The 3 must-know news stories of the week:

- The Fed is not rushing

- Return of European political risk?

- Chinese inflation still struggling…

The Fed is not rushing

The Fed meeting resulted in a status quo. The surprise might appear hawkish for the dot plot with a median projection of only one cut for 2024, instead of two. However, J. Powell mitigated the message during the press conference. Most officials anticipated that they might cut rates once or twice in the four remaining meetings this year, suggesting the start of reductions not before September, even after an inflation report earlier in the day suggested that price pressures had moderated last month.

Overall, the institution maintains a message of caution and patience before being able to start lowering interest rates, as long as they do not have sufficient confidence in inflation’s ability to sustainably return to the 2% target. “Inflation has decreased over the past year but remains high. In recent months, further progress toward the committee’s [monetary policy] 2% inflation goal has been modest,” noted the institution.

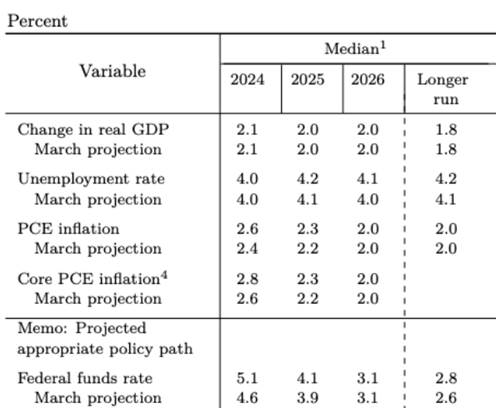

The slowdown at the beginning of the year in the disinflationary trend has led them to consider that the return to normal “will take longer.” The Fed chair’s approach could be summed up by the phrase “Trust, but verify.” He used the word “confident” or “confidence” 20 times during a press conference. In this context, Fed members adjusted their projections for interest rates more cautiously than last March, now only predicting one cut this year, followed by four in 2025. Jerome Powell indicated that the associated inflation projections were deliberately “conservative.” Given that the Fed chair acknowledged that it took three consecutive poorly oriented figures to change their mindset at the beginning of the year, it seems likely that a similar trend in the opposite direction will be necessary to reassure them again in order to move toward lowering interest rates. The Fed is in a dilemma. They wait for more convincing evidence. But this increases the risk that it will be too late to avoid a more severe employment recession when they see this evidence, a point Powell acknowledged on Wednesday. “We fully understand that this is the risk — and it is not our plan to wait until things break and then try to fix them”, Powell said. The alternative for the Fed is to wait to see more economic weaknesses before initiating rate cuts.

The decision to cut rates would be “significant” because it could trigger substantial rallies in the markets that would stimulate spending and investment, thus inflation… Once again… Avoiding the 1970s… We believe disinflation will resume due to lower pressure from real estate in a broad sense, even though it remains at a high level. Many indicators argue for a gradual easing of inflationary pressures (employment, consumption).

The latest inflation report is clearly good news for the Fed. While 2024 started poorly, with the first four inflation reports worse than expected, the April report, in line with expectations, and the better-than-expected May report will revive discussions about Fed rate cuts.

“Virtually no one expected such a good inflation report today”, praised Jerome Powell.

Fed Forecasts

Source : Fed

Return of European political risk?

Often less followed than other elections, rarely has a European election had such strong consequences in France. Although at the European level, the shift to the right of the Parliament is confirmed, there is political stability that should not impact financial markets. The main event remains the call for early legislative elections in France. Indeed, French President Emmanuel Macron decided on Sunday evening to dissolve the National Assembly and call for early legislative elections on June 30 and July 7. The presidential majority list (Renaissance) came significantly behind the National Rally list.

The call for early legislative elections in France increases political risk in Europe and opens a period of uncertainty until the evening of the second round, on July 7. In the short term, European stocks, primarily French ones, will suffer. Great uncertainty now surrounds the future composition of the National Assembly and the resulting government. Indeed, unlike other elections, the two-round nature of legislative elections emphasizes the importance of pre-election negotiations to form alliances between political forces to maximize the chances of winning, in 577 different constituencies.

The coming weeks will be crucial, but in any case, the future parliament and government will face a major challenge: restoring the balance of public finances, which deteriorated after efforts during Covid and to fight post-Ukraine war inflation. This will be the main issue for financial investors as the French deficit exceeded 5% of GDP in 2023 (and France’s sovereign rating was recently downgraded by rating agency S&P).

France/Germany 10-year spread

Sources : Bloomberg, Richelieu Group

Chinese inflation still struggling.

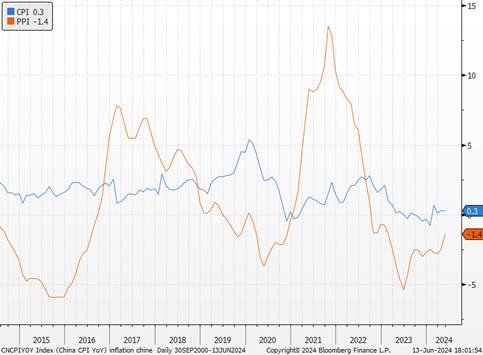

In May, Chinese inflation remained stable (+0.3% year-on-year vs. +0.4% expected and +0.3% in April), and core inflation, excluding energy and food, slightly slowed (+0.6% vs. +0.7% in April), indicating still weak domestic demand. Although the decline in producer prices (PPI) is less pronounced (-1.4% vs. -2.5% in April), partly due to the appreciation of certain metals, this marks the 20th consecutive month of deflation. The period of low inflation in China reflects the difficulties and degraded confidence of Chinese consumers due to the real estate crisis. Recall that Chinese authorities adopted measures last month to improve household credit access and the real estate market. The low inflation offers the People’s Bank of China the opportunity to strengthen its monetary easing. But this policy seems to be hitting the weakness of the yuan (which has depreciated since the beginning of the year despite maintaining a pivot rate close to 7.10 since the beginning of the year). In the absence of targeted stimulus on households and domestic demand, achieving China’s growth target set at the beginning of the year and returning to the past growth rate still seem ambitious, especially as Beijing faces increasingly unfavorable trade policies from the rest of the world. After the United States, Europeans are preparing to implement tariffs on electric cars. The official announcement included a 25% tariff increase within a month. In response to this offensive, China is expected to retaliate, with investigations already launched, notably on spirits, and a threat of possible tariffs on “powerful” vehicles exported by Europe to China.

Producer and consumer prices in China.

Sources : Bloomberg, Richelieu Group

Chart of the Week

France’s borrowing rates at the same level as Portugal

Sources : Bloomberg, Richelieu Group