The 3 must-know news stories of the week and our opinion

- Tariffs are just beginning to bite in the United States, but without any significant impact on the market.

- The French budget announcements signal the return of political risk in the autumn.

- Chinese growth surprises positively in 2Q25: international trade continues to offset weak domestic demand.

Tariffs are just beginning to bite in the United States, but without any significant impact on the market.

Two key inflation indicators were on the menu of US statistical releases this week: the Consumer Price Index (CPI) and the Producer Price Index (CPI) and the Producer Price Index (PPI) for June.

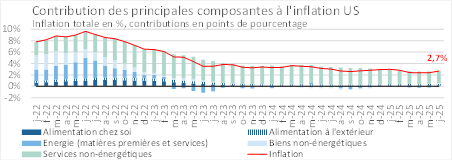

CPI – US

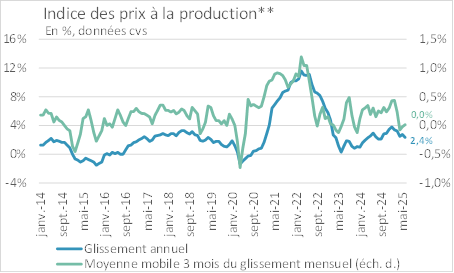

PPI** – US

** of final demand

The much-feared reflationary effect of tariffs is only just beginning to bite, particularly in the CPI:

- Over one month, consumer price inflation reached 0.3%, the highest since January 2025, after only +0.1% in May;

- Year-on-year, consumer price inflation climbed to 2.7% from +2.4% in May;

- Also year-on-year, core inflation excluding the most volatile food and energy prices climbed to +2.9% from +2.8% in May.

Concerning CPI components, over one month :

- Non-energy services remain the biggest contributors to total US inflation, particularly the housing component (shelter), which comes as no surprise given the continuing rise in US residential property prices (most recent S&P CoreLogic Case-Shiller home price index at +2.7% year-on-year in April 2025).

- Energy makes a positive contribution to overall inflation, given the rise in oil prices over the month (Iran-Israel conflict).

- New and used vehicles make a negative contribution to overall inflation, keeping prices of non-energy goods, which are highly exposed to tariffs, in check.

In any case, the markets did not react strongly to these releases. On the CPI front, US sovereign yields picked up a few bps: the US Treasury 10-year gained almost 10 bps, closing at 4.48%, while the 30-year touched the 5% mark again. As for the equity markets, they seemed more interested in the corporate earnings releases in progress for 2Q25. As a matter of fact, the figures published turned out to be in line with or, for PPI, even more benign than investors had expected (see below).

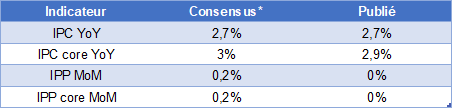

Comparison between published inflation figures and consens* forecasts

* Survey by Dow Jones Newswires and The Wall Street Journal, published by MarketWatch.com.

Our opinion: June’s inflation data are unlikely to change the FED’s monetary policy stance at the end of July (FOMC scheduled on July 29/30). The central bank is likely to opt for a status quo, keeping the FED Funds rate unchanged in the 4.25% / 4.50% range. This remains in line with our forecasts for key US interest rates. We continue to believe that two 25-bp rate cuts could take place from September onwards, when the effects of the trade war on the US economy become real (a combination of slowing consumption and lower inventories), bringing the FED Funds rate to the 3.75% / 4% range by the end of the year.

The French budget announcements signal the return of political risk in the autumn.

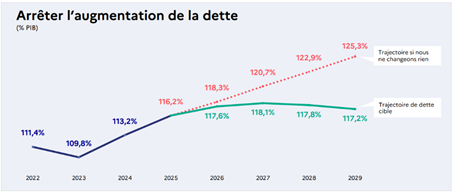

On July 15, the French Prime Minister presented a multi-year plan to rebalance the public accounts, including, by 2026: EUR 43.8 bn in savings (see details below) and a reduction in the deficit to 4.6% of GDP (from 5.8% of GDP in 2024), followed by a downward crossing of the 3% deficit threshold in 2029 (with a deficit of 2.8% of GDP in that year). In more details, the EUR 43.8 bn are obtained by adding up EUR 20.8 bn from the reduction of the State, Social Security and local authorities’ operating expenses; EUR 7.1 bn from the income tax scale freezing and indexation of social benefits discontinuation; tax fairness measures and a review of tax niches for EUR 7.6 bn; the abolition of two public holidays for EUR 4.2 bn; structural reforms for EUR 1.8 bn; and measures against fraud for EUR 2.3 bn.

Public debt stabilization trajectory presented by the government

Savings proposals presented by the French government

It should be noted that the increase in the defense budget remains unchanged in light of François Bayrou’s announcements. On July 13, the French Military Planning Law (LPM) 2024/2030 was definitively adopted by Parliament. It provides for a budget of EUR 413.3 bn for the army, i.e. EUR 118 bn more than the previous LPM. Also, in his speech to the military, Emmanuel Macron announced an additional defense budget of EUR 10 bn over two years (EUR 3.5 bn for 2026 and EUR 6.5 bn for 2027), in addition to the current LPM.

The provisions presented by the government will have to be discussed in Parliament in the autumn, and opposition parties on the left and far right have already warned of their intention to pass a no confidence motion if the 2026 Finance Bill (PLF) includes the July 15 proposals as they stand. To be continued, even if for the moment the 10-year Bund/OAT spread has remained steady at 70 bps.

Our opinion: Given the announcements, the apparent reluctance of the opposition and a few trade unions, and the absence of a clear majority in the National Assembly, we cannot rule out the return of a period of more pronounced political turmoil in France in the autumn, when the debates on the PLF 2026 will take place. However, we do not expect the situation to deteriorate any time soon, beyond what prevailed at the time of the June 2024 snap parliamentary elections, provide no new political shock occurs. Thus, we continue to believe that the Bund/OAT 10-year spread will remain at around 70 bps to 100 bps until the end of 2025, at times pushed towards 70 (which is the case today) in the absence of imminent risks, and testing back the 100 gauge in the event of a no confidence vote or new snap elections.

Chinese growth surprises positively in 2Q25: international trade continues to offset weak domestic demand.

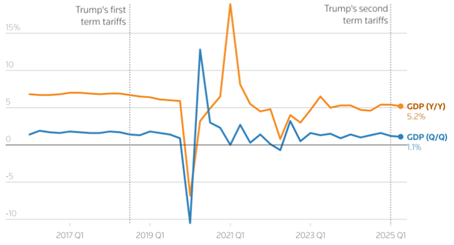

Annual real GDP growth in 2Q25 reached +5.2% in China, after +5.4% in 1Q25, a slowing trend but still solid and above the Chinese government’s stated target of 5% for the full year.

Real GDP growth in China

In blue: quarterly variation, in %

In orange: annual variation, in %

In more details:

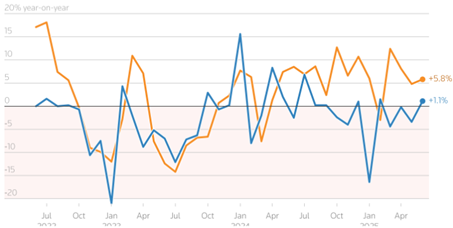

- Foreign trade remains a major contributor to Chinese growth in 2Q25. In fact, in June, Chinese exports accelerated again, to + 5.8% year-on-year, compared with + 1.1% for imports (see below);

- Conversely, domestic demand continues to lag behind: retail sales slowed to +4.8% year-on-year in June, compared with +6.4% in May, and more broadly, they recorded their lowest annual variation since the January-February 2025 period, while deflation remains the order of the day;

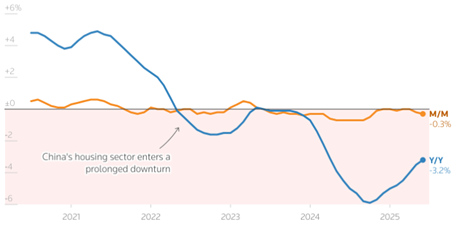

- The real estate crisis is not over, and house prices are still falling (see below).

International trade in Chine

In blue: imports’ annual variation, in %

In orange: exports’ annual variation, in %

Home prices in China

In blue: annual variation, in %

In orange: quarterly variation, in %

Our opinion: The trade war is a major risk for the Chinese economy. That being said, the June figures and, more broadly, growth in 2Q25 are reassuring. The fact that exports are continuing to rise faster than imports is in line with the ongoing phenomenon of anticipation of tariffs coming into force, which is spreading across the globe. This is further evidence that the trend towards stockpiling continued in 2Q25, further delaying global fragmentation’s economic harms. For China, achieving the government’s 5% growth target this year will require further measures to support domestic demand. To be continued.