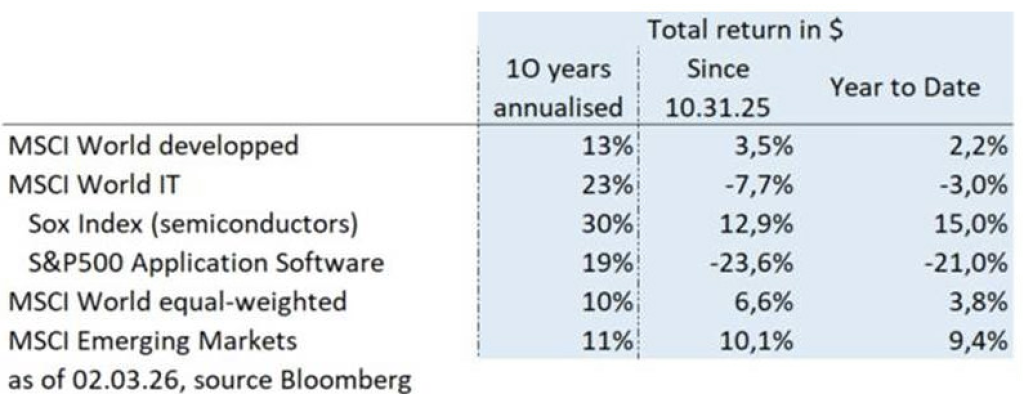

- Since the beginning of the year, stock market index have continued to rise in the wake of 2025, driven by high nominal global economic growth and strong earnings growth. The MSCI World Developed Index rose 2.2% and the MSCI Emerging Markets Index rose 9.4% in $.

- However, behind this apparent calm on the stock market, the information technology sector, which accounts for 25% of the MSCI World Index, is experiencing a major stock market disruption. The digital services sector, i.e., application software, IT consulting, and professional publishing companies, is falling sharply on the stock market. More specifically, the S&P 500 application software sector (which includes for example Microsoft, Oracle, and Salesforce) has fallen 21% since the beginning of the year, while the semiconductor sector (represented by the Sox Index) has risen 15%. On the other hand, the private valuations of Anthropic and xAI are approaching $500 billion, and even $1 trillion for OpenAI, compared to $3 trillion for Microsoft.

- The reason for this underperformance stems from Anthropic’s impressive demonstrations of its robot agents in the last weeks and again yesterday. Following the chatbot revolution in late 2022, the IT world has been turned upside down by advances in robot agents. Unlike chatbots, which responded to queries by writing code or reports, robot agents autonomously perform a string of actions on traditional software. In short, the robot agent makes software automation accessible to everyone. The information technology market is worth $6.15 trillion in 2026, including $1.4 trillion for software, according to Gartner. They are expected to grow by 11% and 15% respectively, according to Gartner.

- Although the software market is set to continue growing, this stock market disruption indicates that the share of added value accruing to traditional software companies will decline sharply in favor of robot agent creators. In our view, this disruption is amplified by herd behavior, algorithms, and automatic position unwinding. However, as the stock market adage goes, never catch a falling knife, we had already focused our investments on the most solid software stock, namely Microsoft. Furthermore, our equity portfolios continue to benefit from the good health of the global economy through industrial , basic materials, banks, energy, and healthcare stocks, which are not directly affected by conversational and agentic AI.