While two Fed governors, Christopher Waller and Michelle Bowman, had recently expressed support for a cut in interest rates, the chairman of the U.S. central bank, Jerome Powell, reaffirmed his intention to wait in order to observe the inflationary effects of tariffs.

During his hearing before the House Financial Services Committee, Jerome Powell had already explained that he was ruling out a potential interest rate cut in July due to the expected inflationary impact of the implementation of trade barriers.

He used his second day of testimony before Congress to reiterate the significance of tariffs and, of course, their effects on the U.S. economy. It remains difficult to predict to what extent the increase in tariffs could drive up prices, but the risk that they may fuel more persistent inflation is significant enough to prompt the Fed to remain cautious.

He emphasized the importance of the economic data for June and July in order to assess the effects on inflation. It is clear that at this stage, the increase in tariffs is not yet reflected in U.S. prices. This is partly due to stockpiling by companies in anticipation. Economic actors will gradually adjust their strategies in response to the new inflationary pressures.

In response to rising import costs, American companies will seek to pass these taxes on to their selling prices while significantly reducing import volumes. Trade between the United States and the rest of the world must therefore be closely monitored, starting with developments in the trade balance.

For the Fed, greater clarity on the trade situation (which will require more agreements) will allow it to resume cutting interest rates, especially as the slowdown in U.S. growth is expected to materialize over the summer, particularly in the labor market.

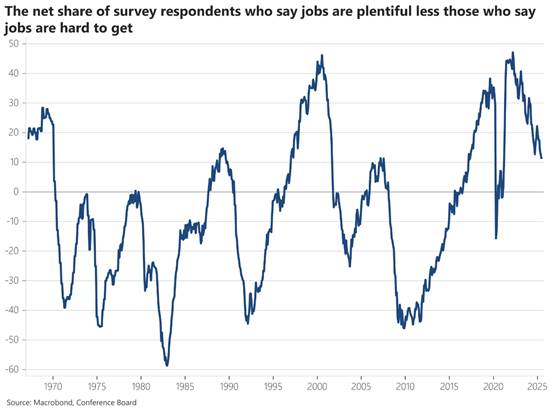

The Conference Board’s labor market gap (the percentage of respondents saying jobs are plentiful minus those saying they are hard to get) fell again in June, reaching a new cyclical low — a level last seen in early 2017.

The Fed chairman was joined in his remarks by several central bank officials, including Williams (New York Fed), Bostic (Atlanta Fed), and Barr (governor), who are calling on the central bank to maintain its current interest rate levels at the upcoming meeting, due to the inflationary risk stemming from the trade war — despite its harmful impact on growth and the effects of immigration policy on the labor market.

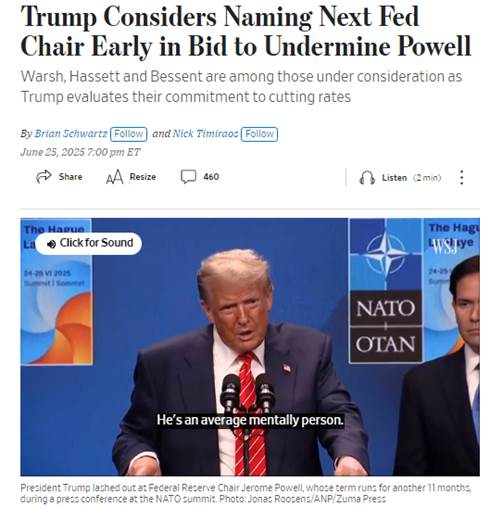

But not everyone shares this cautious stance. Donald Trump once again launched a fierce attack on the head of the Federal Reserve. “A mentally average person,” with a “low IQ,” someone “really stupid.” These were the words used by the President of the United States, speaking from the NATO summit, to describe Jerome Powell, who was in the middle of his semiannual Senate testimony.

According to the Wall Street Journal (link), President Trump’s frustration with the Fed’s slow approach to cutting interest rates is pushing him to consider accelerating the announcement of his pick to succeed Jerome Powell, whose term still has 11 months remaining. This could undermine the dollar..

The Fed’s stated intention not to act in the face of economic destabilization and a recurring inflationary risk raises questions. But there is no urgency: in an uncertain fiscal and trade context, we believe the Fed will wait until September, when it has greater visibility, to continue its monetary easing.