Donald Trump’s policy relies on accelerated reindustrialization driven by the trade war and, secondly, by the weakening of the dollar. Since Donald Trump’s return to the presidency, the dollar index has dropped by about 9%, due to uncertainties related to tariff policy and fears of a recession. A Reuters survey conducted from April 30 to May 6, 2025, reveals that more than 55% of the 83 FX strategists surveyed question the reliability of the dollar as a safe-haven asset, compared to about one-third the previous month.

(https://www.reuters.com/markets/currencies/us-dollars-safe-haven-halo-flickers-amid-fed-fiscal-trade-jitters-2025-05-06/?utm_source=chatgpt.com).

The depreciation of the dollar should not be confused with a loss of its status as the world’s dominant currency. Barring an extreme shock, we believe the advantages of the dollar as a global medium of exchange and store of value are too deeply entrenched for another currency to replace it.

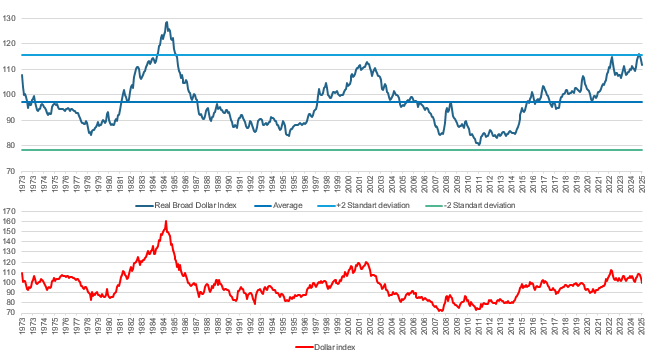

However, in terms of fundamental valuation, Federal Reserve data show that the real value of the dollar still remains nearly two standard deviations above its average since the beginning of the floating exchange rate era in 1973. The only two historical periods with similar valuation levels were the mid-1980s and the early 2000s, both of which were followed by depreciations of 25 to 30%.

Valuation of the U.S. Dollar According to the Fed vs. Dollar Index

In terms of flows, combined with ongoing portfolio movements toward U.S. assets and the outperformance of the country’s equities, the appreciation of the dollar has significantly increased the U.S. share in global investors’ portfolios. The IMF estimates that non-American investors hold $22 trillion in U.S. assets. Any decision on their part to reduce their exposure to the United States would therefore lead to a significant depreciation of the dollar. As long as the U.S. economy continued to outperform its peers, as it has for most of the past two decades, this overvaluation was justified. But that now seems unlikely, at least for the coming years, given the new outlook for the U.S. economy.

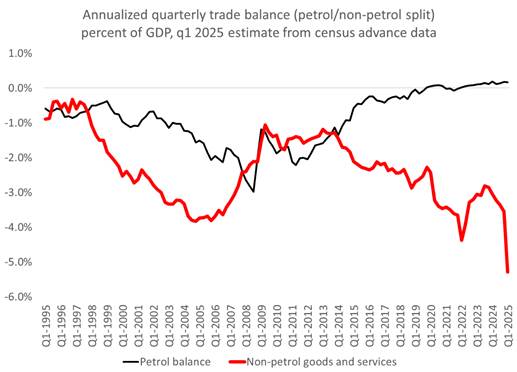

U.S. Trade Balance Deficit

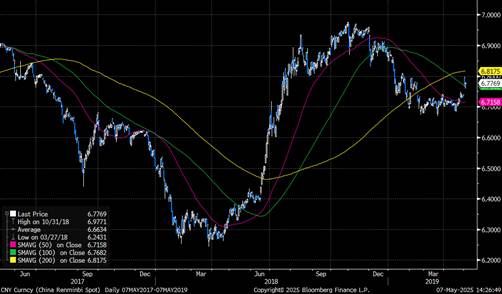

Even though the situation in 1985 is not identical to that of 2025, certain similarities are clearly evident, particularly in terms of the trade deficit, budget deficit, and the strength of the dollar. The Plaza Accord remains to this day one of the rare examples of successful international monetary coordination. Today, the same logic is appealing for a simple reason: a strong dollar fuels the tariffs imposed by the United States, while a stronger local currency could mechanically reduce the need for them. For now, tensions between countries remain high, and isolationist pressures are emerging on all sides. Washington could agree to reduce tariffs on the condition of coordinated action on exchange rates, while Beijing, Brussels, and Tokyo would likely favor this approach over a prolonged trade conflict. The recent appreciation of Asian currencies (Taiwan) shows that exchange rates can serve as tools of support or retaliation, as China did in 2018.

U.S. Dollar vs. Taiwan Dollar 2025

U.S. Dollar vs. CNY 2018

In the medium term, this rebalancing should help reduce the U.S. trade deficit, one of the Trump administration’s key objectives. U.S. policymakers are therefore unlikely to oppose the depreciation of the dollar, even without a potential formal “Mar-a-Lago Accord.” (See : From New York’s Plaza Hotel to the Mar-a-Lago Club ?)

Further declines would certainly worsen price pressures, as tariffs are already driving up inflation, but a weaker dollar—by making exports cheaper and easing financial conditions—would also help reduce the trade deficit and shield the economy from recession. The prospect of a new Fed chair being appointed next year with Trump’s backing is expected to reinforce this trend. More broadly, the current environment is undermining confidence in the U.S. dollar, and that seems to suit “almost everyone.” Progress in trade talks could, in the short term, offer the U.S. currency some relief, but we believe the medium-term trend remains downward given current outlooks. Our year-end target stands between 1.15 and 1.20 against the euro.