- USA: the rate cuts journey is set to be bumpy

- The SNB pauses at 0%

- Leading indicators of economic activity appear mixed in the Euro Area

USA: the rate cuts journey is set to be bumpy

Following last week’s widely anticipated 25 bps cut in the FED Funds rate, three factors weakened the apparent consensus in favor of resuming the monetary easing cycle at the September FOMC meeting.

- Comments made by various FOMC members in the press illustrated the diversity of views on the diagnosis of the US economy, ranging from the risk of a resurgence of inflation requiring a cautious approach to rate cuts on the one hand, to further deterioration in the labor market calling for continued and rapid cuts on the other hand. This week, on the ‘Doves’ side, we can highlight comments by Stephen Miran (Governor) and Michelle Bowman (Vice-Chair for Supervision); on the ‘Hawks’ side, those of Beth Hammack (President of the Cleveland FED) and Raphael Bostic (President of the Atlanta FED); and for those with a more neutral stance and particularly attentive to future data, that of Alberto Musalem (President of the St. Louis FED).

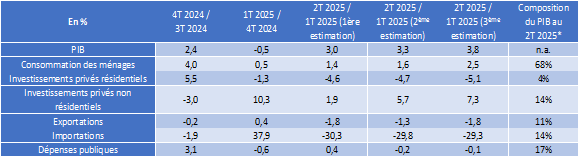

- The sharp upward revision of real GDP growth in Q2 2025 to +3.8% seasonally adjusted at annual rate (compared with +3.3% previously), driven mainly by the upward revision of private domestic demand (up 4.6% in the final estimate compared with 3.5% in the second estimate), particularly household consumption (+2.5% versus +1.6%) and non-residential private investment (+7.3% versus +5.7%), further proof, if any were needed, of the renewed resilience of the US economy.

- The return of the trade war to the forefront with Donald Trump’s sensational announcement at the end of the week of 100% tariffs on medicines, 50% on furniture, and 25% on heavy trucks, without specifying the terms of application for countries that have already signed trade agreements with the United States. This new escalation weakens the FED’s fundamental assumption that the price increases linked to the introduction of tariffs would only be temporary, without completely eliminating it at this point. More than ever, data dependence in the conduct of monetary policy will continue to apply.

US real GDP growth and components over recent publications

* In values. The presence of statistical residues explains why the sum does not equal 100%. Source: Bureau of Economic Analysis, as of 09/25/2025.

Our opinion: After the sharp fall in US sovereign rates in anticipation of upcoming key rate cuts, last week saw the opposite trend. The rise stood at nearly 8 bps for the 2-year US Treasury yield at market close on Thursday September 25 (vs. market close of Friday September 19), and +5 bps for the 10-year US Treasury yield. We do not find the recent market reaction surprising, and it is consistent with our latest interest rate forecasts for the USA at the end of 2025 (FED Funds in the range of 3.5% to 4%, 10-year UST at 4.25%).

The SNB pauses at 0%.

At its monetary policy committee meeting in September, the Swiss National Bank (SNB) kept its key interest rate unchanged at 0%.

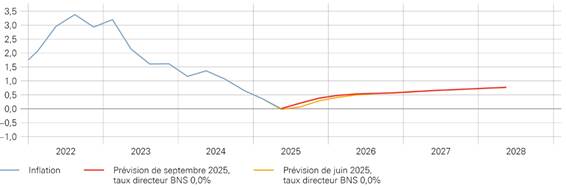

SNB inflation forecast

Change in the consumer price index compared to the previous year, in %

· The Zurich monetary institution considers that inflationary pressures have not really changed since Q2 2025, despite a slight increase during the summer driven by accelerating prices in tourism and for imported goods.

· It should also be noted that the USA now imposes tariffs on Swiss imports that are among the highest in the world (Swiss exports to the USA are subject to 39% tariffs), and that the latest announcements by the US administration regarding the pharmaceutical sector are unlikely to make the situation any better.

Our opinion: Switzerland’s economic outlook has darkened due to the trade war with the USA. As a result, the SNB might keep its key interest rate at 0% for a long time. A further rate cut cannot be ruled out given the ongoing high level of uncertainty. However, it is not on the agenda at the moment due to the risks it poses and recent experience (in particular, losses on financial institutions’ balance sheet, not least the central bank, in the event of a rise in rates). Another lever that the SNB could activate is the exchange rate in order to limit the rise of the CHF with the aim of maintaining price stability (inflation target below 2% without falling into negative territory, according to the institution’s exact mandate). On the markets, on the morning of Friday September 26, all eyes were riveted on Swiss pharmaceutical stocks, which seemed to be holding up well despite the White House’s latest announcements (Roche +0% vs. close on the day before, Novartis +0.3%). These companies making direct investments in the USA to shield their businesses from the new tariffs could well become a reality, with detrimental effects on Swiss GDP. To be continued.

Leading indicators of economic activity appear mixed in the Euro Area.

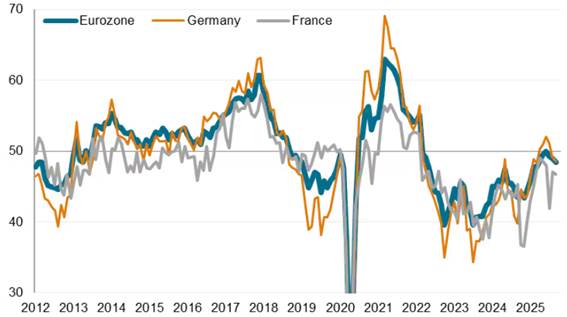

While it was a relatively quiet week in terms of macroeconomic statistics in the Euro Area,a flurry of surveys and other leading economic indicators providing insight into what lies ahead for the Old Continent were on the menu. Two surveys in particular seemed to cast a shadow over the relatively resilient picture painted by the ECB in September:

- Flash PMI surveys. The composite indicator for the Euro Area reached a 16-month high of 51.2 (indicator > 50 = expansion in activity), driven in particular by services, while the manufacturing sector slowed (declines in export sales), although it remained in expansionary territory. But on closer inspection, the divergence in outlook on either side of the Rhine has widened further, while elsewhere in Europe, growth now appears to be moderating. In Germany, activity is accelerating to a 16-month high (composite Flash PMI at 52.4), in stark contrast to France, where the composite activity indicator is now firmly in contraction, at a 5-month low (composite Flash PMI at 48.4).

New export orders PMI

Indices, 50+ = expansion

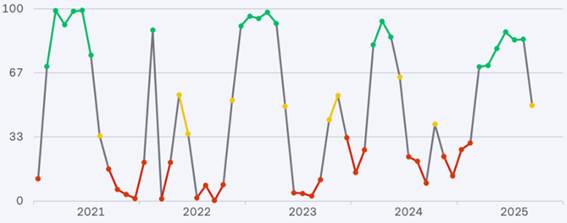

- The IFO survey of business climate in Germany. The business climate index fell to 88.7. In the industrial sector, expectations are deteriorating and the momentum in the capital goods sector that prevailed, now appears to be slowing. In services, the deterioration is even more pronounced, particularly in transports and logistics.

IFO business cycle traffic lights

Monthly probability for economic expansion*, in %

* Monthly evolution of the business climate index, translated into probabilities for two cyclical regimes: expansion and contraction, using a Markov switching model. Probability > 66% = expansion in green; <33% = contraction in red. Source: IFO, September 2025.

Our opinion: The contrasting picture painted by the leading September surveys highlights the challenge facing the Euro Area against the backdrop of the trade war and the loss of export markets. The economic situation in France is also cause for concern, given that the political situation is far from stable. While we believe it is premature to change our interest rate forecasts for the end of the year, as slowing growth was expected given the significant statistical distortions in the first half of the year (front-loading of strong export orders in anticipation of the introduction of tariffs), monitoring future data remains key to detecting any potential slowdown beyond what is already priced in.