- The Japan-US trade deal, more favorable than initially anticipated, paves the way for the Yen to keep on appreciating, but this may be a bumpy ride.

- Bank Lending Survey in the Euro area: credit demand picks up slowly, hampered by the uncertain global landscape.

- « I wish you all a nice wait-and-see holiday »: today’s Governing Council did not surprise, the ECB left key rates unchanged.

The Japan-US trade deal, more favorable than initially anticipated, paves the way for the Yen to keep on appreciating, but this may be a bumpy ride.

It has been a busy week in Japan, marked above all by the announcement of a trade deal with the United States, which turned out to be more favorable to growth in both countries than what had initially been anticipated. The agreement includes:

- The lowering of tariffs on Japanese exports to the USA to 15% from the previous 25% mark, including the Japanese automotive industry;

- In return, Japan commits to allocating USD 550 bn in loans and guarantees from government-affiliated institutions to encourage investment by Japanese companies in the United States in key sectors such as semiconductors and pharmaceuticals;

- Japan also commits to importing more American agricultural products, not least rice, with the Japanese Prime Minister indicating that this would not be detrimental to local producers;

- Donald Trump indicated on his part that he was pretty optimistic regarding the establishment of a US-Japan Joint-Venture (with no confirmation whatsoever from his Japanese counterparts) to finance a gas pipeline project in Alaska, without specifying whether this was the USD 44 billion project dear to his administration, consisting of a 1,300 km pipeline transporting gas to the liquefaction plant in preparation for export;

- It should be noted, however, that the 50% tariff specific to steel and aluminum remains in force, as it was not part of the agreement. Nor was there any mention of the defense sector;

- Finally, while the inclusion of Japan’s automotive industry is good news for the Asian nation, American car manufacturers may be feeling the pinch, as imports from Japan will be favored over imports from Canada or Mexico, which are still subject to the 25% sectoral tariff introduced earlier by the Trump administration.

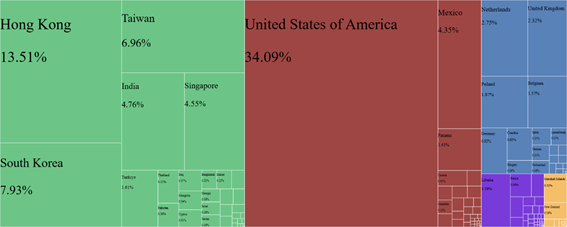

This agreement, which is more favorable than what had initially been anticipated, raises Japan’s economic prospects, as the country remains highly dependent on foreign trade, particularly with the United States and for its automotive industry (see graphs below). This favors a further rise in the Yen, also facilitated by the BoJ’s now greater capacity to continue its monetary tightening cycle (key rate currently at 0.5%), given that inflation is still far from the target (consumer price inflation at 3.3% in June vs. the 2% target).

Japan’s net exports in 2023, by destination

Japan’s net exports to the USA in 2023, by product

Note: sector nomenclature: SITC rev. 2.

Looking at the markets, while the announcement of the deal was welcomed on the equities’ side, not least all over the world, in anticipation of further agreements to come, the Japanese currency remained rather sensitive to the local political situation, as rumors of the Prime Minister’s imminent resignation following his party’s defeat in Sunday’s senatorial election weighed, especially at the beginning of the week, and as weaker inflation figures than initially anticipated were published for the Tokyo region in July, at the end of the week. In any case, the outcome of the election could well lead to a slightly more accommodating fiscal policy, with the ruling coalition now having to find compromises with the opposition within the framework of its sole relative majority in both chambers.

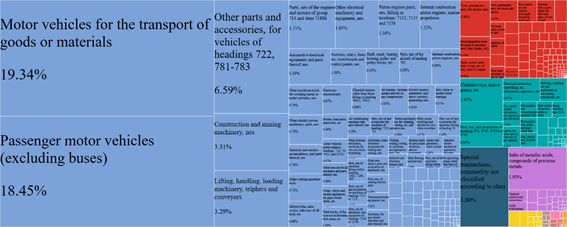

Our opinion: This week’s events in Japan may well move the economy towards more growth, which should support the Yen, in line with our expectation of a USD/JPY exchange rate target of 140/145 by the end of 2025. Still, uncertainty is the name of the game on sovereign interest rates: the BoJ’s hands are now less tied for a further rate hike between now and the end of the year (see the rise in market expectations below), which should further support the Yen; and in the long run, the prospect of further fiscal largesse could well push rates up again (see the evolution of forward curves below). Against this backdrop, we are raising our BoJ rate forecast to 0.75% by the end of 2025 (from 0.5% previously) and our 10-year JGB rate forecast to 1,75% (from 1,5% previously).

Market positionning regarding the BoJ’s key rate

JGB spot and forward curves as of end of 2025

Bank Lending Survey in the Euro area: credit demand picks up slowly, hampered by the uncertain global landscape.

This week, the ECB published its flagship quarterly Bank Lending Survey in the Euro area for 2Q25.

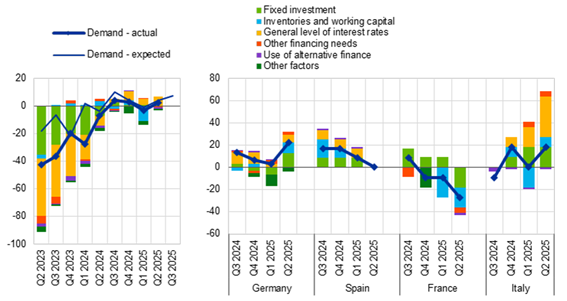

On the corporate side, demand for credit is picking up, but only slowly, despite the fall in interest rates linked to the continued reduction in ECB key rates. The highly uncertain global environment, undermined by the trade war and armed conflicts, may have slowed the rebound, with companies deferring their investment plans pending further clarification (particularly on US tariffs).

Credit demand evolution of corporates and contributing factors

Net balance of surveyed banks reporting an increase in demand, in %

Contributing factors, in percentage points

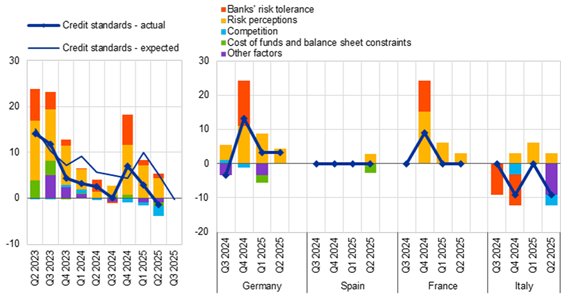

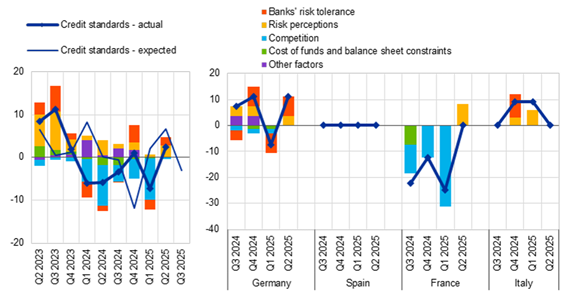

Also, lending conditions for businesses remain unchanged, with the easing brought about by lower interest rates offset by a tougher risk appetite on the part of banks, in anticipation of a deteriorating economic outlook. They are now more vigilant when it comes to companies most exposed to the trade war.

Credit conditions evolution of corporates and contributing factors

Net balance of surveyed banks reporting tighter credit conditions, in %

Contributing factors, in percentage points

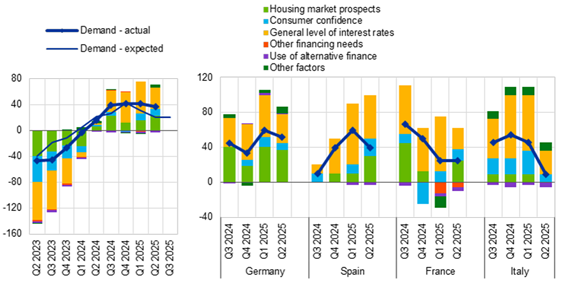

On the households’ side, demand for mortgages rose more sharply, while consumer credit rebounded only slightly. Here again, the global context of uncertainty may have weighed on households’ propensity to spend and consume.

Mortgages demand evolution and contributing factors

Net balance of surveyed banks reporting an increase in demand, in %

Contributing factors, in percentage points

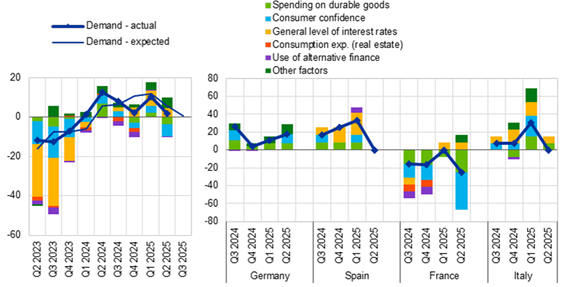

Consumer credit demand evolution and contributing factors

Net balance of surveyed banks reporting an increase in demand, in %

Contributing factors, in percentage points

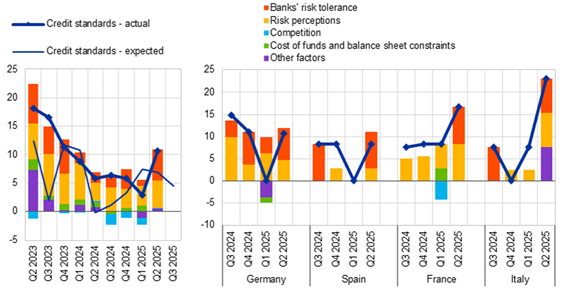

Credit conditions for households firmed up, whether for mortgages or consumer credit, but even more so for the latter. In addition to tighter lending policies (higher margins, stricter collateral requirements), banks are also reporting an increase in the rejection rate.

Credit conditions evolution of mortgages and contributing factors

Net balance of surveyed banks reporting tighter credit conditions, in %

Contributing factors, in percentage points

Credit conditions evolution of consumer credit and contributing factors

Net balance of surveyed banks reporting tighter credit conditions, in %

Contributing factors, in percentage points

Our opinion: The Euro area Bank Lending Survey is important for the ECB, enabling it to measure the quality of the transmission of its monetary policy to the real economy (companies finance themselves largely through bank credit in the Euro area, rather than directly on the markets). The results for 2Q25 are not surprising. Overall, rates charged by banks are falling, in the wake of the ECB’s key rates cuts, and demand for credit from private agents (businesses and households) is gradually recovering. The assessment of credit conditions over the period (stable for businesses, firmer for households) and its expected evolution in 3Q25 (easing) is an interesting compass for the ECB. For now, the situation remains consistent with the monetary policy stance decided by the institution, i.e., a neutral stance, neither accommodative nor restrictive, given the current economic outlook. In this context, we have no reason to change our key interest rate forecast for the Euro area (deposit facility rate between 1.75% and 2% at the end of 2025, with a further 25bp rate cut only from September 2025 onwards, in the event of an additional macroeconomic shock).

« I wish you all a nice wait-and-see holiday »: today’s Governing Council did not surprise, the ECB left key rates unchanged.

At its July Governing Council, the ECB unsurprisingly kept its three key interest rates unchanged (deposit facility rate, main monetary policy rate at 2%, refinancing rate at 2.15% and marginal lending facility rate at 2.40%).

At the press conference that followed, Christine Lagarde indicated that she considered the institution to be in a comfortable position to “hold and watch” given that:

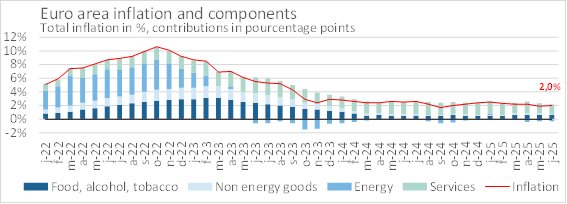

- Inflation had now returned to the 2% target (see below), helped in the short term by the gradual decline in wages in line with expectations and the continued absorption of the increase in unit labor costs by unit profits, and in the medium term by anchored inflation expectations at the 2% target.

- The Old Continent’s economy had shown resilience in a challenging global environment, helped not only by the rise in net exports frontloading, in anticipation of the entry into force of additional US tariffs, but also by the gradual increase in household consumption (historically low unemployment, solid balance sheets) and investment, which was not necessarily expected given the uncertainty.

- While the risks surrounding economic growth were mostly bearish, those related to inflation were less certain. In fact, risks to inflation could well tilt: to the downside, in the event of a stronger Euro, or if some other trading partners (not least China) were to dump their excess capacity in Europe; but they could also trend upwards, fuelled by the fragmentation of global value chains and the resulting bottlenecks.

CPI – Euro area

Going forward, the ECB’s conduct of monetary policy remains unchanged. It will continue to be data-dependent, with no forward guidance and maintaining a meeting-by-meeting approach, without committing to a predetermined path. In this context, the three pillars of future decisions remain:

- The inflation outlook, including related risks.

- The dynamics of underlying inflation.

- The strength of the transmission of monetary policy decisions to the real economy.

During the Q&A session that followed, with Christine Lagarde remaining firm on her position not to hint towards any forward guidance, we still managed to retain that:

- It was too early to comment on the economic effects and monetary policy implications of a possible trade agreement with the United States that would include reciprocal tariffs of 15% (similar to Japan’s, according to press reports released on the evening of July 23). As a matter of fact, Christine Lagarde indicates she would not rule out any possibility for the future, including a rate hike if the trade war outcome turns out to be more favorable for economic growth and spurs inflation.

- Fears that inflation would fall below the ECB’s target are justified, as the economic forecasts presented by the institution itself at its June Governing Council included this possibility for 2026 (inflation at 1.6%). However, the 2% price stability mandate is not based on a specific point in time, but rather on a medium-term trend, and in this regard, given the uncertainty surrounding the trade war and how people will react to the new tariffs, it is better to wait for more clarity before making any decision.

- The decision to keep key interest rates unchanged in July was taken unanimously by the Governing Council.

Our opinion: Today’s ECB decision is in line with our forecast. We continue to believe that with a deposit facility rate at 2% and a gradual recovery in domestic demand, the ECB is in a comfortable position going forward. Furthermore, at this level, real rates remain just above 0, preventing the institution from returning to the side effects of the long period of negative rates that prevailed until the beginning of the 2020s (inefficient allocation of capital, bubbles, etc.). Our forecast for the end of 2025 remains at 1.75%/2%, with a further 25 bp rate cut still possible from September onwards in the event of a further deterioration of the economic outlook.