- The FED stays in “risk management” mode for now, as for investors, the “risk on” mode remains.

- Also in the USA, the positive economic effects of the OBBBA would not be strong enough to offset the combined trade war and anti-immigration measures shock in the medium run. When assessing the health of the US economy, consumer spending remains the best compass. American consumers continue to spend, but their purchasing power remains under pressure.

- Status quo on BoE and BoJ rates at the September 2025 central bankers’ meetings.

1. The FED stays in “risk management” mode for now, as for investors, the “risk on” mode remains

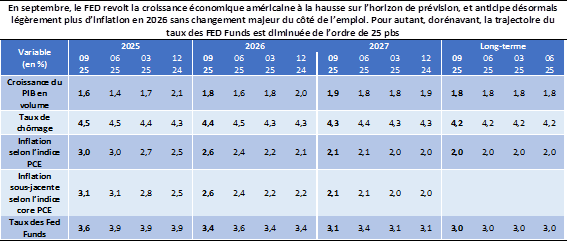

At the September FOMC meeting, the FED resumed its rate-cutting cycle by announcing a widely anticipated 25 bp cut in the FED Funds rate, bringing it to a range of 4 % to 4.25 %. The US central bank justified this decision primarily by the shift in the balance of risks towards greater downside risks on the labor market. Nevertheless, upside risks to inflation, fueled by the trade war, have not disappeared and remain on the institution’s radar, although it currently expects price increases to be temporary rather than sustained.

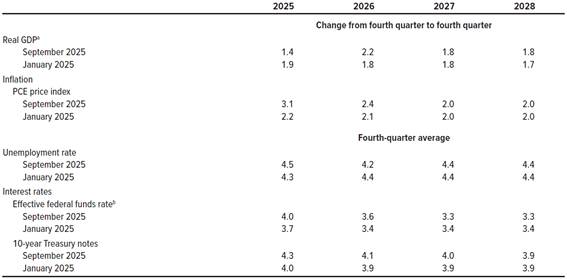

The September FOMC meeting was also an opportunity for the FED to outline a new Summary of Economic Projections (SEP, see below).

September 2025 SEP and comparison with passed projections

From J. Powell’s press conference, we note several key points that explain the FED’s current monetary policy stance, in particular:

- The monetary policy framework will not change, at least in the short run, as long as J. Powell remains FED Chair, and continues to hinge on the understanding of the macroeconomic data as they are released, the evolving outlook and the balance of risks to the FED’s dual mandate of maximum employment and stable prices. In this respect, the FED’s policy is “not on a preset course”.

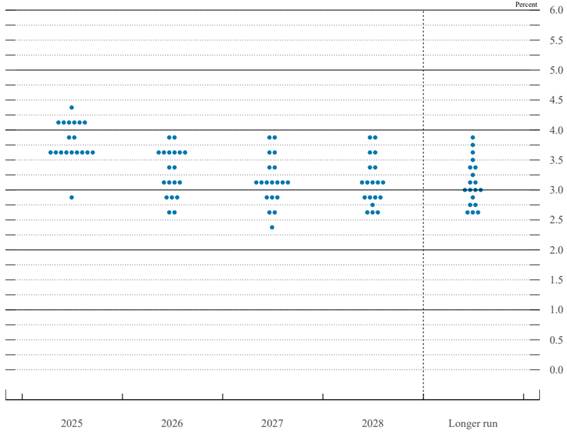

- The explanation for the dispersion of opinions within the FOMC, illustrated by the shape of the “dots plot” (see below), lies in the challenges posed by the current environment, which is particularly uncertain given the economic policies deployed by the US administration, rather than in potential dissensions within the FED’s monetary policy committee. In this regard, today’s decision was taken unanimously by all participants except Stephen Miran, who had favored a 50 bp cut now and a cumulative 150 bp cut by the end of 2025.

- The decision to cut rates by 25 bps this month was based on a “risk management” approach, as Powell explained. The economy remains in a good shape (see upward revision to growth projections in the SEP), and the “curious” equilibrium achieved in the labor market by the double decline in labor supply and demand is artificially maintaining the unemployment rate (see virtually unchanged unemployment forecast in the SEP) without preventing the number of monthly payroll creations from falling below its break-even point, but inflationary risks remain (see upward revision to inflation in the SEP and year-on-year rise in goods prices).

- In response to questions about the independence of the FED since Stephen Miran joined the FOMC while retaining his position as Chairman of the Council of Economic Advisors at the White House, J. Powell explained that the FED will continue to work towards fulfilling its dual mandate of maximum employment and stable prices based on its understanding of the state of the economy, “the DNA of the institution,” regardless of any other considerations. He also refrained from commenting on Scott Bessent’s attacks concerning the need for an independent review of the FED. However, he pointed out that the institution had just conducted a strategic review of its monetary policy framework and is always seeking to improve its internal processes.

- Finally, when asked about a third mandate for the FED to control long-term interest rates, an idea recently taken up by Stephen Miran and Scott Bessent, J. Powell indicated that this would primarily be a by-product of achieving the dual mandate of stable prices and maximum employment. No need, then, to implement new measures to get there.

Dots plot

Our opinion:

The decision to cut the FED Funds rate by 25 bps in September was widely anticipated by the markets. It was also the move we had anticipated. Looking ahead, there appears to be a clear break with the addition of Stephen Miran to the FOMC and the emergence in the dots plot of one participant’s desire to see key rates reach 2.75%/3% by the end of 2025 (probably Stephen Miran’s). It therefore seems today that the FED’s key interest rates may decline much more rapidly in 2026, when J. Powell’s term expires and the FOMC takes a more favorable stance towards the White House’s wishes. By the end of 2025, however, the FED’s gradual and cautious approach is likely to continue. We therefore still believe that the FED Funds rate will fall below 4% by the end of 2025. With the Atlanta FED’s Nowcast for real GDP growth in Q3 2025 remaining very robust (+3.3% annualized quarterly change as of 9/17) and consumption continuing to hold up (upward surprise in retail sales in August this week), we still expect a further 25 bp cut in the FED Funds rate, most likely in December. However, any further slippage in employment figures would bring the additional 25 bp cut back into focus, a move that is now once again widely anticipated by the markets and forecast by the SEP.

For investors, this decision paves the way for a potentially more pronounced cycle of rate cuts over the next 18 months. The US 10-year yield has fallen below 4% twice in the last seven days and stands at 4.10% on September 18, 2025. Since the beginning of the year, the 10-year US yield has fallen by 47 bps, and the 30-year US mortgage rate by 90 bps. However, this decline has not been strong enough to revitalize the residential real estate market: in July, 4 million seasonally adjusted annualized homes changed hands on the secondary market, compared to an average of 5.5 million in 2016/2021. While Main Street remains constrained by financial conditions, Wall Street is already anticipating a likely upturn in activity for homebuilders and specialist renovation retailers. Lowe’s and Home Depot are trading near their highest levels on the stock market, while the valuation (P/E) of the largest homebuilders in the United States is at its highest since 2017 at 14x, a sign of growing hope for an increase in their profits.

2. Also in the USA, the positive economic effects of the OBBBA would not be strong enough to offset the combined trade war and anti-immigration measures shock in the medium run. When assessing the health of the US economy, consumer spending remains the best compass.

In September, the Congressional Budget Office (CBO), a non-partisan analysis agency attached to the US Congress, published an update to its economic outlook for the next three years, incorporating the new tariffs decided by the US administration and in force as of August 19, administrative developments as of August 28, and economic developments and laws in place as of September 2. This interim update comes in addition to the annual review, with the publication of ten-year projections, scheduled for early 2026.

The main macroeconomic developments presented by the CBO are the enactment of the One Big Beautiful Bill Act (OBBBA) this summer, the tariff increases decided by the Trump administration since April 2, and the decline in net immigration. More specifically:

- In 2025, the CBO revises real GDP growth down by 0.5 percentage points to +1.4%, as the trade war and decline in net immigration outweigh the budget’s knock-on effects.

- Conversely, in 2026, the budget’s knock-on effects (permanent provisions of the 2017 Tax Cuts and Jobs Act; incentives for Medicaid and Supplemental Nutrition Assistance Program beneficiaries to return to work, boosting labor supply) outweigh the decline in net immigration. The decline in uncertainty surrounding the trade war is also a positive contributor. As a result, real GDP growth for next year is revised upward by 0.4 percentage points to +2.2%.

- In 2027 and 2028, growth returns to the January scenario trend. The fiscal impulse triggered by the OBBBA fades, the rise in the deficit and public debt crowds out the initial surge in private investment, while the supply shock represented by the decline in net immigration is offset by the rise in domestic production due to relocations facilitated by the trade war. Overall, in 2028, real GDP growth is only 0.1 percentage points higher than in the January scenario, at +1.8%.

- Finally, the CBO anticipates a slower return of inflation to the FED’s 2% target due to the supply shocks represented by the trade war and the decline in net immigration, and as a corollary, higher interest rates in 2025 and 2026 in response to reflation.

CBO’s economic forecasts in September 2025 and evolutions versus January 2025

In %

Notes: (a) Real values correspond to nominal values adjusted for inflation; (b) The median interest rate that financial institutions apply to overnight loans from their monetary reserves. Source: CBO, “CBO’s current view of the economy from 2025 to 2028,” September 2025..

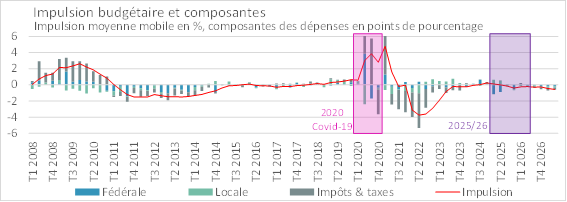

The CBO’s conclusions are in line with the latest analyses from the Hutchins Center on Fiscal & Monetary Policy, part of the Brookings Institution, a Washington, D.C.-based non-governmental organization whose mission is to conduct non-partisan research and analysis with the aim of improving policy and governance at the local, national, and global levels. At the end of August, the center updated its U.S. fiscal impulse indicator in light of the enactment of the OBBBA. They estimate that the US fiscal impulse will remain negative over their forecast horizon (Q3 2025 to Q2 2027 included) despite a slightly positive contribution from the OBBBA to real GDP growth of +0.22 point in 2025 and +0.31 point in 2026 compared to the counterfactual without the OBBBA. They also indicate that tariffs and the reduction in federal subsidies to universities would cost 0.5 percentage point of GDP each year.

US fiscal impulse indicator, by component

Note: The Hutchins Center’s analyses include the effects of discretionary fiscal policy and automatic stabilizers but do not take into account multiplier effects; a negative impulse results from fiscal policy weighing on growth; after Q3 2025, the figures are projections. Source: Hutchins Center “Fiscal Impact Measure,” updated on 8/29/2025.

Our opinion:

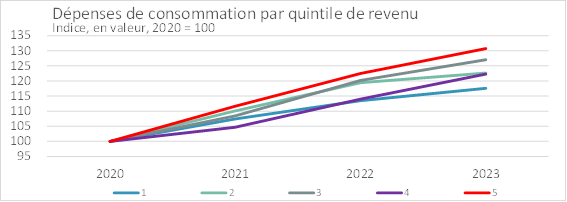

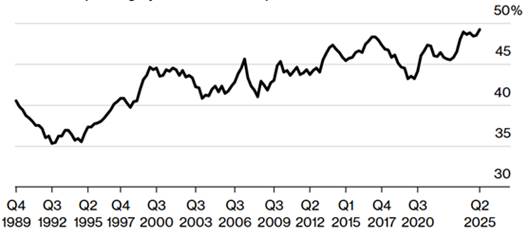

In September 2025, US economic growth remains solid: the decline in real GDP in Q1 2025 (-0.5% on an annualized quarterly basis), due to an unprecedented increase in imports in anticipation of the introduction of tariffs, was more than offset in Q2 2025 (+3.3% in the second estimate), while the latest statistics remaining strong (Atlanta FED GDP Nowcast for Q3 2025 at +3.3% as of September 17). For the moment, private domestic demand, particularly household consumption, remains strong and, even though it has slowed, continues to be the main positive contributor to growth (excluding inventory changes, which are volatile by nature and act in tandem with foreign trade). Looking ahead, the initial analyses available to us on the OBBBA mitigate its positive effects on long-term growth. In fact, to judge the robustness of US economic growth, better to focus on the health of household consumption, the pillar of GDP. And on closer inspection, the composition of consumption, which is particularly driven by the wealthiest households (see chart below for BLS data through 2023, Moody’s analysis for more recent data), and the latest consumer survey by the New York FED (see also below), raise questions about its solidity going forward.

US spending by income quintile

Note: 1 = 20% of the poorest households, 5 = 20% of the wealthiest households. Source: Bureau of Labor Statistics via St. Louis FED database, latest data available for 2023.

Share of spending by consumers in top 10 % income distribution

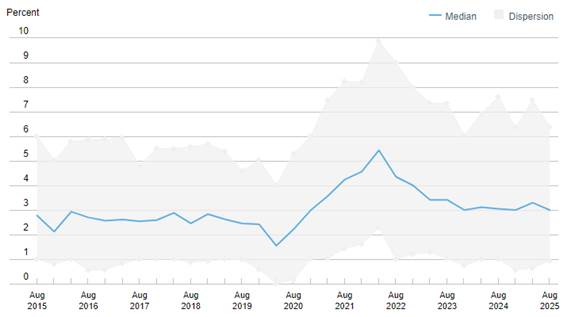

Consumer survey, expected spending

Median expected change in household spending over the next twelve months, in %

Amidst the fog created by the disruptive nature of the Trump administration’s policies (a trade war unprecedented since World War II, anti-immigration measures, and a determination to lower interest rates at all costs), and after years of stubborn inflation, it would be best for the US economy if household consumption did not become the perfect victim. To be continued.

American consumers, whose purchasing power remains under pressure following the inflationary period of 2022/2024 and tighter financial conditions, are spending differently. Walmart and Costco are among the biggest winners in this situation, as their business models – based on finding the lowest price for the former and the best value for the latter -are enabling their private labels to gain market share from major brands. For example, since the end of 2021, P&G has gained 6% compared to +76% and +126% for Costco and Walmart in total return. Since the beginning of the year, this performance gap has persisted: -4% for P&G, +4% and +16% for Costco and Walmart. The rate cut is not expected to dramatically change the new habits of American consumers for everyday products purchased in supermarkets.

3. Status quo on BoE and BoJ rates at the September 2025 central bankers’ meetings.

At its monetary policy meeting on September 18, the Bank of England (BoE) announced that it would keep its key interest rate (Bank Rate) unchanged at 4%. This decision was not unanimous among committee members, as two (out of 9) indicated that they were in favor of lowering the rate by 25 bps to 3.75%. Also at the September meeting, the BoE decided to slow the pace of its ongoing Quantitative Tightening (QT) program.

The BoE’s decision stems from its analysis of progress toward disinflation, particularly the balance between upside risks to inflation and downside risks to demand.

- In August, consumer price inflation stood at 3.8%, still well above the central bank’s 2% target. Inflation was expected to accelerate slightly in September before returning to a downward trend. The slowdown in wage increases (in the private sector, +4.7% year-on-year for the three months ending in July, compared with +4.8% previously) was seen as good news, helping to counteract stubborn inflation, particularly in food prices (+5.1% year-on-year in August). Nevertheless, the balance of risks remained tilted to the upside, as some indicators of inflation expectations were also rising.

- Still, economic growth remained sluggish (despite an upward surprise in GDP growth in Q2 2025, at +0.3% versus +0.1% expected), economic confidence was low, and the labor market was weak. Given the time lag between monetary policy decisions and their impact on the real economy, the restrictive nature of past monetary policy continued to weigh on demand, contributing to the disinflationary process.

Overall, the BoE’s monetary policy committee considered that a gradual and cautious approach to further rate cuts remained appropriate given the circumstances, that decisions would continue to be taken meeting by meeting as macroeconomic statistics were released, and would depend on continued disinflation.

Turning to the Bank of Japan (BoJ), with a monetary policy committee meeting on Friday, September 19, the institution also decided to maintain its key interest rate unchanged at 0.5%. Here too, the decision was not unanimous: two out of the 9 members of the monetary policy committee would have preferred a 25bp rate hike in the wake of fairly resilient growth in Q2 2025 (+0.5% quarter-on-quarter, according to the second estimate, compared with +0.3% initially estimated) and persistently stubborn inflation (between +2.5% and +3% year-on-year due to the impact of wage increases on retail prices on the one hand, and high food prices on the other). In our view, two reasons explain the pause.

- First, as highlighted by the BoJ, the economic outlook remains sluggish and growth is expected to moderate in the wake of the trade war and its knock-on effect on corporate profits. In addition, food price inflation is expected to ease, allowing inflation to decelerate.

- Second, economic policy uncertainty is high in Japan since Prime Minister Shigeru Ishiba resigned in early September. The ruling Liberal Democratic Party (LDP) is expected to elect a new prime minister on October 4, which should clarify the economic direction going forward.

Our opinion:

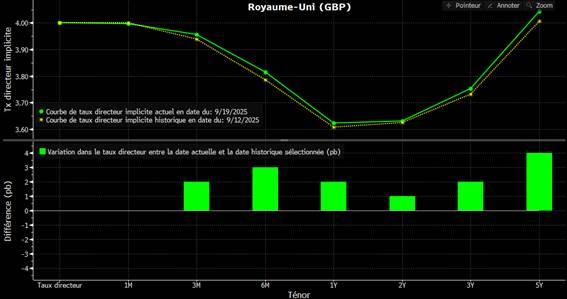

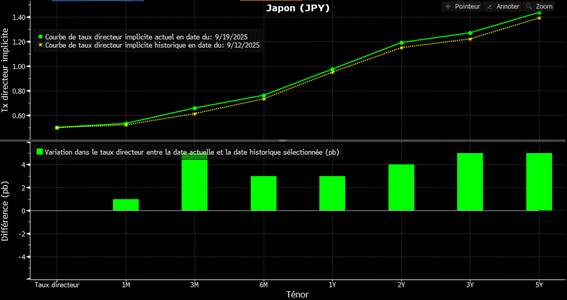

The BoE and BoJ monetary policy decisions in September are in line with our projections for key interest rates at the end of 2025 in the UK and Japan. Looking ahead, the lack of consensus within the two monetary policy committees suggests, in our view, that both institutions will remain cautious and take a gradual approach. We continue to believe that the additional 25bp rate cut by the BoE that markets sometimes factor in (see below) is not a foregone conclusion. Conversely, on the BoJ side, while the bilateral trade agreement between Japan and the United States has reduced the level of uncertainty, growth is holding up, inflation remains high, and the BoJ anticipates an economic rebound after a period of slowdown, we now believe that a further 25bp hike in the key rate by the end of the year is possible.

The UK’s FTSE 100 index, whose companies are largely open to foreign trade, does not share the same difficulties as the UK domestic economy. While the FTSE 100 is up 25% in US dollars and 16% in GBP year to date, the BoE, which is 10 times smaller than the ECB in terms of balance sheet, lacks the tools to revitalize the British economy, which is facing high inflation, a 10-year sovereign bond yield of 4.7%, a current account deficit of 2.1% and a public debt-to-GDP ratio of around 100%.

Implicit key rates in the UK and Japan

In %