I do not think it is likely that the committee will reach a level of confidence by the March meeting

Jerome Powell

Source : X

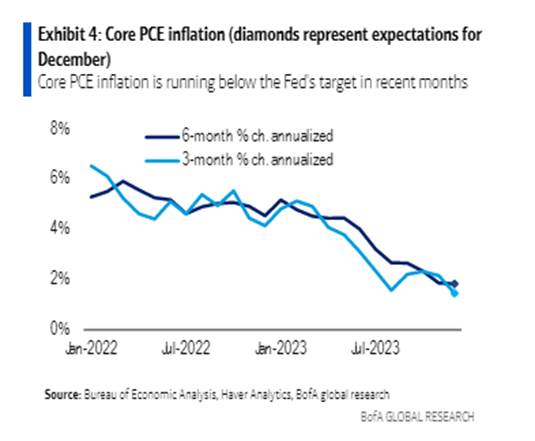

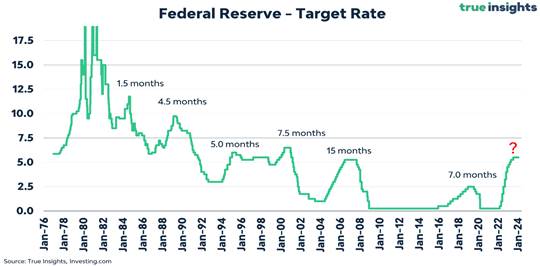

The Fed has indicated it has confidence in the economy but is waiting to have even more confidence before normalizing its monetary policy. Confidence will come from the reduction of inflation, notably wage inflation.

The statement has evolved to mention a decrease in key interest rates (as opposed to the mention of a potential further tightening previously), while emphasizing that it is still too early to consider it.

However, the current dynamic is viewed positively by the institution, which wants to observe a few more well-oriented inflation and employment data to confirm the trend of the last six months.

Graph: Core PCE

Jerome Powell has refrained from giving a precise timeline, with the notable exception of indicating that the central scenario of a cut in key interest rates is not envisaged for March.

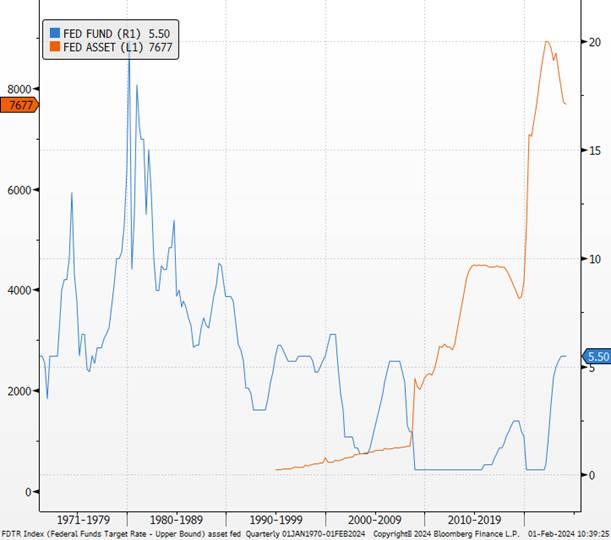

Therefore, we believe the rate cut cycle will begin in June. May remains a possibility, but if the Fed has not observed enough data by March, it is unlikely they will have enough by May (there will only be one inflation report between the two meetings). Our forecast for the first rate cut of 25 basis points is in June 2024, followed by another in September and then December, implying 75 basis points of expected rate cuts this year. In terms of the balance sheet, there will be no slowdown in QT (Quantitative Tightening) until the summer, which will put additional pressure on inflation and allow for the first rate cuts under the best conditions.

Graph: Fed’s balance sheet (in billions)

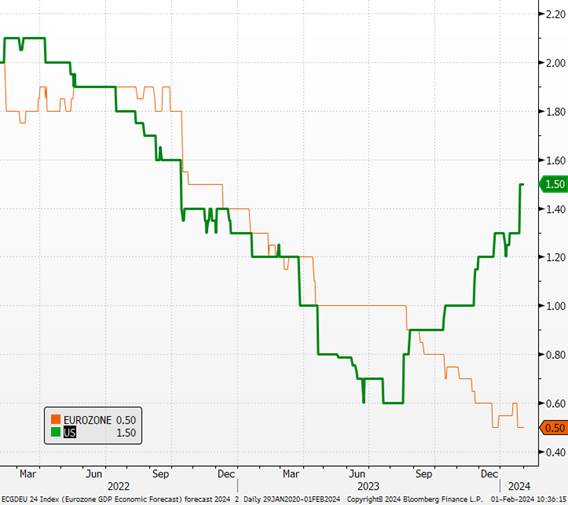

The foreign exchange market interpreted the Fed’s message as hawkish, with a general but modest appreciation of the dollar upon the release of the statement. However, we believe that this should exert short-term upward pressure on the dollar, before a decline in the second half of the year. Our short-term target remains at 1.05.

Graph: EUR versus dollar

The statement now indicates: “the committee does not expect it to be appropriate to lower the target range until it has gained greater confidence that inflation is moving sustainably towards 2%.” The Fed is not looking for inflation to hit 2% just once; “We are looking for it to stabilize at 2%. We do not want inflation to fall below 2%.” J Powell.

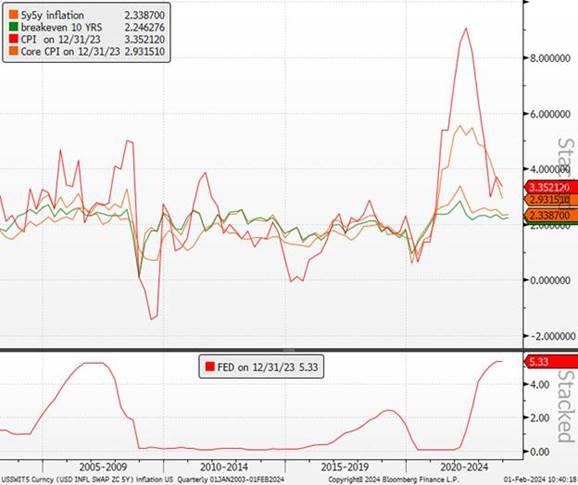

Graph: Expected inflation and overall inflation

The crucial question remains the Fed’s concept of “greater confidence“! We believe this will require a further slowdown in wage growth to 3.5%. Beyond the official statement, Chairman Powell reiterated his rather dovish stance during his press conference, emphasizing the Fed’s intense commitment to achieving a “soft landing.” Mr. Powell stated, “We are not looking to weaken the labor market,” which marks a significant shift from his previous statements that linked a higher unemployment rate to achieving the inflation target.

Source : X

As highlighted by the statement and Jerome Powell, U.S. growth continues to be robust, which contributes to making members less certain of the continuation of the disinflationary movement and should encourage the Fed not to rush.

The Fed does not necessarily need to see weaker growth to start normalizing the key rate, which remains good news given the resilience of the economy in general and the consumer in particular.

Graph: Bloomberg Consensus on 2024 growth in the US and Eurozone

Sources : Bloomberg, Groupe Richelieu

Regarding risks, the Fed Chairman noted that a reacceleration of inflation is possible, but unlikely in his view. The most probable risk is that inflation stabilizes at a level deemed incompatible with their inflation mandate.

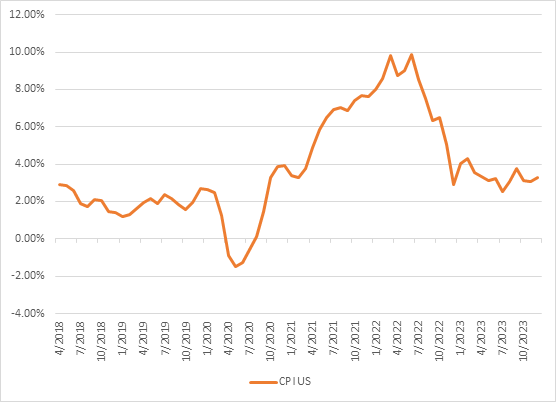

Graph: Overall inflation over the past 6 months

Sources : Bloomberg, Groupe Richelieu

The mention of further tightening is no longer considered. And that’s the main point!

We believe that everything is being done, both in speech and in action, to avoid another wave of inflation and being forced to raise rates before the end of 2025. Everything is done to avoid the troubles of the 1970s. This in itself is good news and demonstrates a desire to be credible vis-à-vis the markets.