On Monday, August 25, during a press conference aimed at raising public awareness in France about the urgent need to control the public deficit and debt, Prime Minister François Bayrou announced that he would call on the National Assembly to vote on a motion of confidence on September 8, pursuant to Article 49, paragraph 1, of the Constitution.

The Prime Minister’s gamble is fraught with consequences. In order for the government to remain in power, it must obtain a majority of votes without having to reach a specific threshold. Thus, unlike typical no confidence votes required by deputies, abstentions and non-participations are not deemed to constitute support to the government. Overall, if the government does not win the National Assembly’s confidence, the Prime Minister must submit his government’s resignation to the President of the Republic, pursuant to Article 50 of the Constitution.

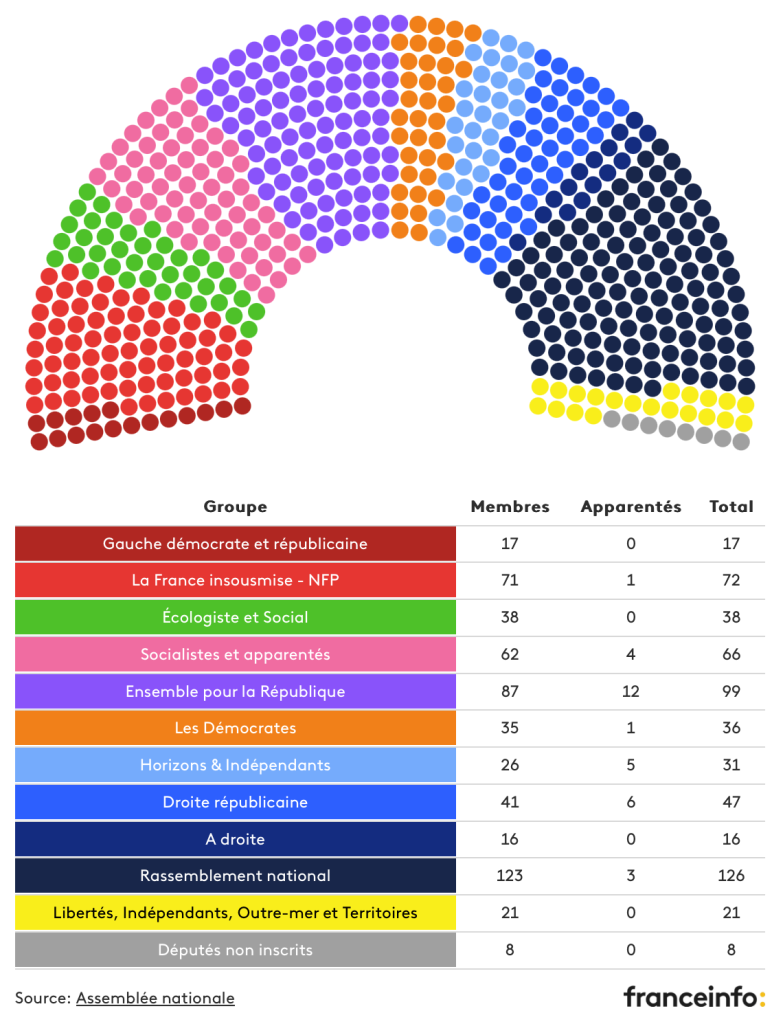

National Assembly Composition

In number of seats

Political reactions were swift following this announcement, and a quick back-of-the-envelope calculation shows that François Bayrou’s government has very little chance of staying in power. The four left-wing groups, the National Rally, and Eric Ciotti’s “A Droite” group have all indicated that they will vote ‘against’ (with a slight nuance on the part of the Socialists, who may abstain rather than vote “against,” but with no impact on the final outcome of the vote). The total number of votes “for” would thus only reach 242 at most, far from a majority, which would automatically lead to the fall of the government.

The markets reacted swiftly in this context, with Tuesday’s closing figures showing:

- The CAC 40 falling by nearly 1.5% after already dropping 1.6% the previous day, with financial stocks among the most heavily sold (Société Générale – 6.8 %; Crédit Agricole – 5.4%, BNPP – 4.2 %, Axa – 4.0%);

- French sovereign bond yields rising by almost 10 bps compared to the August 22 close, with the 10-year OAT now reaching 3.5%;

- The France/Germany spread widening to nearly 80 bps, compared to 70 bps at the August 22 close.

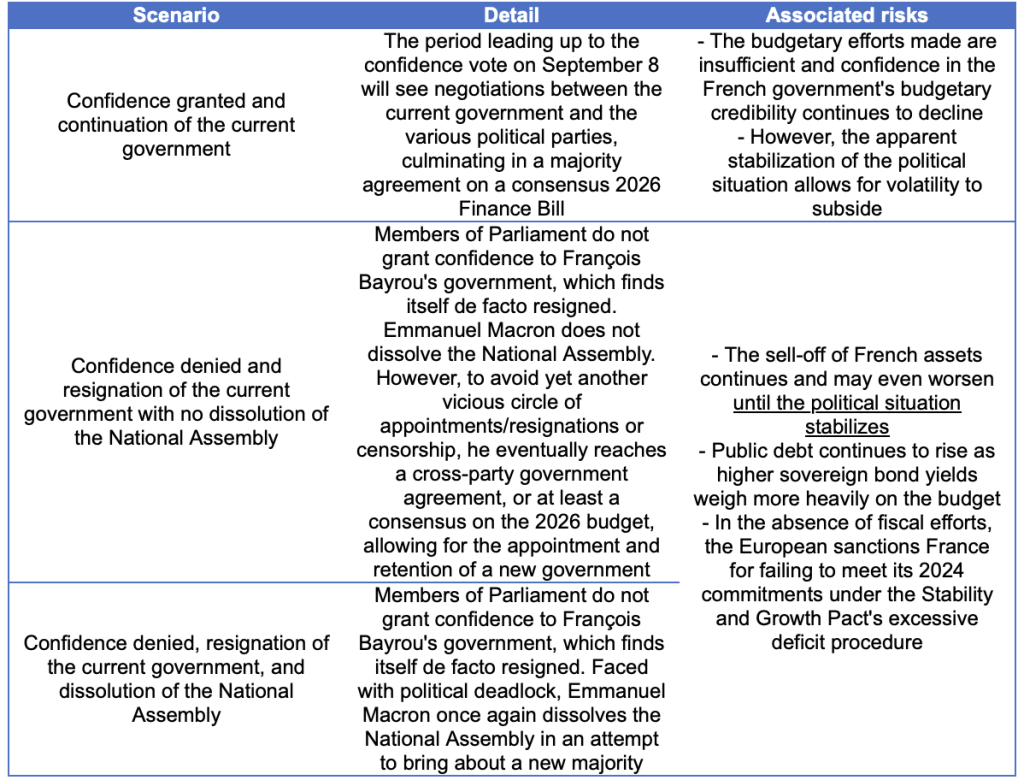

In this context, three possible scenarios emerge for the future (see below).

Possible scenarios and associated risks

Our opinion: Given the latest announcements, we believe that François Bayrou’s government is unlikely to remain in power. The period of political instability that is now beginning could last until the President of the Republic manages to form a new governing majority, either through cross-party dialogue or by dissolving the National Assembly and holding snap elections. In this context, we continue to believe that the 10-year OAT/Bund spread will widen, possibly even testing the 100 bp level reached during the 2024 snap elections, particularly due to fears that extreme parties with very low economic credibility will come to power. As for France’s economic situation and financial risk as such, the country’s ability to raise taxes has not changed and safeguards are in place (Special Finance Law, etc.) to ensure the continuity of the State. In addition, France continues to place its debt on the markets without difficulty. There is no cause for alarm, therefore, but rather a need for clarity and caution, certainly with regards to sovereign debt, but also on the equity markets, where investors may prefer to hold non-French European stocks given the local instability.