- CATERPILLAR

- SIEMENS ENERGY

US EQUITIES

Caterpillar is firing on all cylinders

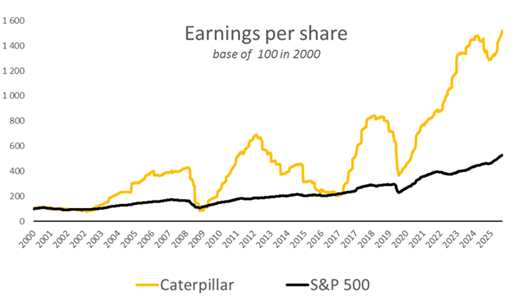

- Since the beginning of the year, and over the last five days, Caterpillar has posted the best and second-best performance on the Dow Jones, with gains of 32.4% and 4.42% in dollar terms, respectively. Over these two periods, the S&P 500 has remained stable and is down 1.44% respectively. Caterpillar celebrated its centenary last year with its share price hitting record highs, defying the cost of tariffs ($1.8 billion in 2025 and $2.6 billion in 2026) but reporting record sales of $68 billion in 2025. Its recent return has therefore been excellent, as its long term historical return over the last nine years: x10 dividends included compared to x3.6 for the S&P 500.

- Caterpillar is known to the general public for its construction and mining equipment. However, Caterpillar is also a leader in engines for rail, boat engines, power generators, compressors, and gas turbines under 39MW, which are grouped together in its Power and Energy division. The latter has already been benefiting from growing demand from the shale oil and gas industry in the United States since 2008, which accounts for 20% of its 2025 revenue. For the past two years, Caterpillar has been benefiting from a new market: data centers. These centers are always equipped with backup diesel generators, and some under construction produce their own electricity directly with Caterpillar’s small gas turbines.

- The Power and Energy division is more profitable and less volatilecompared to the rest of the group, accounting for an average of 42% of operating income between 2011 and 2023. In 2027, its contribution is expected to be nearly two-thirds of operating income, i.e. $10 billion. This new dynamic explains most of the recent stock market performance. The mining business is still generating operating income well below its record level ($2 billion in 2025 vs. $5 billion in 2012). The construction business is generating solid operating income of $4.7 billion in 2025, but this is below the peak of $7 billion in 2023.

- Caterpillar’s business is extremely cyclical, and its fixed costs amplify fluctuations in its profits. For example, during the commodities and emerging market boom between 2002 and 2012, EPS increased tenfold, then fell by two-thirds until 2016. Despite this significant variability in its revenue,Caterpillar has some solid strengths: few competitors can match the robustness and quality of its machines, which have a lifespan of decades; the responsiveness of its after-sales and maintenance service; its dealer network; and its financial arm, which finances its customers and contributes around 10-15% of its profits.

- Caterpillar reste une valeur très volatile et atypique, la rendant difficile à intégrer dans un portefeuille. Néanmoins, la cyclicité de l’activité est en général bien anticipée par les investisseurs. Au cours des 25 dernières années, un bénéfice haut de cycle est valorisé de l’ordre de 10 à 15x, à l’inverse un bénéfice bas de cycle est valorisé plus de 20x. Aujourd’hui valorisé 33x ses bénéfices de l’année 2026, BPA26 record de 23$, les investisseurs valorisent une poursuite de la dynamique pétrole, gaz, centre de données et espèrent un rebond des activités construction et mines.

EUROPEAN EQUITIES

Siemens Energy, European winner of global growth in electricity demand

- Siemens Energy (SE), which went public in 2020 and in which Siemens AG still holds a 14% stake, has just posted a solid first quarter (fiscal year ending September 30), suggesting a possible upward revision of its 2026 guidance and boding well for margin expansion in Gas Services (GS: gas turbines, long-term service, etc.) and Grid Technologies (GT: transmission equipment, transformers, etc.), its two key divisions. One of the pleasant surprises in the report was the limited loss recorded by its wind power division, Siemens Gamesa, increasing the likelihood of reaching operational breakeven in 2026 after years of huge losses.

- For this quarter alone, GS recorded orders for gas turbines representing more than 50% of last year’s volumes. The group’s visibility is therefore very solid, with an order book covering 90% of 2026 revenues and 70% of 2027 revenues.

- This strong demand is only partly linked to data centers (which account for 25% of reserved projects) and AI, which will continue to grow given the massive capex required in the networks for its deployment. It is interesting to note that SE’s management does not consider the demand from hyperscalers to be irrational and finds the announced capacity additions to be appropriate. Other drivers supporting the growth of gas turbines are the need to replace equipment (particularly that from the 1995-2000 cycle, given that a turbine has an average lifespan of around 30 years), energy security concerns, and strong demand in the Middle East (benefiting from low gas prices) andAsia, in a context of a shift from coal to gas.

- Everything suggests that in Gas Services, we are only at the beginning of an upward cycle (approximately two years into a cycle that normally lasts four to five years), given that the market will remain undersupplied until 2030. Nevertheless, one of the fears among investors is that there may beovercapacity, although the expansion of plants worldwide is expected to remain below demand. The expansion of supply appears to be much slower than during the major order cycles of the 2000s or 2014-16; furthermore, it is mainly brownfield (via the recommissioning of “dormant” capacity, which can therefore be reduced if the cycle reverses), and none of the three major gas turbine manufacturers (GE Vernova, SE, and Mitsubishi Heavy Industries) has announced any greenfield projects at this stage.

- The key to SE’s business model lies in its long-term service agreements(LTSA), which are much more profitable than equipment sales (and increasingly so with the rise in turbine prices), offering recurring and predictable revenues (with a 2-3 year lag after equipment orders are placed). This exceptional visibility is undoubtedly a future safeguard against economic cycles: SE is therefore less exposed to a future decline in demand for gas turbines than in previous cycles, with after-sales service accounting for more than 60% of GS revenues, compared with less than 40% in the previous period. In addition, it will benefit more than some of its peers from the growth in electrification thanks to its exposure to Grid. More than 70% of the group’s operating income is exposed to the structural and profitable growth of the aftermarket and networks (Grid).

- Siemens Energy, which is among the global leaders in all its areas of activity, is still trading at a significant discount compared to GE Vernova(2027 P/E ratio of 30.1x compared to 37.7x for the American company), which could narrow in the medium term as Gamesa’s recovery is confirmed and the group focuses on improving capital allocation (share buyback program of €6 billion starting in March). Finally, we appreciate the pragmatism of the management, which has indicated that it is prepared to consider all options if onshore wind power does not achieve a double-digit operating margin or a number two global position.