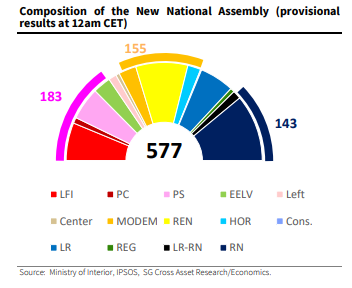

No party or coalition has managed to secure an absolute majority in the National Assembly (289 seats out of 577).

The surprise is real with the arrival of the New Popular Front (NFP) at the top, albeit far from an absolute majority. A new period of uncertainty opens regarding the French policy that will be pursued.

The coming weeks will be crucial regarding the formation of the future government. No clear combination allows for an absolute majority. A “very broad centrist” bloc is still mathematically possible, but given the stances of parties refusing compromises at this stage, and the parties forming “Ensemble!” refusing to collaborate with both the “Rassemblement National” (RN) and “La France insoumise” (LFI), discussions are likely to drag on before the French President decides who to ask to form a government.

Our central scenario bets on a government seeking compromises on a case-by-case basis (whether technocratic or led by a political figure), without an absolute majority. This should prevent the implementation of significant expenditures, but also significantly complicate the ability to reduce the budget deficit. The absence of an absolute majority confirms that the balance point of what can be voted on in the coming months is likely center-left.

The risk of a break with the European Union institutions seems to be ruled out.

Regarding the future Prime Minister, the appointment will be up to the President of the Republic, who usually chooses a member from the Assembly majority, but nothing obliges him to do so. The appointment of the Prime Minister is not subject to a confidence vote in the National Assembly either.

If the different parties forming the broad coalition government fail to agree, Emmanuel Macron could appoint a “technical” government (economists, senior officials, diplomats, public figures). However, it will need to reach a consensus to avoid a no-confidence motion that would force it to resign.

In any case, until another government is appointed, the current one led by Gabriel Attal can remain in office only to handle current affairs and ensure state continuity.

The 2025 budget, the next major step

The next government will face two major deadlines at the start of the school year: the construction of the 2025 Finance Bill and the excessive deficit procedure opened by the European Commission. A coalition government will have to make compromises, which could be rather expensive given the weight of left-wing parties, to validate a budget for 2025. France’s last stability program forecasted a deficit reduction from 5.5% of GDP in 2023 to 5.1% in 2024, with an even greater adjustment to 4.1% in 2025. All these targets are now out of reach. A target of 5% for 2025 would be considered a success.

In any case, France risks facing another downgrade of its sovereign rating by the main rating agencies in the coming quarters. Meanwhile, financial markets will continue to act as a reminder to limit overly expensive and unfunded policies.

Impacts on financial assets

In this context, we remain cautious regarding French sovereign rates and OAT-Bund spreads. The spreads of peripheral European countries with major budgetary imbalances will also remain higher than in the past (France/Italy). Such a scenario would result in an OAT-Bund spread of around 70/80 basis points, a structurally higher level than before the dissolution of the National Assembly. A phase of tension with the European Commission and new downgrades of the French sovereign rating should occur in 2025 due to the likely tensions related to budget definition. We favor countries whose public finance management reassures, with a willingness to comply with European budgetary objectives, such as Portugal or Spain.

The euro should stabilize. The range of 1.07-1.12 is not currently in question thanks to the cyclical dynamics in the eurozone and structural factors (primary surplus) that offset the interest rate differential.

EURO versus USD

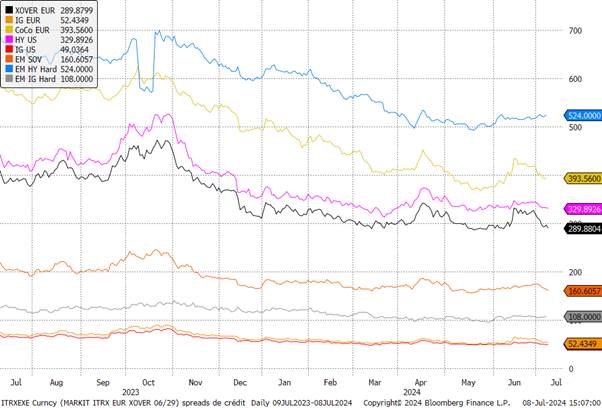

In the credit sector, the spread of French issuers should remain slightly above its previous level. Concerns remain contained and should mainly affect, besides financials (perception linked to the spread and sovereign risk), groups particularly exposed to the French economic dynamics, to an increased taxation risk or margin pressure. We maintain our positive view on credit, whose performance will materialize through carry. The strengthening of the cyclical rebound in Europe and the continued monetary easing by the ECB are likely to keep spreads relatively stable, including in the High Yield segment. In the Investment Grade segment, non-financial hybrids still seem attractive compared to non-financial senior debt (spread differential for equivalent issuer credit risk). The senior financial spread is also attractive compared to senior non-financials, with a significantly higher composite index rating. We remain cautious on the lowest ratings.

Credit Spreads

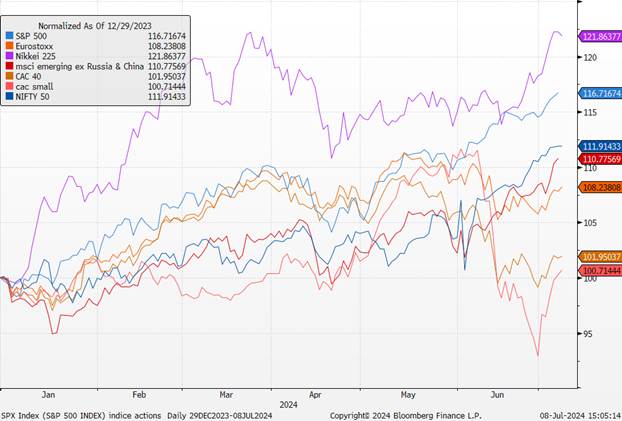

In the equity markets, there is a risk of rising costs (including through tax pressure), but without justifying the current level of French equity indices. However, in the short term, although the market may be reassured by the fact that the RN did not obtain an absolute majority, the good results of the NFP can cause some nervousness, which could lead to risk-averse behavior. We remain negative on the banking sector in France in the short term.

Equity Index

In the medium term, the center of gravity of the National Assembly is leaning more to the left than the previous one. Even if an interim coalition government emerges, major reforms seem excluded and deficit reduction will be a challenge, so uncertainties will remain, limiting the prospects for significant risk premium compression.