JULY WILL PROVIDE ANSWERS

It’s hard to say whether trade tensions will be contained in the second half of the year, but by then negotiations will have made considerable progress. Donald Trump’s about-turns show that he is in more of a hurry than his “partners”. Determined to make his mark before the mid-term elections in 2026, the American president is determined to demonstrate the effectiveness of his economic program at all costs. He is betting on a tight timetable, hoping that the measures adopted will have a rapid and visible effect. He would be jeopardizing his majority in Congress if he provoked a recession or financial crisis.

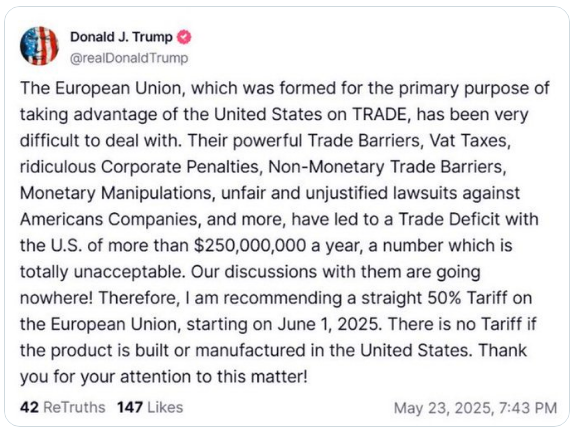

Publication by D. Trump on his social network

Halfway through Trump’s 90-day grace period for reciprocal tariffs, trade negotiations seem to be stalling and markets are getting nervous again. Trump is losing patience, and late last week threatened to impose 50% tariffs on EU products before changing his mind. The question is whether he really intends to act, or whether he is simply seeking to step up the pressure to speed up negotiations.

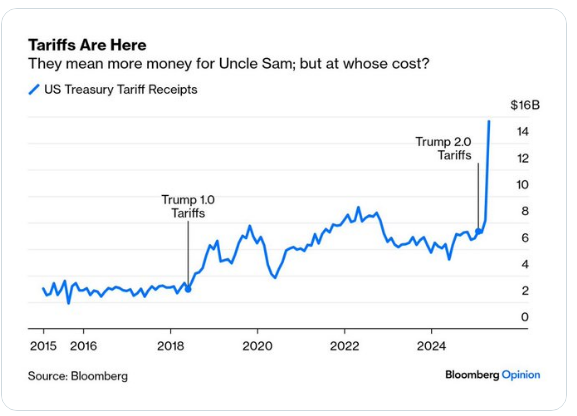

Now that the US government has started collecting more import duties, we have to ask ourselves who pays and who will pay between foreign suppliers, US companies and consumers. We should have the answer within a few months.

In general, markets are not reflecting the potential for deterioration in macroeconomic conditions, nor the damage created by the US President’s back-and-forth. We remain cautious on equity markets, which offer limited visibility despite the good results published in the first quarter. Longer-term estimates show that most asset classes are negatively correlated with the US dollar, suggesting that a weaker dollar should be positive for global markets, both equities and bonds, and for both emerging and developed markets.

US: THE BACK-AND-FORTH POLICY

On the economic front, the United States will avoid recession in 2025, with growth still resilient (1.4%). But the risks are increasing as the year draws to a close. Recent trade negotiations suggest that the US administration is keen to conclude agreements. The postponement of the most extreme tariffs between the US and China also allows other shock absorbers to be put in place: US tax cuts and deregulation efforts.

Faced with a deteriorating bond market and growing protests from business leaders and elected Republicans, the US President had already announced a 90-day truce in the application of reciprocal tariffs, after proclaiming “Liberation Day ” a week earlier. However, the period of trade tensions is far from resolved: new specific duties could soon be decreed by the President. It’s a time for flip-flops.

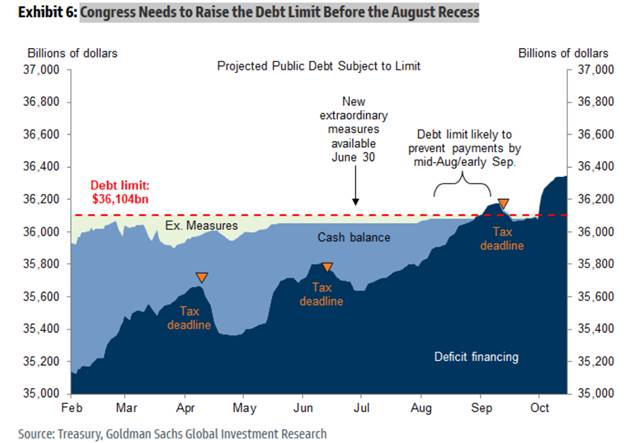

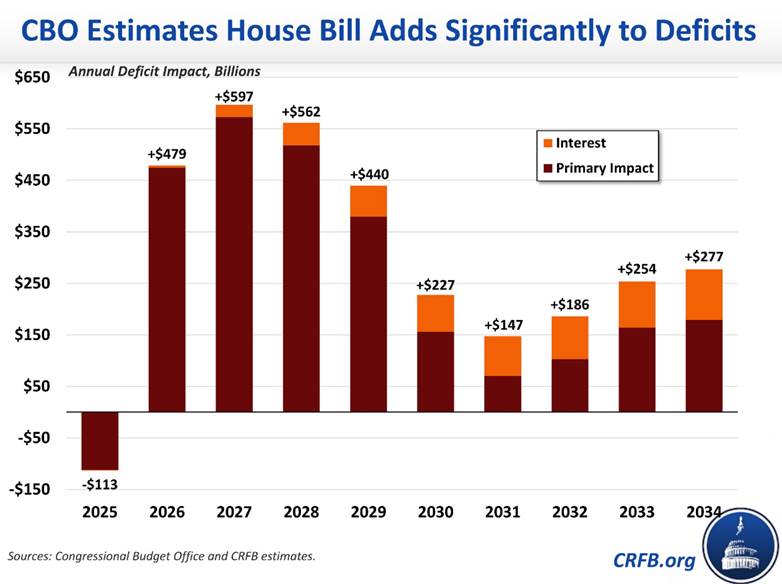

Trump must reassure a Congress hungry for fresh resources and keep his promises to reduce the deficit by July 4. In the House of Representatives, the budget bill narrowly passed (215 votes to 214), forcing the President to use his influence to win support. The text, a thousand pages long, includes an extension of the major tax cuts of 2017. Modestly named the One Big Beautiful Bill Act, it aims to roll out a series of budgetary and fiscal measures that are part of the new president’s political agenda. Many voices point out that it could significantly increase the imbalance in US public finances. Although it could still be marginally modified by the Senate, the Congressional Budget Office (CBO) estimates that, over the next decade, it would add 3,100 billion to the public debt (200 to 300 billion USD per year, or +1 point of nominal GDP in 2025). The CBO does not take into account additional revenues from tariffs, which remain the cornerstone of the project’s financing.

Trump is in a hurry and needs to maintain his credibility with Congress. On the other side of the Atlantic, the EU – whose pace of decision-making is usually slow, despite its negotiating capacity (as seen during the Brexit or the sovereign crisis) – is struggling to formulate a rapid response. The delay granted before the application of sanctions is designed to hasten discussions, to the benefit of the Americans. As it stands, European VAT appears to be a sticking point: American exporters are at a competitive disadvantage compared with companies on the Old Continent, which do not charge this tax on goods destined for export. So far, negotiations have been fraught with difficulties, with no clear middle ground. Any unilateral demands by the USA that would undermine the bloc’s regulatory and fiscal autonomy are likely to remain red lines.

As with China, Donald Trump’s retreat seems above all defensive in the face of extreme risk. But what will happen on July 9, 2025? Time is running out for the President, who wants to see his program implemented as quickly as possible in order to demonstrate the benefits of his policies before the mid-term elections in 2026.

The Fed’s stated intention not to intervene in the face of economic destabilization and recurring inflationary risk also raises questions. Economic data remains solid, even if soft data is deteriorating. There’s no hurry: in an uncertain fiscal and trade environment, we believe the Fed will wait until September, when it has better visibility, to pursue monetary easing.

FED rates via future contracts

Sources: Bloomberg, Richelieu Bank Group

First-quarter results remain satisfactory; however, positive surprises mask disappointing sales figures. Polls indicating business leaders’ willingness to pass on rate hikes to consumers are hardly reassuring. The tug-of-war between the President of the United States and the Chairman of the Fed is still in its early stages. Activity indicators do not yet point to the deterioration to come, but inflation is likely to remain under pressure.

We therefore maintain a strategy of relative caution on equity markets, with a negative view on the US market. We expect trade tensions to de-escalate significantly, and for the Fed to change course and continue cutting rates. The month of July should provide some answers: it coincides with the end of the moratorium on tariffs and a meeting of the FOMC. We recommend stock-picking , targeting quality stocks.

On sovereign bonds, our target has been raised to between 4.5% and 4.75%. Long-term yields remain relatively unstable, and risks appear to us to be on the rise, due in particular to numerous auctions and the risk of budgetary issues. In relative terms, short-duration Investment Grade bonds are a coherent choice. We are staying away from the most fragile segments, given the refinancing risks: high yield spreads are below their recessionary or sharp slowdown levels, and the risk increases towards the end of the year. The lowest segment of high yield (CCC) is sending warning signals that the US economy may soon face slower growth, higher inflation and, potentially, a recession. Finally, we recommend continuing to hedge a significant proportion of dollar exposure for the time being.

BBB/BB and BBB/CCC spreads

Europe: Germany and the ECB support economic resilience

In other regions, we continue to favor countries capable of negotiating, implementing retaliatory measures if necessary, and supporting their domestic economies through stimulus plans and accommodating monetary policy (Europe, China).

Based on our analysis, the eurozone remains the preferred region. In the end, Europe appears more resilient and attractive in relative terms. Admittedly, financial conditions have tightened (corporate credit distribution) in the early part of this year, and we anticipate weak growth in the eurozone, at around 0.7% in 2025, below ECB and IMF forecasts. Despite this, monetary easing, combined with a rebound in household purchasing power, should prevent an excessive deterioration in growth this year. Economic surprises remain positive.

Defense spending will have a significant impact on European growth. According to the European Commission, real GDP would increase by 0.5% compared with the reference scenario by 2028, while the EU’s public debt/GDP ratio would be 2 percentage points higher than in the reference scenario by 2028. The figure appears modest compared to US academic readings, which would put the growth surplus at 1%. A higher share of spending on R&D and infrastructure investment could generate more positive effects on GDP in the long term. However, a higher share of imports in defense spending (which is not the case in the USA) would reduce the overall economic stimulus.

Economic surprise indicators

However, we remain cautious about the speed of the European stimulus and its effects on growth, which will nonetheless provide gradual support for economic activity towards the end of the year. We expect this to be only mildly inflationary – not enough to panic the ECB’s Governing Council!

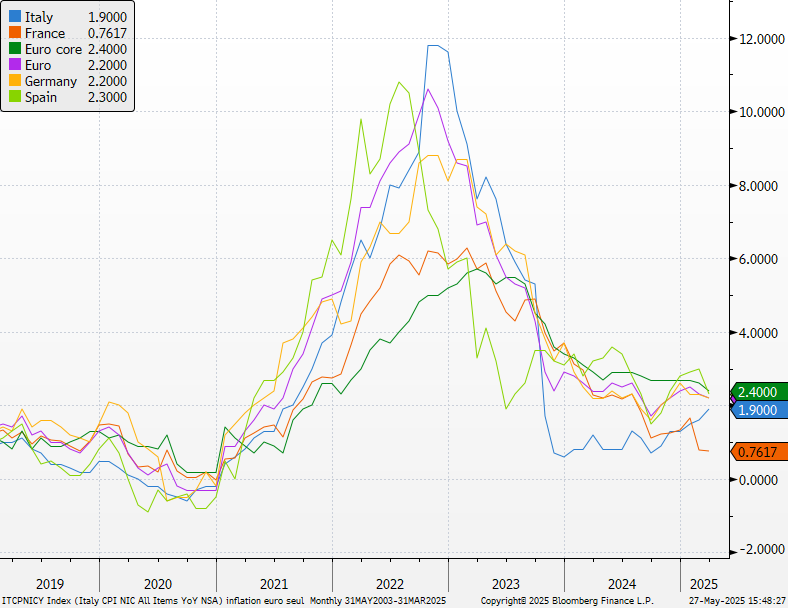

Inflation indicators in Europe

The ECB is ready to adopt an accommodating policy. We believe it will also support defense policies. Its role in preserving European integrity should go beyond its monetary mandate. “We are at an existential moment for Europe,” Christine Lagarde recently declared, calling for us to “embark together on this march towards independence, both in terms of defense, energy, and in financial and digital terms”.

The European Central Bank could go much further. For the time being, we’re counting on a further 25bp cut after the June 5 cut, in September, to reach a terminal rate of 1.75%. A further cut remains possible if the economic situation deteriorates as a result of the trade war (1.5%). Political support, both monetary and fiscal, continues to create a favorable environment for European sovereign credit.

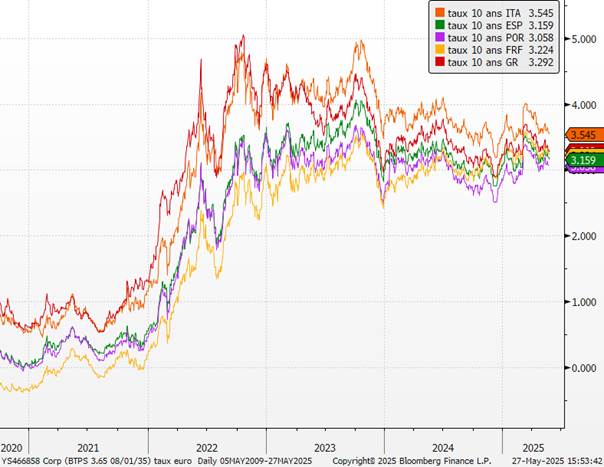

We therefore remain positive on eurozone bonds and recommend extending the duration of portfolios. Unlike US government bonds, the German Bund remains a benchmark safe haven. The steepening of the curve partly protects long yields against headwinds.

10-year rate

Political risk in France remains a persistent uncertainty, but we do not anticipate any tangible deterioration in the short term (except in the event of new elections). We continue to favor Spain, whose fundamentals remain solid. We recommend partial exposure to sovereign credit to benefit from duration in the eurozone.

Spreads France/Spain

We have a strong preference for quality eurozone bonds in the short and medium term. Hybrid bonds (which have suffered from interest-rate volatility) remain attractive in a context of falling interest rates. In the high-yield segment, we remain highly selective, but financing conditions are improving significantly. Given the downward trend in interest rates, we are focusing on capturing substantial yields. Commercial banks are likely to maintain restrictive credit criteria, given the poor visibility, and refinancing of the most fragile issuers is likely to become more complex. Fundamentals for euro-denominated IG credit remain solid: euro-denominated IG credit spreads are at historically low levels, close to their ten-year lows, reflecting strong demand. This is also due to the strength of corporate balance sheets. The stable macroeconomic environment and resilience of the European economy should continue to support this asset class. The ECB still holds 315.6 billion euros of corporate bonds via its purchase programs, representing 27% of the eligible market. Since March 2023, the ECB has been gradually reducing its holdings, but buying pressure remains sustained by yield-seeking investors. Liquidity is no longer sufficiently remunerative in euros, and we prefer to position ourselves on longer maturities.

Credit spreads

For equities, stimulus plans will be gradually implemented and financing conditions will improve throughout the year. MSCI Europe companies have so far posted a 3.8% rise in earnings, against an expected 1.4% fall, according to Bloomberg Intelligence data.

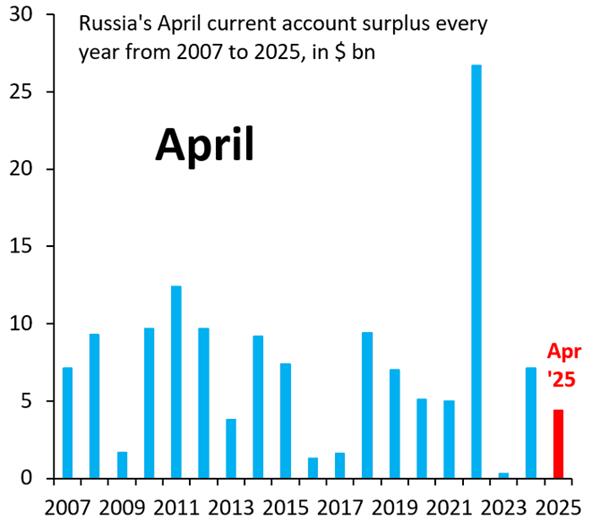

A lull on the Ukrainian front and the prospect of an agreement on rare earths could reduce the zone’s risk premium. Indeed, the fall in oil prices is putting additional pressure on Vladimir Putin, whose current account surplus is shrinking.

Russia’s current surplus

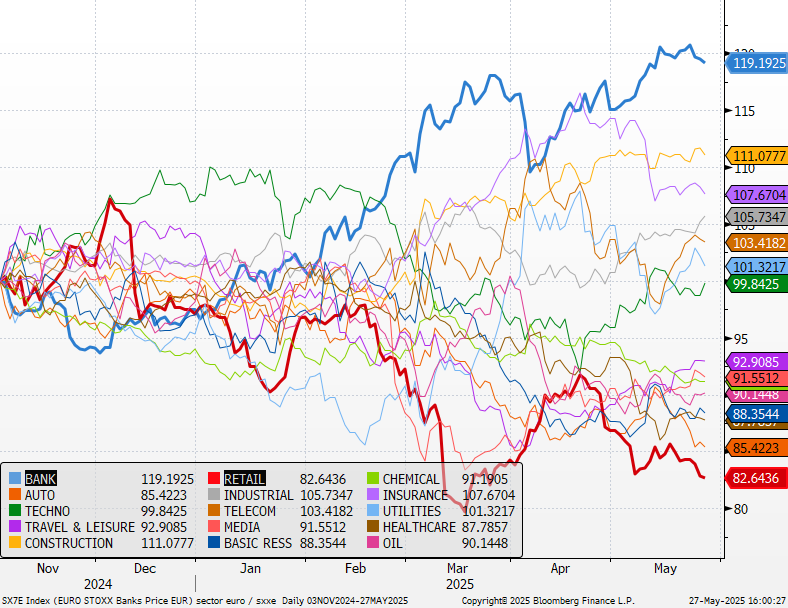

In sectoral terms, we maintain our positive views on infrastructure, construction and defense. The European Union is preparing a €800 billion rearmament plan, which could increase annual defense spending from €326 billion to over €600 billion, if all member states increase their military budgets. A majority of them have agreed to activate the exceptional expenditure clause, allowing them to increase their military spending by +1.5% of annual GDP for four years without breaching the Union’s strict budgetary rules. The banking sector, whose results have been substantial, will remain one of the main beneficiaries of accelerated consolidation, despite a less attractive interest-rate environment. However, we feel that valuations are excessive, and are likely to remain so. According to the European Commission, real GDP will increase by 0.5% compared to the reference scenario by 2028, while the EU’s public debt/GDP ratio will be 2% higher. The intensification of geopolitical tensions has highlighted the need to strengthen the EU’s defense capabilities. The Readiness 2030 package, presented by the European Commission in March, aims to support the European defense industry, deepen the single defense market and facilitate increased defense spending, notably through budgetary flexibility. As the international context is likely to be less recessionary, companies with exposure to the domestic economy should be favored, in particular the German stock segment, the first beneficiaries of the national stimulus plan (in addition to mid-sized German stocks).

Relative performance of Eurostoxx sectors

Japan: fears over the impact of rate hikes

As for the other zones, many reported progress in the tug-of-war with the Trump administration, but remain on their guard. Bilateral trade negotiations seem to have taken shape at the end of the month, but the dynamics are uneven. All, however, are ready for battle.

Japan was initially keen to find a way out, but the tone seems to have changed slightly, with the Ishiba government now taking a more combative stance. Finance Minister Katsunobu Kato, for example, revealed to the local media that he had raised the subject of Japan’s trillion-dollar Treasuries holdings during the talks. While he did not explicitly threaten to use them as retaliatory leverage, he did specify that this portfolio should serve as a liquidity reserve in the event of intervention on the dollar-yen parity.

Dollar versus Yen

The latest business indicators show an improvement, with the composite PMI reaching 51.2, compared with 48.9 in March. We are adopting a more neutral stance on the country, which appears to us to be a safe haven like Switzerland. Real wages rose slightly in April, by 0.6% over the month. According to the Ministry of Labor, nominal wages are set to continue rising over the coming months, despite the disruption caused by the trade war. Wage growth also remains high on part-time contracts, reflecting persistent tensions on the labor market. We therefore favor sectors linked to the domestic market.

Faced with the crisis in long-term rates, the Bank of Japan is likely to halt its rate hike program for the time being, which should allow risk premiums to fall. Since the suspension of reciprocal tariffs by the United States, Japanese sovereign yields have rebounded sharply, due to reduced fears about growth. The movement has been particularly marked on the long end of the curve. While the 10-year rate edged back above 1.5% (its March level), the 20- and 30-year rates temporarily breached the 2.5% and 3% thresholds, respectively. This led to a sharp steepening of the yield curve.

Japanese rates

For the Japanese government, this represents a major risk in terms of public debt sustainability. The country has a very high stock of debt (237% of GDP in 2024, according to the latest IMF data), and refinancing it could become significantly more expensive. The Minister of Finance has said he is monitoring the situation closely, fearing that increased debt servicing could put a strain on government resources at a time when greater budgetary support is needed to deal with the consequences of the trade war.

For the time being, the Bank of Japan has opted for patience, leaving its monetary policy unchanged. It prefers to wait for better visibility on the consequences of the trade war. Tensions also persist on the labor market, due to the shortage of manpower.

China: consumer spending remains the key to success

A significant part of China’s economic growth, sustained in recent years by massive support for export industries, has been driven by foreign trade. Faced with the acceleration of Chinese exports, the United States’ main response materialized in Donald Trump’s trade war.

After several weeks of escalating tensions between the two powers, the agreement reached is finally more promising than expected. In a joint statement, Beijing and Washington announced a temporary suspension of part of their respective tariffs, recently introduced, for a period of 90 days from May 14. U.S. tariffs on China will fall from 145% to 30%, while those applied by China to the U.S. will drop to 10% from 125%. This signal of de-escalation rules out the possibility of a more virulent trade war in the short term.

However, Chinese exports are likely to slow significantly in the months ahead, especially as many companies have built up inventories ahead of the tariff barriers. Beijing will therefore have to find domestic growth drivers.

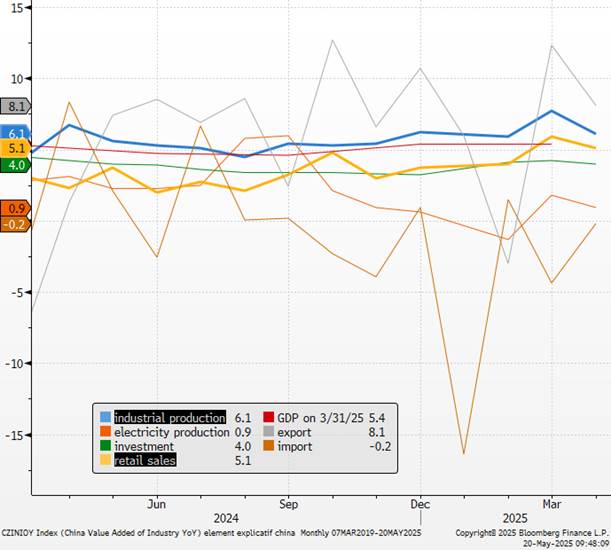

Elements explaining Chinese growth

The Chinese authorities clearly changed their tone at the “Two Sessions” congress, pledging to adopt a more proactive fiscal policy and a moderately accommodating monetary policy. The official growth target of 5% for 2025 was confirmed, but we are expecting a figure closer to 4.6%.

Even if China is facing a number of challenges (public and private debt, loss of household confidence, demographic decline, risks of deflation, imbalance between investment and consumption), we believe that this trade war represents an opportunity to foster a real awareness of the need to develop domestic consumption.

The measures in place should create a wealth effect via rising equity markets, thereby boosting consumer confidence, while real estate remains too fragile in the short term to play this role.

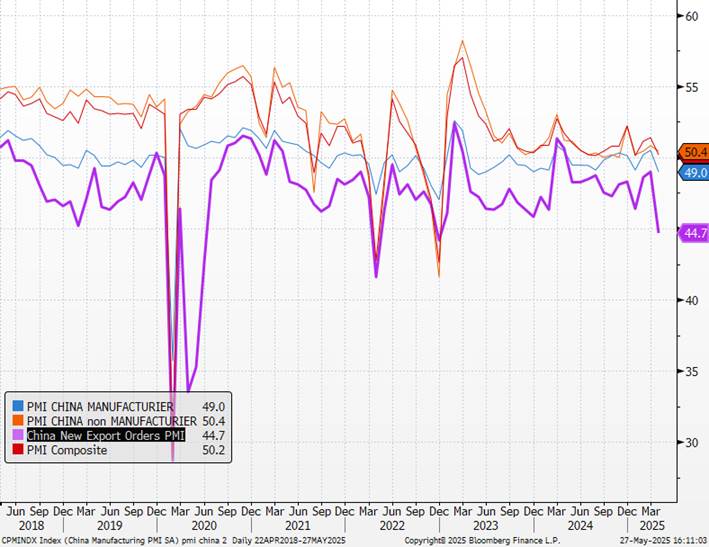

The downturn in overall activity, particularly in industry, was largely due to lower order books, reflecting weakened domestic demand and a lack of visibility on the economic outlook. Service companies also cut back on staffing levels for the second month running, in order to contain rising input costs.

Chinese PMI

On a positive note, however, Chinese household spending increased during the May vacations, a sign of a gradual return to confidence and a willingness to put in place conditions to boost domestic consumption.

So, overall, we remain constructive on China, even if volatility will continue to be exacerbated by the back-and-forth between tensions and appeasements with the United States. The main uncertainty lies in Europe’s attitude. Donald Trump’s strategy, including the introduction of the 90-day moratorium, seems aimed at strategically weakening China. It remains to be seen whether Europe will be led – which is probably a central point of the negotiations – to choose sides and, in turn, enter into a trade war, which would be unfavorable to both blocs.

Emerging countries adapt

Emerging markets are adapting and showing that they are avoiding becoming hostages to geopolitical tensions. Resilient domestic demand in these economies and the credibility of their central banks are partially mitigating the impact of trade uncertainties.

We are upgrading our opinion on emerging markets to neutral, as trade negotiations there are less complex, the growth gap with developed countries is widening, and the dollar’s decline should benefit them. A slowdown in emerging market growth to around 3.7% in 2025 remains more than double that of advanced economies. Supported by fiscal spending, domestic demand in emerging markets contributes to their resilience. Consumption and investment are holding up well in India and Brazil. Emerging-market bonds should be favored by monetary policies that are now accommodative, and by the falling dollar.

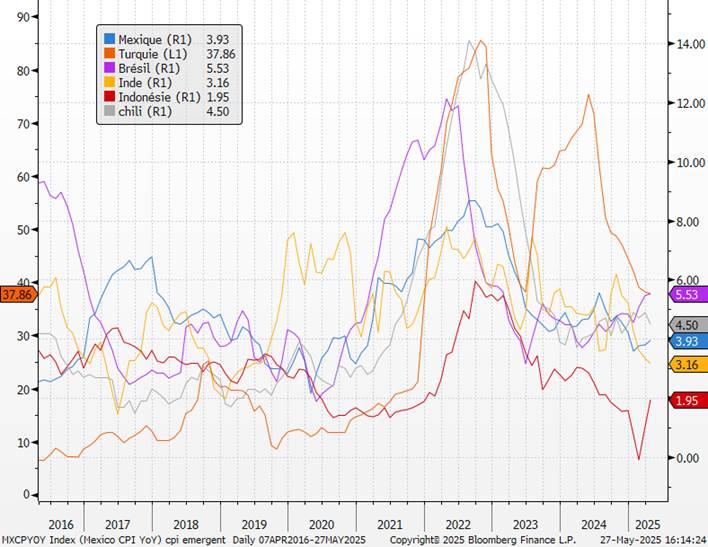

Inflation in emerging countries

The impact of US tariffs on emerging markets varies considerably from region to region. It depends both on direct trade exposures to the US, globalized supply chains, and the ability of countries to redirect their exports to other trading partners in response to US measures.

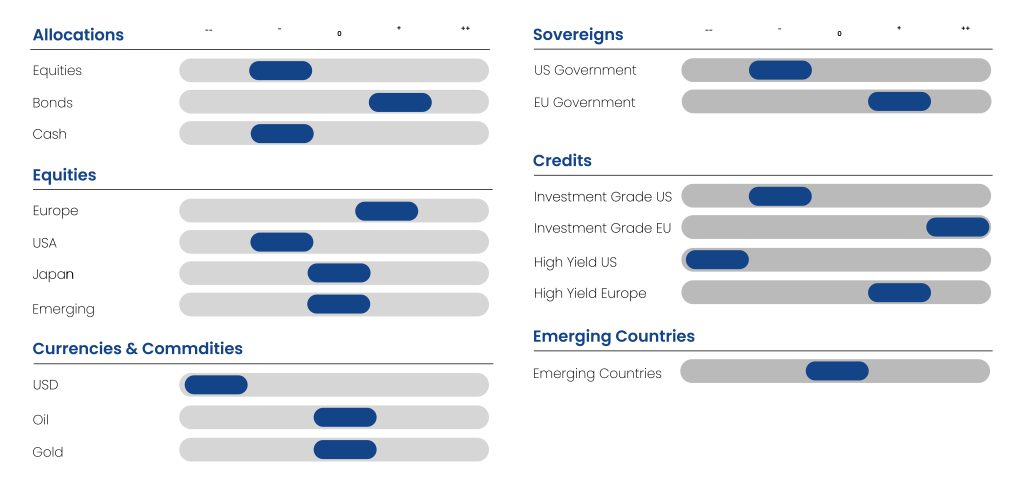

Asset allocation table