- WARNER BROS.

- INDITEX

US EQUITIES

Warner Bros. Back at the Center of Wall Street’s Attention

- Warner Bros. Pictures, the iconic Hollywood studio behind Batman, The Matrix and Harry Potter, is a well-known. Its reputation on Wall Street, however, is far less flattering. In 2000, AOL offered $182 billion to Time Warner shareholders in what was billed as a merger of equals, creating a group valued at roughly $400 billion. Yet only a few years later, AOL was worth just a few billions. Then in 2016, AT&T, one of the three major U.S. telecom operators, announced its plan to acquire Time Warner for $86 billion, aiming to combine distribution pipes with premium content. The deal closed in June 2018 after two years of antitrust scrutiny. In 2022, facing value‑creation challenges, AT&T spun off Time Warner and merged it with Discovery, another heavyweight in audiovisual content, forming Warner Bros. Discovery (WBD).

- In June 2025, Warner Bros. Discovery, which also owns HBO, best known for producing Game of Thrones, announced plans to split the company in two by mid‑2026. One entity would house streaming and studio operations; the other would regroup its portfolio of TV networks, including CNN and Discovery.

- On October 21, 2025, following weeks of speculation, WBD confirmed that several media groups had expressed interest in acquiring the company. The presumed bidders include Paramount Skydance, controlled by the Ellison family, Netflix, and Comcast (the cable giant and parent company of Universal Studios and DreamWorks).

- On December 5, 2025, Netflix announced its acquisition of Warner Bros., which is set to separate from Discovery. Warner Bros. is valued at $82.7 billion in enterprise value, including $10.7 billion in debt. With low debt levels and a large market capitalization, the company is financially well positioned. However, the risk that regulators amend or even block the deal is significantly higher for Netflix, given antitrust concerns.

- Netflix counts 320 million subscribers on its streaming platform, far ahead of Disney+ (125 million), HBO Max and Discovery (125 million together), and Paramount+ (75 million). Yet Netflix remains a minority player in U.S. TV viewership, holding an 8% market share in October 2025, behind YouTube’s 12.9%, according to Nielsen.

- The media‑entertainment business is undeniably lucrative, but it is also highly complex, for executives as well as for investors. The industry is constantly changing. It is being reshaped at high speed by technological innovation across physical distribution channels (cable, satellite, radio) and digital ones (streaming, video‑on‑demand), by targeted advertising, by the evolution of viewing devices (TV, PC, mobile), by a wide range of business models (ads, subscriptions, theatrical releases, rights sales, bundled offerings) and by an ever‑expanding variety of content formats (films, series, documentaries, sports, news, user‑generated content, podcasts), and in the future by AI-augmented content production. Capturing the attention of viewers, who switch platforms more than ever, requires giving creative teams significant freedom and a top management team.

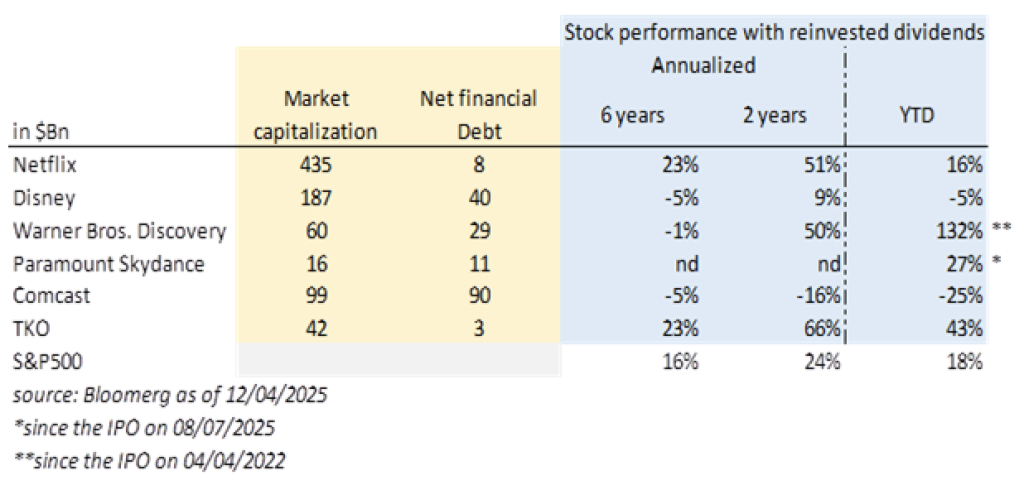

- Alphabet, through YouTube, and Netflix have found winning formulas, as reflected in their stock‑market performance. Disney has also enjoyed moments of market glory since its founding in 1923, but it has endured long dry spells as well. TKO, for its part, is riding the global enthusiasm for combat sports thanks to its WWE (wrestling) and UFC (MMA) franchises.

- If Netflix’s bid for WBD is accepted, the main challenge will be reconciling two very different creative cultures. A challenge that could ultimately be worth several hundred billion dollars.

EUROPEAN EQUITIES

Inditex defies the gloom in its sector!

- Inditex, 59% owned by the Ortega family, is one of the largest fashion chains in the world, with Zara as its main brand (66% of the group’s sales), followed by Bershka (9%), Massimo Dutti (7%), Pull & Bear (7%) and Stradivarius (6%). The group still has a very European profile, with Americas accounting for only 16% of its turnover and Asia and the rest of the world 23%.

- In a difficult consumer environment, Inditex has once again demonstrated its resilience by publishing Q3 results that exceeded expectations, with undeniable sequential acceleration in constant currency (Q1 +4%, Q2 +6%, Q3 +8.4%). Growth (at constant exchange rates) was widespread, with all geographical areas and brands posting positive growth. The group also reported very strong trends for Q4 (double-digit growth), illustrating the positive reception of the autumn/winter collections.

- Managerial excellence is reflected in very strict control of operating expenses and inventories. Inditex reported its highest quarterly operating margin (24.2%) since its IPO in 2001, levels that are sustainable in the medium to long term.

- The current acceleration in growth therefore bodes well for the next six months, which will also benefit from easier comparables, paving the way for upward revisions in earnings per share. Currently, sales growth in constant currency is at the high end of the company’s long-term forecast range (+6-8%). This trend should be supported by internal levers: the ramp-up of its Zaragoza II logistics center (equivalent in size to 39 football pitches!), the expansion of its product range and the upmarket positioning of its brands, and selective expansion in the United States, where its market share is still low, notably with the opening of the first two Bershka stores in Miami in 2026, following its online success. The group will also be able to count on external growth drivers, notably the impact of GLP-1 treatments (which provide support for fashion) and consumer behaviour towards these price points.

- 2026 will mark the end of the group’s peak in exceptional investments (€1.8 billion between 2025-26, notably in logistics) and should therefore, thanks to the strong cash flow expected, enable an acceleration in returns to shareholders, possibly through extraordinary dividends.

- Inditex structurally outperforms its market, which justifies its high valuation (next year’s P/E ratio at 25x) with a high profitability profile thanks to a unique business model: ultra-fast product renewal, very short production times, centralized inventories in a few large logistics centers, constant innovation (pioneer in online sales, 90% of transactions in flagship stores now self-service, etc.).