- WALL STREET, MAIN STREET, AND FINANCIAL LEVERAGE

- SAP AND THE SOFTWARE BEAR MARKET

US EQUITIES

Wall Street, Main Street, and financial leverage

- This week, three sources of concern that have been looming since at least last summer crystallized on the stock market: the threat of AI to traditional software companies, fears of excessive financial leverage in private credit, particularly in the software sector recently, and doubts among some investors about the profitability of hyperscalers’ colossal investments.

- The AI that powers chatbots and agent bots is already delivering productivity gains for white-collar workers. There are many examples in our daily lives. However, these deployments are being rolled out tentatively and do not always offer immediate returns. Jamie Dimon warned investors of this in his Q4 2025 earnings conference call. In a recent interview withTheEconomist, Bret Taylor, ex co-CEO of Salesforce, referred to a 1997Wired article stating that some banks had invested $20-50 million, an amount that seems excessive today, to develop a website giving access to their customers’ accounts. Thirty years later, the release of the Cowork robot agent suite, announced on January 12, 2026, by Anthropic, had a spark-like effect on the stock market. Then a series of new product launches by Anthropic this week were the catalyst for a further decline in software stocks.

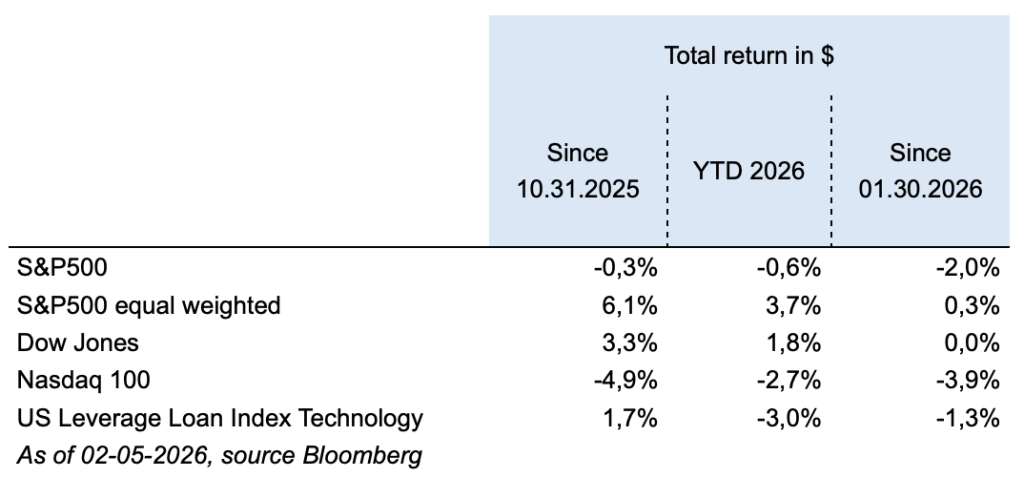

- Furthermore, the US leverage loans (variable-rate private credit market for issuers with low credit ratings), valued at $1.4 trillion according to Bloomberg, has corrected since mid-January, particularly in the technology segment, which is worth just over $270 billion. The Bloomberg US Leverage Loan Index Technology fell from 95 to 91.2 between January 12, 2026, and February 5, 2026. According to Bloomberg, distressed loans in the leverage loan technology sector currently account for 14% of the sector, just below the record level of more than 16% at the end of 2022.

- Finally, in recent days, the earnings reports of hyperscalers (Meta, Alphabet, Microsoft, Amazon), which account for 17% of the S&P 500 market capitalisation, have for the most part been poorly received by investors.Although their operating cash flow (cash available before investment) is growing strongly, their investments represent an increasingly large share of this cash flow. For example, Alphabet reported a $40 billion increase in CFO to $165 billion, but a $40 billion increase in investments to $91 billion in 2025. These companies are set to accelerate their investments even further in 2026. In total, these four companies plan to invest more than $600 billion in 2026, which is $30 billion more than the oil and gas industry in 2025, according to the IEA.

- Since the beginning of the year, we have therefore seen a continuation of the powerful sector rotation that has been underway since the end of last summer in favor of non-AI-related directly, i.e. more traditional companies. They are benefiting from a generally favorable economic environment on the one hand, and a certain mistrust among investors towards AI leaders on the other. The latter will spark investor enthusiasm again as their FCF improves or tangible evidence of the profitability of their investments emerges. In the meantime, our investments are focused on Large Cap companies with sustainable debt levels or net cash, unlike certain private assets, where leverage appears excessive in certain sectors.

EUROPEAN EQUITIES

SAP and the software bear market?

- For over a year now, we have been witnessing a massive stock market sell-off of software companies, which intensified in early February when SAP published its results at an unfortunate time (the same day as Microsoft), a black day for other players in the sector, including Oracle, Salesforce, Workday, and Intuit. For the past year, SAP has underperformed the DAX by 50%; its weighting in the index (10%) is now second only to Siemens AG. Fears surrounding AI have triggered a rotation from software to semiconductors.

- What lessons can be learned from SAP’s publication? Do the results confirm fears of AI disruption weighing on the sector? The disappointment surrounding the publication stems mainly from the 2025 growth of the Current Cloud Backlog (CCB) at +25%, which is slower than the 29% at the end of 2024 and in a context where management suggested last December that a figure below 26% would be disappointing… SAP reassures us that no customer has delayed migration to its S4 Cloud due to the rise of AI. On the contrary, two-thirds of Q4 orders included AI (90% of large contracts). This discrepancy is therefore more attributable to a complicated macroeconomic and geopolitical context that has caused them to fall behind in recognizing certain contracts since last June. Finally, management specifies that the expected slowdown in CCB in 2026 will be significantly lower than in 2025.

- The market must therefore adopt a slightly more cautious outlook on cloud growth in 2026 (forecasts between 23-25%), which is certainly key to the investment thesis, but nevertheless implying only a marginal change in forecasts and, above all, not warranting a valuation (2027e PER down to 20x!) lower than the one the group had when it warned in 2020 that it would face three years of weak growth!

- It will certainly take time for the sector to stabilize and validate what SAP is trying to explain, namely that most of its customers rely on them to run AI applications. In the meantime, the group, which has announced a €10 billion share buyback program to be completed by the end of 2027, confirms that the transition to the cloud is progressing well, enabling these double-digit revenue growth forecasts and improved margins.

- Even though market sentiment is clearly negative at present, SAP is uniquely positioned in the European software market, with high, predictable growth and significant potential for improving its profitability.

- The market reaction is excessive, as evidenced by the stock’s rebound in subsequent sessions amid high volatility. It is important to be aware thatfundamentals are taking a back seat at the moment and that it would be dangerous to fight against negative stock market momentum. As long as earnings releases continue to trigger declines regardless of operating performance, it would be futile to try to catch falling knives… Nevertheless, we should keep in mind that the “rule of 40” (revenue growth + operating margin = 40%), the holy grail for software companies, seems achievable for SAP by 2030: the shift towards more cloud will automatically increase growth (and the impact of the decline in licenses will fade over time), while margins will also be helped by AI-related efficiency gains. SAP’s growth will be boosted by its customers’ adoption of AI and its Business Data Cloud offering, which provides a solid foundation for deploying AI. SAP’s management insists: “We win contracts thanks to AI. We don’t lose them because of AI.”