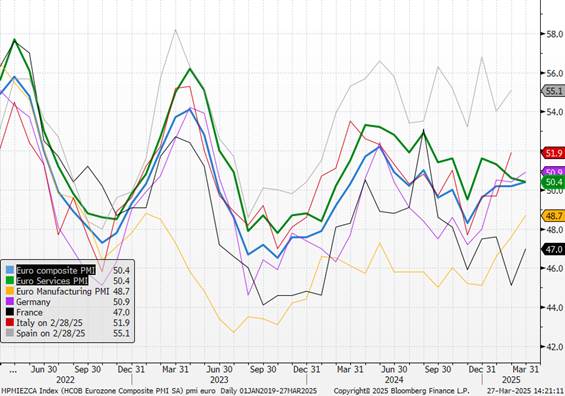

In the run-up to the expected tariff announcements on April 2, Europe remains in a state of uncertainty. Trade tensions, rising long-term interest rates and still hesitant economic activity are weighing on the economy. For Europe, higher tariffs will not be without consequences for inflation and growth. F. Villeroy de Galhau estimated that a 25% increase in US tariffs in Q2 would lead to a 30bp drop in annual growth in the euro zone, while its effects on inflation would be limited. However, medium-term positive factors are beginning to emerge, starting with the German stimulus plan and increased fiscal momentum in the European Union. In short, the short-term risks are many, but the medium-term outlook is improving.

European PMI indicators

After Germany’s historic budgetary turnaround, Europe is regaining control of the future trajectory of its industrial and defense sectors, and of its economy. The political climate has greatly improved in Europe, particularly in Germany, where the victory of the CDU/CSU and the adoption of Friedrich Merz’s fiscal stimulus plan have restored confidence. From a German point of view, this is a historic month. German MPs adopted, by a two-thirds majority, the constitutional reform put forward by the conservative Friedrich Merz and supported by the Social Democrats and the Greens. This vote, which marks a major turning point, authorizes the partial lifting of the “debt brake” and unblocks colossal public investment. This reform, dubbed the “fiscal bazooka” by Friedrich Merz, turned the page on decades of fiscal orthodoxy. Germany, often considered the champion of fiscal rigorism, will now have significant leeway to finance an ambitious investment and modernization program.

In the longer term, these measures should have a knock-on effect on the eurozone as a whole. The consensus is for a rebound in European growth in 2026, particularly in Germany (+1.5%), France (+1%), Italy (+0.9%) and Spain (+1.9%). In 2025, the recovery will remain modest (growth of 0.8% in the Eurozone), and Europe will continue to underperform the United States. Spain remains the dynamic exception, outperforming the continent’s other major economies. In the short term, trade tensions could counteract the positive effects of these announcements.

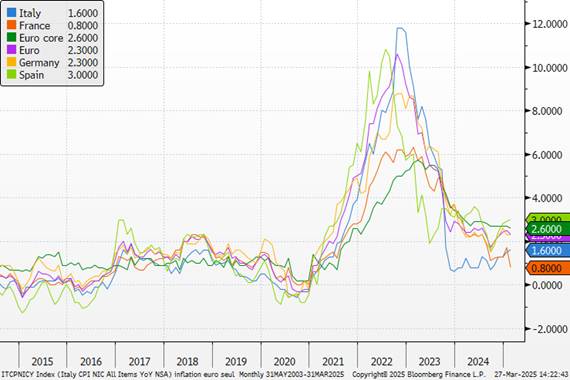

Eurozone inflation

On the inflation front, price dynamics appear to have reached an inflection point, dropping from 2.8% in January to 2.7% in February. Core inflation is also continuing its slow decline. This month, the Governing Council of the European Central Bank approved a further rate cut – the sixth since the start of the series and the fifth in a row – reducing the deposit rate from 2.75% to 2.50%. At the same time, the Frankfurt-based institution published new three-year economic projections, revising downwards its growth forecast for 2025. In both cases, these announcements do not take into account the latest budgetary plans discussed in Germany and at European level. The general mood is that of a more cautious ECB, worried about the “high level of uncertainty”. In its press release, the ECB changed its monetary policy from “still restrictive” to “significantly less restrictive, as rate cuts make new borrowing cheaper for companies and households”. While the ECB is confident that disinflation will continue towards its 2% target, driven by moderate wage pressures among other factors, Christine Lagarde remains very cautious about the outlook for growth, which she deems to be “still on a downward trend”. “The situation changes radically from one day to the next, and the effects of defense investment projects will depend on the details”, she warns.

Fiscal policy aimed at investment needs to be accompanied by a monetary policy that allows it. If the budget plans were adopted, their multiplier effect would be very gradual. Wage growth in the eurozone has slowed, supporting the European Central Bank’s plans to continue cutting interest rates as inflation falls. As we anticipated, this data supports the ECB’s assumption that wage growth should now slow down after adjusting to rising inflation in recent years. This should, in time, lead to a reduction in services inflation. We should see 2 more cuts (April and July), followed by a landing for a 2% target for the deposit facility rate. To compensate for the rise in long rates due to fiscal spending, the ECB is likely to continue cutting short rates, in order to steepen the yield curve and encourage lending, and hence the recovery in activity. The next meeting on April 17 will be decisive in gauging the evolution of its stance. The conditions are ripe for a more robust recovery, driven by stimulus plans, gradual disinflation and a more accommodating ECB.

China: very different from 2017

Despite an ambitious official growth target of 5% for 2025, Beijing is still struggling to convince people of its ability to restore household confidence and revive still-fragile domestic consumption. Doubts remain as to the effectiveness of the new stimulus package unveiled in early March, while trade tensions with the United States intensify and the geopolitical situation in the Taiwan Strait deteriorates. At its traditional “Two Sessions”, China announced a series of far-reaching measures to bolster its economy. In particular, Beijing plans to increase the budget deficit to 4% of GDP and issue 1,300 billion yuan in very long-term special treasury bonds. Local governments will also be authorized to raise 4,400 billion yuan in special debt, accompanied by tax reforms. A fund of 500 billion yuan is earmarked for the recapitalization of large state-owned banks, and a further

300 billion will be devoted to consumer subsidies, particularly in the electric vehicle and household appliance sectors. Adjustments are also planned on the social front, albeit limited. But, as is often the case, observers remain sceptical. For ten years now, Beijing has been promising a transition to a more consumer-oriented growth model. For the time being, the trajectory remains that of an organized soft landing towards a growth model more in keeping with a developed economy. The data confirm a moderate recovery: the manufacturing PMI edged back above the expansion threshold, while services recorded a rebound.

The trade war with the United States poses an additional risk to growth. Since Donald Trump’s return to center stage, tariff hikes have been one after the other: +20% on all Chinese exports to the United States, including 10% imposed in early March. In the face of this turbulence, China is seeking closer ties with Europe. To mark the 50th anniversary of diplomatic relations with the European Union, Beijing reactivated the Comprehensive Agreement on Investment ,which has been frozen since 2021. Chinese official Wang spoke of “new goodwill gestures” to boost trade, including full visa liberalization for OECD countries and better access for foreign companies to Chinese markets.

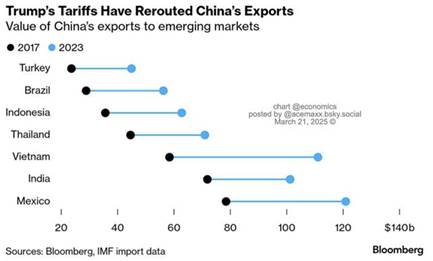

In economic and geopolitical terms, China is no longer the same as it was in 2017 when Donald Trump took power, and has not only acquired negotiating skills it didn’t have then, but has also undergone a technological catch-up that makes the country a serious competitor to American leadership. Trade flows have shifted to other countries. This puts the risk of exporting to these countries less on China.

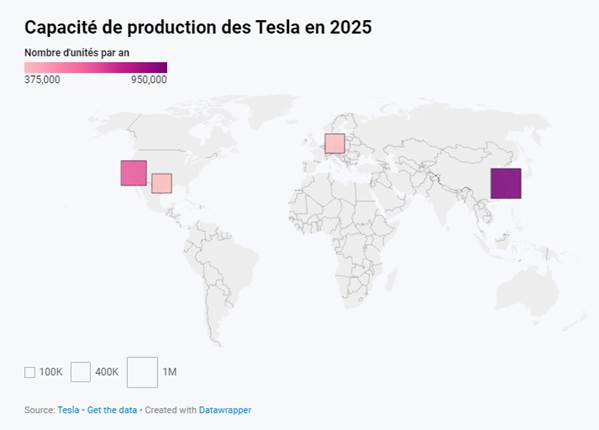

The Deepsick episode, which we’ve looked at at length, is just one example. Electromobility has just changed dimension in China. Less than ten days after lifting the veil on its Super E-Platform 1.0 platform, which many still took to be an ambitious stylistic exercise, BYD has already confirmed the launch of its 1,000 kW superchargers on its territory. A technological feat which, on paper, can recover 400 km of range in… five minutes. The United States is no longer an uncontested leader. What’s more, even if Elon Musk’s pro-China stance is in total contradiction with the Trump administration, there is a close link between him and Beijing that could lead Donald Trump to be more in dialogue with the authorities. At its Shanghai plant inaugurated in 2019, Tesla produces the Model 3 and the Model Y, the small electric SUV that was the world’s best-selling car in 2023. According to the brand’s 2025 figures, the Shanghai site today has a production capacity of over 950,000 cars a year, far ahead of California, Texas and Berlin.

However, in the background, the issue of Taiwan darkens the picture. In recent weeks, relations between Beijing and Taipei have hardened considerably. Taiwanese President William Lai Ching-te delivered a strongly worded speech on March 13, describing mainland China for the first time as a “hostile foreign force”. He also announced a series of measures aimed at strengthening the island’s sovereignty. Beijing immediately denounced these announcements as a provocation, pointing out that formal independence for Taiwan would constitute a “red line” that could lead to an immediate military response. Donald Trump’s alignment with Vladimir Putin’s demands for Ukraine’s capitulation provides China with unexpected arguments.