The 3 must-know news stories of the week:

- Excessive public deficit procedures against 7 EU countries

- British Conservatives on the verge of total eradication in the general elections

- In Japan, inflation accelerates in May.

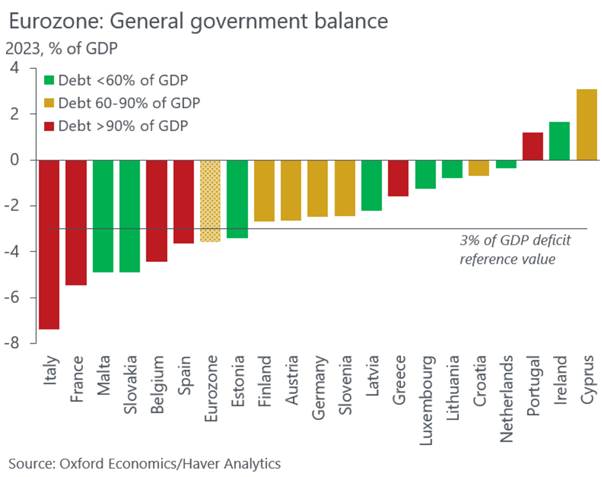

The European Commission is considering excessive public deficit procedures against 7 EU countries

The European Commission is considering excessive public deficit procedures against seven EU countries: France, Italy, Belgium, Hungary, Poland, Slovakia, and Malta. These countries exceeded the public deficit limit of 3% of GDP last year, set by the Stability Pact, which also limits debt to 60% of GDP. The highest deficits in the EU last year were recorded in Italy (7.4% of GDP), Hungary (6.7%), Romania (6.6%), France (5.5%), and Poland (5.1%). European rules require countries with excessive deficits to reduce their deficit by at least 0.5 points per year, necessitating a massive effort for fiscal austerity. The Stability Pact theoretically provides for financial sanctions of 0.1% of GDP per year for countries that do not implement the required corrections, amounting to nearly 2.5 billion euros in the case of France. In reality, these politically explosive penalties have never been applied. France, whose last budget surplus dates back to 1974, has mostly been in excessive deficit procedures since the euro was created in the early 2000s. However, it emerged from this procedure in 2017. The country, under scrutiny by rating agencies, is in political crisis following the dissolution of the National Assembly decided by President Emmanuel Macron after his camp’s defeat in the European elections on June 9.

Source : X

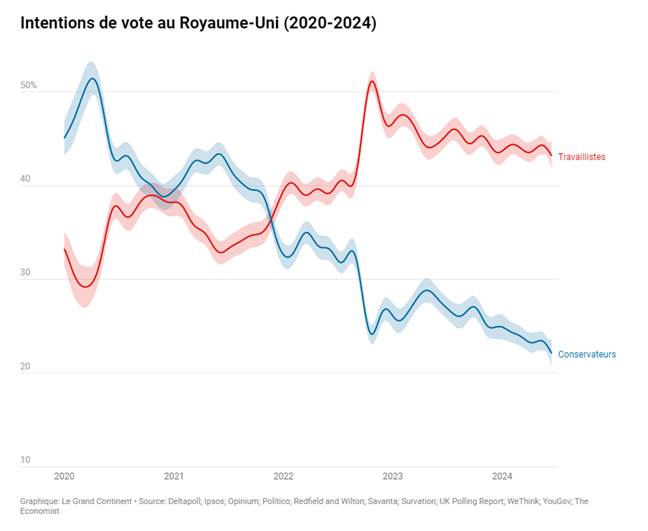

British Conservatives on the verge of total eradication in the general elections

Three “mega-polls” predict an unprecedented collapse of the Conservative Party in the July 4 general elections. A long period of political wilderness awaits the Tories. The survey conducted among a sample of 17,000 people in view of the July 4 elections “is terrifying for the Conservative Party,” exclaims the newspaper close to the ruling majority (https://www.telegraph.co.uk/politics/2024/06/19/kemi-badenoch-future-of-tory-party-general-election-2024). According to Savanta’s modeling, Labour could win up to 516 of the 650 seats in the House of Commons. The Tories? Only 53. An unprecedented downfall, coupled with an unprecedented coup de grace: outgoing Prime Minister Rishi Sunak would lose his seat, along with a number of senior figures, such as the Home Secretary James Cleverly and former Prime Minister Liz Truss.

Voting intention

Source : X

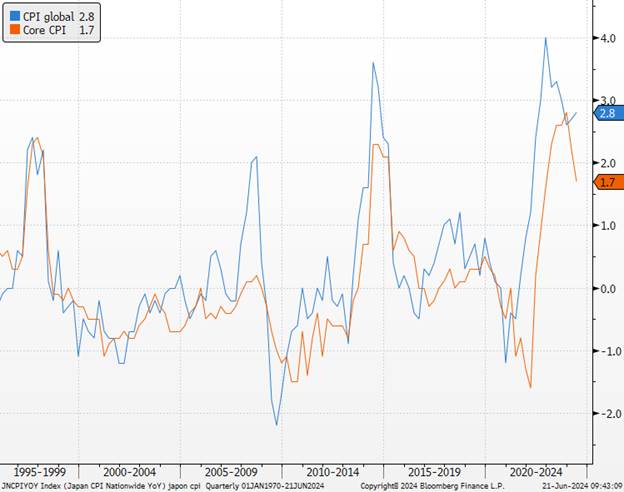

In Japan, inflation accelerates in May

Inflation statistics indicate an acceleration in prices after two months of slowdown, both in general inflation (+2.8% year-on-year vs. +2.9% expected and +2.5% in April) and core inflation excluding fresh products (+2.5% vs. +2.6% expected and +2.2% in April). However, another measure of core inflation, excluding products and energy (the one traditionally used in Europe and the United States), slowed in May (+2.1% vs. +2.2% expected and +2.4% in April) due to the slowdown in service prices (+1.6% vs. +1.7% in April). The evolution of the services component tends to indicate that this inflation resurgence in May does not yet come from wage growth, as hoped by the Bank of Japan. But according to statements by K. Ueda, these data do not seem sufficient to question the possibility of a key rate hike in July. The Bank of Japan president had estimated that it was possible for key rates to be raised in July, but that this decision would depend on statistics, inflation, and financial conditions. These should continue to evolve favorably, especially in a context where significant wage increases adopted during spring negotiations (+5%) will gradually be reflected in statistics by July.

Moreover, inflation and the associated weakness of the yen are weighing on demand and business activity, as evidenced by the decline in preliminary PMI activity indices for June published this morning. Service activity is returning to contraction territory (at 49.8 vs. 53.8 in May) while the manufacturing sector stagnates (at 50.1 vs. 50.4 in May). Surveyed companies cite pressures on their margins due to rising labor costs and the depreciation of the yen. For the BoJ, the incentive to combat yen weakness and inflation strength is therefore reinforced, likely leading it to raise key rates by around 15 basis points in July, at the time of its forecast update, before a second increase early next year. Combined with the slowdown in its asset purchases, these decisions should support the yen as well as Japanese sovereign rates.

Japanese inflation

Sources : Bloomberg, Richelieu Group

Graph of the Week