The 3 must-know news stories of the week and What We Think :

- Powell turns a deaf ear to Trump’s injunctions

- Oil: OPEC+ reignites the battle for market share

- The United States secures a first agreement

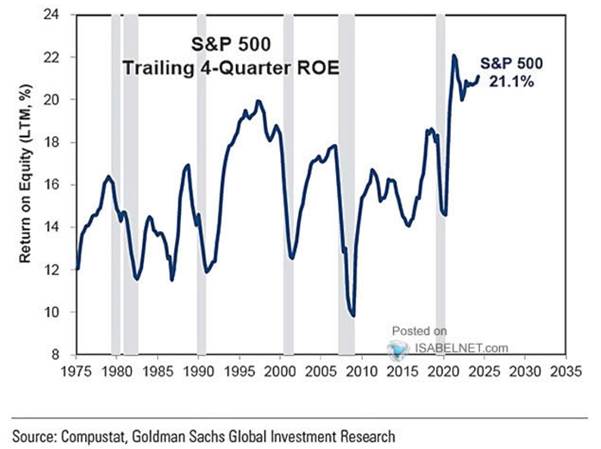

Chart of the week: Profitability of American companies

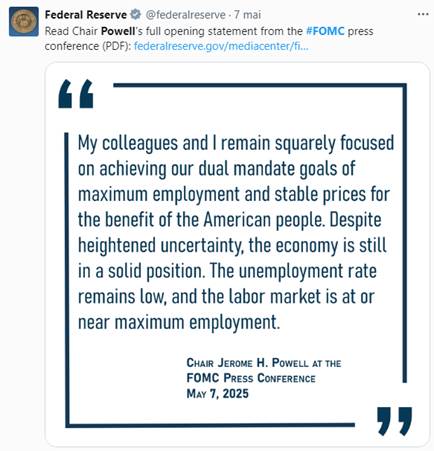

Powell turns a deaf ear to Trump’s injunctions

The Federal Reserve has opted for the status quo. Meeting on Wednesday evening, the institution maintained its key interest rate in the range of 4.25% to 4.50%. Speaking to the press, its chairman Jerome Powell emphasized “the strength of growth excluding foreign trade” and “the resilience of the labor market.” “We don’t need to rush,” Jerome Powell insisted, adding that Donald Trump’s statements on monetary policy “do not affect” the Fed’s actions. The unanimous decision aims to allow time to assess the impact of the new tariffs on inflation. Still above the 2% target, inflation accelerated in the last quarter. According to the Fed, the trade war increases both the risk of a surge in prices and the risk of a slowdown in employment—a combination that complicates the task of central bankers. For now, the former danger prevails; the tariffs sought by the Trump administration could push inflation well beyond 3%. The only silver lining: the Fed no longer detects inflationary pressure on wages. But as long as major trade disputes remain unresolved, caution will remain the guiding principle. “What comes next will depend on the balance of risks,” Jerome Powell concluded, refusing to commit to a future rate path.

Our view : The standoff between the President of the United States and Jerome Powell is entering a decisive phase. For now, activity indicators have yet to reflect the expected deterioration, but inflationary pressures remain clearly on the rise. In this context, caution prevails. The calendar puts all eyes on July: the end of the tariff moratorium on one side, and the FOMC meeting on the other. These two events could trigger a de-escalation of the trade conflict… or, conversely, deepen the impasse. To calm the markets—and, incidentally, the White House—without compromising its credibility, the Fed could opt at the end of July for a limited rate cut, more psychological than economic. A measured move aimed at easing financial tensions while preserving the institution’s independence.

Oil: OPEC+ reignites the battle for market share

OPEC+, the alliance uniting OPEC producers and their partners, has decided to slightly open the taps. Starting in June, eight of its members — including Saudi Arabia and Russia — will increase their production by 400,000 barrels per day. The cartel is even considering repeating the move each month through November, which would bring the additional output to around 2.2 million barrels per day. This push comes as global stockpiles hover near historic lows, impacted by Venezuela’s struggles and stagnant U.S. shale oil production. For Riyadh, the aim is mainly to regain ground against non-cartel players: OPEC+ has seen its market share erode in recent years, to the benefit of the United States. Still, the group’s unity is faltering. Iraq, Kazakhstan, and the United Arab Emirates are already pumping around 1.2 million barrels per day above their official quotas. Kazakhstan has even warned that it will prioritize budgetary needs over cartel solidarity—a reminder that OPEC+ “discipline” is often theoretical. On the Saudi side, the move also targets the White House. The Trump administration is pushing for lower prices, both to ease costs for American motorists and to maintain economic pressure on Russia. Meanwhile, the kingdom’s finances remain vulnerable due to weak crude prices; Riyadh is betting that higher volumes will offset more moderate prices.

Brent and WTI prices

Our View : In the short term, fundamentals remain tight, which should prevent any immediate plunge in prices. However, the excess capacity within OPEC+ and the threat of a global recession suggest sustained downward pressure on prices. We anticipate short-term stabilization. For Europe, a more affordable barrel would help curb inflation and give the European Central Bank more room to cut rates. Politically, the move offers an indirect boost to Donald Trump, whose popularity is suffering from the erosion of American households’ purchasing power. Conversely, U.S. shale producers are seeing their profitability waver: below $60 per barrel of WTI, many would fall below their breakeven point. We are raising our recommendation to neutral, with an unchanged WTI target of $60—a pivotal level that will determine the U.S. industry’s ability to stay in the production race.

The United States secures a first agreement.

The American president announced from the Oval Office that he had reached the foundations of a “historic trade agreement” with the United Kingdom and expressed satisfaction at being able to announce this progress on the anniversary of the Allied victory in 1945. The compromise reached between London and Washington marks a major step in the trade war initiated by the United States. The tariff shockwave unleashed by the U.S. has just seen its first significant easing. London and Washington have sealed a major deal that could serve as a model for future negotiations.The United Kingdom is not exempt from tariffs: the 10% rate will remain the standard for its exports to the United States—a floor now set in stone. In return, Downing Street has agreed to reduce its own tariffs on American goods from 5.1% to 1.8%, and, most notably, to place around $10 billion in orders with Boeing, according to Howard Lutnick. However, the deal also includes key gains for London: automotive, metallurgy, and aerospace.

It’s worth noting that the British tax on digital giants remains untouched; this sensitive issue for Brussels did not derail the talks. For the White House, this agreement is a “prototype.” Donald Trump has promised more swift signings, raising hopes for continued de-escalation. Next up: this weekend’s meeting with Chinese negotiators, crucial for containing the protectionist spiral between the two superpowers. The latest Chinese trade data underscores the urgency: in April, exports to the United States plunged by 21% year-on-year, while shipments to the rest of the world jumped 8.1%. The 21% increase toward ASEAN raises suspicions of tariff circumvention. Exports to Europe rose by about 10%, in line with recent trends, but still insufficient to raise deflationary concerns for the ECB.

The European Union is refining its countermeasures against Donald Trump: the Commission has published a $95 billion list of American products (automobiles, aerospace, agriculture, spirits) that could be taxed if talks fail. This threat echoes European offers to lower tariffs and increase purchases—a carrot-and-stick approach Brussels hopes will be sufficiently persuasive.

Our view : It remains to be seen whether the British example will inspire other capitals to follow suit. Between the end of the U.S. tariff moratorium and upcoming multilateral summits, the coming weeks will show whether the truce turns into genuine de-escalation or if the trade standoff resumes with renewed intensity. The United States, the UK’s top trading partner, posted an $11.9 billion (10.6 billion euros) surplus with the country last year, according to the Census Bureau. This negotiation is therefore likely the simplest among those Washington is pursuing with other major economies, given the imbalance favors the U.S. Nonetheless, the era of trade tensions is far from over. New targeted tariffs could soon be imposed by the American president. The tariff hikes on China also raise concerns about rising inflation and slower growth in the United States. We view Donald Trump’s actions as primarily defensive in response to an extreme risk.

The Fed’s stated unwillingness to intervene—despite economic destabilization and recurring inflation risks—also raises questions. We continue to favor countries capable of negotiating, implementing retaliatory measures if necessary, and supporting their domestic economy through stimulus plans and accommodative monetary policies. In this respect, Europe remains, in our view, the preferred geographical zone: it appears more resilient and relatively more attractive. In China, U.S. trade representatives Scott Bessent and Jamieson Greer will meet with Vice Premier He Lifeng to ease trade tensions. “We don’t want to decouple; we want fair trade,” Bessent told Fox News. Hours after the announcement, the PBOC cut its key interest rate and lowered banks’ reserve requirements to support the economy. We believe these discussions could lead to reduced U.S.–China tensions, as current tariffs (145% and 125%) are threatening activity in both countries. Although we maintain a negative short-term view on emerging markets (due to their strong dependence on the U.S., which limits their negotiating power), we remain more constructive on China, even if volatility will be heightened by the back-and-forth between tension and easing with Washington.