The 3 must-know news stories of the week and What We Think

- European activity still hampered by economic uncertainties.

- Japanese yields soar.

- Trump: A narrow victory in the House of Representatives.

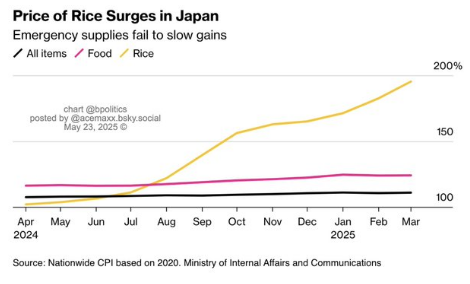

Chart of the week : Rice prices in Japan

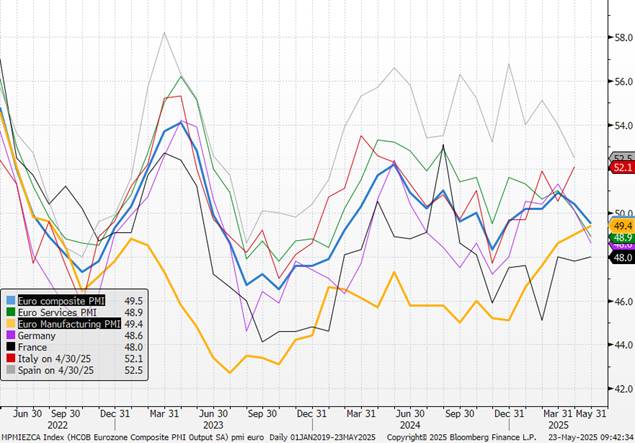

European activity still hampered by economic uncertainties.

Contrary to expectations and despite somewhat more positive news on tariffs, the composite PMI fell below the 50-mark in May. The services sector, which has recently been the only driver of growth, was the main cause of the decline, with the services PMI falling below 50 for the first time this year, to 48.9 in May. The PMIs did not confirm the positive message from other surveys. In contrast, the IFO index for Germany recorded a stronger increase than the previous month, thanks to a solid improvement in the expectations component. The U.S. administration’s reversal on the most extreme elements of its tariff plan provided some relief to businesses, while expectations were also positively influenced by higher growth prospects associated with the German government’s fiscal expansion. Similarly, Eurozone consumer confidence edged up slightly in May. As for the PMIs, manufacturing input costs and output price inflation declined, highlighting the disinflationary impact that a tariff environment could have on the Eurozone, while they rose in the services sector.

Chart: Eurozone PMI

Notre avis : The PMIs presented a more negative picture than other surveys, such as the ifo and ZEW. We already expect Eurozone GDP to barely grow this quarter, but the deterioration in the services sector poses a downside risk if confirmed by other indicators. Despite recent adjustments in U.S. trade policy (a 90-day pause on reciprocal tariffs, easing tensions with China, agreement with the UK), the Eurozone’s economic rebound will be restrained this year by the current environment. We believe that prolonged uncertainty will exacerbate the impact of weaker trade, with this uncertainty being particularly harmful to business investment. These factors are likely to prompt the European Central Bank to continue lowering its key interest rates, bringing its monetary policy into accommodative territory (deposit rate at 1.50%-1.75% in our view) and allowing European growth to gradually resume starting next year. We remain positive on Eurozone rates over medium durations (5 years). The ECB minutes confirmed that the Governing Council members have increased confidence in the disinflation process. Inflation is likely to be lower in 2025 than projected in the March forecasts, if the exchange rate and energy prices remain near current levels.

Japanese yields soar

As pressure mounts on JGB yields, Asahi Noguchi—despite being a dovish member of the BoJ—dismissed the likelihood of central bank intervention, calling the movement “rapid but not abnormal.” He also advocated for a prolonged pause in monetary tightening. The Bank of Japan, still the most accommodative among major central banks and holder of over half the JGB stock, has ceased public debt purchases. Domestic investors have not stepped in to fill the gap. On May 20, a 20-year bond auction recorded its worst results since 1987, exposing liquidity issues in parts of the Japanese bond market. According to weekly data, investors have recently shifted heavily into foreign debt, which only partly explains the weak demand for domestic bonds. After decades of deflation, Japan has entered an inflationary regime. The core price index excluding food and energy rose 2.9% year-on-year through March and is accelerating sharply in Tokyo. Japanese government bond yields remain under pressure, particularly at longer maturities. The 30-year yield hit a record high of 3.13%, while the 10-year rose above the symbolic 1.50% threshold. The BoJ’s disengagement is expected to continue, and longer maturities, initially spared, are now also under pressure. Price pressures persist. Japan’s core inflation rate climbed at its fastest pace in over two years in April, further intensifying pressure on the Bank of Japan as it seeks to normalize interest rates. Core inflation, which excludes fresh food but includes energy prices, rose 3.5% year-on-year last month, exceeding the 3.2% pace in March and marking the highest level since January 2023.

Chart: Japanese Yields

Our view: We do not rule out episodes of volatility in global bond markets. The yen is the ultimate carry trade currency, allowing for low-cost financing of speculative positions. When these carry trades need to be unwound urgently, market moves can be violent, as witnessed in August 2024. U.S. equity and bond markets are vulnerable, having been inflated, like the dollar, by Japanese capital flows. If the sharp rise in JGB yields prompts Japanese investors to repatriate their assets, the unwinding of carry trades could trigger significant volatility, particularly in the U.S. market.

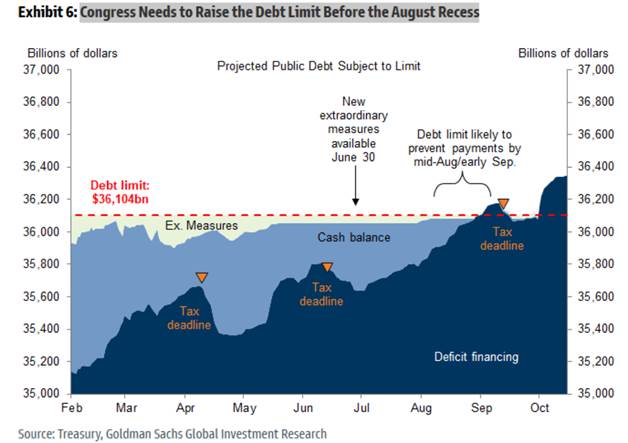

Trump: A narrow victory in the House of Representatives

Donald Trump’s pressure on Republican lawmakers ultimately paid off, as they managed to pass the budget bill by the narrowest of margins: 215 votes to 214. The bill includes the extension of large portions of the 2017 tax reform, along with new tax exemptions (for social benefits, overtime pay, and tips), in exchange for certain spending cuts (ending “green” subsidies implemented during Joe Biden’s term, reducing access to the Medicaid program, etc.). The budget does not include a further reduction in corporate tax rates, despite Trump suggesting it during the election campaign. According to estimates, this plan could generate between $3 trillion and $5 trillion in additional debt, depending particularly on how many measures are made “permanent” and whether the extra interest burden is included. While some of this cost will be offset by the expected revenue gains from increased U.S. tariffs (around $350 billion per year, assuming an average tariff rate of about 15% maintained over time), concerns over a widening U.S. deficit could lead Senate lawmakers to revise the bill in order to reduce the potential fiscal imbalance.

Our view: These cost-saving measures appear insufficient in the eyes of investors, as the debates surrounding this budget bill have significantly contributed to pushing U.S. sovereign yields higher (notably through a sharp increase in the term premium) and have heightened concerns over U.S. assets more broadly. As a result, further substantial negotiations are likely over the coming days and weeks, which could continue to generate volatility across asset classes, especially as the debt ceiling deadline gradually approaches, raising the risk of a potential payment default by the end of the summer.