- PHARMACEUTICAL SECTOR

- BAYER

US EQUITIES

Are investors beginning to re‑embrace the pharmaceutical sector?

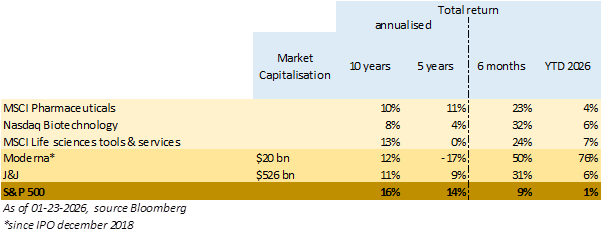

- Since the tariff threats at the end of July 2025, and even more so since the announcement of the first deals between major pharmaceutical companies and the Trump administration on 09‑30‑2025, biotechnology companies, large traditional pharmaceuticals companies, small biotechs, and their equipment suppliers have been outperforming the market.

- However, their performance over the past five to ten years has generally been lower than that of the market. They did outperform between 2020 and 2021 during the Covid pandemic, but the sharp rise in interest rates in 2022 slowed biotech funding and merger‑and‑acquisition activity among major laboratories. On top of this unfavorable environment, more structural factorshave weighed on performance: pressured healthcare budgets, uncertain clinical success, and difficulties in achieving significant commercial breakthroughs in a competitive sector.

- Since the beginning of the year, the sector has continued the momentum seen at the end of 2025. Signs of renewed investor interest include the recent performance of Moderna; one of the most emblematic biotechs of the past six years; and the positive market reaction to J&J’s results, the world’s largest pharmaceutical company by revenue.

- J&J is likely the laboratory with the most balanced drug portfolio, thanks in particular to its strong internal R&D. Revenue from protected drugs greworganically by 6.2% in Q4‑25 and by 4.1% in 2025, and is expected to reach $64 billion in 2026, $4 billion more than in 2025. Furthermore, the stock market success of a large conglomerate like J&J also relies on successful mergers, acquisitions, and divestitures, as well as a healthy balance sheet. In this regard, the planned spin‑off of DePuy Synthes ($9.3 billion in 2025 revenue from equipment, robots, and prosthetics for orthopedic surgeons), scheduled by J&J’s management in the next 18 months, is likely to create shareholder value.Stryker, the closest comparable peer to DePuy, is valued at 27x its 2025 earnings, compared with 19x for J&J’s total earnings.

- Conversely, Moderna, the biotech star of the COVID period, has seen its market capitalization increase by $12 billion since the beginning of the year, reaching $21 billion. This remains far from its peak valuation of $182 billion in September 2021, when investors expected sustained revenue from its SARS‑CoV‑2 vaccine franchise. Nevertheless, this short‑lived commercial success enabled Moderna to build a massive cash position of $18 billion by the end of 2022. This war chest has been deployed across numerous clinical trials of mRNA vaccines aimed at preventing infectious diseases and cancer relapse. This week, one of the mRNA candidates in development confirmed its commercial potential in preventing melanoma recurrence. A 50% reduction in the risk of relapse over five years was demonstrated in a Phase II clinical study.The second factor driving investor enthusiasm is Moderna’s promise to stop burning cash starting in 2028. However, these promises still need to be confirmed, as Moderna has disappointed since 2021.

- Breakthrough innovation in biotechnology platforms (monoclonal antibodies, synthetic hormones, antibody‑drug conjugates, nuclear medicine, CRISPR‑Cas9, mRNA, siRNA, CAR‑T, etc.) and operational excellence were powerful stock‑market drivers from the 1980s to 2015. The pharmaceutical industry continues to face headwinds: long and costly R&D cycles, clinical and commercial uncertainty, regulation, and constrained healthcare budgets.

- The outperformance of the pharmaceutical sector over the past six months does not yet appear to represent a major turning point. Only a few large healthcare conglomerates can truly be considered reliable long‑term portfolio holdings. Although new biotechnology platforms are inspiring, great caution remains warranted for investors.

EUROPEAN EQUITIES

Bayer : epilogue in sight for Bayer in the glyphosate case?

- In a major turning point last December in the Roundup/glyphosate litigation, the US Solicitor General issued a positive recommendation for Bayer, meaning that he recommended that the US Supreme Court accept Bayer’s appeal, which it finally announced it would do on 16 January.

- The Supreme Court has therefore agreed to consider the following question related to the Durnell case (a plaintiff who claims to have developed lymphoma after prolonged exposure to Roundup): ‘Does the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) preclude a lawsuit based on a lack of warning on the label when the EPA did not require such a warning?’

- Bayer is therefore expected to file its opening brief in March for a potential hearing in April and a final decision before the end of June 2026. Expert feedback, given the current composition of the court, suggests a roughly 70% probability of a ruling in Bayer’s favour. A positive decision, even if there are still several steps to go before the glyphosate case is completely resolved, could reduce total liability below the £6 billion provision recorded by Bayer. If the Supreme Court rules in Bayer’s favour, the thousands of claims (>60k) for failure to warn could be invalidated, and Bayer’s total financial liability could therefore be significantly reduced.

- The market will finally be able to focus on the company’s fundamentals. For the Pharma division (40% of turnover), 2026 is likely to be further impacted by the loss of revenue from Xarelto (an anticoagulant whose patent expired in 2024, resulting in a shortfall of €2.6 million until 2027) and pressure on prices and volumes for its Eylea franchise (treatment for retinal diseases) following the arrival of biosimilars on the market. However, from 2027 onwards, growth will be more sustained, driven by five potential blockbuster assets: Nubeqa (prostate cancer), Kerendia (diabetes-related kidney disease), Beyonttra (treatment for cardiomyopathy), Lynkuet (treatment for vasomotor symptoms) and Asundexian (anti-FXI anticoagulants), which has strong potential and for which the latest Phase III data is expected on 5 February. Bayer has announced a launch at the end of the year and hopes for rapid adoption of this product, which could represent an opportunity worth £3 billion (peak sales).

- In the Crop Science division (48% of revenue), cost-saving plans are not offsetting price declines and increased competition from Chinese glyphosate generics. Uncertainties also remain due to US-China tariffs (decline in agricultural income affecting soybean acreage). Nevertheless, Bayer is well positioned thanks to its presence in both the United States and Latin America, where soybean cultivation could shift. It will be able to count on the rationalization of its portfolio to boost growth, the growing adoption of technologies in soybeans and cotton, and the expected re-approval of the herbicide Dicamba for the next season. The group has implemented a five-year plan to improve its growth and profitability. By 2029, Bayer is targeting more than €3.5 billion in additional sales and above-market growth through innovation.

- Although the legal outcomes remain uncertain, this is a key step for the group, which is still heavily indebted (net debt of €35 billion for EBITDA of €10 billion) and could thus begin to turn the page on the glyphosate litigation that has weighed on the stock since 2018, when it acquired Monsanto. Bayer’s share price has already begun to rebound in this context, gaining more than 60% since the end of November 2025, but remains at a discount due to this litigation, which could disappear in 2026.