The phase of trade uncertainty is weighing on activity prospects, which will prompt the ECB to continue easing its monetary policy.

The growth and inflation environment is clearly deteriorating in Europe due to trade tensions with the United States, and these are likely to affect the confidence of economic agents in the Eurozone over the coming months.

In terms of economic growth

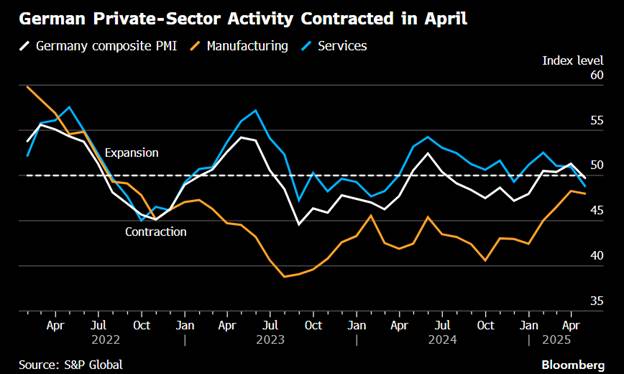

Although the composite PMI for April only moderately declined to 50.1, it likely benefited from the anticipation of orders related to tariffs imposed on its manufacturing branch. The preliminary PMI figures for April indicated an economic activity somewhat more deteriorated than expected. The environment of trade uncertainty appears to be weighing on the confidence of European business leaders, particularly in the services sector, where activity contracted in April—a sector paradoxically less exposed to U.S. protectionist policy.

Leading indicators such as the ZEW, Sentix, and consumer confidence all point to a significant slowdown ahead. Trade tensions are weighing on investment, and weaker global growth is impacting exports. The lack of visibility regarding economic prospects and the rising costs of imports are likely to hinder corporate investment, with businesses remaining attentive to developments in the trade situation.

Still Mixed Financial Conditions

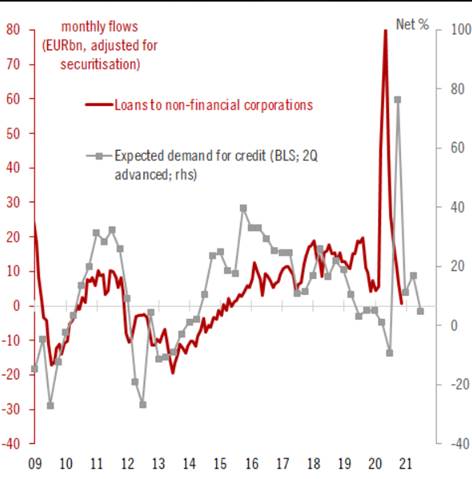

In addition, financial conditions are tightening at the start of the year. The quarterly Bank Lending Survey on credit conditions in the eurozone for the first quarter sent mixed signals regarding credit dynamics. Despite the policy rate cuts already implemented, the recovery in corporate lending is more constrained by the lack of visibility caused by domestic and trade-related uncertainties. In the first quarter of 2025, the survey reveals a slight tightening of lending conditions, as banks are limiting access to credit for businesses due to growing concerns about economic prospects. At the same time, corporate demand for credit has decreased, mainly due to a negative contribution from inventories and working capital.

Households Holding Up

In contrast, the situation is more favorable for households, whose demand for mortgage loans is responding positively. Households continue to benefit from the rebound in purchasing power. The slowdown in inflation, which allows real wages to grow, along with the recent decline in energy prices, should support European consumption. We are seeing a lesser impact on households compared to businesses in the current environment, which supports our assumption that consumption will remain the main driver of European growth.

Growth Outlook Remains Very Moderate

We anticipate weak growth in the eurozone, around 0.7% in 2025, below the forecasts of the ECB and the IMF. Nevertheless, monetary easing, combined with the rebound in household purchasing power, will prevent a significant deterioration in growth this year. We remain cautious about the speed of deployment of the European stimulus and its effects on growth; these will nevertheless provide gradual support to economic activity by the end of the year.

IMF Forecasts

Monetary Policy: Providing Support

As expected, the ECB has lowered its three key interest rates and removed the reference to rates being “significantly restrictive.” We could then expect Christine Lagarde to moderate her tone in upcoming meetings. And although this did not take the expected form, the door is now clearly open to several further rate cuts.The ECB is ready to adopt an accommodative policy. It will do so more explicitly in June. It was emphasized during the press conference that the June forecasts will be a key element in understanding the impact of all the shocks the eurozone is experiencing on the economy; the impact on growth is clearly negative for the ECB.

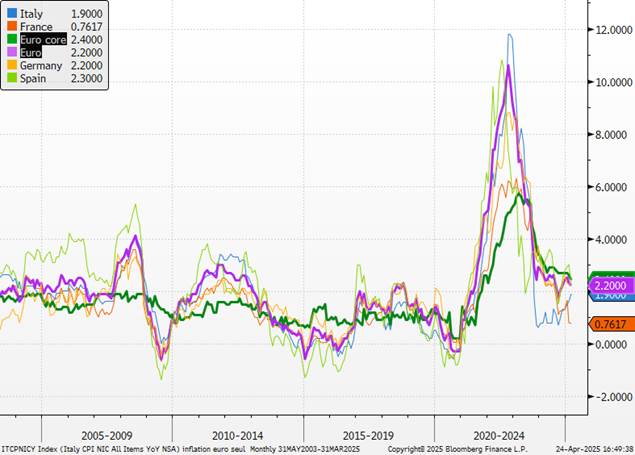

What about inflation? Consensus among the governors is less clear. Conditions are very favorable to disinflation due to the slowdown in wage growth, the appreciation of the euro, the decline in commodity prices, and imported deflation resulting from the diversion of Chinese goods from the U.S. to Europe. There may be only one potential upside risk in the defense stimulus plans, particularly in Germany. However, like the president of the German central bank, we do not believe these programs will be inflationary, as they are primarily focused on investment. “As far as I can see, this will not be inflationary,” said Nagel. “We are emerging from a situation of stagnation, a kind of recession. This will not be inflationary in the coming years. It is helpful for the economy. It means economic growth. It is good news.” If even the BuBa isn’t concerned… why should we be?

Eurozone Inflation

We believe that the ECB will support defense policies. European integrity should go beyond its mandate. “We are in an existential moment for Europe,” added Christine Lagarde in a recent interview, calling for the ability “to begin together this march toward independence—defense-wise, energy-wise, financially, and digitally.” “We must take the reins now,” she insisted.

Interview with Christine Lagarde on France Inter

We believe that inflation forecasts will therefore be revised downward, falling below 2%. The June projections are a key element in the policy path of our central scenario. Based on current data, we even think these forecasts will indicate medium-term inflation closer to 1.5% than 2%, thus signaling the need for an accommodative monetary policy. Our previous forecast was 1.75%-2% by the end of July, followed by a pause of a few months. We now believe the European Central Bank could go much further, with a deposit rate forecast of 1.5% by September. For the time being, we are expecting a 25 bps cut on June 5 and also two rate cuts in July and September, bringing the terminal rate to 1.5%.

As for asset allocation: favor Europe.

We therefore continue to favor countries and geographic areas capable of negotiating, implementing retaliatory measures if necessary, and supporting their domestic economies through stimulus plans and accommodative monetary policy. Europe (and China) appear to us to be the main candidates.

Equity indices since the election of Donald Trump

Given our analysis, the eurozone remains the preferred region compared to other geographic areas. Europe ultimately appears more resilient and attractive in relative terms. Regarding equities, stimulus plans will gradually be implemented, and financing conditions are expected to improve throughout the year. A possible easing of tensions on the Ukrainian front and the prospect of an agreement on rare earths should help reduce the risk premium for the region. The banking sector is showing strong resilience. In a context that is likely more recessionary, it is advisable to favor companies exposed to the domestic economy, particularly the segment of German equities, which are the primary beneficiaries of the German stimulus plan.

It is worth noting, however, that most European companies have spent years increasing their exposure to the U.S. dollar. We estimate that the majority of this exposure comes from assets, employees, and businesses based in the United States rather than exports. While this is good news in that it limits their vulnerability to tariffs, it also means they remain exposed to a weakening dollar as well as to declining confidence and growth in the U.S.

We broadly favor high-quality bonds in the eurozone over the short and medium term. Hybrid bonds (which have suffered from increased interest rate volatility) remain attractive in the current context of falling rates. In the high-yield segment, we remain very selective given the environment. Commercial banks are expected to remain restrictive in their lending criteria due to limited visibility, and refinancing for the most fragile borrowers is likely to become more complicated.

Credit Spreads in the Eurozone