- Large US banks continue to grow

- LVMH : return to favour ?

US EQUITIES

Large US banks continue to grow

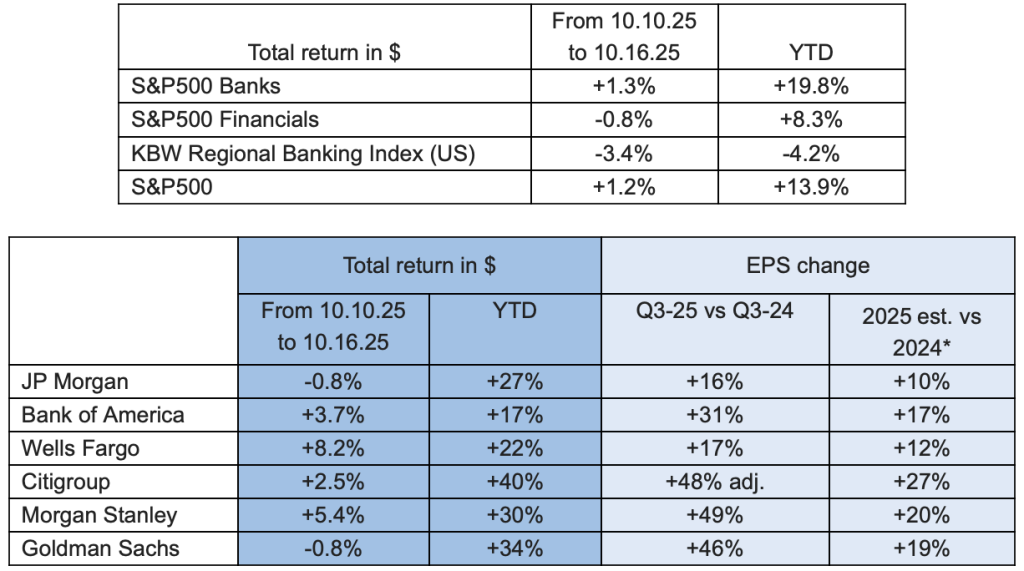

Large US banks have published fairly good quarterly financial results. These publications were well received by investors. However, fears about the quality of US banks’ balance sheets also resurfaced yesterday. This follows the two collapses in September of First Brands, an automotive equipment manufacturer, and Tricolor, a company specializing in auto loans to the Hispanic population in the United States. Yesterday, Zions Bancorporation and Western Alliance Bank, two banks with market capitalizations of less than $10 billion, lost 13% and 11% on the stock market following losses on loans granted to funds investing in loans. This announcement rippled down the entire banking sector on the stock market. At this stage, regional banks are suffering the most. Large banks continue to outperform the US stock market:

- Focus on the performance of JPM, the world’s biggest bank: $830 billion market capitalization and a balance sheet of over $4.5 trillion.

With a presence in all banking activities—retail banking, investment banking, and asset management, JPM is one of the most diversified and best-capitalized bank. Interest margin, which accounts for just over half of its net revenue, has been the main driver of earnings growth since 2019. Loan volumes have grown strongly (+50%) and its interest margin in percentage has increased. In Q3-25, the interest margin rose modestly compared to last year: +2%, in line with the increase in H1-25 compared to H1-24. It is expected to reach more than $90 billion in 2025. In the third quarter, JPM’s operating performance was driven by strong market activities. Their net banking revenue rose 25% compared to last year. It remained stable compared to Q2-25, a quarter of high market volatility following Trump’s Liberation Day.

This strong performance in market activities was seen across all major banks, particularly Goldman Sachs and Morgan Stanley.

Primarily exposed to the US market, the major US banks reflect not only their sound management but also the good health of the US economy.

- What are the prospects for large US banks?

Firstly, the spread between 10-year and 2-year rates has been positive since the start of the year, whereas it was negative between 2022 and the end of 2024. This supports banks’ interest margins in 2025 and should continue to be favorable in 2026. Secondly, US banks’ credit loss provisions have remained stable at $200 billion since 2024 (source FED). We will see whether regional banks’ Q3 Earnings cause this figure to change significantly. In addition, M&A activity and securities issuance could continue to improve as rates gradually fall. Furthermore, the US banking market remains highly fragmented. JP Morgan, for instance, has only a 10% market share in US retail deposits and investment banking fees. The Republican administration’s banking deregulation program should certainly free up capital, but it will also increase risk-taking. Smaller banks will undoubtedly be the most vulnerable. The best-capitalized and best-managed banks could once again benefit in the long run from a potential banking crisis. Finally, banking remains a human capital-intensive business, andgenerative AI could give a new boost to bankers’ productivity. In a somewhat provocative tone, Goldman Sachs CEO Salomon said last January that 95% of an IPO prospectus could be written by generative AI.

EUROPEAN EQUITIES

Does LVMH’s outstanding publication mark the confirmation of luxury goods’ return to favour?

- The return to organic growth (+1%) at LVMH after two quarters of contraction (including -4% in Q2) surprised the market, which had expected a 1% decline: all divisions recorded positive organic growth, with the exception of Fashion & Leather Goods. However, the latter posted the strongest sequential improvement, rising from -9% in Q2 to -2% in Q3, taking investors by surprise given the consensus forecast of -3.9%. Store traffic and higher volumes explain the quarterly performance. Wines & Spirits also delivered a pleasant surprise (+1%) thanks to growth in Champagnes and Wines (+7%) and an acceleration in Selective Retailing (+7%) through Sephora’s continued market share gains.

- From a geographical perspective, the improvement came from the United States (+3% versus -1% in H1) and Asia excluding Japan (+2% after -6% in Q2!) thanks to a return to positive growth in mainland China, while growth in Europe remained slightly negative (low tourist demand in an unfavourable currency environment).

- It should be noted that this publication benefited from an easier basis for comparison than will be the case in the fourth quarter (strong spending in the United States in Q4 2024 following Donald Trump’s election), and the negative impact of currency fluctuations is also expected to be stronger.

- In this context, the group’s management is prioritising investment in brands rather than protecting its margins in the short term, a factor that is likely to be reflected in the half-year operating result.

- Already during the summer, the market had become more positive towards the luxury sector, withencouraging signs in China and resilience among US consumers, as confirmed by this publication.

- In terms of valuation, with a 2026 P/E ratio of 24.8x, LVMH, like the sector as a whole, is trading at thetop of its historical range (20-25x). This could be a point of concern for investors, especially as upward revisions will not be so significant after Q3. Nevertheless, this publication should mark the end of the cycle of downward earnings revisions for this sector which still appears to be under-owned by investors (the recent rise mainly coming from hedge fund short covering).

- Chinese luxury consumption (21% of sector spending in 2024) is therefore key. Although it is showing signs of improvement (already highlighted by Brunello Cucinelli in its publication and by positive handbag import data in Q3 for the first time in two years), it remains under pressure(Chinese tourist spending continues to fall by double digits), with little change in the macroeconomic environment.

- If the next publications, notably those of Hermès (22 October) and Richemont (8 November), confirm the tangible improvement in the trend in China and the strength of the American consumer, a sustained rebound in the sector is expected.