- Four titans

- Faced with a resilient Euro Area economy, the ECB keeps its monetary policy unchanged

US EQUITIES

Four titans

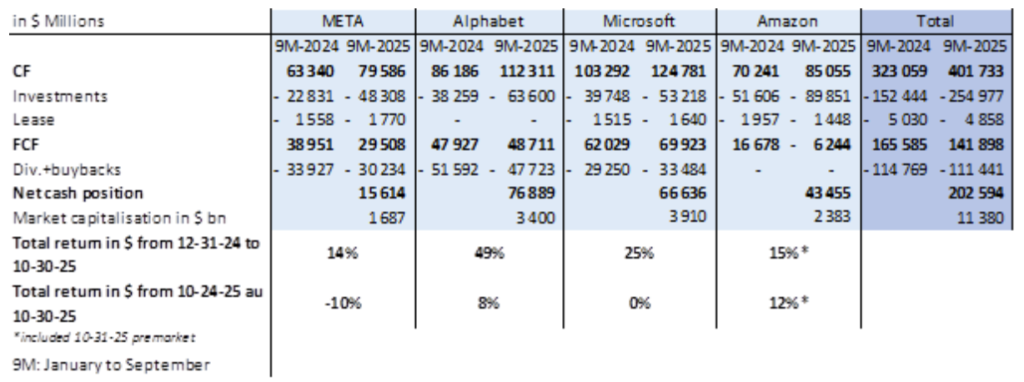

- This week, Meta, Alphabet, Microsoft, and Amazon reported their financial results. The stakes are high for equity investors, as these four companies have acombined market capitalization of $11.4 trillion, or six times CAC40 and a quarter of the S&P500. All four companies reported revenue growth even acceleration for some and strong Cash Flow (CF*) growth.

- Alphabet advertising revenue from Google’s search engine and YouTube grew by 15%, revenue from YouTube subscriptions, Play Store, and Pixel smartphones grew by 22%, and cloud services grew by 33%. Year-on-year, Microsoft’srevenue grew by 18% and Meta‘s by 26%. Amazon total revenue grew 12% over the quarter. Particularly, AWS, its cloud division and the group’s cash cow, is accelerating, posting revenue growth of +20%, the highest in three years.

- In total, over the first nine months of 2025 (9M-25), their CF grew by 24%, or $78 billion!

- Although they operate in different sectors, META, Alphabet, Microsoft, and Amazon have one thing in common: each has been investing heavily in chips and data centers since the arrival of chatGPT in late 2022 in order to support the development of artificial intelligence. Computing chips account for around 50% of their investment, while data center infrastructure (buildings, land, air conditioning, power generators, transformers, etc.) and network equipment account for the other half. In the first nine months of 2025, these investments totaled $255 billion for these four companies, which is $103 billion more than in the first nine months of 2024.

- Shareholders therefore have $25 billion less in available cash flow for 9M-2025 period compared to 9M-2024 period. Amazon is drawing on its cash reserves to support its investments and is not returning any cash to shareholders. META’s FCF** is declining and is being paid out in full to shareholders. Microsoft, which is more cautious in its capital allocation, is the only one of the four to see its FCF grow significantly without paying it all back to shareholders.

- For now, this investment strategy is funded and generate growth. However, the return of these new investments is not yet reflected in financial accounts. This explains the underperformance of some of its stocks since the beginning of the year compared to the S&P 500, which is up 17% (total return). The Google search engine has adapted and is defending well ChatGPT’s market share gains, explaining part of its strong stock market rebound in 2025. Microsoft, which is more cautious in its allocation and a shareholder in OPEN AI, maintains a very good competitive position in office software. Amazon is adapting AWS to this new deal, while its e-commerce business is not threatened by AI. Finally, some investors fear that META’s investments may be excessive, as in 2022 with the Metaverse.

- In the longer term, we believe that there are five building blocks necessary to create long-term shareholder value in the field of artificial intelligence: a large database, computing power, researchers and fundamental models, and alarge user base. These four companies are among the few that have all the ingredients to successfully capitalize on consumer AI. However, they all depend on Nvidia‘s computing processors, with whom they must share the value creation.

* Cash Flow: cash flow available for investment, debt repayment, and shareholder return.

** FCF: Free Cash Flow: cash flow available for debt repayment and shareholder return.

EUROPE MACROECONOMICS

Faced with a resilient Euro Area economy, the ECB keeps its monetary policy unchanged

- At the October Governing Council meeting, as we had expected, the European Central Bank made no changes to its monetary policy: the deposit facility rate (the main policy rate) was maintained at 2%.

- The conduct of monetary policy also remained unchanged. The ECB is not committing to a predetermined path and continues to adopt a gradual approach, meeting by meeting, based on three factors: data as it is released, the underlying inflation outlook and the quality of transmission of monetary policy decisions to the real economy.

- One element stood out from Christine Lagarde’s speech and the subsequent Q&A session. That is the resilience of the European economy, stronger than what was initially anticipated.

. This comes in the wake of the removal of three downside risks to growth through the signing of the EU-US bilateral trade agreement this summer, the ceasefire in the Middle East and the progress made on the China-US trade dispute on the sidelines of the APEC summit in South Korea this week.

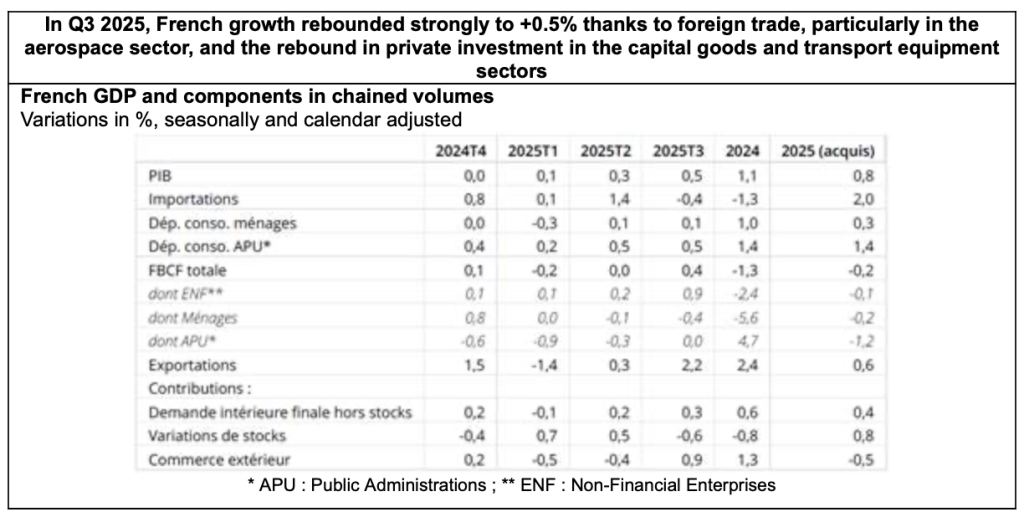

. This observation also echoes the Q3 2025 GDP growth in the Euro Area, published on October 30, at +0.2%, an element highlighted by Christine Lagarde, who noted France’s improved performance in particular (see below).

- In the details, regarding the inflation outlook and the quality of monetary policy transmission to the real economy, Christine Lagarde stated that:

. discussions within the Governing Council remained cordial despite differing sensitivities regarding inflation, and that the day’s decision had been taken unanimously;

. there were still upside risks to inflation, which the ECB was monitoring closely but which had not materialized for the time being (in particular, possible disruptions or tensions in the supply of rare earths from China);

. the ECB remained in a comfortable position with regard to its medium-term inflation mandate, which is symmetrical around the 2% target;

. the quality of monetary policy transmission remained good for the time being, and the tightening of bank lending conditions, as reported in this week’s Bank Lending Survey, was mainly due to changes in banks’ risk appetite.

- One final topic also dominated the press conference: the digital Euro. The ECB reiterated its strategic importance in the context of the ever-increasing digitization of payments (2/3 of payments made in Europe now go through non-European platforms). The institution announced that it was launching a new phase of the project, namely its technical implementation (with a view, if the legislation was ready, to move on to a pilot exercise in 2027 and a possible first issue in 2029).

- In a nutshell, let us note that, following the decisions of October 30, our interest rate forecasts for the end of 2025 in the Euro Area remain unchanged: the deposit facility rate is expected to remain stable at 2% and the 10-year Bund rate is expected to continue to fluctuate between 2.5% and 2.75%.