The 3 must-know news stories of the week:

- Joe Biden under pressure from his own party

- Powell: The US economy is too strong to justify such high deficits

- Oil supported by escalating geopolitical tensions and supply concerns with the start of hurricane season

Joe Biden under pressure from his own party

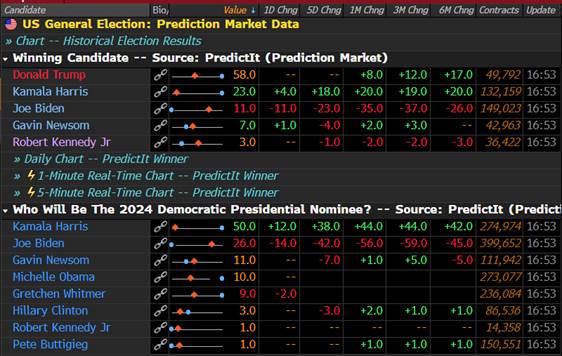

Joe Biden is under increasing pressure to abandon his reelection bid after a Democratic legislator publicly called for him to withdraw from the presidential race. Lloyd Doggett, a Democratic congressman from Texas, was the first legislator from the president’s party to publicly urge Biden to step aside, citing the risk of a Donald Trump victory in November. Jared Golden, a Democratic congressman from Maine, and Marie Gluesenkamp Perez, a Democratic congresswoman from Washington state, have also expressed doubts about Biden’s chances of winning, citing his performance during the debate against Trump.

Democratic governors plan to meet with Biden to discuss his candidacy, reflecting growing concern within the party about the president’s age and physical fitness. This concern has been heightened after his performance in last week’s debate against Trump. A CNN poll revealed that Biden’s approval rating among voters dropped to a historic low after the debate, and that Kamala Harris, his vice president, would be more competitive against Trump.

Among the Democratic governors who might attend the meeting, Gavin Newsom of California and Gretchen Whitmer of Michigan are considered potential candidates to replace Biden if he steps down. JB Pritzker, governor of Illinois and co-chair of Biden’s reelection campaign, will also be present. The CNN poll showed that three-quarters of voters, including more than half of Democrats and Democrat-leaning independents, believe the party would have better chances with a new candidate. Trump leads Biden by six points among registered voters nationwide.

Nancy Pelosi, former Democratic Speaker of the House, acknowledged that questions about the president’s health are legitimate, while Jim Clyburn, a staunch Biden supporter, indicated he would back Kamala Harris if Biden withdrew. Democratic Senator Sheldon Whitehouse also expressed concerns about the president’s condition. White House Press Secretary Karine Jean-Pierre acknowledged that Biden had a bad night during the debate but emphasized his experience and track record. She added that the White House team understood voters’ concerns..

Prediction on the US Presidential Election

Source : Bloomberg

Powell: The US economy is too strong to justify such high deficits

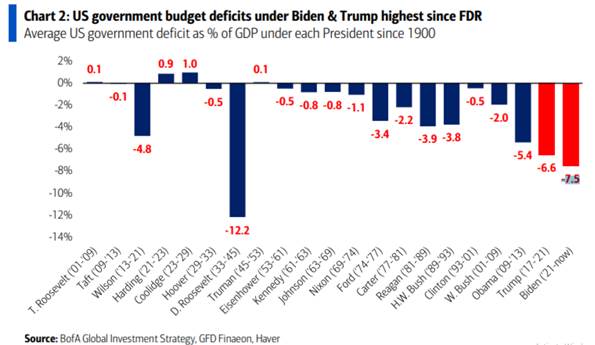

Jerome Powell, chairman of the Federal Reserve, warned that the US economy is too strong to justify such high deficits and urged Washington to address its fiscal imbalance “sooner rather than later.” Speaking at the European Central Bank’s conference in Sintra, Portugal, Powell stated that the current level of debt is sustainable, but the current trajectory is not. He criticized the Biden administration for taking excessive risks by maintaining a high deficit during a period of full employment, noting that the unemployment rate has not exceeded 4% for more than two years.

Despite rapid economic growth compared to other major advanced economies since the Covid-19 pandemic, the US fiscal deficit remains larger than that of its G7 counterparts, even with unemployment near record lows. The Congressional Budget Office projects the deficit will reach $1.9 trillion this year, or 7% of GDP, and that the debt-to-GDP ratio will hit 122% by 2034.

Powell also welcomed the recent drop in inflation to 2.6% in May as “very good progress,” but indicated that the Fed wants to see more evidence of easing price pressures and a cooling labor market before beginning to cut interest rates. Borrowing costs in the US have slightly decreased in response.

Governments have increased their debt issuance in recent years to support households and businesses in the face of the pandemic and the energy crisis following Russia’s invasion of Ukraine. But central bankers now fear that politicians are too slow to cut spending, which could threaten financial stability and keep inflation high.

Christine Lagarde, president of the ECB, partially endorsed Powell’s remarks, stressing the need for EU governments to adhere to the bloc’s debt rules by reducing their deficits while encouraging them to support growth and productivity through targeted investments and structural reforms.

Roberto Campos Neto, governor of Brazil’s central bank, added that high levels of debt and borrowing costs are starting to cause volatility in emerging markets, calling for a stable debt trajectory in the future.

Source : Bofa

Oil supported by escalating geopolitical tensions and supply concerns with the start of hurricane season.

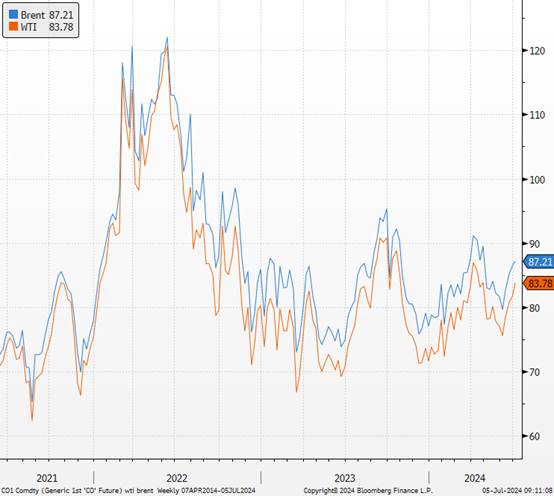

Oil prices have hit a two-month high as the summer driving season begins and Middle East tensions resurface. Brent, the international benchmark, climbed to $86.92 a barrel on Wednesday, having gained about $10 since early June. US West Texas Intermediate reached $83.53 before slightly retreating.

According to a weekly report from the US Energy Information Administration (EIA), commercial crude oil inventories fell by 12.2 million barrels from the previous week, as refineries increased production to meet a record summer travel season. Inventories are now about 4% below the five-year average for this time of year. Oil imports increased by 9% from the previous year, and gasoline stocks fell by 2.2 million barrels, standing 1% below the five-year average.

Demand for gasoline and jet fuel is expected to surge in the coming weeks. The American Automobile Association projects that the July 4th holiday week will see over 7 million people travel, the highest number since before the Covid pandemic.

Oil supplies have also tightened. OPEC+ has cut exports, partly due to strong energy demand caused by the heatwave in the Middle East. Oil prices had dropped in early June after OPEC+ announced a gradual reintroduction of 2.2 million barrels of cut production starting in September.

However, Saudi Arabia has assured that production increases will depend on market conditions, helping prices rebound. Concerns about a potential conflict between Israel and Hezbollah, along with bets on further oil price increases beyond $90 a barrel, have also contributed to the price rise. Fears that Hurricane Beryl could disrupt production in the Gulf of Mexico before the July 4th holiday have eased.

Prix du pétrole

Sources : Bloomberg, Richelieu Group

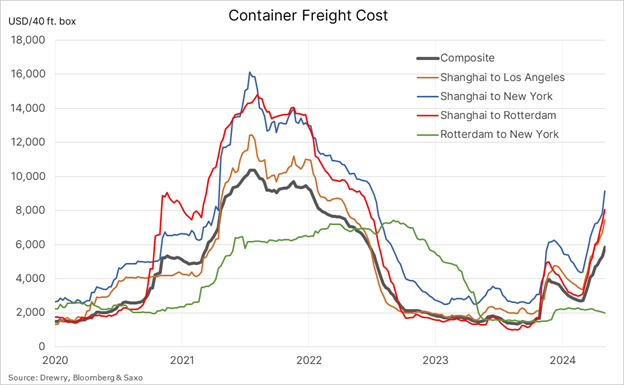

Chart of the Week

Source : X