- The New York Fed is Concerned About Credit Card Defaults.

- ECB: Starting Signal.

- OPEC+ Ministers Reject Bearish Reaction to Oil Production Increase.

The New York Fed is Concerned About Credit Card Defaults

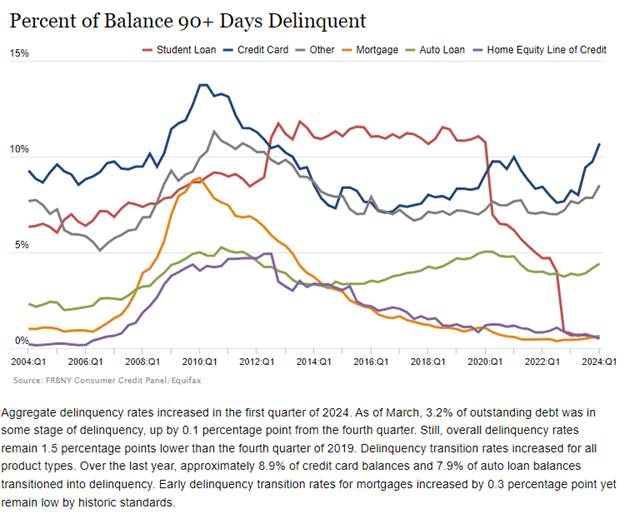

The Federal Reserve Bank of New York has recently expressed concerns about the increase in credit card defaults, particularly among heavy users. Although the risk to banks remains limited, a widespread occurrence of this phenomenon could weigh on consumption in the United States. In the first quarter of 2024, American household debt increased by $184 billion, reaching $17.69 trillion. The increase primarily concerns mortgage loans (+$190 billion) and auto loans (+$9 billion). In contrast, other consumer loans and credit card balances have seen their totals decrease. Credit card default rates increased from 3.1% to 3.2% of the total outstanding balance in the first quarter of 2024. The rate for credit cards reached 8.9% for the past year, and payment delays of more than 90 days climbed to 10.7%

Heavy borrowers, using more than 90% of their available credit, are particularly at risk.

Economists at the New York Fed highlight a strong correlation between future defaults and a high credit card usage rate, often indicative of tight cash flow. The situation could foreshadow a weakening in consumption, although the overall impact remains to be assessed. Major banks seem less exposed, with low net losses compared to small regional banks. The New York Fed is closely monitoring the evolution of these trends, which, if they deteriorate, could have significant repercussions on the American economy.

Source : New York Fed

ECB: Starting Signal

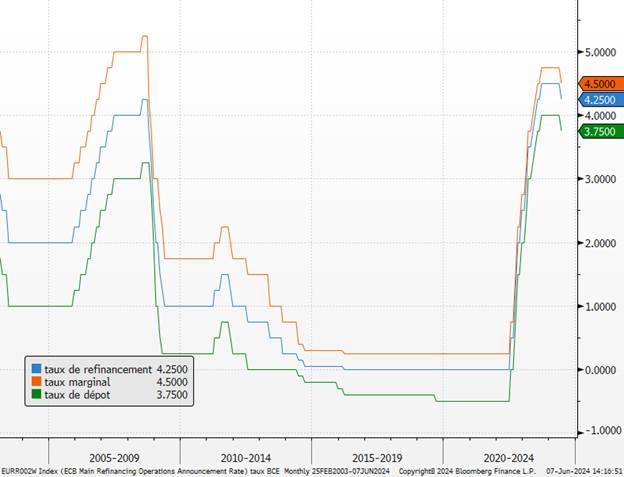

The ECB is beginning its monetary easing. Unsurprisingly, the ECB reduced its three key interest rates by 25 basis points (to 3.75% for the deposit rate) following its monetary policy meeting. We note the upward revision of inflation forecasts (+2.5% in 2024; +2.2% in 2025; +1.6% in 2026, an increase of 20 basis points in 2024 and 2025 and stable for 2026) and growth (+0.9% in 2024, +1.4% in 2025, and +1.6% in 2026, an increase of 30 basis points in 2024, -10 basis points in 2025 and stable in 2026). The ECB also confirmed the early cessation of part of the reinvestments of maturing bonds in its PEPP portfolio during the second half of 2024, before stopping all reinvestments at the end of the year. During the press conference, C. Lagarde remained true to the institution’s data-dependent approach. While the ECB president did not affirm that the path forward would be a reduction in key interest rates, she indicated that the probability of this hypothesis was strong, especially since the ECB’s monetary policy, even after today’s rate cut, was more restrictive in real terms (i.e., inflation-adjusted key rates) than it was last October.

Nevertheless, C. Lagarde insisted that the trajectory of the ECB’s key rate cuts would remain uncertain due to the non-linear (“bumpy”) profile of inflation slowdown, which will not sustainably return to 2% until the second half of 2025 according to the central bank. This is explained, in our view, by the only gradual slowdown in wages and the institution’s desire to avoid tying its hands if an inflation or wage statistic were to evolve unfavorably temporarily. Notably, C. Lagarde reportedly indicated to journalists post-conference that the first-quarter wage statistic in the eurozone would remain stable at +4.7% (published this morning with the revision of the eurozone GDP), following negotiated wage data that also did not show a downward path. The inflation slowdown (whose rebound was mainly due to temporary factors, particularly in Germany) will allow the ECB to proceed with gradual key rate cuts over the next few quarters (at a rate of -25 basis points per quarter until the end of 2025 to stop at 2.25% for the deposit rate).

BCE rates

Sources : Bloomberg, Richelieu

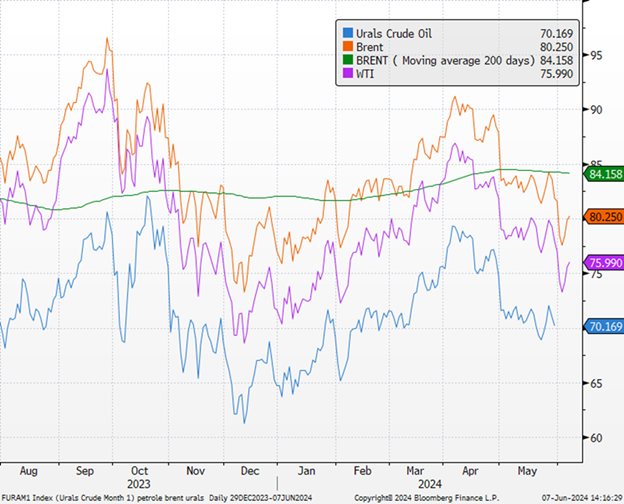

OPEC+ ministers have dismissed the bearish reaction to oil following its decision to gradually increase crude production from October and predicted that the market would eventually understand that the group’s policy is correct.

The alliance remains committed to oil market stability and can react quickly to any changes, the ministers of the group’s largest producers said Thursday at the St. Petersburg International Economic Forum in Russia. Saudi Energy Minister Prince Abdulaziz bin Salman reiterated that Sunday’s agreement, like many other OPEC+ agreements, retains the possibility to suspend or cancel production changes if necessary. He accused bank analysts and the media of “ambush” and “intimidation.”

It was agreed last to gradually reduce production cuts by about 2 million barrels per day starting in October. Since then, crude prices have fallen by more than 3% in London, dropping below $80 a barrel, as analysts question whether the market can absorb this additional supply. Speaking at the same event in St. Petersburg, UAE Energy Minister Suhail Al Mazrouei and Russian Deputy Prime Minister Alexander Novak presented a united front with their Saudi counterpart, seeking to dispel any doubts about the OPEC+ agreement. Oil demand is strong and remains resilient, said OPEC Secretary General Haitham Al-Ghais, with global consumption up by 2.3 million barrels per day in the first quarter. In contrast, the International Energy Agency said that demand in the first three months of 2024 was weaker than expected and estimates growth at only 1.2 million barrels per day..

Oil Price

Sources : Bloomberg, Groupe Richelieu

Graph of the week

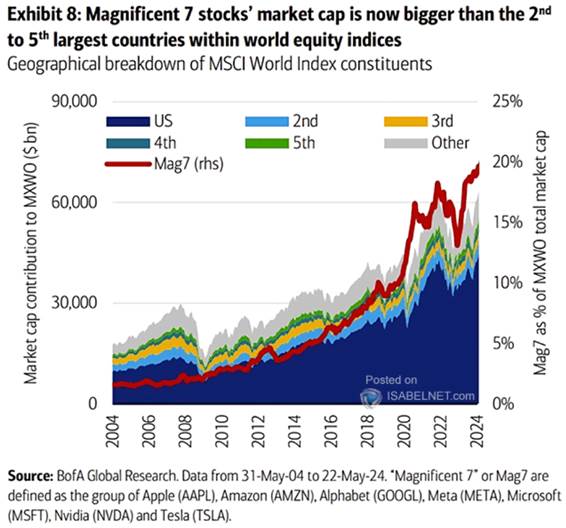

The combined market capitalization of the Magnificent Seven would make it the second-largest country stock exchange globally

Source : X