China and the New World Disorder: Economic Stakes and Strategic Alliances

Macro Point

National People’s Congress 2024

Source : X

In a world marked by increasing economic uncertainties and heightened geopolitical tensions, China finds itself at a crucial crossroad in its economic development. Despite the challenges posed by the COVID-19 pandemic and international trade frictions, notably with the United States, China continues its efforts to ensure a robust and sustainable economic recovery. Monetary easing, recently characterized by a significant drop in long-term credit rates, is part of a series of measures aimed at stimulating the economy.

Preferred interest rates for loans

Sources : Bloomberg, X

However, disappointing financial statistics and the struggling real estate sector testify to the complexities of the current situation. The various dimensions of China’s economic strategy remain intertwined with the domestic context but, obviously, with the current geopolitical challenges that continue to escalate.

Source : X

The annual sessions of the National People’s Congress (NPC) and the Chinese People’s Political Consultative Conference (CPPCC) are key moments for the formulation of Chinese economic policies.

The announcement of the official economic growth target for 2024, expected during these meetings, is highly anticipated. Chinese leaders have expressed their “confidence” in the long-term growth prospects of the world’s second-largest economy, despite the numerous challenges ahead. The mentioned challenges are manifold and complex. Economic issues are a major concern. Youth employment, especially for young graduates, is a subject of great worry. The persistent real estate crisis, deflationary pressures, lack of confidence from international investors, and increasing resistance to Chinese exports, particularly from Europe and the United States, are all factors weighing on economic prospects.

Source : French.china.org (Link)

In response, Chinese leaders have emphasized a strategy that combines proactive fiscal policy and accommodative monetary policy, aimed at moderately supporting growth while avoiding macroeconomic imbalances.

President Xi Jinping and Premier Li Qiang play a central role in formulating this strategy. Their approach appears to prioritize a long-term vision, aiming to transform China into a global manufacturing superpower while carefully managing immediate economic risks. This strategy requires a delicate balance between stimulating growth and maintaining financial stability. To achieve a growth target of 5% in 2024, Beijing may need to increase its fiscal deficit beyond the usual target of 3% of GDP for the second consecutive year. Although investment in infrastructure and housing has traditionally been favored, it is likely that the government will invest more in advanced technologies, recognizing their importance for the country’s economic future.

Chinese deficit

Source : Bloomberg

The economic recovery in China post-pandemic remains fragile. Key indicators, such as manufacturing and non-manufacturing PMI (Purchasing Managers’ Index), show an uneven recovery, with particularly weak manufacturing activity. This reflects hesitant domestic and international demand, exacerbated by geopolitical tensions and global economic uncertainties.

Chinese leading indicators

Sources : Bloomberg, Richelieu Group

In this context, the Chinese government has taken measures to stimulate domestic demand and support key sectors of the economy, including housing and technology. However, these efforts face significant obstacles, such as high household debt and low consumer confidence. China must therefore find ways to revitalize its domestic demand while maintaining stable economic growth. Given China’s size, stage of development, and excessive savings, a key element of any macroeconomic stability strategy must be an increase in private and public consumption as a share of GDP.

Chinese savings versus Europe and the US

Source : FT

The tensions between China and the United States lie at the heart of global economic and geopolitical concerns.

These tensions, spanning trade to technology and regional influences, have profound implications for the Chinese economy. The trade war initiated under the Trump administration, with the imposition of substantial tariffs, has not only disrupted global supply chains but has also signaled an era of economic confrontation between the two superpowers.

2018 Article on the Trade War between China and the United States

Source : Reuters

Under the Biden administration, although the tone has shifted slightly, the fundamental strategy towards China remains firm. The United States continues to aim at reducing its dependence on Chinese supply chains, particularly in critical technological sectors. For China, this means not only potential loss of export markets but also an increased need for innovation and self-sufficiency in key areas such as semiconductors. In the electoral duel between Trump and Biden, China finds itself as the clear and undisputed loser. Trump pledged to impose huge tariffs that could significantly diminish Sino-American trade, even reducing it to zero according to Bloomberg analysis. Meanwhile, Trump’s rhetoric could increase pressure on Biden to take harsher measures as the election day approaches. American opinion polls on China are clear-cut, Biden plans to introduce new constraints even before the election.

Opinion Poll on China in the United States

Sources : X, Gallup

The trade confrontation initiated by Donald Trump in 2018 against China has weakened the economic relations between these two global giants. Trump’s ambitions for a second term could permanently sever these ties. Trump is proposing a 60% tariff on all goods imported from China.

Source : BBC

According to Bloomberg Economics, this would nearly annihilate a trade flow valued at $575 billion. This radical measure is just one among several contemplated by Trump if he manages to turn his slight lead in the polls against incumbent President Joe Biden into a victory in November. Trump’s offensive strategy could compel Biden to adopt tougher stances as the election approaches. Biden is aware that he needs to take a firm stance towards China. While his proposals are not as extreme as the tariffs envisioned by Trump, and while his administration has expressed opposition to a complete separation, he has a range of unprecedented restrictions to impose, ranging from data management to the electric vehicle industry.

Excerpt from Bloomberg Economics Article

The perspective of the US elections adds an additional layer of uncertainty. The aggressive policies proposed by both candidates could lead to an escalation of tensions, further affecting trade and economic relations. In this context, China must navigate cautiously, seeking to diversify its trading partners while strengthening its position on the international stage.

Beyond the United States, China’s relations with other Western countries, notably the European Union, are also experiencing moments of tension. Concerns regarding trade practices, human rights, and China’s geopolitical ambitions have led to a climate of mutual mistrust. However, China and the EU continue to recognize the importance of a strong economic relationship, with recent efforts to engage in dialogue on topics such as climate change and multilateral trade.

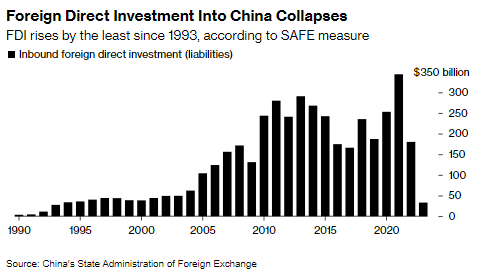

Australia has invited the Chinese Foreign Minister to visit the country at the end of March for discussions on trade, security, and other subjects. The Australian minister states that China has no role to play in maintaining order in the Pacific. For the first time on record, China has experienced a leakage of foreign direct investments, raising concerns in the markets about the prospects of the world’s second-largest economy and leading some observers to assert that this is a sign that foreign companies have chosen to reduce risks or “relocate” their operations.

China is actively seeking to strengthen its relations with other nations through economic diplomacy, highlighting initiatives such as the Belt and Road Initiative. These efforts aim to create mutually beneficial economic dependencies while promoting an image of China as a reliable and indispensable trading partner however, it is among so-called emerging countries that China remains most proactive.

Sino-Russian relations have strengthened, particularly in the context of tensions with the West. This strategic alliance provides China with an alternative source of raw materials and a political partner in its quest to reshape the global order. However, this closeness with Russia also carries risks, particularly in terms of international perception and potential additional economic sanctions. The peak of G7 exports to Russia occurred in mid-2008, just before the global financial crisis. Chinese exports to Russia have just reached this level in December 2023. China has become by far Russia’s top trading partner since the invasion of Ukraine.

Exports to Russia

Source : BofA

China is intensifying its military spending, fueling regional and global tensions. The Chinese military budget has seen steady growth in recent years, reaching $1.782 trillion in 2023. This intensification aims to modernize the Chinese military, develop new military technologies, and assert China’s power in the South and East China Seas. This arms race worries neighboring countries and increases the risk of conflicts. This growth has accelerated in recent years, with a growth rate of 7.2% in 2023, slightly higher than that of 2022 (7.1%). Beijing plans to spend around €214 billion on defense in 2024 – a 7.2% increase in one year – which remains more than three times lower than that of the United States. This intensification of military budgets is part of an ambitious modernization and expansion of the Chinese military, the People’s Liberation Army. Beijing has more than doubled its annual defense budget since Xi Jinping took office in 2013, against a backdrop of increasing tensions around Taiwan and in the South China Sea.

Since the beginning of the war, China has replaced the European Union as Russia’s top energy buyer and goods supplier. Trade relations between the two countries are reaching record levels. While Russia’s war in Ukraine has entered its third year, Western sanctions have failed to cripple the Russian economy or stop its war effort. One of the main reasons is China’s economic support. In a short amount of time, China has replaced the European Union as Russia’s top energy buyer and goods supplier, providing Russia with both liquidity and manufactured goods needed to survive. Not only has China never condemned Russia’s offensive, but Beijing has notably drawn closer to Moscow in its ideological battle against the West and has taken advantage of the void left by Western companies. Total trade between China and Russia reached $240 billion (€221.78 billion) in 2023, more than double that of 2018 and far exceeding the $200 billion target set for 2024 by Presidents Vladimir Putin and Xi Jinping.

The reconfiguration of global supply chains offers opportunities to emerging countries. China, by diversifying its import sources and exploring new markets for its exports, can play a key role in the economic development of these countries. China is shipping more goods to the United States via Mexico, thereby bypassing the high tariffs imposed by the Trump administration and maintained by the Joe Biden White House. This increase occurred as Mexico surpassed China as the largest exporter of goods to the United States last year. This dynamic not only allows China to reduce its dependence on traditional markets but also offers emerging countries the chance to further integrate into the global economy.

For example, India appears as the new alternative to China for global asset managers. The Indian market offers them a welcome diversification, especially since the two economies are loosely linked. Economically, it is the last major country that has not yet emerged, with strong growth potential. India, which has recently surpassed China in terms of population, is not expected to replicate China’s resource-intensive growth model. However, it remains attractive to investors due to the increasing formalization of its economy and the diversification it offers compared to other emerging markets. Despite challenges such as dependence on energy imports and the need to create jobs for a growing population, the outlook for Indian assets remains positive.

China is at a decisive moment in its economic development. Faced with internal and external challenges, it must adapt its strategy. This requires skillful navigation of geopolitical tensions, constant innovation to reduce technological dependence, and domestic policies that stimulate demand while maintaining financial stability. In terms of demographics, China is at a turning point that implies its potential future growth. Life expectancy in China has increased significantly in recent decades, reaching 78.08 years in 2020. This has led to an increase in the number of elderly people and a decrease in the working-age population. Urbanization, rising living standards, and changing mindsets have also contributed to the decline in the birth rate.

The way China addresses these challenges will not only determine its economic future but also its position in the new world order. In the short term, tensions are expected to escalate under the impetus of the United States, which sees the Middle Kingdom as its new top adversary.

Chinese currency and stock market

Sources : Bloomberg, Richelieu Group

Allocation

Between resilient growth and anchored inflation, doubt may arise.

This month, we adjust our investment strategies to account for the continued rise in equity markets since November 1st, which limits the upside potential (following Jerome Powell’s accommodative speech that we have often mentioned) and inflation figures on both sides of the Atlantic that could raise some doubts about the intensity of rate cuts this year.

The main inflation figures have been firmer than expected on core measures, largely due to persistent tensions in services. Disinflation has entered a more complex phase, which serves as a reminder of recent messages from Fed members, who want to see more evidence of disinflation progress before considering any rate cuts.

The theme of steady disinflation, providing room for the Fed to make rapid rate cuts, is coming to an end. The upward trend in equity indices in recent weeks has largely exhausted the potential we identified. However, momentum is expected to remain favorable as real sovereign rates are expected to decline again in the coming months.

This leads us to downgrade our outlook on equity markets to neutral (versus positive) for the next few months. We believe it is appropriate to go along with the upward momentum of equity markets and that it makes sense to count on a catch-up of the “cyclical” theme that is lagging behind.

Equity index in Euros since November 1st, 2023

Sources : Bloomberg, Richelieu Group

US : Real estate at the center of concerns

The situation remains complex in the United States for Jerome Powell. US growth will remain very resilient in 2024, even though it is starting to slow somewhat according to activity indicators and economic statistics published since the beginning of the year.

Consumer spending stalled in January. This weakness was exacerbated by weather conditions, but it primarily reflects slower income growth (annual growth in disposable income dropped from 7% in December to 4.6%). Regarding investments, 2024 will be less favorable as the effects of past stimulus and investment plans dissipate, and no new impetus will be validated this year during an election period. This trend is expected to continue throughout the first semester, allowing disinflation to persist and reassure the Fed about the opportunity to lower interest rates in 2024. However, we believe that the economy’s landing will be “smooth,” not requiring an urgent monetary easing from the central bank. Inflation is not decreasing as quickly as expected, and financial conditions remain very favorable. Core service inflation excluding housing remains anchored. According to us, this is a key measure monitored by the Fed (also known as SuperCore inflation). In January, this indicator jumped by 0.7% month-on-month, the largest increase since September 2022. The other source of concern remains housing. Even though rent indices (Zillow or ApartmentList) dropped in 2023, the most surprising increase is still in housing (+6% on an annual basis; 0.6% on a monthly basis). Extremely low vacancy rates, both for owner-occupied properties and rental buildings, as well as mortgage rates that have more than doubled in recent years, maintain pressure on inflation. The most worrying sign is the resurgence of housing inflation over 3 and 6 months.

Housing Inflation in the US

Sources : BofA, Richelieu Group

Combined with this initial effect, the rise in markets creates a significant wealth effect for the American consumer and the risk of persistent inflation. The situation in residential real estate remains a particularity in the US that could restrain the Fed in its ambitions to change monetary policy. The Fed may want to slow growth more pronouncedly to avoid a new wave of inflation after the US presidential elections.

Regarding central bank rates, we have already seen a recalibration of expectations mainly in the US thanks to the rhetoric of FOMC members since the beginning of the year. We still expect a maximum of 3 rate cuts, which will weigh on the entire yield curve. Other cuts of the same magnitude will follow each quarter until early 2026 to reach a balance rate that we estimate to be 3.25-3.5%. Our year-end target for the US 10-year yield is 3.80%, taking into account the economic slowdown. The 2-year yield should settle at similar levels, signaling the end of the inverted yield curve period. As for the US market, the momentum has largely been driven by the results of the “magnificent seven” in particular and artificial intelligence in general, on which we remain positive. We believe that movement in very large capitalizations could falter and underperform the rest of the market due to excessive valuations despite the quality and solidity of the balance sheets.

Index of the “Magnificent Seven” versus Equally Weighted S&P 500

Sources : Bloomberg, Richelieu Group

Eurozone : The low point has passed

In the Eurozone, despite weaker-than-expected GDP growth in the fourth quarter, recent surveys seem to indicate signs of improvement, a trend confirmed by Christine Lagarde, who expects growth to accelerate during the year. The rebound of the European economy is expected to strengthen as credit conditions loosen. In parallel, core inflation came out above Q4 levels in January and February.

We now anticipate GDP growth of +0.6% in 2024. We expect inflation to be 2.6% and 2.2% respectively in 2024 and 2025. We maintain the first rate cut in June 2024 and bet on 3 cuts of 0.25% in 2024. Although the ECB’s overall inflation forecast is expected to be revised downward (mainly due to the decline in natural gas prices), the same cannot be said for core inflation, where progress in disinflation has been slower. The cyclical weakness of the economy, the decline in real estate combined with gas prices, makes an accommodative central bank more credible.

Gas Prices in Europe

Sources : Bloomberg, Richelieu Group

European cyclical companies at this stage should benefit from the gradual rebound of European growth, with real wages in positive territory supporting consumption. The macroeconomic surprise dynamics remain in favor of the Eurozone compared to other geographical areas.

Macroeconomic Surprise Indicators

Sources : Bloomberg, Richelieu Group

Credit : Capturing Quality Yield

Corporate credit is attractive, except for the lowest-rated HY companies. The yields offered by the corporate credit markets are attractive given our assumptions of stability (or decline) in sovereign rates, combined with the absence of recession in the United States and the beginning of a rebound in growth in the eurozone. We continue to favor Europe given our convictions on monetary policies. Credit spreads are expected to continue moving sideways compared to current levels. These spreads remain wide and already incorporate the observed weakness in eurozone growth, as well as the planned withdrawal of the ECB (non-reinvestment of part of maturing corporate bonds); this does not apply to the United States, where the Fed has not acquired such assets outside of the real estate market.

Eurozone Credit Spreads

Sources : Bloomberg, Richelieu Group, Markit

Emerging Markets : China Has Not Emerged

In the electoral showdown between Trump and Biden, China emerges as the undisputed loser. Trump pledges to impose massive tariffs that could significantly diminish Sino-American trade, potentially reducing it to zero according to Bloomberg analysis. Meanwhile, Trump’s rhetoric could increase pressure on Biden to take tougher measures as the election approaches. American public opinion polls on China are unequivocal, with Biden planning to introduce new constraints even before the election. We were more cautious on China despite the measures announced by Chinese authorities. Chinese PMIs still point to deteriorating activity while sending conflicting signals. Activity in the non-manufacturing sector rebounds much more than expected, but the details are less favorable. New orders in services are slowing down and remain in contraction territory, as do employment and selling prices. This once again demonstrates the fragility of domestic demand beyond the exceptional effects associated with the Chinese New Year. On the other hand, the rebound in manufacturing activity remains very moderate. The Caixin index increases slightly, but its official counterpart remains in contraction territory. This is due to the slowdown in production and new orders, which fail to improve, hampered by weak domestic demand for goods and global demand. Note that according to official indices, small businesses are the hardest hit, with their activity reaching a low point since June 2023. We believe that pressure should continue largely throughout 2024. Given the share of Chinese stocks in emerging market indices, we have shifted to neutral despite the momentum in other countries (India, Brazil, Vietnam, Mexico) benefiting from the situation.

Economic Indicators in China

Sources : Bloomberg, Richelieu Group

Oil : Above $80… That’s It!

At the end of the month, OPEC+ confirmed the extension of its oil production reduction agreement, initially established last year, for an additional quarter. This extension aims to maintain a significant decrease of 2.2 million barrels per day. This strategic decision resulted in a slight increase in crude oil prices in international markets, signaling the effectiveness and regained unity of OPEC+, despite the turbulence and uncertainties that have marked the organization recently, particularly after Angola’s withdrawal last November. The distribution of production cuts among OPEC+ members is carefully allocated, with Saudi Arabia committing to reduce its production by one million barrels per day. Other members, such as Iraq, the United Arab Emirates, Kazakhstan, Algeria, and Oman, also contribute to this collective effort with significant reductions. Russia, a major player in OPEC+, announced an adjusted reduction in its production to 471,000 barrels per day, exclusively in crude oil, with a clear strategy to reduce its exports to zero by June. These measures surprised the markets, which did not expect such a strict extension of production quotas, projecting total OPEC+ production well below initial expectations. This OPEC+ policy is part of a broader strategy to stabilize oil prices at a sustainable level, aiming to defend a floor price above $80 per barrel. This decision reflects not only the organization’s commitment to regulate global oil supply to avoid an oversupply that could depress prices but also a degree of caution regarding demand prospects for the second quarter, which may seem less promising than anticipated. Despite challenges and criticism, OPEC+ demonstrates its ability to act collectively to influence global oil markets. This should now favor the sector.

Oil Production of Major Countries

Source : Bloomberg

Allocation Table

| Allocation | – – | – | 0 | + | + + |

|---|---|---|---|---|---|

| Equities | |||||

| Bonds | |||||

| Cash |

| Equites | |

|---|---|

| Europe | |

| US | |

| Japan | |

| Emerging |

| Currencies | |

|---|---|

| USD |

| Commodities | |

|---|---|

| Oil | |

| Gold |

| Bonds | – – | – | 0 | + | + + |

|---|---|---|---|---|---|

| US Government | |||||

| UE Government | |||||

| Inv. Grade US | |||||

| Inv. Grade US | |||||

| High Yield US | |||||

| High Yield Europe | |||||

| Emerg. countries |

| Preferences | |||

|---|---|---|---|

| Yield / Innovation | Hybrid corporate bonds | Europe crossover bonds |