China at the heart of geopolitics

By Alexandre Hezez, Group Strategist

Editorial

Russia’s invasion of Ukraine is a potentially transformative event, which has highlighted a shift in the world system. The increase in geopolitical tensions within Europe itself has had repercussions that seem to be amplifying on a global scale. Paradoxically, the central point of crystallization has shifted over the months to Asia.

Economically, China is expected to be the engine of global growth this year. At a time when the Chinese rebound has only just begun (see Monthly Review January 2023), relations between China and the rest of the world become one of the elements to be taken into account in our analyses, whether in terms of tension or appeasement.

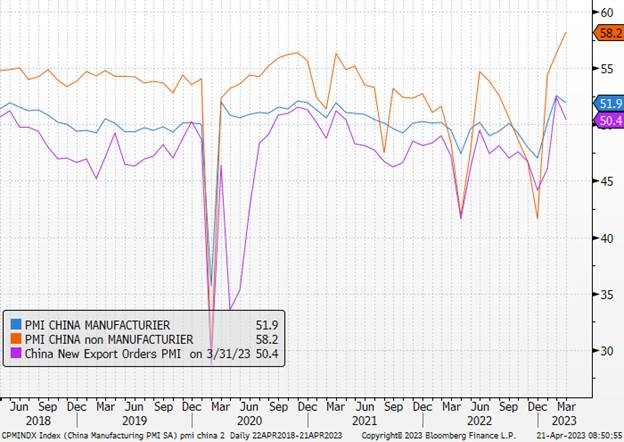

The publication of the Chinese GDP for thefirst quarter confirmed the speed of the rebound following the end of the “zero-covid” policy at the end of November. In March, retail sales accelerated sharply, confirming the signals already evoked by the PMI indices, driven in particular by the “reopening effect”, an effect amplified by a large stock of savings. This trend should continue in the coming months, fuelling demand for raw materials and supporting sectors exposed to Chinese demand (tourism, luxury goods in particular), even if certain elements remain less favorable (industry and real estate). The economy is therefore on track to meet or even exceed the government’s target of 5% for 2023, which seemed conservative when it was made official late last year.

Source : Bloomberg, Richelieu Group

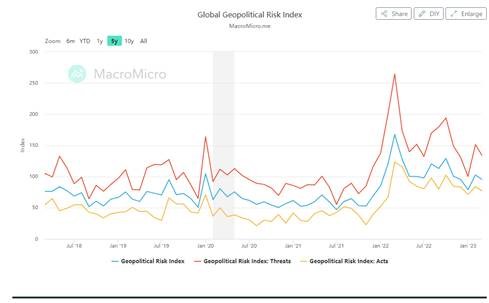

The conflict in Ukraine and the rising tensions in the South China Sea call for special attention. We are currently witnessing a continuous diplomatic ballet between China and Russia, with Xi Jinping’s 3-day visit to Moscow as a highlight. At the same time, China is stepping up the pressure on Taiwan with unconcealed military maneuvers that are still going on.

The war in Ukraine has forced Xi JIPING to manage a new set of economic, financial and political risks. China is becoming the central geopolitical and economic axis.

The Geopolitical Risk Index, compiled by the U.S. Federal Reserve, has reached its highest level since the invasion of Iraq in 2003.

Source : FED, macromicro.me

Between intensifying tensions with the United States, a strengthened friendship with Russia and a rapprochement with the Middle East, China is becoming an essential geopolitical link and a new central diplomatic actor.

At the same time, after a lull at the end of 2022, areas of tension are increasing, particularly due to the formation of a China-Russia Eastern bloc that is causing concern.

We believe it is important to objectively analyze China’s future attitude in our central scenario for the coming months in order to study the implications in terms of asset allocation.

Taiwan

The “One China” principle, which asserts that there is only one China including mainland China and Taiwan, is being challenged for a variety of reasons, including political, economic and social. U.S. Secretary of State Antony Blinken traveled to Brussels for a NATO meeting. In recent years, the Chinese leadership believes that the status quo that has prevailed for four decades and maintained peace and stability in the Taiwan Strait is no longer acceptable. China is stepping up the pressure on Taiwan by increasing its coercion.

Tensions between China and Taiwan have reached a worrying level, posing a major risk to the global economy. The Taiwan Strait, 130 to 180 kilometers wide, has become an almost unavoidable passage for maritime transport. This passage represents the only border between China and the island of Taiwan and is a strategic geopolitical issue for global maritime exchanges. According to Bloomberg, about 48% of the world’s 5,400 active container ships sailed this route in 2022, and it accounts for 88% of the traffic of the largest cargo ships.

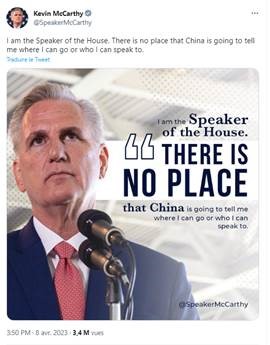

China has regarded Taiwan as a province to be reunified since the end of the Chinese civil war in 1949. Taiwanese President Tsai Ing-wen’s visit to the United States and meeting with House Speaker Kevin McCarthy may have avoided a major Chinese reaction in the short term thanks to careful staging, lack of publicity, and provocative rhetoric, despite the U.S. commitment to Taiwan’s defense. Whether this dynamic leads to renewed diplomatic contact between the United States and China is something to watch. Antony Blinken’s trip to China has been suspended following the spy balloon incident. A phone call between Biden and Xi is expected to renew the contacts that led to a significant de-escalation of relations, as observed during the G20 meetings the previous year.

Source : Twitter

The analysis of the political context in Taiwan is essential. The January 2024 elections are a brake on escalation. China should avoid an aggressive approach, given the uncertain election that could bring in a Taiwanese leader willing to forge closer ties with Beijing. Sources tell us that the Taiwanese public is increasingly divided over how to handle cross-strait relations and the United States, which could lead to a paradigm shift in the January elections in favor of the KMT (Taiwan’s traditionally China-friendly political party).

The mood of the Taiwanese people is one of pragmatism and avoidance of extremes with regard to Taiwan’s status, whether it be reunification or independence. Thus, the Taiwanese population might favor the candidate of “stability” rather than an ideological successor. Overall, these conditions favor a limited potential for escalation as China seeks to encourage a more natural evolution of Taiwan’s political position toward relations with the mainland.

US

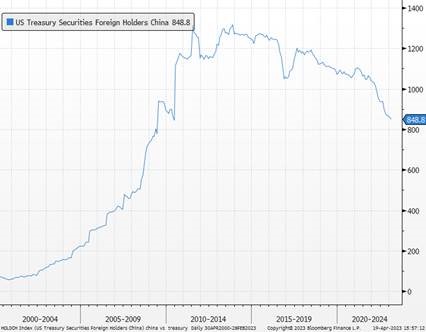

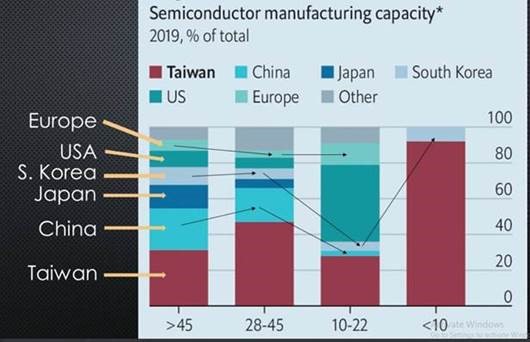

While U.S.-China contact has been limited, opportunities for travel to China by senior U.S. officials and bilateral consultations may serve as a pressure relief valve in the coming months as the two countries seek to smooth relations in the second half of the year. The key issues we continue to monitor are China’s retaliation against U.S. economic/technology restrictions (following the recently announced investigations and potential ban on rare earth exports) and obviously the degree of Chinese support for Russian President Vladimir Putin. Overall, a “managed tensions” dynamic that limits the potential for escalation remains our baseline scenario for U.S.-China relations. The irony of the economic situation is that the technology battle is over semiconductors and the largest semiconductor company, TSMC, is Taiwanese. China, meanwhile, continued to reduce its stake in U.S. Treasury debt in February and it reached its lowest level in nearly 13 years.

Source : Bloomberg

Over the past decade, our world with the United States as the sole pole – dominant in the economic, diplomatic, military and geopolitical spheres – has gradually given way to a world where power is more diffuse, and where China acts as the main counterweight. The conflict in Ukraine has highlighted the strategic rivalry between the camp of the West, dominated by the United States (and Europe), and that of a zone where China occupies a central position. Others could develop, including a smaller sphere of Russian influence.

The rise of geopolitical risk, caused by the war in Ukraine, reveals the increasingly divergent nature of the global system. We must take into account in the medium and long term asset allocations. Two themes will emerge in the years to come: a slowing of world trade and an accelerated transition to renewable energies to reduce the dependence of Western countries.

Source : Twitter

Europe

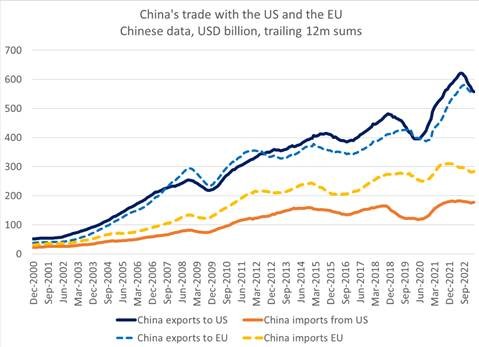

Europe is following the lead of the United States. The German minister was also very firm on the issue of Taiwan, where a military escalation in the strait where 50% of world trade transits every day, would be a “catastrophic scenario for the whole world. His visit came a week after that of President Emmanuel Macron and the head of the European Commission Ursula von der Leyen who had also called on Beijing to play a role in peace in Ukraine. Beijing officially claims to be neutral but has never condemned the Russian invasion. European issues are paradoxically more complex. Europe is potentially hit hard by Ukraine and Taiwan; China is a key partner for the EU. China must rely on Europe in its economic recovery after 2 years of zero Covid policy. Despite declining exports due to health restrictions, China remained Germany’s largest trading partner for the seventh consecutive year in 2022.

Josep BorrellVice President of the European Commission, wants to show the unity of the EU and insists in his speech on the Sino-European relationship with a growing number of irritants (such as China’s disproportionate response to the EU’s targeted restrictive measures, China’s trade measures against Lithuania, and China’s position in the war against Ukraine). At the same time, however, he acknowledges that Europe is committed “to engagement and cooperation” and recognizes “China’s crucial role in addressing global and regional issues.”

In a way, Europe needs China as much as China needs Europe. With the war in Ukraine, China’s relations with the U.S. reaching new lows, Chinese leaders want to avoid alienating the European Union, one of the country’s largest trading partners, as well. China’s main tactic (which remains important) has been to reassure European countries that it will use its own ties to Russia to prevent Putin from deploying nuclear weapons.

Russia

The war in Ukraine is not in China’s immediate strategic environment. It is not in his priorities. Beijing officially claims to be neutral but has never condemned the Russian invasion. However, the priority remains the intensification of relations with Moscow in order to increase its supply of raw materials and to consolidate a sort of axis, a bloc against the West and, at the same time, to build an alternative international order to what the West was able to induce in the aftermath of the Second World War.

On the trade front, trade between the two countries has more than doubled in volume over the past ten years and, by early 2023, Russia had become China’s largest supplier of crude oil. China is Russia’s largest trading partner – involved in 30-40% of its trade. Russia is a strategic country for China. China’s reasons for maintaining good relations with the Kremlin go beyond the war in Ukraine. The two countries share a long border and a history of disagreements. China cannot afford additional tensions on its other borders. The two countries share a border of 4,300 kilometers (the width of Europe). China, focused on the actions of the United States and its allies in East Asia and the Indo-Pacific, simply cannot afford to provoke tension or unrest on its other borders unless it provokes a global conflict. The war in Ukraine has forced Xi JIPING to manage a new set of economic, financial and political risks.

Beijing does not like disorder, especially in the post-Covid context, and the collapse of Putin’s regime would not be good news for China. A rapprochement between China and Russia can be expected, but the level of Chinese involvement will depend on Russian internal stability. Our consultations with our partners show that Chinese leaders are generally indifferent to the end of the war in Ukraine and are primarily concerned with Russia’s internal stability, in order to avoid regional instability on their borders. Thus, the likelihood of China crossing the international “red line” by supporting Russia militarily and materially in a more aggressive manner remains low, but cannot be completely ruled out at this stage. China would be more inclined to support Russia materially in case of a major internal conflict threatening the stability of Putin’s regime. Close ties with Russia are deemed necessary for China’s long-term development goals, which would be jeopardized if Russia’s current leadership collapses. We see the Chinese position on the war in Ukraine as a pressure factor on global macroeconomic stability. This dynamic will also challenge U.S.-EU relations and may encourage more accommodating policies from Europe on various economic and trade issues. In the coming weeks, we must be alert to any contact between Xi and Volodymyr Zelensky that might highlight prospects for a peace agreement. We still believe it will be several months before an outcome emerges, but the next catalysts for a change in trajectory include the Russian military holiday on May 9, the G7 meetings in Japan in late May, and the NATO summit in July. Sino-Russian ties remain close, and Chinese diplomats are navigating a delicate balance in trying to maintain their ties with major European economies.

China / Rest of the world

At the same time, China is working to strengthen its ties with other countries in the South, focusing on energy and food security. The majority of non-Western nations are seeking to stimulate their post-Covid recovery through trade and investment. Chinese diplomacy marked a turning point by formalizing the resumption of diplomatic relations between Iran and Saudi Arabia. Although the content of this agreement remains unknown, it allows Beijing to get involved in a diplomatic game that was previously largely dominated by Western powers. “No one will stop Brazil from strengthening its ties with China,” the Brazilian president said after official visits to the United Arab Emirates and China, hoping that these two countries and others will join a “political G20” to try to end the war. Xi Jinping insists on the importance of relations with Brazil.

In recent weeks, we have seen an endless parade of heads of state and officials in Beijing, reflecting China’s importance in geopolitical relations and its growing influence. and officials in Beijing, reflecting China’s importance in geopolitical relations and the growing scope of its influence.

Conclusion

At this point, being complementary to the West is not a viable option for China, given its hopes of achieving a robust economic recovery after years of zero-COVID policies. Its relations with the United States have reached new lows, and China’s leaders want to avoid alienating the European Union, one of the country’s largest trading partners, as well. China will likely continue to use the conflict to create space between the EU and the U.S., while blaming some of the war on U.S. and NATO influences. Recent news reports show no appeasement(China is building cyber weapons to hijack enemy satellites, according to a U.S. leak).

If China feels that it is increasingly at odds with the West as a whole, it must temporize at all costs. In any conflict, wisdom may not prevail. The war in Ukraine continues to test China’s ability to navigate a maze of conflicting interests and rapidly changing sentiments. A risk premium remains in an uncertain geopolitical context : however, our central scenario remains the temporization of China in 2023 to allow it to rebound economically.

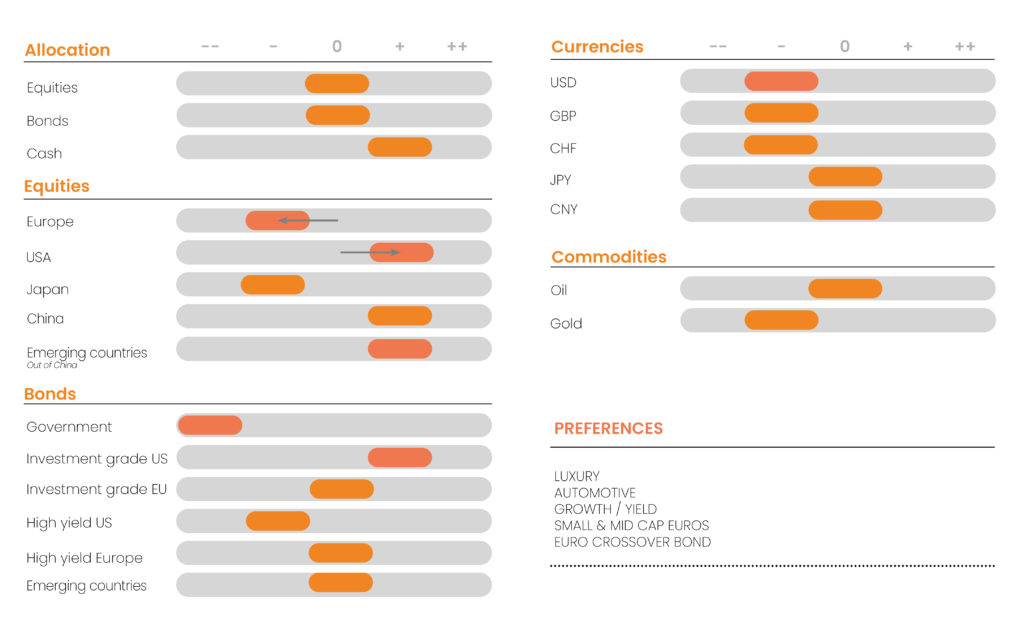

CONVICTIONS

POSITIONING WITH RESPECT TO RISK CRITERIA

A month of May for central banks

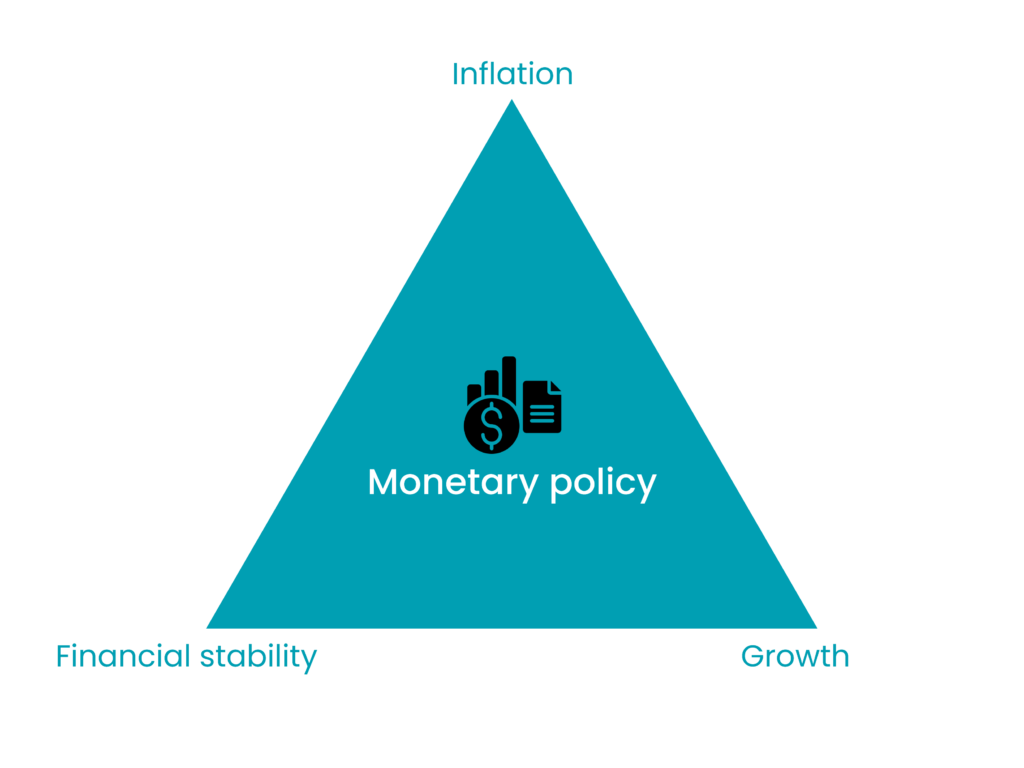

While policy efforts may stabilize concerns about the financial stability of the banking sector, rising interest rates and tighter lending conditions will persist. Central banks are now faced with a trilemma: monetary policy with regard to inflation, growth and financial stability.

Source : Richelieu Group

US : FED must take into account deteriorating credit conditions

At the end of the year, we thought that the generalized pessimism was not justified and that investors’ prudence could be put to the test. Of course, there are still sources of uncertainty, but their impact is being reduced. Inflation is falling at a steady pace in the United States, and the SVB/First Republic Bank episode is likely to amplify the disinflationary trend. The sharp rise in rates is putting many mid-sized banks in the U.S. in trouble, causing both a contraction in their deposits and a deterioration in the value of their assets. It is likely that these banks, which produce almost 50% of the credits, will reduce their activity considerably. This significant deterioration in financial conditions makes it more than problematic for the FED to continue to raise rates, thus relegating the fight against inflation to the background. The U.S. central bank will hold its next monetary policy meeting on Wednesday, May 3. We do not believe they will raise rates again. Our scenario remains 5%/5.25% for 2023 and part of 2024. This should allow the yield curve to steepen in the second half of the year.

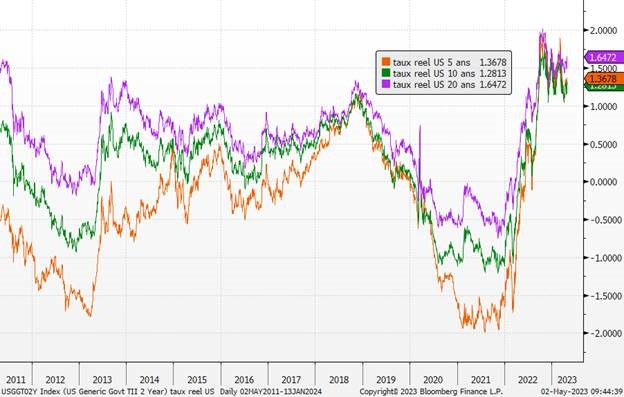

We continue to discount the risk of a severe recession, as the labor market remains resilient. The stabilization of real rates (we still expect the US 10-year real rate to be around 1.0%) together with the prospect of a moderate slowdown in the US will favor high-visibility stocks and a further appreciation of the euro against the dollar.

Sources: Bloomberg, Richelieu Group

The banking sector’s woes could affect consumer and business morale. A possible crisis of confidence could have a significant impact on consumer spending and business investment . The latter, like households, would probably choose to hold on to the savings accumulated during the pandemic. We believe that the obsession of households remains inflation. If it stalls, confidence is not expected to deteriorate and offset credit pressures. We have lowered our target for the US 10-year to end-2023 to 4%. The slowdown in the US economy has finally been fully integrated by analysts and downward revisions should stop as activity shows resilience, companies retain pricing power and that they cut costs quickly if necessary.

In equities, earnings expectations were revised downward for the first quarter (-8%). That said, the initial results seem encouraging. For the time being, the results published by the companies are well above the consensus expectations. So far, 54% have reported EPS above expectations (46% historically). S&P EPS growth is currently -5% for 2023 (-7% for consensus). The buyback recovery could be positive as approvals for 2023 mark an all-time high. We could thus see the pendulum swing back and bullish revisions. The end of the FED’s aggressive policy, an absence of hard landing or soft landing and a structurally weaker dollar could be beneficial in the short term for US assets in local currency compared to Europe. The main risk would be to enter a recession in the US. However, distrust of US assets remains strong, as evidenced by hedging positions in derivatives. In this context, US investment-grade bonds remain the preferred choice, benefiting from lower interest rate volatility and an attractive yield.

Sources: Bloomberg, Richelieu Group

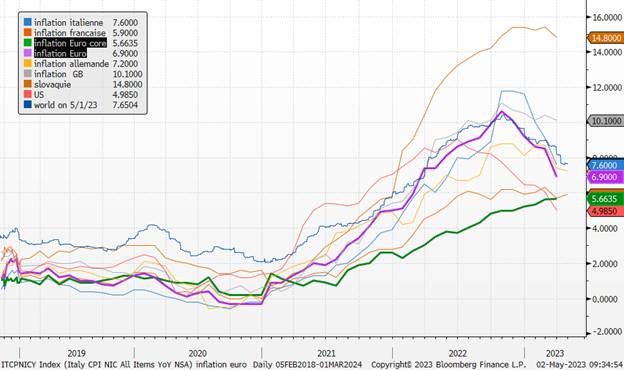

EUROPE: the ECB is still not done with rate hikes

In Europe, the inflationary situation remains worrying. If, unlike in the United States, inflation is due to an exogenous element (gas), it has become more “sticky” in the real economy. Even the International Monetary Fund has called on the European Central Bank to continue to raise interest rates until mid-2024, and on the European Union’s finance ministers to tighten fiscal policy in a concerted effort to bring down high inflation. Beyond geopolitical and energy risks, inflation remains the biggest concern. For the ECB, this means additional, longer tightening until mid-2024 to bring inflation back to its target in 2025. The fiscal stimulus to the economy that governments put in place during the Covid-19 pandemic, and then maintained during the Ukrainian crisis, will have to be contained, reducing the zone’s growth potential. If not, the ECB will have to be much more aggressive. By supporting economic growth, governments have prevented a slowdown in demand and thus supported inflation over time. This trend is expected to gradually reverse in 2023, in connection with more targeted and then reduced aid. The resurgence of social tensions since the end of 2022, against a backdrop of inflation that is weighing on households, will constrain the desire to rebalance the public finances of States, whose margins for manoeuvre are already reduced. We expect economic growth to be sluggish but not recessionary in 2023. Savings will not save consumption. The savings rate had risen sharply during the Covid crisis. It is now close to normal, a sign that financial leeway has been reduced. Household savings intentions are on the rise again, this time reflecting fears of recession and instability in the financial markets, which may inflate savings at the expense of consumption. Equity markets remain heavily influenced by expectations of monetary policy changes, even more so since the banking stress.

Sources: Bloomberg, Richelieu Group

In this context, we believe that the consensus earnings per share (EPS) forecast remains optimistic in Europe (2.5%). The strong outperformance of European equities could be dampened by downward earnings revisions, a more aggressive ECB and persistent inflation pressures. We are taking a more cautious view in the short term as we await Christine Lagarde’s upcoming meetings. We maintain our preference for companies that offer visibility for the time being. Small caps, lagging behind large companies and offering reasonable valuation levels, should do well, as evidenced by the numerous acquisition announcements in this segment (Network International, Dechra Pharmaceuticals, Software AG, Majorel, Simcorp, Vilmorin) in late April. Small cap funds benefited from a shift in expectations toward more resilient growth, ending long quarters of outflows. We believe that this dynamic is not yet over, even if banking stress remains an obstacle to be removed. Small & Mid Caps still have various assets to outperform by the end of 2023. The low levels of growth expected in the coming months will keep the PMI indicators close to their current levels, already limiting the rebound potential of the equity indices. Cyclical companies were penalized by the banking stress. We expect a gradual return of confidence to allow for a catch-up, but the weakness of economic growth should then quickly prompt selectivity. Stock picking should be favored in more defensive or value sectors. Bond assets should suffer from the central bank’s dithering. The riskiest segments should be impacted under these conditions and the highest rated segments will suffer from higher rates. We remain positioned in the BBB-/BB segment, which we believe is the most resilient. The liquidity remains well paid and allows you to be patient.

CHINA: a diesel engine

Against all expectations, the exit from its zero COVID policy is not translating into a strong revival of activity, even if consumption is rebounding. We still believe that growth will accelerate in the second half of the year as savings accumulated during the confinements decline and expansionary policies are implemented. As we demonstrate in this month’s editorial, China will do everything it can to maintain resilient economic growth at the cost of a precarious diplomatic balance. China’s growth positively surprised the consensus by rebounding to 4.5% year-on-year in the first quarter. It still needs to consolidate to reach the official target (“around 5%”), but should be helped by very favorable base effects, especially in the second quarter. The recovery is finally starting to be driven by household consumption.

Sources: Bloomberg, Richelieu Group

As a result, retail sales rose sharply, outpacing the economy’s growth rate, something that has not happened since mid-2020. Some of this savings will fuel the recovery in consumption in 2023. The real estate sector, which accounted for nearly 30% of China’s GDP in the past, is still plagued by structural imbalances. The authorities have encouraged financial institutions to provide more support to real estate developers in order to stabilize the sector and avoid a crisis.

The authorities’ response remains to ease monetary policy by lowering reserve requirements for banks and encouraging them to increase their credit production. With private investment remaining weak, the economy is still a long way from overheating and is not expected to fuel headline inflation, which is reassuring news given the tensions in other countries. China’s recovery is on track and will offer a breath of fresh air to the entire planet in 2023. A substantial rebound is underway, as evidenced by high frequency indicators as well as PMI activity indices. This is expected to continue, but the ability of the PMIs to surprise on the upside will be an issue for financial assets in the coming months. The battle against inflation in the OECD countries is not yet won, despite signs of improvement underway or to come, and the continuation of restrictive monetary policies will weigh on the ability of the other economies to rebound in 2024. The acceleration of Chinese growth should allow the price of oil to return above USD 80.

Sources: Bloomberg, Richelieu Group