- Following the FOMC on October 28/29, the FED once again lowered the FED Funds rate by 25 bps, now standing at between 3.75% and 4%. The US central bank also announced it would end its Quantitative Tightening (QT) program on December 1(reinvesting maturing Mortgage-Backed Securities – MBS – in US Treasuries from that date onwards).

- These two decisions were widely anticipated by the market, as was the continuation of the general philosophy behind the conduct of monetary policy, which remains based on the three pillars of data dependency, economic and inflation outlook, and the balance of risks surrounding the dual mandate of price stability and maximum employment. What was less expected, however, was:

· on the one hand, the extent of dissent within the monetary policy committee. Stephen Miran once again voted against the day’s decision, preferring a 50bp cut in the FED Funds rate (as was the case at the September FOMC), but even more surprisingly, Jeffrey Schmid, President of the Kansas City FED, also opposed the 25bp cut, preferring this time to pause, i.e. to keep the FED Funds rate unchanged in the 4% / 4.25% range;

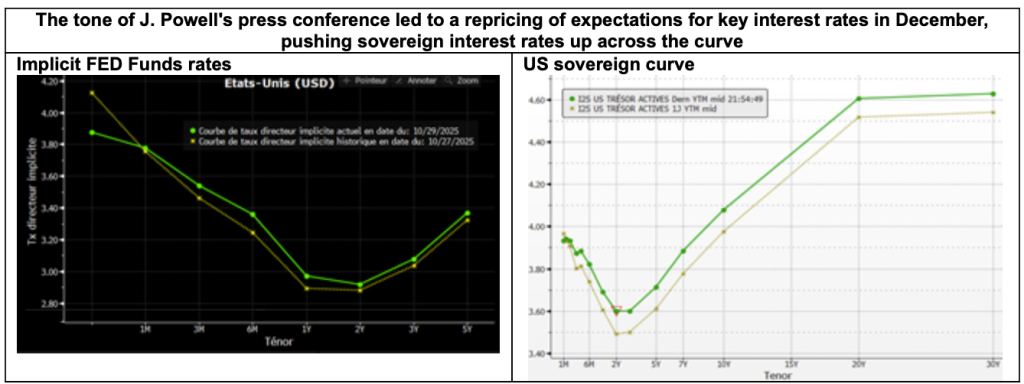

· on the other hand, J. Powell adopted a more hawkish tone at the press conference stating, regarding the December FOMC: “What would you do if you were driving in the fog? You would probably slow down”; and “[A December rate cut] is not a foregone conclusion, far from it”.

- Beyond that, our main takeaways from the press conference are:

· Despite the ongoing shutdown, which complicates understanding of the economic situation by delaying the publication of key government data, the FED believes that the economic situation has changed little since September. In terms of data, it can continue to refer to private indicators (ADP, Indeed), survey data (Beige Book in particular) and some public data that are still being published (state-level initial unemployment claims). In this regard, the labor market has not deteriorated further since September.

· The FED does not consider there to be any imminent risk to financial stability(banks are sufficiently capitalized, household balance sheets are healthy overall, there are a few pockets of weakness in subprime lending but nothing systemic). Furthermore, the decision to end the quantitative balance sheet reduction from December onwards reflects the desire to maintain ample bank reserves, with signs that the threshold in this area has been reached having become more pronounced in recent weeks.

· The FED continues to believe that tariff-related price increases will continue(probably until spring 2026) but without triggering a reflationary spiral (a rise in the general price level rather than inflation).

Our Opinion :

The FOMC’s October decisions and the shift in tone of J. Powell’s press conference remarks come as no surprise to us. We continue to believe that US economic activity is robust, driven not only by massive ongoing investments in AI, but also by a resilient consumption, even if it is mainly driven by the wealthiest households. The outlook is also good for 2026, with expectations of the OBBBA fiscal stimulus, not to mention hopes of easing global trade tensions, industrial relocations and direct investments resulting from the various trade agreements signed this year.

In this context, the FED’s cautious approach seems appropriate and we continue to believe that, in the absence of further deterioration in employment, which seems to the case at this stage, the US central bank may prefer to pause in December.

Overall, our interest rate forecasts remain unchanged: FED Funds rates at 3.75% / 4% and the 10-year US Treasury yield in the range of 4% / 4.25% by the end of 2025.