- American consumption

- The Dubaï Airshow

US EQUITIES

Treasure Hunt Retail Drives American Consumption

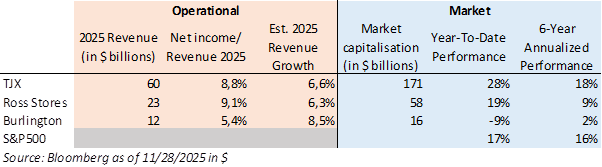

- Burlington is the smallest of the three major American off-price chains, behind Ross Stores and TJX. These stores mainly sell surplus clothing stock at prices around $10-15, representing discounts of up to 60% off the original price.

- On November 25, Burlington’s earnings report disappointed investors, contrasting with their positive reactions last week to the earnings reports from TJX and Ross Stores. However, Burlington posted revenue growth of +7% and adjusted earnings per share up by 16%.

- TJX pioneered the concept in 1956, followed by Ross in 1982, and Burlington began focusing on retail in the 2000s. These three stocks dominate the off price retail sector in the United States, and TJX and Ross have outperformed many major retailers for several years.

Four factors explain this outperformance.

o The first is that all American households have seen their purchasing power squeezed since 2021 due to sharp rises in prices and interest rates. These three retailers serve households across the income spectrum. The increase in tariffs partly explains the acceleration in same-store sales growth for Ross Stores and TJX in the second half of 2025 (>5%). This is undoubtedly the main factor that disappointed investors in Burlington’s results, with same-store sales growth of just 1% in the third quarter.

o The second is that over the past 15 years, these three major retailers havegained market share against department stores and shopping malls, while also proving remarkably resilient to the growth of e-commerce. Americans are attached to this store concept: items turn over quickly, the thrill of getting a bargain is great, and the “treasure hunt” gamecontinues to work. TJX sums up the winning formula as follows: Brand, Fashion, Price, Quality.

o The third is that their business model creates value for shareholders. These three chains generate operating margins that are several points higherthan those of supermarkets, dollar stores, and department stores. Their distribution costs are lower, there are no backroom storage, e-commerce is non-existent, there are no marketing costs, the sector is highly concentrated, and customer loyalty is strong. Finally, these players benefit from the advantages of monopsony (one buyer facing several sellers).

o Finally, their management is of high quality, particularly at TJX and Ross Stores, which significantly outperform Burlington. The latter has four former Ross Stores executives among its 5-member executive team.

- It is therefore a particularly resilient niche sector, especially in periods of supply chain disruption, and which has gradually become one of the pillars of American consumption.

EUROPEAN EQUITIES

Key Takeaways from the Dubai Airshow

- Airshows remain an exceptional showcase for industry players, and the 2025 Dubaï edition was no exception, recording all‑time highs in aircraft orders. A total of 414 purchase commitments were announced by Airbus, Boeing, and Embraer, well above the 325 at the 2025 Paris Air Show and far beyond the 189 at Farnborough in 2024.

- Airbus was the clear winner of this Airshow with 232 commitments (32 firm) compared to Boeing’s 175 commitments (100 firm), largely driven by Emirates’ order for 65 Boeing 777X. By aircraft type, strong demand was fueled by large orders for narrow‑body and wide‑body jets.

- Airbus continues to win new customers, most notably with the symbolic gain of Flydubai, traditionally loyal to Boeing, which is making a strategic shift in its fleet. The airline signed a $24 billion MoU for 150 A321neo aircraft, with options for an additional 100 units.

- The rise of Middle Eastern carriers is undoubtedly the key takeaway from this Airshow: the region is a strategic hub with massive long‑term demand expected to account for 20% of the global wide‑body market. Airbus forecasts more than 4,000 deliveries in the Middle East over the next 20 years, nearly half of which will be wide‑bodies (Emirates has just confirmed an additional order for eight A350‑900s).

- The Airshow was also marked by the first flight demonstration outside Asia of COMAC’s C919 (Commercial Aircraft Corporation of China). The C919, of which only 13 deliveries took place in 2024, is a narrow‑body aircraft competing directly with the Boeing 737 MAX and Airbus A320neo. COMAC’s current strategy is to secure its domestic market (100% of deliveries to date have gone to Chinese airlines, whether for the C919 at the start of production or for its regional jet, the C909, already in service) before opening internationally in the medium term. The historical duopoly of the market (with Airbus holding more than 60% of estimated market share against Boeing) will gradually (2030–35?) evolve into anoligopoly, with COMAC’s market share expected to reach around 8% before 2045 compared to 1% today. COMAC also has major ambitions for its wide‑body long‑haul aircraft, the C929 (designed to compete with the A350 and B787 Dreamliner); however, the Chinese group has had to postpone its first flight to 2029–30 (initially planned for 2025) due to technical delays and a reorganization following its split with its Russian partner.

- The level of orders at the Airshow clearly illustrates the dynamism of the sectorand the confidence of market operators, who are equipping themselves for the coming decades. It should be remembered that the global civil aviation market is expected to double within 20 years.

- For Airbus, 2025 was marked by supply chain bottlenecks, particularly for engines, which limited the production ramp‑up. As this limiting factor normalizes, the group’s profitability should accelerate, supported by higher deliveries, a better mix of aircraft delivered (driven by the rise of the A321), and improved absorption of fixed costs.