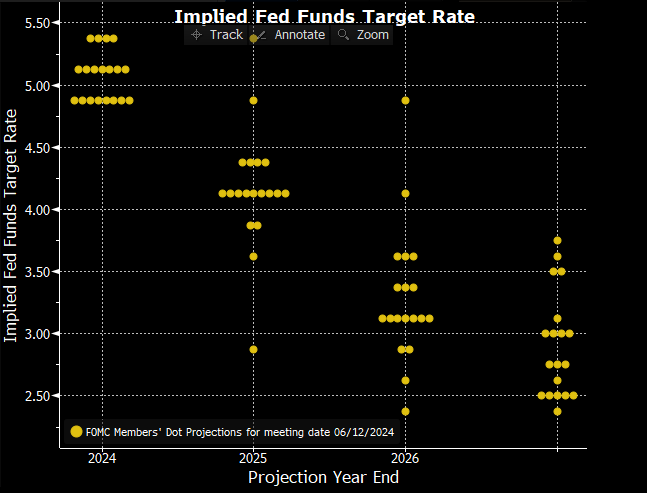

The Fed meeting resulted in a status quo. The surprise could appear hawkish for the dot plot with a median projection of only one cut for 2024, instead of two. J Powell, however, mitigated the message during the press conference. Most officials anticipated that they might lower rates once or twice during the four remaining meetings this year, suggesting a start of reductions not before September, even after a report on inflation earlier in the day suggested that price pressures had moderated last month.

Overall, the institution maintains a message of caution and patience before starting to lower key rates, as long as they do not have sufficient confidence in the ability of inflation to sustainably return to the 2% target.

Source : Bloomberg

“Inflation has decreased over the past year but remains high. In recent months, additional progress toward the committee’s [monetary policy] 2% inflation target has been modest,” the institution noted.

The slowdown in the disinflationary trend earlier this year led them to consider that the return to normalcy “will take longer.” The Fed chair’s approach could be summarized by the phrase “Trust, but verify.” He used the word “confident” or “confidence” 20 times during a press conference.

Source : Twitter

In this context, Fed members adjusted their key rate projections more cautiously than last March, now only expecting one cut this year, then four in 2025. Jerome Powell indicated that the associated projections on inflation were deliberately “conservative.”

Fed Futures Rates

Source : Bloomberg

Given that the Fed chair acknowledged it took three consecutive misaligned figures to change their mindset at the beginning of the year, it seems likely it will take a similar trend in the opposite direction to reassure them to move towards lowering key rates. The Fed is in a dilemma. It waits for more convincing evidence. But this increases the risk that it will be too late to avoid a more severe employment recession when they see this evidence, a point Powell acknowledged on Wednesday. “We fully understand that this is the risk — and it is not our plan to wait for things to break and then try to fix them,” Powell said. The alternative for the Fed is to wait to see more economic weaknesses before initiating rate cuts.

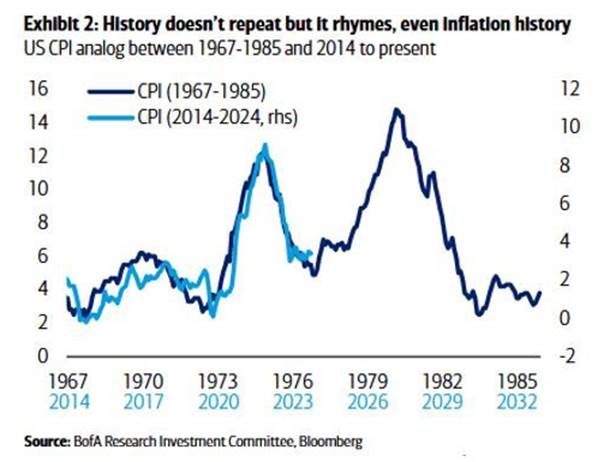

The decision to lower rates would be “consequential” as it could trigger substantial rallies in the markets that would stimulate spending and investment, thus inflation… Once again… avoiding the 1970s…

We believe disinflation will resume thanks to less pressure on real estate broadly, even though it remains at a high level. Many indicators argue for a gradual easing of inflationary pressures (employment, consumption).

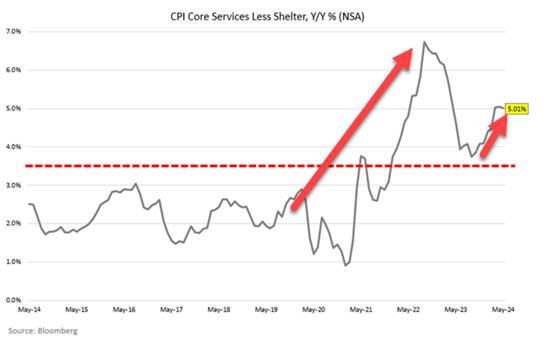

Core inflation drops from 3.6% to 3.4%, with a monthly variation of +0.16% (the smallest increase in almost three years!). The 6-month annualized variation of core CPI drops slightly to 3.7%, which is still high. The “supercore” (services excluding housing) slows slightly to +4.3% year-over-year, compared to 4.5% in April.

The latest inflation report is clearly good news for the Fed. While 2024 had a rough start, with the first four inflation reports being worse than expected, the April report, in line with expectations, and the May report, better than expected, will rekindle discussions on Fed rate cuts.

“Almost no one expected such a good inflation report today,” praised Jerome Powell.

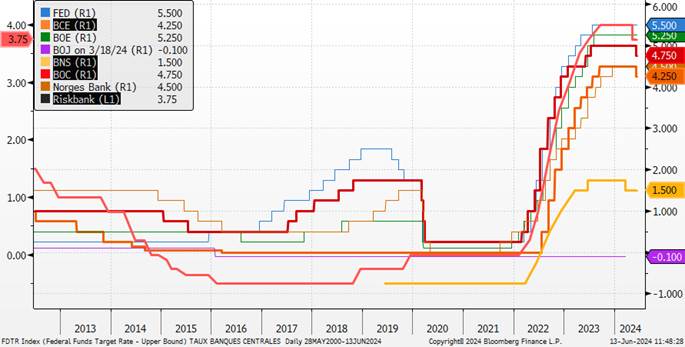

The European Central Bank and the Bank of Canada reduced interest rates last week and indicated that further cuts were possible even if inflation remains above their targets — because they expect inflation to continue to fall. “Overall, our confidence in the path forward, because we need to be forward-looking, has increased over the past few months,” said ECB President Christine Lagarde last week.

Rates of major Central Banks

Sources : Bloomberg, Groupe Richelieu

But the United States is, for now, in a different position. Growth is stronger and strict monetary policy may transmit more slowly to the economy. The US financial system relies less on bank loans than before. Many homeowners are protected against rapid rate increases in 2022 and 2023 because they locked in ultra-low rates on 30-year fixed-rate mortgages.

In this context, we believe it will be necessary to wait until September to gather enough indicators to lower key rates. We remain in our scenario of one or even two cuts this year (the second in December).

The continued gradual decline in inflation, favored by a slowdown in US growth, will reassure investors and then Fed members, leading to a further decline in sovereign rates and the dollar in the second half. (if political risks in Europe dissipate by then).