Les trois informations de la semaine à ne pas manquer:

- A Majority of Americans Wrongly Believe Their Country is in a Recession

- The ECB, a Creditor Unlike Any Other.

- Persistent Obstacles to Chinese Growth.

A Majority of Americans Wrongly Believe Their Country is in a Recession

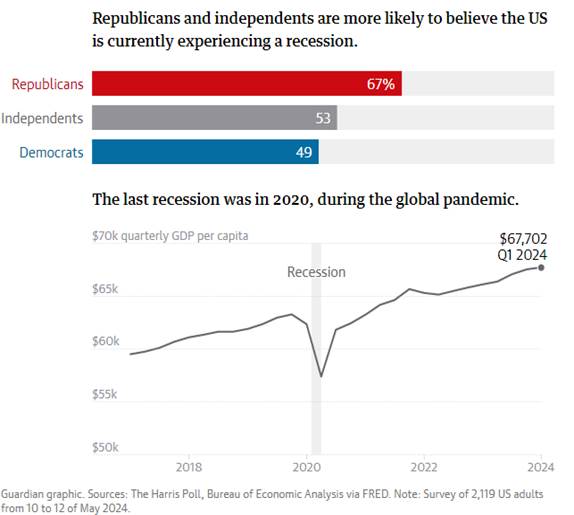

According to a poll, many voters have misconceptions about the state of the U.S. economy, even claiming that unemployment is at an all-time high. This is bad news for President Joe Biden, who is being blamed for this supposed recession. It’s not a real recession but rather a general gloom about the economy, says New York Times columnist Paul Krugman. A “vibecession,” as coined by analyst Kyla Scanlon.-

Nearly 56% of Americans think the United States is in an economic recession, according to a recent Harris poll for The Guardian, “and the majority attribute the blame to the Biden administration,” notes the British newspaper. Thus, “58% of respondents say the economy is deteriorating due to the current presidency’s poor management.” However, the country has enjoyed robust growth since the pandemic.

Going from bad to worse

“49% of respondents believe that unemployment is at its highest in the past fifty years, while the unemployment rate is below 4%, nearly its lowest level in fifty years,” the poll indicates.

Survey on Perceptions of a US Recession

Source : The Guardian

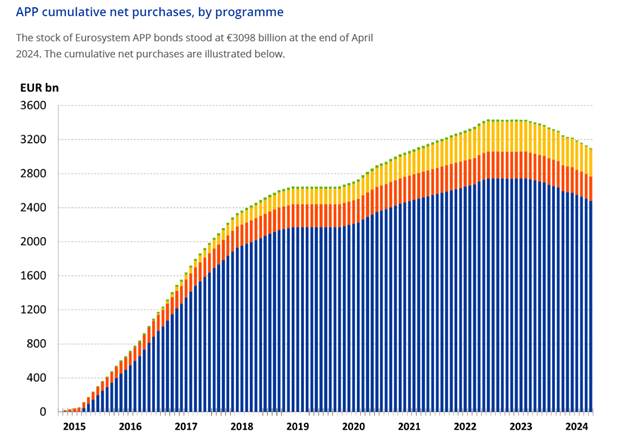

The ECB, a Creditor Unlike Any Other.

As the May 31 deadline for Atos takeover bids approaches, the European Central Bank’s (ECB) exposure to the IT group’s debt raises questions about the management of its vast corporate bond portfolio. In May, it was revealed that the ECB held up to 20% of Atos’s bond debt, an investment now headed for a painful restructuring. The two potential buyers, David Layani (Onepoint) and Daniel Kretinsky (EPEI), must submit their bids for the troubled group by midnight on May 31. This situation sheds light on the ECB’s bond portfolio management, as the largest holder of listed corporate debt in Europe.In June 2016, under the presidency of Mario Draghi, the ECB decided to include corporate debt in its quantitative easing program. It bought corporate bonds massively until December 2018, then resumed purchases from November 2019 to June 2022, both in the primary and secondary markets. For one year, the ECB continued to reinvest part of its portfolio’s maturities before stopping all interventions from July 2023. As of May 24, the program’s balance stood at €310 billion, representing just over 10% of purchases made under the quantitative easing policy.

The ECB publishes the entire portfolio’s lines but does not detail the amounts of each. It includes bonds from various European issuers, including three from Atos, acquired when the company was still rated as an “investor” grade and eligible for the program. However, Atos’s financial situation has deteriorated, and its rating has fallen to “CCC-“, one step from default. Atos’s three bonds are currently trading at around 22% of their nominal value. Why hasn’t the ECB reacted?According to a debt restructuring specialist, the ECB is not equipped to handle such cases as a bond or distressed fund would. Its teams, accustomed to intervening in the government bond market, executed an asset purchase program according to the institution’s rules but do not manage the portfolios actively. Moreover, the ECB, as a public institutional creditor, does not participate in negotiations and structuring operations, unlike a private creditor.

The ECB will decide at the end of the process whether its internal constraints allow it to hold the instruments resulting from Atos’s restructuring or if it should sell them to third parties. This wouldn’t be the first time for the ECB, which had already liquidated its position in the Steinhoff case in 2017, preferring an immediate loss to an inevitable debt restructuring. It is likely that the ECB will soon sell its Atos securities, based on monetary and financial considerations rather than political ones, although Atos’s strategic importance for France might temporarily involve the ECB in discussions with the French state before any sale.

Eurozone PMI Indicators

Source : ECB Europa

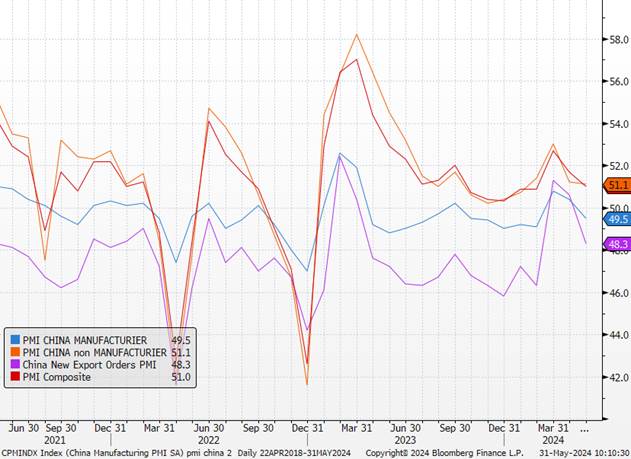

Persistent Obstacles to Chinese Growth

The release of the official PMI indices for May this morning has highlighted the ongoing challenges faced by Chinese growth (composite index at 51.0 vs. 51.7 in April). Despite efforts by the authorities to mitigate the negative impact of the real estate sector, domestic demand remains hampered by the caution of Chinese households, thereby limiting the expansion of services (51.1 vs. 51.5 expected and 51.2 in April). However, it is in the industrial sector that the PMI indices disappointed the most this morning (the manufacturing index fell back into contraction territory at 49.5, vs. 50.5 expected and 50.4 in April).

This is partly due to significantly lower new orders, including exports, as many countries attempt to limit China’s access to their domestic markets (notably, several South American countries raised their tariffs on steel in April). While this is bad news for Chinese growth, which is expected to remain modest in the coming quarters, it could help ease maritime freight tensions and be good news for Western central banks.

China PMI

Sources : Bloomberg, Richelieu Group

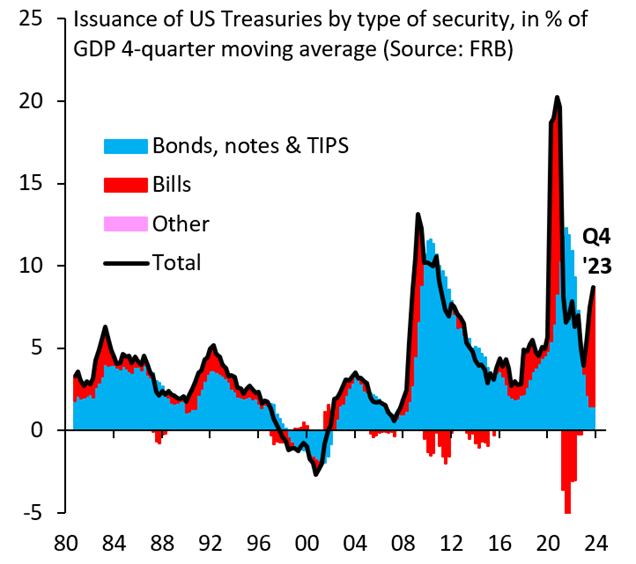

Graph of the week

It’s hard to understate just how unprecedented the scale of US fiscal stimulus is at the moment. Not only is the deficit massive for a non-crisis period, but its financing is almost entirely via very short-term issuance, which has never been the case before in a non-crisis time.

Source : X