On Monday morning, Bruno Retailleau’s Right Wing disapproval of the new governmental team appointed by Sébastien Lecornu accelerated the fall of that government, while the opposition (PS, LFI, RN) had already threatened it of a no confidence vote on Sunday evening.

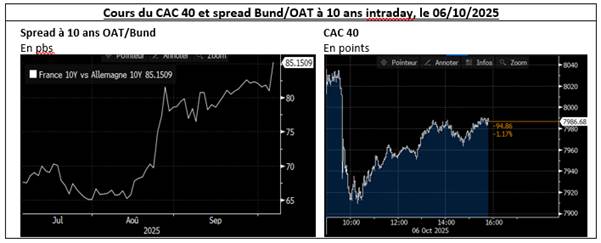

Unsurprisingly, the announcement of Lecornu’s resignation sent the CAC 40 into a downward spiral, driven in particular by stocks exposed to the French sovereign (utilities, financials) on the one hand, and on the other hand, the opening of the 10-year Bund/OAT spread beyond 85 bps (see below).

As the political crisis accelerates, there are several alternatives for providing France with a 2026 budget before the end of the year or, at the very least, ensuring the functioning of the administration: 1. a new government appointed quickly and a draft finance bill (PLF) submitted to the National Assembly on time, on October 13; 2. the exceptional submission of a draft budget by the outgoing government, but deputies and senators are not supposed to legislate without a fully functioning government; 3. budget by decree, but only after attempting to pass a PLF and failing to do so within 70 days, at the risk of exacerbating the crisis in parliament; 4. passage of a Special Law, taking up the appropriations from the 2025 budget, as was the case last year.

Our opinion :

Given the time constraints and the severity of the crisis, we believe that the scenario of passing a Special Law is the most likely outcome. This Special Law would authorize the government to raise taxes without changing anything (freezing tax brackets, etc.) and, at the same time, to open operating credits equal to those voted last year (except for social security, where benefits are automatically indexed in the absence of legislation).

While the passage of a Special Law should ease market tensions, it is unlikely to reassure investors about France’s long-term credibility and political stability, especially as events are now likely to unfold rapidly (new government, new no confidence vote, dissolution, etc.). As a result, the French market and securities that are particularly exposed to the French sovereign are likely to continue to be shunned by investors (financials, utilities, sectors sensitive to public procurement excluding defense). Similarly, on the sovereign bond side, the 10-year Bund/OAT spread is likely to continue drifting above 80 bps, and could even approach 100 bps in the event of further deterioration (new dissolution, new deadlocks, etc.).

Beyond that, the situation in France is likely to accentuate the steepening trend ongoing in Europe due to rising long-term interest rates. On Monday, October 6, during market session for example, the yield on the 10-year Bund rose by 2 to 3 bps, while in peripheral economies (Italy, Spain), increases reached 5 bps.