I. US MILITARY

US EQUITIES

Make US military Great Again

- On January 7, 2026, following his successful capture on Maduro in Venezuela, Trump signed an executive order to prevent defense equipment suppliers from prioritizing shareholder returns over investment in innovation, production capacity, and on-time delivery of military equipment. At the same time, Trump announced his goal of a $1.5 trillion defense budget in 2027. These two announcements are part of a strategic continuum to breathe new life into the U.S. defense industry against the New Axis of Evil (China, Russia, Iran, North Korea).

- Firstly, the United States once again has major military rivals since the fall of the USSR. China’s ambition to be a major military power and the resurgence of Russian military power threaten the US military supremacy acquired since Reagan launched the Star Wars program in 1983. Secondly, high-intensity conflict has once again become a possibility since the intensification of the Russian-Ukrainian conflict in February 2022. Finally, new technologies such as drones, hypersonic missiles, lasers, autonomous vehicles, cyberwarfare techniques, advances in space exploration, and securing access to critical raw materials are forcing the US to rethink national defense and the Art of War.

- The US Department of Defense budget is projected at $962 billion for 2026, including $205 billion for new equipment, $180 billion for R&D, testing, and development, $360 billion for current expenditures and maintenance, and $195 billion for personnel expenses. Defense spending has been only 3% of GDP per year since 2015, compared to 6% in 1986.

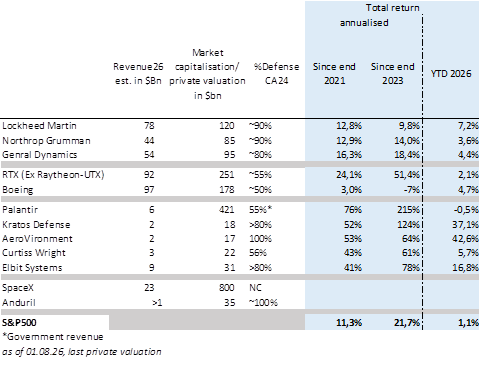

- In the United States, three major arms specialists (Lockheed Martin, Northrop Grumman, General Dynamics) and two diversified manufacturers (RTX and Boeing) share the majority of the US market. However, on the eve of the fall of the Berlin Wall, only 6% of military spending was allocated to specialists. The industry consolidated their military activities into these five large conglomerates following the decline in military equipment spending beginning in 1985 and even more so after 1993, when the “Last Supper” meeting announced major budget cuts for the industry. In constant 1996 dollars, the equipment budget fell from $136 billion in 1985 to $40 billion in 1996.

- This oligopolistic situation, conformism, and bureaucracy have created a favorable environment for more agile companies to modernize the US military industry. Anduril, Palantir, and SpaceX are among the leaders of this new world. These three companies would not have been created without the audacity of Thiel, Musk, and private equity capital. Private funding has grown from $8 billion in 2017 to $20 billion in 2024, and $130 billion in total since 2021. Other US-listed companies such as Kratos Defense, AeroVironment, Curtiss-Wright, and Elbit Systems are generating strong investor enthusiasm.