The 3 must-know news stories of the week and What We Think

- Inflation Not Yet Affected by Tariffs.

- The Euro: An Alternative to the Dollar?

- Oil Price Stabilization Underway

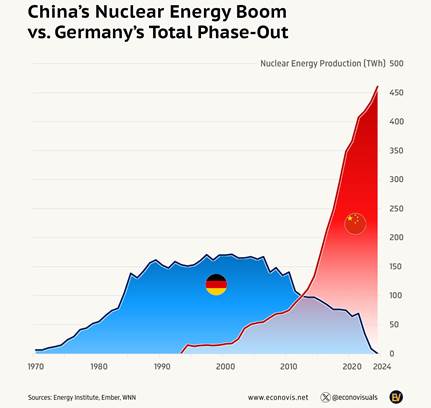

Chart of the week : Nuclear production

Inflation Not Yet Affected by Tariffs

PCE inflation – the Federal Reserve’s preferred gauge for determining its monetary policy path – fell to 2.1% year-over-year in April, its lowest point since the pandemic, a level already reached last September. Economists had forecast an annual inflation rate of 2.2%, compared to 2.3% in March. Core PCE inflation dropped to 2.5% year-over-year, the lowest level since March 2021. On a six-month annualized basis, core PCE stands at 2.6%. The decline in core PCE is mainly driven by non-housing services inflation (“supercore”), which even saw its first month-over-month decline since April 2020! Year-over-year, the “supercore” now increases by only 3%. PCE inflation, the Fed’s most closely watched inflation measure, has returned to its lowest level in four years and currently shows no significant impact from the recent tariff hikes. Notably, the decline in core PCE was driven by non-housing services, which had been one of the main sources of concern for the Fed in recent quarters. Inflation is now within striking distance of the Fed’s 2% target. Could this be enough to convince the U.S. central bank to resume its rate-cutting cycle, with rates currently between 4.25% and 4.50% since December? The Fed remains cautious. The President of the San Francisco Fed and Governor Christopher Waller have reiterated their support for a rate cut later this year, given the expected impact of higher tariffs on inflation and unemployment. While inflation appears contained despite rising durable goods prices, and while consumer spending remains resilient according to the data, uncertainty lingers for the coming months’ statistics. April’s import and producer price data currently show no significant effect from the tariffs. However, these measures were still only partially in place, and companies had stockpiled significantly ahead of their implementation. The “prices paid” component of ISM indicators has seen a notable uptick since the start of the trade war. A new source of concern has emerged for the labor market, linked to Donald Trump’s immigration policy. The U.S. Supreme Court has authorized the revocation of legal status for more than 530,000 migrants living in the country. The U.S. administration will therefore be able to proceed with deportations, which will restrict migration flows and soften the increase in unemployment expected this year in connection with the economic slowdown..

Our view : The impact is therefore still to come, and the Fed is compelled to take it into account in its decisions. The central bank will likely keep its monetary policy unchanged at the upcoming meeting (June 17–18) in order to limit the risk of renewed inflationary pressures, before being able to lower rates in the second half of the year as unemployment begins to rise. The Fed’s stated intention not to intervene in the face of economic destabilization and a recurring inflation risk also raises concerns. Economic data remain solid, even though soft data are deteriorating. There is no urgency: in an uncertain fiscal and trade context, we believe the Fed will wait until September—when it has greater visibility—before continuing its monetary easing.

The Euro: An Alternative to the Dollar?

In a speech in Berlin, the President of the European Central Bank urged European leaders to accelerate reforms aimed at positioning the euro as an alternative reserve currency to the dollar, in a context where recent measures taken by Washington have contributed to undermining the greenback’s status. “The global economic order is fracturing,” warned ECB President Christine Lagarde on Monday, May 26, noting that this could also benefit the euro, which currently plays a secondary role to the dominant dollar. The central bank remains concerned about this issue, which was already raised in the minutes of its April meeting. As the ECB president reminded, the euro area is highly dependent on global trade (nearly one-fifth of its value added), and in the event of fragmentation, would face high costs for its businesses. Establishing the euro as a lasting monetary alternative would thus offer several advantages: increased investment, protection against potential coercive measures, broader access to international markets, and lower borrowing costs for both companies and states. This would support the region’s potential growth, which has lagged behind that of the United States for decades.

Reflecting on the history of major monetary shifts, Christine Lagarde nonetheless emphasized that such status “must be earned” and depends on two conditions: first, representing a significant share of global trade, and second, having the currency dominate international reserves. On the first point, the euro is well positioned, as the Union actively pursues trade agreements and remains an attractive partner. On the second, the single currency is losing ground: the recent dedollarization of emerging market reserves is trending primarily toward gold rather than the euro. According to the ECB president, three areas must be strengthened: geopolitical foundation, economic base, and legal framework. Geopolitical weight—including the ability to uphold alliances through force—reassures investors; thus, strengthening European defense autonomy is a positive signal. Economically, deeper policy coordination and the removal of internal barriers are necessary, as already highlighted in the Draghi report. Furthermore, the European market for high-quality debt remains insufficiently deep to support the euro as a reserve currency; common borrowing would address this challenge, despite persistent political hurdles. Finally, she stressed that a strong institutional environment remains essential: central bank independence, a clear commitment to the inflation target, and a less unanimity-dependent decision-making process in Europe would enable faster progress..

Our view : This speech is highly significant in understanding the stance the ECB seeks to adopt and the support it intends to provide for the transformation of the Eurozone. It confirms a recent interview that had already led us to conclude: the ECB is ready to adopt an accommodative policy. We believe it will also support defense-related policies. Its role in preserving European integrity should go beyond its monetary mandate. “We are at an existential moment for Europe,” Christine Lagarde recently stated, calling to “begin this path toward independence together—on defense, energy, and in financial and digital matters.” Based on our analysis, the Eurozone remains preferable compared to other regions. Europe ultimately appears more resilient and relatively attractive. Admittedly, financial conditions have tightened (corporate lending) in early 2025, and we anticipate weak growth in the euro area, around 0.7%—below ECB and IMF forecasts. Nonetheless, monetary easing, combined with a rebound in household purchasing power, should prevent an excessive deterioration in growth this year. The European Central Bank could go much further. For now, we expect a 25 basis point cut on June 5, followed by two additional cuts in July and September, bringing the terminal rate to 1.5%. Ongoing political support—both monetary and fiscal—continues to create a favorable environment for European sovereign credit. At this stage, the euro is still far from dethroning the dollar, and the necessary reforms identified by Christine Lagarde remain highly uncertain in terms of implementation. However, it could gradually benefit from this new environment, which leads us to maintain a structurally bullish bias on the euro against the dollar..

Oil Price Stabilization Underway

OPEC+ has announced a significant new increase in oil production for July—the latest sign that the cartel intends to unwind the first phase of its long-standing production cuts as quickly as possible. Eight member countries of the oil-producing group, including Saudi Arabia and Russia, stated on Saturday that they would collectively raise production in July by 411,000 barrels per day (b/d). Among the eight countries involved, however, three—reportedly including Russia, Algeria, and Oman—have expressed disagreement with the decision, signaling growing discomfort among some members with this expansionary and costly supply strategy, as it keeps crude prices near four-year lows. The challenge for OPEC will be to maintain enough internal consensus without putting too much downward pressure on prices while still pursuing its goal of regaining market share. This comes as U.S. oil production and the number of operational rigs have both declined in recent weeks, due to the breakeven price for new wells in the U.S. sitting around $60 per barrel for WTI. Some of the eight countries involved are exceeding their production quotas, which suggests that OPEC+’s final production increase may be lower than announced. OPEC+ has been curbing supply since 2022 to support prices. A group-wide reduction of 2 million b/d and a voluntary cut of 1.65 million b/d by eight members are set to remain in place until the end of 2026. An additional voluntary reduction of 2.2 million b/d by those same eight countries was later imposed. It is this latest series of cuts that is now being lifted. Allowing a production increase and a decline in prices has also helped curry favor with Trump.

U.S. Production and Rig Count

Notre avis : This non-unanimous decision reduces the probability of another similar production hike in August, which had until now seemed largely priced in (a meeting on this matter is scheduled for July 6). We view $60 per barrel as the minimum threshold. (https://news.banquerichelieu.com/en/2025/05/05/market-flash-opec-wants-to-regain-market-share/ ) At the microeconomic level, the current decline in oil prices poses a direct threat to the profitability of U.S. producers, particularly those focused on shale oil—and this is already having an impact. After having maintained a negative stance for several months, we changed our view once prices fell below $60. Prices should stabilize in the short term. We remain neutral on the sector.