- ORACLE

- TOTALENERGIES

US EQUITIES

Oracle : Main Street vs Wall Street !

- Oracle published its quarterly results on December 10, and its share price fell by 11% the following day, causing the Nasdaq100 to drop by 0.35%, while the Dow Jones rose by 1.34%.

- Over the past few months, investor sentiment toward Oracle has swung from one extreme to the other. On September 10, 2025, the day after the announcement that its remaining performance obligations had increased 4.6 times at the end of August 2025 compared to August 2024, the stock rose 36% and closed at $328! On December 11, 2025, the stock was worth only $199. Most of the decline occurred after its investor day on October 16, 2025.

- Oracle nevertheless reports promising financial prospects: 31% and 28% annual growth in revenue and EPS (earnings per share) by 2030. However, the business plan requires significant investment.

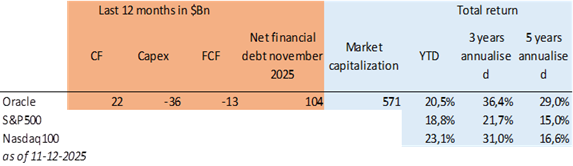

- Indeed, the acceleration of Oracle’s AI infrastructure business, which involves leasing IT infrastructure dedicated to AI, is very intensive (chips and infrastructure fixed costs). Until now, Oracle’s main business has been software, where gross margins are above 80% and operating margins above 40% In addition, the software business mainly involved variable human costs (salespeople, developers). In contrast, the AI infrastructure business has a gross margin of 35% and an operating margin of probably more than 30%. However, the AI infrastructure business is growing rapidly and is not self-financing. Based on information from Oracle’s latest investor day, we estimate the payback period to be 2.2 years. Furthermore, the software business is not able to finance this new activity either. Oracle is therefore seeing its debt explode. Bernstein, a broker, predicts, for example, that Oracle will burn through another $50 billion by April 2028.

- While investors generally seem optimistic about the prospects for generative AI, as evidenced by the valuations of Anthropic and OpenAI, Oracle’s ambitions are being hampered by credit stress. Oracle is now borrowing at 5% for 5 years, representing a credit spread of 100 bps higher than at the end of June 2025.

- In search of new sources of funding, Oracle has also announced that it will finance its chips through its suppliers and its customers, a move that has raised concerns among some investors.

- Oracle is certainly one of the oldest and most resilient information technology companies, but it is not immune to the financing issues that its competitors do not currently face.

- Founded in 1977 by Larry Ellison (81), its first product revolutionized database. In the 2010s, Oracle missed out on the SaaS (Software as a Service) revolution. However, its database management tools remain its strength, and Oracle has recently adapted them to cloud infrastructure, where they will be very useful for AI. Today, Cloud Database generate only $2.4 billion in 2025, but its growth is expected to accelerate to reach $20 billion in 2029/2030, according to Oracle. We believe this activity could generate $8-10 billion in annual cash flow by that time.

- Oracle does not have any foundational AI models, proprietary chip technologies, or a consumer base. However, it does have private databases belonging to companies. Oracle does not want to miss out on the generative AI revolution dedicated to businesses. It is relying on its new infrastructure to exploit its customers’ private data, which it has been hosting for over 45 years, to sell AI dedicated to its professional user base.

EUROPEAN EQUITIES

TotalEnergies goes on the offensive in America!

- On 8 December, TotalEnergies converted its ADRs (American Depositary Receipts introduced on Wall Street in 1991) into ordinary shares, becoming the third European group to be listed in both Europe and the United States, alongside Ireland’s CRH and Spain’s Ferrovial.

- There are many advantages to a direct listing on the NYSE, beyond continuous trading of shares 13 hours a day thanks to the two stock exchanges. Three major arguments justify the conversion of its ADRs: the strong presence of American investors in its capital (at the end of June, more than 50% of the group’s institutional shareholders were American, representing 38% of total shareholders), the desire to eliminate the costs and friction associated with ADRs, and the ambition to further expand its American investor base to institutional funds that were unable to invest via ADRs. The group will be able to be included in US stock market indexes and ETFs, thereby automatically attracting index funds when ADRs were not eligible.

- Increased visibility for the French group and greater liquidity for the stock, which is often lacking with ADRs, should therefore be increased for US investors; an increase in trading volumes will also reduce spreads for trading. This obviously means that, at this stage, the group’s share buyback programs will be carried out exclusively on Euronext, even if they are nevertheless highly appreciated by US investors.

- Being listed in the United States is therefore a strong commitment for TotalEnergies, which will see its credibility enhanced and an easier access to US capital. Above all, TotalEnergies’ management, which is preparing to accelerate its roadshows with US investors, hopes for a better valuation of the group by the market, more in line with its local peers ExxonMobil and Chevron.

- Indeed, the French oil company’s valuation has always paled in comparison to the American majors: the French group is trading at 9.6x its 2026 earnings, compared to 19.9x for Chevron and 16.4x for ExxonMobil, and at 5.12x in terms of 2026 price/cash flow, compared to 7.55x and 8.41x for the US companies. Beyond the size effect, with TotalEnergies’ market capitalisation ($144 billion) dwarfed by its US peers (Chevron $303 billion and ExxonMobil $504 billion), TotalEnergies’ relative undervaluation can be explained in particular by differences in the perception of geopolitical and regulatory risk.

- TotalEnergies is heavily exposed to Europe (higher taxation with specific production taxes and operating royalties, stricter regulation and stronger ESG pressure) and to countries with high risk premiums (30% of production in Africa), whereas Chevron, for example, is more firmly rooted in the United States (48% of hydrocarbon production and 70% of investments) and therefore benefits from a more favorable tax and regulatory environment for its hydrocarbons. Above all, the quality of cash flows and the mix of activities differ significantly, as Chevron derives the majority of its cash flows from upstream oil and gas (60% oil and 40% gas, with no significant renewable production at present), while TotalEnergies has a more diversified mix (electricity, renewables, LNG, etc.), with cash flows that are certainly more stable but offer lower returns. TotalEnergies’ strategy is clearly moving towards a significant shift towards electricity, whereas Chevron only has a few gas-related electricity projects via power plants for datacenters. By 2030, TotalEnergies is aiming for a production mix of 20% electricity (> 100 TWh of electricity, 70% of which will be renewable), 40% gas and 40% oil.

- A US listing will certainly bring TotalEnergies’ multiples closer to those of its US peers, but given their differing strategies and positioning, US oil majors currently deserve their valuation premium. In the medium to long term, TotalEnergies’ investments in the energy transition should be more highly valued by the market given the market potential and the leadership position that the group is currently establishing.