The 3 must-know news stories of the week and our opinion

- Trade war: tensions loom as first 90-day moratorium expires.

- Oil prices rebound despite OPEC+’s new production boost.

- Despite monetary and fiscal stimulus, China struggles to escape deflation.

Trade war: tensions loom as first 90-day moratorium expires.

It’s been a busy week on the trade war front, with no major surprises given the expiry on July 9 of the first moratorium on the introduction of so-called “reciprocal” U.S. tariffs (on U.S. trading partners excluding China), decided on April 9 in the wake of the Liberation Day stock market crash.

On July 7:

- Donald Trump signed an executive order postponing the expiration of the moratorium from July 9 to August 1; while

- White House spokeswoman Karoline Leavitt reported that the US Administration had notified a number of partners that new reciprocal tariffs would come into effect on August 1 (see summary below), without eliminating the prospect of continued bilateral negotiations on the matter.

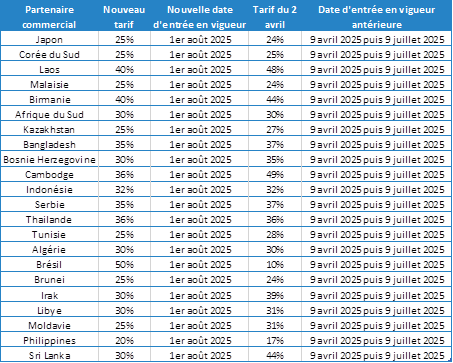

Summary of new tariffs decided on week starting July 7, 2025

These announcements come at a time of high expectations regarding possible new bilateral trade agreements, and a strong news flow circulating in this regard, not least:The trade framework reached with Vietnam on July 2, including a 20% tariff on exports from Vietnam to the USA, rising to 40% for Chinese products bound for the USA transiting via Vietnam;Press reports of a possible agreement with the European Union limiting reciprocal tariffs to 10%;Threats of additional tariffs on the BRICS (on top of reciprocal tariffs) if they adopt anti-American policies;Threats of sectoral tariffs, in particular the 50% tariff on copper mentioned by Donald Trump this week;Threats of a 35 % tariff on products coming from Canada (not included in the USMCA)

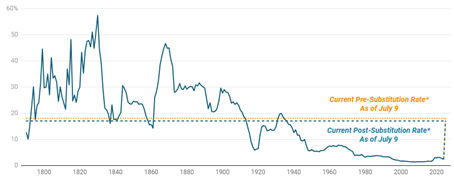

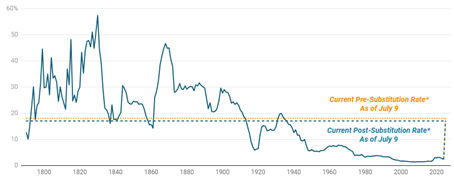

Average effective tariff rate

Tariff rates versus imports, in %

Oil prices rebound despite OPEC+’s new production boost.

On July 5, 8 OPEC+ countries (Saudi Arabia, Russia, Iraq, the United Arab Emirates, Kuwait, Kazakhstan, Algeria and Oman) announced a further increase in their monthly production quotas, accelerating the recovery in global supply. The increase continued in the wake of the alliance members’ desire to regain market share, whereas the voluntary cuts introduced from 2022 to support prices were no longer respected by all. In detail:

- The production increase for August 2025 is of 548,000 barrels/day;

- This follows successive increases of 138,000 barrels/day in April and 411,000 barrels/day each month from May to July included;

- For September, press reports suggest a further production increase of 550,000 barrels/day (decision to be announced on August 3), cancelling out the voluntary cuts of 2.2 million barrels/day decided in 2022 (source oilandgas360.com);

- In September, the same sources mention the possible increase in the specific production quota for the United Arab Emirates of 300,000 barrels, initially scheduled for September 2026;

- In addition to the above-mentioned developments, OPEC+ will still have to decide whether or not to maintain its decision to cut production by 3.7 million barrels/day, which is currently due to expire at the end of 2026.

In any case, the combination of rising OPEC+ production and trade-war-related global demand fears has not contributed to the decline in oil prices this week (see below).

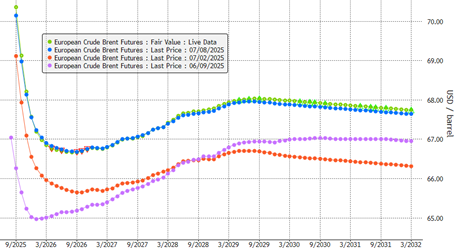

Brent futures at different dates

In USD/BBL

Rather, the opposite phenomenon has been observed, driven by:

- The return of Houthi attacks on commercial vessels in the Red Sea;

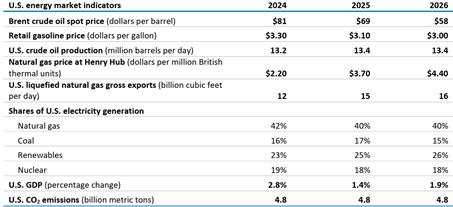

- The Energy Information Administration’s downward revision of US shale production levels for 2025 and 2026 (producers reluctant to restart drilling in the current price environment, see below). On this point, it should be noted that if the agency did revise the price of a barrel marginally upwards in 2025 (Brent + 3 USD/BBL versus June 2025 forecasts), this is mainly as a result of the worsening of the Middle East conflict (Iran/Israel, now on pause). However, this in no way calls into question their medium-term view, which emphasizes the bearish bias on prices given the risk of oversupply (Brent at 58 USD/BBL in 2026, – 11 USD/BBL over one year, even before this weekend’s OPEC+ announcement).

July 2025 Short-term energy outlook summary

Our opinion: We continue to believe that oil will now suffer from the combination of rising production and a worsening global demand outlook linked to the global macroeconomic slowdown caused by the trade war. Against this backdrop, our price forecast of around 65 USD/BBL in 2025, excluding the geopolitical risk premium, remains unchanged. In the meantime, the high level of uncertainty (in particular, on the Middle East geopolitical and trade war fronts) means caution remains key.

Despite monetary and fiscal stimulus, China struggles to escape deflation.

This week, inflation figures for June 2025 in China continued to show an economy mired in deflation. Specifically: consumer prices rose by a total of +0.1% year-on-year (core index, excluding the more volatile food and energy prices at +0.7% year-on-year), while producer prices remained down by 3.6% year-on-year (see below).

Consumer and producer price indices in China

In dark blue: total consumer price index;in light blue: core consumer price index;in green: producer price index;in annual variation, in %

These figures come as:

- The Chinese government has announced a number of measures to support consumption (e.g. subsidies for the exchange of durable consumer goods or the purchase of electric vehicles), and others to limit overcapacity in certain sectors (not least solar, steel and cement);

- The PBOC is committed to easing credit conditions in order to boost domestic demand (lowering the reserve requirement ratio of the country’s major commercial banks and cutting prime lending rates in May).

Our opinion: The Chinese government has taken the measure of the risk posed to its economy by the trade war unleashed by Donald Trump. It is therefore disseminating its support measures as events unfold, whether in terms of macroeconomic performance or international conditions. That said, we must not lose sight of the fact that Chinese monetary and fiscal support remains subject to constraints: the PBOC has to juggle credit stimulus with limiting exchange rate depreciation and the deterioration in commercial banks’ net interest margins; the level of public debt remains problematic, and the real estate crisis has not yet been fully resolved. Overall, our opinion remains unchanged: we keep our neutral stance on the country.