The global pivot of central banks towards rate cuts will not be complete without the Fed, and, according to recent speeches by FOMC members, there is still a desire to wait and gather more data in the United States.

- United States: Disinflation will resume as growth momentum weakens

- Europe: France and Germany are dragging down the rest

- Japan: The yen’s decline must be contained

- Emerging markets: The Chinese rebound is not reassuring

United States: Disinflation will resume as growth momentum weakens

The American economy is showing increasing signs of weakness. In May, retail sales barely increased after their drop in April. Households are facing not only a slowdown in their incomes, which no longer benefit from fiscal policy support, but also a gradually deteriorating labor market. The good news is that this weakening demand should help reduce inflation.

Long-term retail sales

Even though Fed members remain cautious, having been burned by excessively high inflation statistics earlier in the year, some are beginning to believe that continuing the current trend will pave the way for a rate cut this year. Adriana Kugler (FOMC member) stated that a rate cut later this year might be appropriate.

For his part, A. Musalem (the new president of the St. Louis Fed) opined that it might take longer, months or even quarters, before the Fed is in a suitable position to lower its rates.

The June Fed meeting resulted in a status quo. Overall, the institution maintains a message of caution and patience before it can start lowering rates, as long as it is not sufficiently confident in inflation’s ability to return sustainably towards the 2% target.

US Inflation

Sources : X, Wall Street Journal

In this context, Fed members have adjusted their projections for interest rates more cautiously than in March, now expecting only one rate cut this year, followed by four in 2025.

Jerome Powell indicated that the associated inflation projections were deliberately “conservative.” The Fed is in a dilemma. It waits for more convincing evidence, but this increases the risk that it will be too late to avoid a more severe employment recession by the time they see this evidence, a point Powell acknowledged on Wednesday. “We fully understand that this is the risk — and it’s not our plan to wait for things to break and then try to fix them,” Powell said.

The alternative for the Fed is to wait to see more economic weakness before initiating rate cuts.

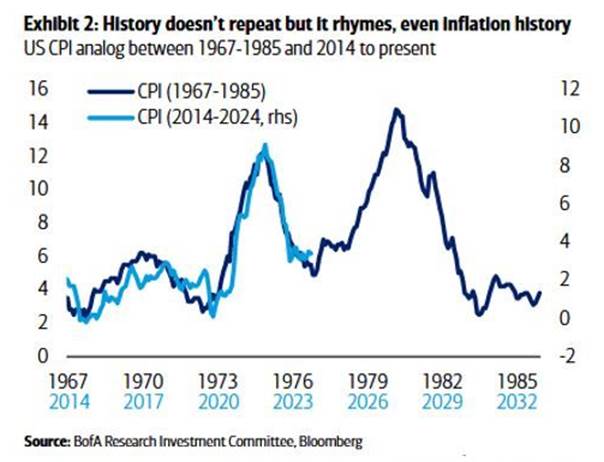

The decision to lower rates would be “consequential” because it could trigger substantial rallies in the markets that would boost spending and investment, thus increasing inflation… Once again… Avoiding the 1970s…

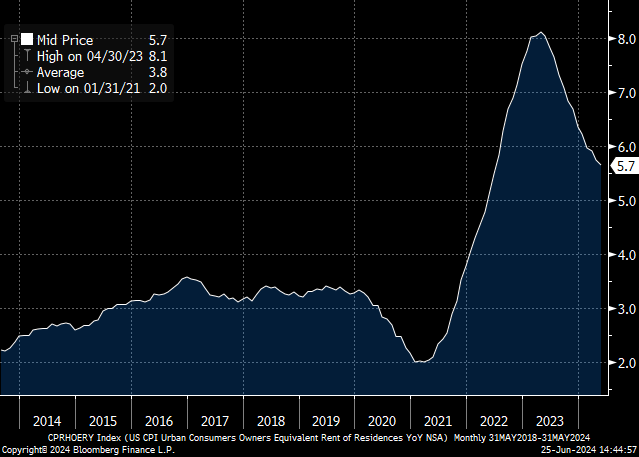

The real estate market is beginning to stabilize in terms of price dynamics. The CoreLogic single-family rental series increased by 3% in April, largely in line with the pre-pandemic trend. Single-family homes (without shared walls) maintained a 3.3% increase in April (versus 3.4% in March, 3.4% in February, and 2.6% in January).

We believe the trend for the real GDP of the United States is around 2%. Even though total household wealth is near a record high (see May’s editorial), recent increases in credit card and auto loan default rates, higher interest rates for borrowers, and weaker spending signals in April and May have raised concerns about the financial health of American consumers, particularly among low-income households.

Therefore, inflation is expected to be measured by a moderation (at best) in growth and a lesser impact from real estate in the second half of the year. Any confirmation of weakness in the U.S. labor market could also tilt the balance toward rapid Fed rate cuts. Inflation readings remain critical. We believe that a few more months should be enough to confirm that the “final stretch” of this inflation fight is progressing acceptably in the United States. We anticipate a rate cut in September followed by another in December, which will affect U.S. sovereign rates.

Rent inflation in the United States

Source : Bloomberg

Europe: France and Germany penalize the rest

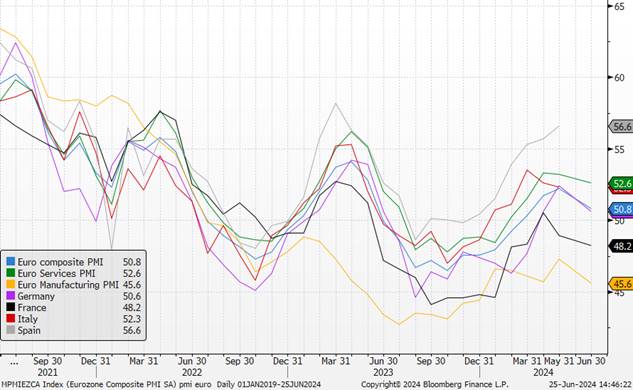

The European economy stalled in June according to PMI indices, with a notable decline in the overall index to 50.8 from 52.2 in May. However, a breakdown by country data shows that most of the decline is attributed to Germany and France. Germany’s industry struggles to move forward amid weak demand and strong uncertainties related to the risk of a trade war with China. As for France, the deterioration is primarily due to political uncertainties stemming from upcoming elections, significantly reducing visibility.

PMI in the Eurozone

Sources : Bloomberg, Richelieu Group

This disappointment can be attributed to both the weakness in the services component (52.6 vs expected 53.4) and the industrial sector, but national data shows that it is primarily France and Germany that are penalizing the Eurozone, each for distinct reasons.

In Germany, the industrial sector continues to struggle and has further slipped into contraction territory, primarily due to declining demand. Highly dependent on China, the renewed tensions in trade between the EU and China have likely increased uncertainty among German business leaders. Following the EU’s decision to impose additional tariffs on imports of Chinese electric vehicles starting in early July, Beijing retaliated by threatening similar measures on several products, including large-displacement combustion engine cars. Both parties have reportedly resumed negotiations to find a favorable solution and avoid further tariffs, but the outcome remains uncertain as Beijing insists that Brussels first abandon its tariffs on electric vehicles.

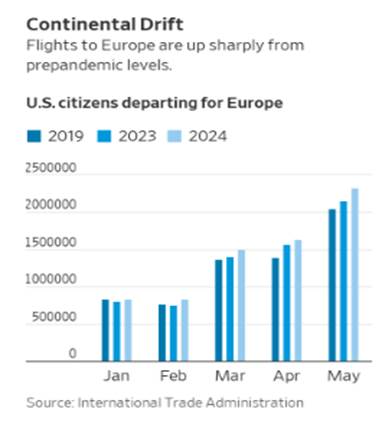

Political events do not affect our outlook for a rebound in European growth towards the end of the year. In terms of consumption, rising wages combined with a decrease in inflation should bolster purchasing power. Additionally, the strong dollar and a robust post-Covid recovery have enabled millions of Americans who previously vacationed domestically before the pandemic to now afford luxurious trips to Europe. Some Americans are even coming to Europe to attend Taylor Swift concerts! Tourism now contributes a fifth of Lisbon’s economic output and supports one in four jobs.

Japan: the decline of the yen must be contained

The Bank of Japan (BoJ) continues to adopt a more assertive stance, diverging from its initially perceived very dovish message. Summarizing the views from the latest Policy Meeting (CPM), the “opinions” of BoJ members at the June 14th meeting confirmed a growing inclination towards normalizing monetary policy through a potential rate hike at the upcoming July meeting.

Increasing inflationary pressures, linked with a virtuous price-wage loop, remain the primary concern for most members, exacerbated by the weakness of the yen which could amplify inflationary risks. In this regard, Deputy Finance Minister Mr. Kanda stated that Japanese authorities are prepared to intervene in the foreign exchange market in case of excessive yen movements. Domestic demand remains subdued due to consumer spending being hampered by strong inflation. This situation is expected to gradually improve as wage increases enable Japanese consumers to enhance their purchasing power.

Moreover, rising wages should facilitate the formation of a price-wage loop that will counteract the lingering effects of past inflationary shocks. Inflation will also be supported by the removal of government measures that had been implemented to curb price increases for households.

Sources : BNN Bloomberg, X

Emerging Markets: The Chinese rebound does not reassure

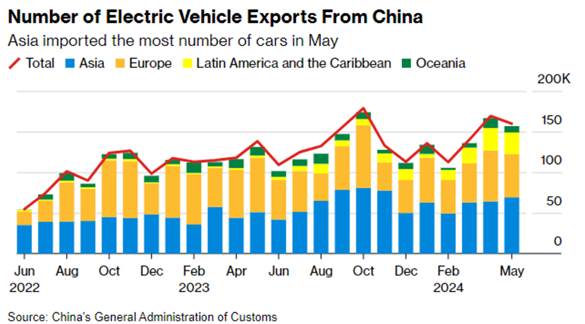

The implementation of numerous fiscal and monetary measures has prevented a worsening of the economic slowdown and led to a rebound in growth earlier this year. However, the room for maneuver is diminishing as neither the state nor the central bank wishes to pursue massive support that would allow growth to continue unabated. The multiplication of support measures in recent months has prevented the Chinese economy from weakening, but part of the strategy relying on foreign demand makes the rebound risky.

Economic statistics released in China once again show a mixed month for Chinese activity. While retail sales have slightly rebounded, other indicators are less favorable, such as the slowdown in industrial production and investments.

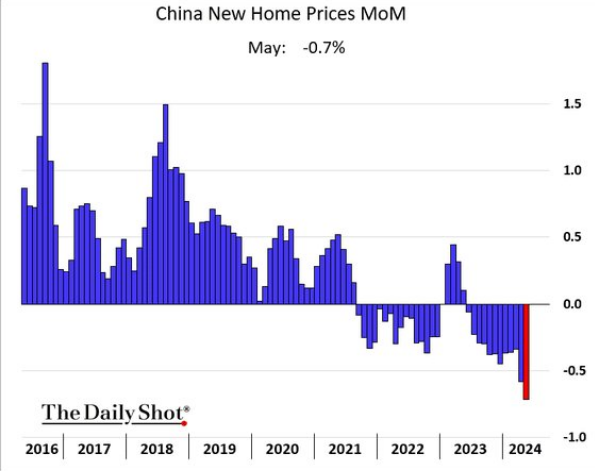

The real estate sector remains in crisis, with continuing declines in real estate investment and prices of both new and existing homes. Last month, authorities announced measures aimed at supporting the housing market, including easing credit conditions for first-time homebuyers and local governments purchasing homes.

For the tenth consecutive month, the People’s Bank of China (PBoC) has maintained its medium-term lending facility rate at 2.5%, highlighting its focus on preserving interest rate margins for banks and stabilizing the yuan (currently at 7.256 USD/CNY), rather than reducing borrowing costs.

Considering the structural vulnerabilities of the Chinese economy—such as the real estate crisis, declining household confidence, public and private debt, liquidity traps, and demographic challenges—the rebound in China’s growth will likely remain modest this year.

Sources : Bloomberg, Richelieu Group

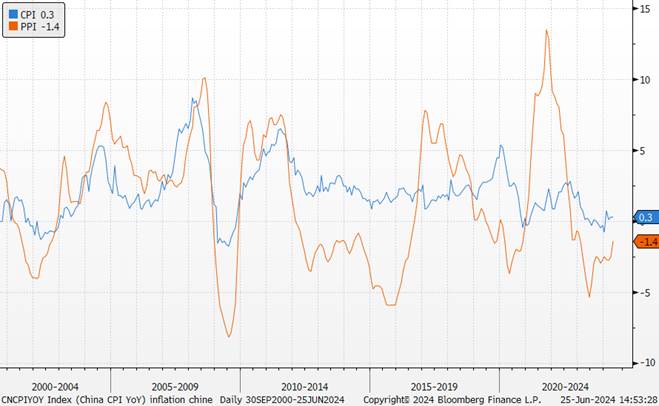

Chinese inflation has remained stable, indicating continued weak domestic demand. While the decline in Producer Price Index (PPI) has moderated, helped in part by the appreciation of certain metals, it marks the 20th consecutive month of deflation.

The period of low inflation in China reflects the challenges and deteriorated consumer confidence due to the real estate crisis. Moreover, following the United States, Europeans are preparing to impose customs barriers on electric vehicles. In response to this move, China is expected to retaliate, as investigations have already been launched, particularly targeting spirits, and there has been a threat of possible tariffs on “high-powered” vehicles exported from Europe to China.

Inflation in China

Source : Bloomberg

Regarding other emerging markets, there is an improvement in the industrial cycle evident from the return to expansion territory in PMI indices, driven by global demand recovery and monetary easing.

This positive trend is expected to gradually extend into 2024. The decline in inflation enhances purchasing power and thus domestic demand. Emerging economies will benefit from increased demand for commodities, improved consumption, and the ongoing monetary easing. Financial conditions had significantly tightened from late 2021 to mid-2023. In response to slowing inflation, some central banks have already begun lowering their benchmark interest rates.

Leading economic indicators in India

Source : Bloomberg