- Republicans and Democrats have failed to agree on a bill to extend funding for the US government beyond the end of the fiscal year (September 30)

- As a result, the US government is operating at reduced capacity as of today, with employees in non-essential roles being furloughed (see below)

- This is not the first shutdown under President Trump: in 2018/2019, triggered by a disagreement over funding for the anti-immigration wall, the shutdown lasted 35 days

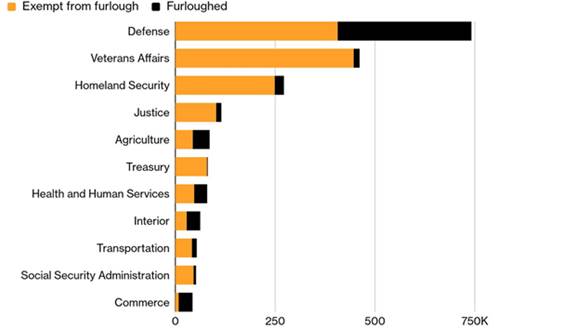

US federal agencies’ contingency plans indicate that one-third of employees will be furloughed this time around, which is less than usual (typically 4/10)

Civilian federal workers by shutdown furlough status

In numbers

Our opinion

. Historically, the economic and financial effects of shutdowns have been limited. However, the longer they last, the greater their impact. The Congressional Budget Office estimates that the GDP loss in 2019 linked to the last shutdown was 0.02%. As for the equity markets, while periods of political and budgetary tension may be accompanied by increased volatility, underperformance is often offset once a consensus financing bill is passed

. The current situation could prove more difficult for two main reasons: first, the Trump administration has threatened to use this period to accelerate the wave of layoffs already underway in the civil service; secondly, while the FED is maintaining its data-dependent approach to monetary policy, the delay in the publication of key employment data (initially scheduled for Friday, 10/3) and inflation data (10/15) due to the shutdown could well complicate the fulfillment of its dual mandate

. In the markets, the main reactions we expect include:

– Continued depreciation of the US Dollar;

– Continued rise in the price of gold;

– Volatility on US sovereign bond yields (as seen today, with the importance given to ADP employment figures – a decline of 32,000 jobs, compared with anticipations of an increase of 45,000 by economists surveyed by the Wall Street Journal – leading to a fall in US yields);

– Volatility on equity markets torn between continued rising valuations in the wake of lower rates and various sectoral impacts (negative, for example, for companies sensitive to public procurement – defense, construction, utilities)