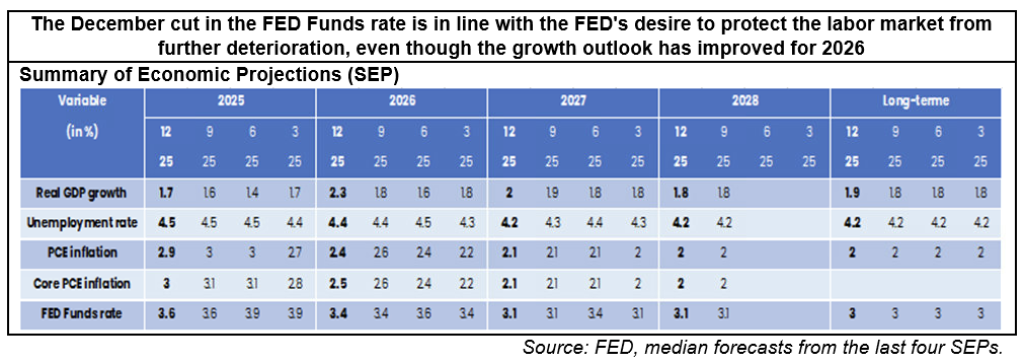

- If we had to explain the reasons for the further 25 bp cut in the FED Funds rate decided at the FOMC meeting on December 9/10, we would opt for the following argument put forward by J. Powell during his press conference: given the difficulty of the situation, where achieving the dual mandate of price stability (inflation at 2%) and maximum employment appears impossible because it requires contradictory approaches (higher rates for the former, lower rates for the latter), it is better to move closer to the neutral rate.

- Thus, at 3.5%/3.75%, the FED considers that FED Funds rate now falls within the broad range of estimates for the neutral rate and that should stabilize the labor market. The central bank is therefore well positioned to wait (i.e. without lowering rates anytime soon in the absence of major macroeconomic developments).

- This new cut, which was widely expected by investors, was already priced in and did not cause any turmoil on the bond markets. There was also no change in the anticipated FED Funds rate for 2026 (the implied rate remains around 3% from September 2026 onwards according to the CME FED Watch Tool on Wednesday evening). However, confirmation of the cut consolidated the rebound in US equity markets over the course of the day.

Beyond that, we take away the following from the press conference:

- Admittedly, there is strong dissent within the FOMC (three votes against this time, with Miran still in favor of a more aggressive 50 bp cut, while Goolsbee and Schmid were more in favor of a pause), but this stems primarily from different views on the balance of risks to the dual mandate rather than opposing understandings of the economic situation. In fact, for J. Powell, the view that inflation is still too high and that the labor market is softening is a consensus view.

- The FED’s central scenario is still one of a rise in the general price level that is likely to continue over time, linked to the pass-through of tariffs to the economy, rather than a self-sustaining price-wage spiral. Moreover, the limited data available to us continues to point in this direction (rise in goods inflation, fall in services inflation).

- The FED’s decision to resume asset purchases (mainly T-bills) from December 12 onwards is aimed at maintaining ‘ample’ bank reserves, enabling monetary policy decisions to be transmitted effectively to the real economy at all times, particularly when bank reserves fall (e.g. at tax payment time). It should therefore not be interpreted as a sign of any difficulties with market liquidity.

Our Opinion :

The shutdown has delayed the release of key macroeconomic data for the understanding of the US economic situation, particularly with regard to inflation and employment.

Furthermore, as highlighted by J. Powell, key employment data for November, due on December 16, both from the household survey (unemployment rate) and the establishment survey (monthly job creations) will be particularly unclear due to the cancellation of the surveys for October. This confusion would add to a systematic overestimation of the number of jobs created each month, which J. Powell puts at around 60,000, further damaging the picture of the job market situation in recent months.

In our view, these factors weighed particularly heavily in favor of lowering the FED Funds rate in December, rather than waiting until January, as if to pre-empt any disappointment that might arise as the end of the year approaches.

Looking ahead, two key factors will enable us to adjust our interest rate scenario.

– Firstly, and unsurprisingly, the release of lagging of macroeconomic data to clarify the economic scenario.

– Secondly, and more importantly, the governance of the FED, from the succession of J. Powell, for which we should have some clues before the holidays, to Donald Trump’s desire to shape a more conciliatory FOMC (Lisa Cook’s hearing before the Supreme Court on January 21, the President’s expressed will to revoke the FOMC appointments signed by Joe Biden by ‘autopen’), and attacks on district FEDs.

In the meantime, given these residual uncertainties, we are maintaining our key interest rate trajectory unchanged: FED Funds rate around 3% at the end of 2026, 2-year UST around 3.5%, having already fully priced in these key rate cuts, 10-year UST potentially falling temporarily below 4% in anticipation of the key rate cuts, but structurally driven upwards in the medium term (higher growth expectations and term premium).