The 3 must-know news stories of the week and our opinion

- August inflation figures and disagreements within the Governing Council confirm that the ECB will halt interest rate cuts, at least for the time being.

- Chinese domestic demand seems to be recovering, but caution should remain key regarding the effectiveness and sustainability of the stimulus measures.

- US employment figures in August confirm J. Powell’s pivot at Jackson Hole.

August inflation figures and disagreements within the Governing Council confirm that the ECB will halt interest rate cuts, at least for the time being.

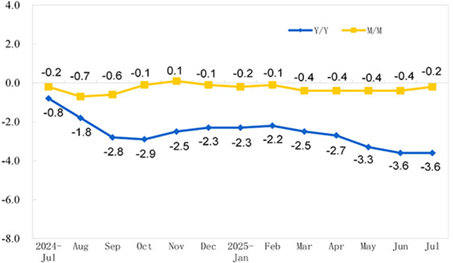

In the Euro Area, key inflation figures were published this week, providing greater insight into the monetary policy decision to be taken at the ECB Governing Council meeting in September (press conference scheduled for 9/11).

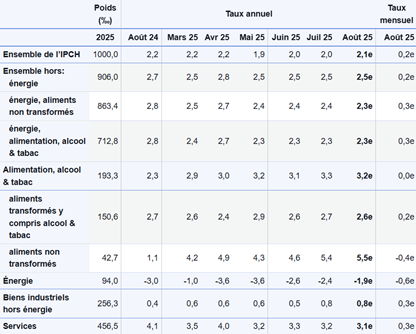

- In August, the flash estimate of inflation as measured by the consumer price index came in at + 2.1 % year-on-year, up 0.1 point from July (see below). The core index, which excludes the more volatile prices of food, energy, alcohol, and tobacco (the latter two being more sensitive to taxes), remained stable at + 2.3 % year-on-year, but still far from the ECB’s target of 2 %.

Harmonized Consumer Price Index in the Euro Area, by component

In %

In further details, the most striking part concerns the rise in industrial goods prices excluding energy (+ 0.3 % month-on-month, + 0.8 % year-on-year) and that of services prices (+ 0.3 % month-on-month, albeit slowing year-on-year to + 3.1 % compared with + 3.2 % the previous month), two key components of inflation. This month’s increase also occurred despite energy prices continuing to fall (- 0.6 % month-on-month, – 1.9 % year-on-year).

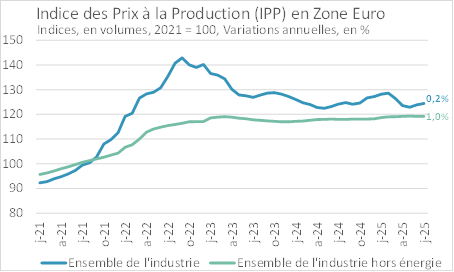

- The same is true for the Producer Price Index. It accelerated, at + 0.2 % year-on-year for industrial prices and even at + 1.0 % for industrial prices excluding energy (see below).

Domestic Producer Price Index in the Euro Area

These publications come as the European Union and the USA have reached a trade deal (albeit one that is highly unfavorable to the Old Continent), removing the prospect of retaliatory tariff barriers on the part of the European Union. Hence, despite bilateral agreements, the global geo-economic fragmentation accelerated by the trade war initiated by the US seems likely to have raised global industrial production costs, at least temporarily, while the most heavily affected value chains are being reconfigured.

This observation should come as no surprise to Isabel Schnabel. The hawkish member of the ECB Governing Council spoke out this week in an interview with Reuters calling for a halt in the ECB rate cutting cycle in the absence of further shocks to the Euro Area economy, a view shared by many other central bank presidents at the Eurosystem.

Her main argument is that inflationary risks are now structurally higher:

- She argues in particular that supply shocks are more recurrent today than in the past. both being more frequently provoked (protectionism, trade wars, reorganization of global value chains, armed conflicts) and more frequently experienced (pandemics, physical climate risks, agricultural overexploitation resulting in lower arable land productivity and higher food prices).

- The second aspect mentioned by Schnabel relates to the positive fiscal stimulus expected, particularly as a result of the German recovery plan. In this regard, the extent of the risk of rising inflation would depend on the sectoral response to the stimulus, more specifically whether capacity constraints arise as a result of an overly sharp increase in demand.

- Finally, Schnabel points out that in the current European context of recovering domestic demand, the transmission of the potentially deflationary effect of the strong Euro to consumer prices could ultimately be less significant than is typically estimated by inflation forecasting models.

Based on these findings, Isabel Schnabel also emphasizes the importance of monitoring inflation expectations as a safeguard against heightened volatility in price dynamics. In this regard, she points out that inflation expectations remain firmly anchored at the 2 % target, according to the latest ECB surveys (Survey of Monetary Analysts, Survey of Professional Forecasters).

Finally, Isabel Schnabel notes that the European economy is doing well and that the latest data point to a recovery in domestic demand and convergence of growth towards its potential.

Our opinion: The minutes of the ECB Governing Council’s last meeting in July revealed strong disagreements among the institution’s members regarding the future course of monetary policy. This situation automatically increases the likelihood of a pause in the ECB’s rate cuts, at least temporarily in September. Beyond that, the latest macroeconomic statistics published, whether in terms of prices or activity, indicate that with the ECB deposit rate at 2 %, monetary policy appears appropriate for the current situation. This reinforces the view of the most hawkish members of the Council, not least Isabel Schnabel, as mentioned above. This is also in line with our interest rate forecasts for the Euro Area until the end of 2025. Our central scenario remains that the ECB will halt rate cuts (deposit facility rate at 2 % by the end of 2025), without completely ruling out the possibility of a final additional cut of 25 bps if the economic situation deteriorates rapidly. Given the current volatility (evolving trade war, political situation in France), this risk scenario, which is less likely to occur in the short run, remains valid for the time being.

Chinese domestic demand seems to be recovering, but caution should remain key regarding the effectiveness and sustainability of the stimulus measures.

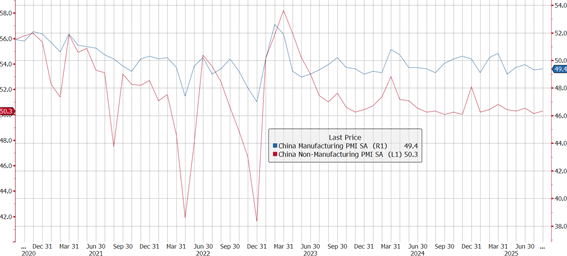

The latest official PMI surveys for August in China outlined some improvement in the state of the economy. The manufacturing PMI indicator stood at 49.4, up 0.1 points over the month, while for the non-manufacturing sectors, it stood at 50.3, up 0.2 points (see below). As a reminder, an indicator below 50 indicates that the sector is still contracting. Thus, even though activity in the manufacturing sector appears to have slightly improved, it has struggled to really take off since March 2025 (the most recent date on which the indicator exceeded 50).

Official PMI surveys

50+ = expansion

In fact, looking more broadly at the latest Chinese macroeconomic publications, the situation appears to be rather mixed.

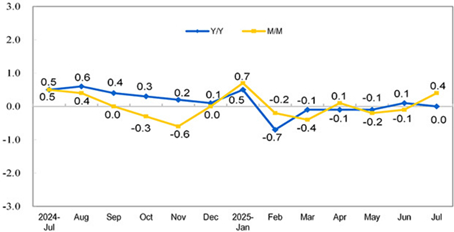

- On prices, there seems to be a slight improvement. In particular, the consumer price index recovered to + 0.4 % month-on-month in July, while the producer price index appeared to break away from the very negative levels at which it had been stuck (- 0.2 % in July, up 0.2 point month-on-month).

Consumer Price Index in China

Monthly variations (in yellow), annual variations (in blue), in %

Producer Price Index in China

Monthly variations (in yellow), annual variations (in blue), in %

- However, also in July, growth slowed after strong results in 1H25 (GDP growth at + 5.4 % in 1Q25 and + 5.2 % in 2Q25, exceeding the annual target of 5 % for China). The backlash appears to be widespread, affecting domestic consumption (slowing retail sales), private investment and net exports (unsurprisingly given the ongoing trade war), while industrial production, the spearhead of the Chinese economy, is also slowing.

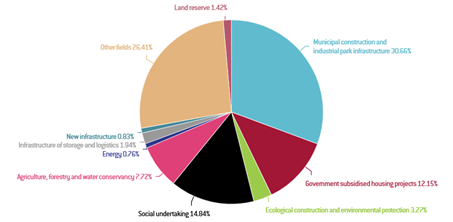

This situation raises questions about the effectiveness and sustainability of the fiscal and monetary stimulus measures deployed by the Chinese government since the beginning of the year in an attempt to shield the economy from the intensifying global trade conflict. One way to answer this question is to analyse how the various stimulus measures have flowed within the economy. - Most of the local government special bonds have been used to finance construction and infrastructure projects in municipalities (see below).

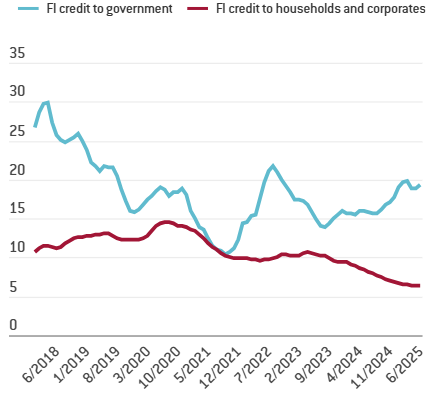

- As for the PBOC’s monetary easing, it has certainly helped to boost lending, but on closer inspection, the new loans granted mainly concern the public sector rather than households or businesses (see below).

Breakdown of announced targets for special bonds

In %

Financial institutions, credit to government, households and corporates

Annual variations, in %

Our opinion: During August, a massive influx of hedge funds and foreign institutional investors flocked to Chinese onshore equities, propelling the Shanghai Composite Index to a one-year monthly high (up nearly 8% over the month). The underlying assumption is that domestic demand in China will rebound, successfully offsetting the weakening of net exports brought by the intensification of the trade conflict with the USA. In fact, hopes are high since Xi Jinping’s government appeared to take stock of the challenge by announcing an increase in the budget deficit target to 4 % of GDP in 2025 (up from 3 % previously), while the PBOC committed to lowering key interest rates to combat deflation. Signals sent this summer that the fight against domestic industrial overcapacity was beginning (anti-dumping measures and rationing of excess capacity in key sectors such as steel, batteries, photovoltaics, and automobiles), combined with the stimulation of domestic consumption through programs encouraging the trade-in of consumer goods, have fuelled hopes of a shift in domestic policy toward a model more focused on domestic demand rather than the mercantilism seen to date. However, as mentioned above, support measures targets have not really deviated from the traditional sectors of preference. In this context, we believe it is premature to claim that China is on the verge of changing its model, or to bet on a strong and sustainable recovery in domestic demand. The structural weaknesses at stake within the Chinese economy have not disappeared. The country remains plagued by demographic aging and a real estate and debt crisis that has permanently weakened household balance sheets (their savings were heavily invested in real estate) and their propensity to spend without the establishment of a social safety net. Domestic activity in China is showing signs of picking up, but it would be unwise to bet on a lasting rebound at this stage.

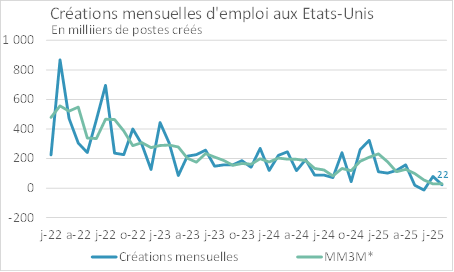

US employment figures in August confirm J. Powell’s pivot at Jackson Hole.

As expected, US employment figures continued to slow in August (22,000 jobs created compared with 79,000 in July according to the second estimate, see below) in the wake of the July release, which saw May and June figures revised downward and brought the quarterly moving average for monthly job creations to 35,000, well below the historical average outside of crises (183,000 jobs created per month between 2010 and 2019, for example).

Monthly job creations in the USA

* 3-month moving average. Source: Bureau of Labor Statistics via Saint-Louis FED, Last data point for August 2025.

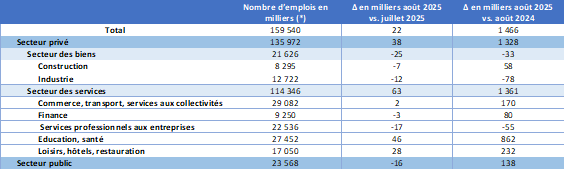

Specifically, the 22,000 created jobs mainly concern the private sector, specifically in services producing domains: retail, transports, education, health, and hospitality-leisure (see below). The unemployment rate remained largely unchanged at 4.3 % (+ 0.1 point over one month).

Job creations in the USA as of August 2025, by sector

* Preliminary data. Source: Bureau of Labor Statistics.

Over the week, the JOLT survey for July also showed a slowdown, with 7.2 million job vacancies (0.2 million fewer than in June and 0.6 million fewer than in May) and a hiring rate of 4.3% (compared to 4.4% in June and 4.6% in May). Also, in July, for the first time since March 2021 and the beginning of the gradual emergence from the pandemic, the ratio of job openings to unemployed persons fell back below 1 (to 0.99 job openings per unemployed person).

Against this backdrop, the analysis of the situation remains unchanged: the spontaneous and induced decline in immigration currently underway in the United States is offsetting the negative effects of the decline in labor demand from businesses, given the uncertainty mainly caused by the trade war.

As for the residual inflationary risks often cited to justify the FED’s caution in continuing its rate cuts cycle, the FED’s Beige Book survey, also published this week, reported stagnant economic activity and a decline in household consumption. Households are suffering from a decline in purchasing power amid rising prices linked to the trade war, while their wages are not keeping pace.

Our opinion: As J. Powell reiterated in his speech at Jackson Hole at the end of August, the combination of falling labor demand and falling supply, which is artificially keeping the unemployment rate at a historic low in the United States, should not exempt the FED from worrying about its maximum employment mandate. Similarly, given the weakness of the labor market, employees have little bargaining power to obtain wage increases in the face of price increases linked to tariffs. This reduces the risk of a full-blown wage-price spiral. The latest data published this week confirm the FED’s pivot towards rate cuts. They also reinforce our forecast of key interest rates at 3.75%/4% in the USA by the end of 2025, with the first cut to come in September (FOMC on 9/17). Until then, the consumer price index for August (on 9/11) and the QCW preliminary benchmark revision to the establishment survey (on 9/9) will provide additional information to help us form our view on the upcoming monetary policy decision.