The 3 must-know news stories of the week and What We Think

- Trump’s Volteface: Not really…

- US–China: Eye for an Eye

- Treasuries Basis Trade: A Risk to U.S. Debt?

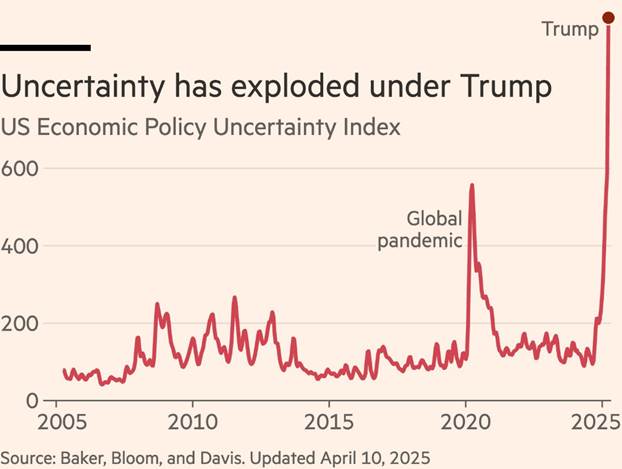

- Chart of the week : no comment

Donald Trump’s Volteface: Not really…

In response to the deteriorating bond market and growing dissent from business leaders and Republican officials, the American president announced a 90-day truce in the implementation of reciprocal tariffs. During this period, all countries affected by these measures last week will see their customs duties reduced to 10%. China, which had responded to the U.S. tariffs with countermeasures amounting to 84%, now faces duties rising to 125%, accused of escalating the situation with the White House occupant. U.S. Treasury Secretary Scott Bessent stated earlier on Wednesday, during a conference at the American Bankers Association, that he believed the Trump administration could reach tariff agreements with U.S. allies. He is preparing to conduct negotiations with more than 70 countries in the oming weeks.

The specific tariffs already in place, notably targeting Canada, Mexico, or the automotive sector, remain unchanged. On financial markets, the reaction was immediate: stock indices rebounded significantly, reflecting investor optimism about the possibility of a compromise between Donald Trump and his trade partners, and a reduction in extreme risks. However, the period of trade tensions is far from over. New specific tariffs may soon be imposed by the American president, particularly in the pharmaceutical sector. The increase in tariffs on China also raises concerns about rising inflation and a slowdown in U.S. economic growth.

After a negotiation phase, the effective tariff rate collected by the U.S. administration is expected to drop sustainably and stabilize around 15% (down from about 26% today). Such a reduction would limit risks to growth and give Donald Trump the opportunity to pass some of his tax cuts thanks to the additional revenue generated by these tariffs. However, with Donald Trump, everything can still change very quickly—on a daily basis. Without action on his part, the risk was that the market would continue to fall and plunge the country into a situation of systemic danger. On Wednesday and Thursday, two auctions were held for 10-year and 30-year U.S. bonds. The risk was one of unprecedented distrust, but they ultimately went well.

From Donald Trump on His Social Network

Our View: Donald Trump’s action appears purely defensive in the face of an extreme risk. The reasons are as follows:

Political:

- Destabilization of the U.S. financial system;

- Link with the April 15 tax deadline and the payment of American taxes (approximately $246 billion to be collected, offering a breath of fresh air to the Treasury);

- Demonstrating additional revenue to Congress.

Geopolitical:

- Short-term focus on China to secure European commitment to a pro-American stance; this will be the key issue in negotiations with Europe during the moratorium.

- We believe there will be an agreement on Ukraine and on rare earths during this same period to ease tensions.

Economic:

- Increased pressure from business leaders, early allies;

- The Fed’s stated intention not to intervene amid economic destabilization.

Financial:

- Breaking the negative spiral (especially in U.S. equities, with many hedging positions unwound);

- Avoiding a bond market crisis as major auctions were scheduled.

Fundamentally, we do not believe this will restore confidence in the United States. Donald Trump’s close allies remain in place, notably Marco Rubio and Howard Lutnick, and this does not alter the underlying scenario. Inflation is expected to remain under upward pressure. We therefore maintain a cautious strategy on equity markets, with a negative outlook on the U.S. market. We continue to have a (relatively) stronger preference for European equities, which should benefit from rate cuts by the ECB and from German and European stimulus plans during the year. We believe equity as an asset class should remain underweighted.

Conversely, our outlook on U.S. Treasury bonds has turned negative since the beginning of the week (see the third point). Furthermore, the decreased likelihood of a recession rules out any acceleration in Fed rate cuts, which should not exceed two at most this year. Lastly, we maintain a very negative view on the dollar, with an initial target range between 1.15 and 1.20.

US–China: Eye for an Eye

Since Wednesday evening, tariffs have reached 145% on one side and 125% on the other. Eye for an eye, tooth for a tooth: economic relations between the world’s two leading powers are deteriorating, raising the risk of recession. While Donald Trump currently seems willing to negotiate with international partners, China is responding firmly. Beijing announced that it would raise tariffs on all American products from 84% to 125% as of April 12 and that it would no longer consider any new increases decided by Washington, deeming the Trump administration’s strategy a “joke.” According to a statement from China’s Ministry of Finance, this decision is a direct response to the White House’s confirmation that tariffs on Chinese goods would rise to 145%. For China, it is no longer viable for the United States to continue imposing new tariffs: “Given that American products are no longer marketable in China at current rates, if the U.S. further tightens its measures on our exports, we will no longer respond to such announcements,” the Ministry of Commerce said.

In this highly tense context, dialogue appears nearly broken. The two countries disagree both in substance and in approach, and do not share the same vision of how potential negotiations should unfold. China, for its part, has adopted a posture of immediate and forceful reaction to every new measure taken by Donald Trump. To offset the loss of several hundred billion euros in exports to the United States, Beijing is seeking new markets. It has moved closer to Australia—so far without much success—and also hopes to strengthen ties with its Asian neighbors. In this regard, Xi Jinping will travel to Malaysia as early as next week. The Chinese regime is also turning toward the European Union and has announced it has begun discussions to enhance cooperation. The Chinese Minister of Commerce held a videoconference with the European Trade Commissioner. At the same time, Beijing authorities have warned their citizens against traveling to the United States and have advised Chinese students not to pursue their studies in “certain U.S. states,” a clear shift from Xi Jinping’s earlier policy of openness in bilateral exchanges.

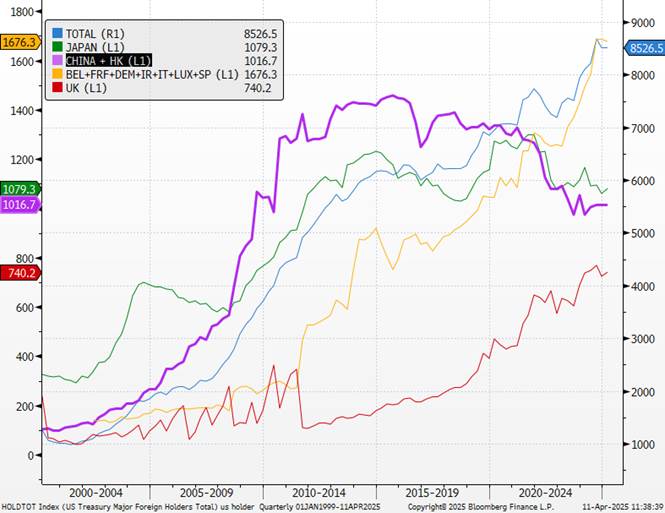

Main Foreign Holders of U.S. Debt

Our View: Donald Trump’s reversal on the 90-day moratorium granted to most countries except China is far from insignificant. A white paper by the Bank of China, however, mentions the possibility of renewed negotiations, highlighting the real benefits of the U.S.–China trade relationship. See : https://english.news.cn/20250409/7458b316f22944fe9059d229d4d22ed3/c.html

Beyond the already harmful trade tensions, this is also a global power struggle: who will ally with whom? In the short term, the consequences for the global economy are highly negative. China could further threaten to sell off its U.S. sovereign bonds, which would lead to a drop in demand for these securities. China holds a significant portion of U.S. debt. The standoff is intensifying: our view on U.S. Treasuries, particularly on the long end, and on the dollar remains negative. Our current target range is 1.15–1.20 but may be revised.

Treasuries Basis Trade: A Risk to U.S. Debt?

You’ll likely be hearing a lot about a trending new term: the “basis trade.” The basis trade is a strategy used by hedge funds to bet on the spread between the price of Treasury securities in the cash market and the price of futures contracts. Since this spread is often very small, investors typically rely on borrowed funds to amplify their positions—sometimes by as much as 50 to 100 times the capital invested. Recent estimates place the total value of these bets at around $1 trillion, nearly double the level five years ago.

Even though there are variations among different carry trade strategies in the markets, the underlying principle remains broadly the same: profiting from even minimal illiquidity premiums. The smaller the premium, the greater the leverage needed. In the case of Treasuries, which are known for their liquidity, the illiquidity premium is relatively small compared to that of the futures market—thus justifying the use of high leverage.

In the short term, there is a risk to U.S. long-term debt. Several factors contribute to this:

- Growing distrust of Donald Trump

- The risk of soaring inflation in the U.S. (due to rising tariffs)

- The country’s massive financing needs

- Escalating trade tensions

- Foreign investors, who hold significant portions of U.S. debt, becoming increasingly wary

A worrying development appears to be unfolding: U.S. Treasuries, long considered a safe haven during turmoil, are gradually losing their safe asset status. This echoes the unwinding of basis trades at the start of the pandemic, when massive deleveraging caused this popular hedge fund strategy to collapse—leading to a sharp drop in bond prices. Such an event can trigger a domino effect, driving yields higher and even paralyzing the bond market, as seen in 2020.

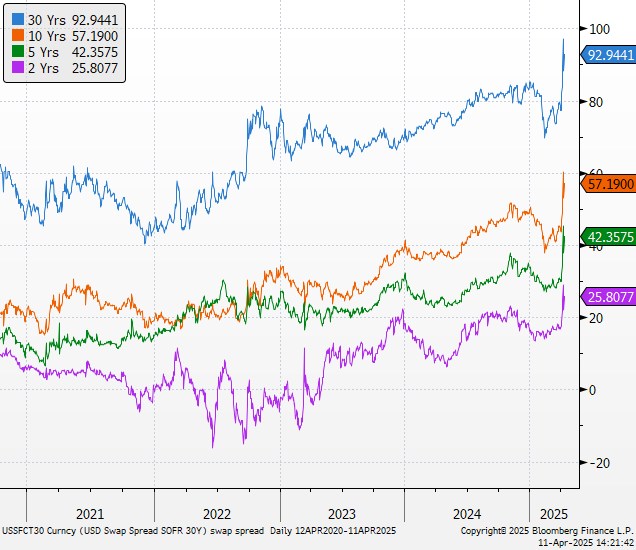

The movement observed at the start of this week is consistent with an unwinding of basis trades on the 30-year maturity, where the bulk of the leverage is concentrated. This could indicate that investors are liquidating their positions, including in assets traditionally seen as high-quality.

Additionally, this week saw a flood of new Treasury issuances:

- $58 billion in 3-year notes

- $39 billion in 10-year notes

- $22 billion in 30-year bonds

These auctions were ultimately well received, showing strong demand from investors, despite a major sell-off in the bond market triggered by the growing trade war between the U.S. and its key partners—most notably China. The results even exceeded expectations, helping to calm the market in the very short term.

Donald Trump’s intervention played a role here, helping to ease risk premiums (as illustrated by swap spreads). Investors using carry strategies—swap spread via interest rate swaps or basis trade via futures—thus benefited from a temporary reprieve.

Swap Spreads (differential between Treasuries and interest rate swaps.)

Our View: The risk could quickly resurface regarding the appeal of long-term U.S. debt. Since 2020, regulators have been closely monitoring basis trades, as the high market volatility that year triggered margin calls on Treasury futures and increased funding pressures in the repo market. At the time, the Fed intervened massively, purchasing trillions of dollars in bonds and providing emergency repo funding. But 2025 is not 2020, and the Fed may be less inclined to step in again with such forceful measures. Moreover, Donald Trump is reportedly pressuring Jerome Powell to take action, which could hasten a Treasury crisis and further worsen the situation. To assess liquidity stress in the markets, we are closely watching swap spreads across all maturities. The risk remains present, and another wave of stress could trigger even larger unwinding of Treasury basis trade strategies. Meanwhile, Treasury Secretary Scott Bessent has stated that there is nothing systemic in this “uncomfortable but normal deleveraging” affecting the bond market. According to him, once leverage is sufficiently reduced, the market will stabilize. Still, the overall atmosphere remains tense, revealing that panic was not far off. And it’s not Trump who will ease the pressure—it will be J. Powell, once he decides to act.