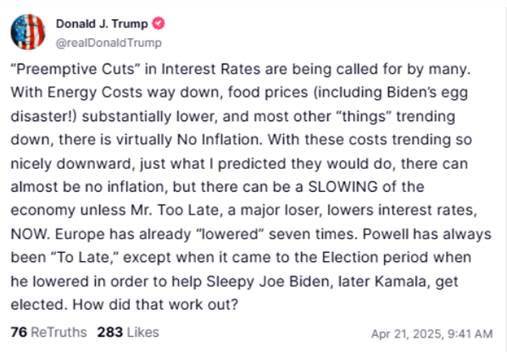

Donald Trump has recently launched a scathing attack on the monetary policy of the U.S. central bank, suggesting that his administration might consider firing its chairman, Jerome Powell. Trump has intensified his criticism, publicly calling Powell a “big loser” and demanding a preemptive interest rate cut, even going so far as to write on social media that Powell’s departure “can’t happen soon enough.”

This escalation in rhetoric represents a significant short-term threat to financial markets, exacerbated by recent uncertainties surrounding tariffs and growing questions about Trump’s economic management. On his Truth Social platform, Trump claimed that there is “virtually no inflation left,” adding that the economy could slow down “unless Mr. Too Late, a big loser, lowers interest rates immediately.”

While these public attacks on Powell are not new (Trump had already criticized Powell during his first term without removing him), they are now taking on a more troubling dimension due to the recent dismissals of other Senate-confirmed officials leading independent agencies (notably at the FTC, Federal Trade Commission https://edition.cnn.com/2025/03/27/business/fired-ftc-commissioners-trump-lawsuit/index.html). These precedents heighten concerns that Trump may indeed attempt to remove Powell or other members of the Federal Reserve Board of Governors, even though such an action would face significant legal, regulatory, and, of course, political hurdles.

Many investors are wondering whether such a scenario is plausible. The probability remains low due to the legal protections surrounding Powell’s term, but an early departure cannot be entirely ruled out. Jerome Powell’s current term runs through May 2026, suggesting a potentially prolonged period of uncertainty for financial markets.

Kevin Warsh is considered by some as a potential successor. A prominent figure in the U.S. financial sector, Warsh has extensive experience in both the private and public sectors. A former Fed governor appointed under the Bush administration in 2006, he played a key role during the 2008 financial crisis, working closely with Ben Bernanke, while later expressing reservations about policies such as quantitative easing. His marriage to Jane Lauder, heiress to the Estée Lauder group, further strengthens his influential network in New York.

In 2017, Warsh was already a contender to succeed Janet Yellen as Fed Chair before Jerome Powell was ultimately chosen. Recently, discussions have reportedly taken place between Trump and Warsh regarding a possible early succession of Powell. However, Warsh is said to have advised Trump to respect the legal duration of the current term. According to some sources, both Warsh and Treasury Secretary Scott Bessent have warned of the significant risks such a move would pose to market stability.

In this context, the upcoming Fed Board meeting on May 6 and 7 will be closely watched, with Trump potentially exerting political pressure in the lead-up. However, a significant shift in Fed policy appears unlikely given the current “data-dependent” approach. Moreover, Jerome Powell holds only one vote among FOMC members, and a dismissal aimed at lowering rates could backfire, with other members likely opposing such a move.

An early removal of Powell would undoubtedly trigger immediate legal challenges based on the Federal Reserve Act of 1913, which clearly states that governors, including the chair, may only be removed “for cause” (misconduct, neglect, or incapacity). However, the Trump administration is challenging the constitutionality of the legal protections granted to leaders of independent agencies, a strategy aimed at expanding presidential control in line with the theory of the “unitary executive.” The unitary executive theory is a U.S. constitutional doctrine asserting that the President has exclusive and absolute authority to control all executive branch actions of the federal government.

This strategy could call into question the 1935 precedent “Humphrey’s Executor v. United States,” which strictly limits presidential removal powers. If Trump were to attempt a dismissal based solely on political disagreements, Powell and his allies would likely mount a legal counterattack, plunging the Fed into an unprecedented institutional crisis.

Fed spectrometre

Such a situation could durably undermine confidence in the U.S. economy and financial markets, potentially leading to an accelerated depreciation of the dollar and a rise in long-term U.S. interest rates due to fears of a loss of control over inflation.

While the legal possibility of firing Powell remains very low, the mere prospect represents a major risk to economic and financial stability. A decline in the dollar continues to be our main scenario. Trump has stated that the U.S. economy should have lower interest rates to anticipate the widely expected slowdown resulting from his trade war.To reassure the markets (and the President!) without compromising the Fed’s credibility, Powell could opt for a symbolic rate cut as early as July (or even May), aiming to ease tensions while avoiding a systemic crisis and without jeopardizing the Federal Reserve’s credibility.

Dollar index