A new U.S. tax provision included in the budget law “One Big Beautiful Bill Act,” passed by the House of Representatives, could have significant consequences for the markets.

Section 899 introduces what is commonly referred to as a “revenge tax.” Its stated objective is to penalize countries that impose “unfair” or “discriminatory” taxes against American companies by increasing the tax rate on certain categories of U.S.-source income received by any government, individual, foreign corporation, or private foundation residing in those countries. This could impact European savers, who send €300 billion to the United States each year.

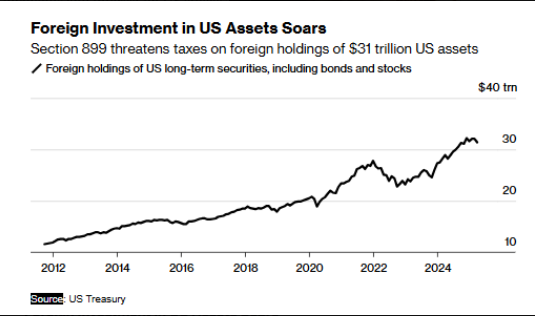

If a country is designated as a DFC (Discriminatory Foreign Country), all income subject to U.S. taxation that is paid out will be subject to increased rates, potentially reaching up to 20%.If holding U.S. securities (Treasury bonds, debt instruments, etc.) becomes less attractive to foreign investors, the yield demanded on U.S. Treasury securities could rise. According to some estimates, the increase in surtax could reduce the net interest received by an investor by approximately 100 basis points. In order to preserve their returns, investors may redirect their capital to other markets.

The short-term budgetary consequences would naturally be positive. Section 899 is expected to generate significant revenue in its early years thanks to the surtaxes collected, but the taxable base would shrink over time.

Many major countries—the United States’ closest trade allies (EU members, the United Kingdom, Japan, Canada, South Korea, Australia, etc.)—could be affected. By directly challenging the taxes implemented under the OECD agreement, the United States risks finding itself isolated on the international stage, while the goal of fiscal multilateralism is precisely to limit tax evasion and profit shifting to tax havens. By following the same logic as a sanctions escalation (as in the trade war), the approach of Section 899 would amount to a form of “blackmail”: if you keep your taxes, we will surtax your income.

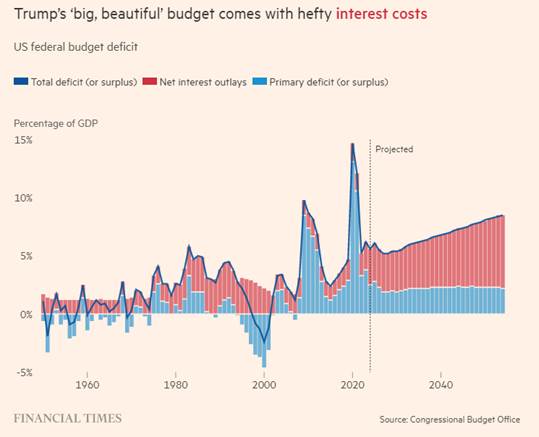

There is clear division among Trump’s advisers. This would obviously appeal to the “MAGA” base. According to the Financial Times, a think tank aligned with Vice President JD Vance estimates that such taxes could generate $2 trillion in revenue over the next decade. The Congressional Budget Office (CBO), for its part, estimates that this measure could raise up to $116 billion over ten years. But Treasury Secretary Scott Bessent is likely to be reluctant, as he does not want to drive global investors away from the Treasury bond market. Federal Reserve officials have recently expressed concern about the potential harm to the U.S. economy if its status as a “safe-haven investment” is undermined.

While it aims to defend American economic interests by discouraging hostile tax measures, it involves significant challenges and numerous areas of uncertainty. The risks of a fiscal escalation and medium-term revenue losses make it a measure whose implementation urgently requires clarification. The “One Big Beautiful Bill” (OBBB) must now be reviewed by the Senate. The latter may insist that this clause be watered down or removed altogether.

In any case, Donald Trump—through his rhetoric on global trade or taxation—has always maintained that America’s historical partners have benefited for years from the country’s strength and growth without offering anything in return, and that the time has come to present the bill. The idea that foreign investors benefit from high returns may also be part of the message.

On the other hand, the country is in dire need of investors to finance itself. The short-term consequences could be very negative for U.S. interest rates and could significantly weaken the dollar.