HEALTHCARE EQUITIES BOOSTED BY THE PFIZER DEAL?

In the United States, large pharmaceutical companies and their suppliers are taking off.

US EQUITIES

On 31 July 2025, Trump ordered large pharmaceutical companies to significantly lower the price of their drugs or face 100% tariff from 30 September 2025.

On 30 September 2025 and 1 October 2025, the healthcare sector rallied on the stock marketfollowing news of a deal between the US administration and Pfizer on drug prices, followed by a pause in the implementation of tariff in order to negotiate deals with other major laboratories.

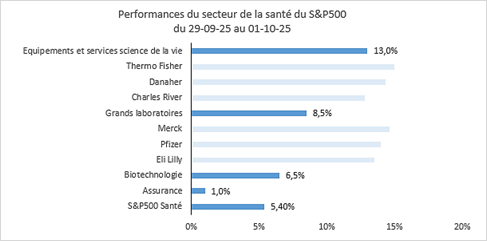

The healthcare sector of the S&P 500 rose by 5.4%, while the S&P 500 rose by 0.8% in euro terms.

Among the best performers are the large pharmaceutical companies and their equipment manufacturers and service providers.

Pfizer’s deal gives investors confidence that common ground can be found for other major pharmaceutical companies.

After two years of underperformance (+2.75% for the S&P 500 Health Care Index and +44% for the S&P 500 Index) and a sharp discount (forward 12-month P/E ratio of 17.4x for the S&P 500 Health Care Index and 22.8x for the S&P 500 Index) lower interest rates could be another positive driver by boosting funding for biotechnology companies and M&A in this sector.

What is at stake for European healthcare companies?

EUROPEAN EQUITIES

On Wednesday, the pharmaceutical sector posted its strongest intraday rise in five years (driven by Sanofi+8.4%, Merck +10% and AstraZeneca +11.6%), buoyed by optimism that the Pfizer agreement paves the way for similar deals for European companies.

According to Donald Trump, such an agreement, which includes a three-year grace period for customs duties, should serve as a model: the White House has therefore announced a pause in the introduction of 100% tariffs on imported pharmaceutical products pending bilateral agreements with the companies concerned.

Admittedly, the market was already anticipating exemptions, particularly for laboratories involved in new US production sites, so the direct impact may seem limited, but in our view this removes some of the uncertainties that had been weighing on the sector.

Encouraged to continue their dialogue with the US government, European laboratories should be able to agree on constructive solutions in the coming weeks, so we can expect more reassuring news flows.

Is this, however, a turning point for this sector, which has been significantly under-owned by investors since 2022 and is still underperforming the market by more than 12% YTD?

Although the worst-case scenario now seems unlikely, the sector’s valuation is striking: the Stoxx Europe 600 Health Care index is trading at a 25% discount to its historical P/E ratio, which has only happened twice in 17 years (during the 2008 financial crisis and Covid).

In such a context, a significant underweighting of the sector, as is the case in most generalist portfolios, seems less justified to us, even if a number of uncertainties remain (particularly regarding the regulation of drug prices).

Among the stocks to revisit, we believe that investment opportunities are particularly attractive among Life Science/Bioprocessing groups (the two Sartorius companies are pure players, and the German company Merck KGaA has a significant exposure to this segment). Clarification on pricing could give the biotech segment a new boost and enable better deployment of R&D spending. Finally, these groups should be among the winners of the relocation trend, which will support demand for equipments for at least the next five years.