The 3 must-know news stories of the week and What We Think

- US job market: a gradual slowdown without immediate tension

- US budget: Trump pushes through his “Big Beautiful Bill”

- Eurozone inflation: on target, ECB stays the course

US job market: a gradual slowdown without immediate tension

U.S. job creation exceeded expectations in June, with 147,000 new positions added versus 110,000 anticipated. The May figure was revised upwards to 144,000, confirming a moderate but still positive momentum. These gains were concentrated in the healthcare and local government sectors, while job cuts continued at federal level, in line with the Republican executive’s goal of reducing the size of government. The unemployment rate fell slightly to 4.1% (from 4.2% in May), where analysts had expected it to rise to 4.3%. This level is generally considered to be close to full employment. But behind this apparent solidity, the ADP report published the day before sent a more worrying signal: 33,000 net job losses in the private sector, a rare event (only the second contraction since the Covid). The three-month rolling average for job creation fell to 19,000, its lowest level since the health crisis. According to ADP, this contraction is due not so much to waves of layoffs as to employers’ pronounced caution in hiring or replacing departures. In terms of salaries, annual pay rises for job stayers fell to 4.4%, a four-year low.

U.S. ADP Nonfarm Employment Change:

Our opinion: The U.S. labor market is sending mixed signals: still resilient on headline figures, but showing signs of an underlying slowdown. The Fed can afford to wait — the data doesn’t justify an immediate rate cut, but a persistent deceleration could force its hand by autumn. For now, this supports a wait-and-see approach, while keeping the door open to a rate cut in September.

U.S. budget: Trump passes his “Big Beautiful Bill”

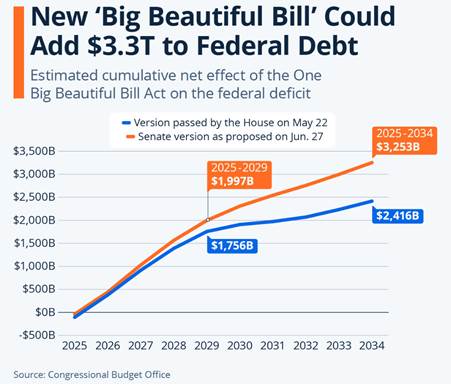

A major political turning point: Donald Trump has succeeded in pushing his massive $3.4 trillion budget plan through the House. Passed by a narrow margin (218 votes to 214), the bill signals a decisive shift in U.S. economic policy: tax cuts, reductions in social programs, a ramp-up in defense spending, and a rollback of several energy transition initiatives. Two Republicans — Thomas Massie (Kentucky) and Brian Fitzpatrick (Pennsylvania) — voted against the bill, siding with the Democratic opposition. It took extensive negotiations to win over the final holdouts. Trump plans to sign the bill on Friday at 4:00 p.m. during a ceremony at the White House. Among the flagship measures are the elimination of taxes on tips (a strong symbolic gesture aimed at working-class voters) as well as increased support for military spending and stricter immigration control. However, the plan has sparked concerns: according to the Congressional Budget Office, it will increase the national debt by more than $3.4 trillion by 2034

Our Opinion: The “Big Beautiful Bill” signals a clear return to expansionary fiscal policy with an electoral undertone at the cost of a significant increase in the deficit. Seemingly favorable to households and businesses, this budget bill could have second-round effects (pressure on US rates and the dollar). It offers short-term economic support but could quickly complicate the Fed’s efforts if inflation picks up again. Some sectors are likely to benefit including defense, aerospace, industrials, semiconductors, and fossil fuels. On the other hand, some tax incentives will be withdrawn from sectors such as renewable energy, electric vehicles, and agri-food.

Eurozone inflation: on target, ECB stays the course

Annual inflation in the eurozone stood at 2% in June, compared to 1.9% in May exactly in line with the ECB’s target and market expectations. The uptick was mainly due to a smaller drop in energy prices (-2.7% vs. -3.6% in May) and a slight increase in service prices (3.3% after 3.2%). Core inflation excluding energy and food remained stable at 2.3%. This level, still above the ECB’s target, supports the gradual policy path adopted since the first rate cut in June 2024. In other components, food prices continued to ease (3.1%, down 0.1 point), while inflation for industrial goods fell to 0.5%. Christine Lagarde stated that current interest rate levels are appropriate and reaffirmed the ECB’s strong commitment to maintaining its 2% inflation objective.

Our opinion: The ECB’s June 5 decision came as no surprise and fits within the trajectory of policy adjustments since the inflation crisis peak. With eight rate cuts already implemented, the central bank now appears ready to pause over the summer. However, another cut may still be on the table before year-end, if economic and inflation data warrant it.