- FED: an almost certain rate cut in September

- French legislative elections: The least bad scenario

- Chinese inflation is not reassuring

FED: an almost certain rate cut in September

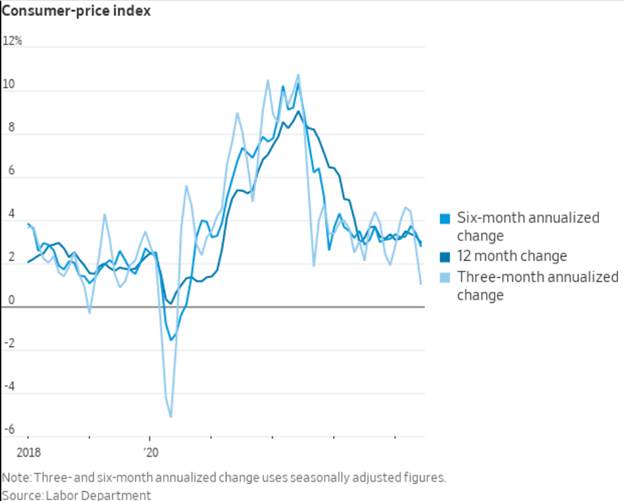

Inflation in the United States fell faster than expected to 3% in June, surpassing economists’ forecasts (3.1%) and falling below May’s 3.3%, leading investors to anticipate interest rate cuts. Treasury yields fell as traders increased their bets on two interest rate cuts this year, and President Joe Biden hailed these figures as a sign of significant progress in the fight against inflation.

According to LSEG data, the probability of a cut in September rose to 100% after the release of CPI data, up from 72% previously. The Federal Reserve, led by Jay Powell, is seeking further evidence that price pressures are easing in the world’s largest economy before proceeding with a rate cut. Powell stated that the central bank needed “more good data” before it could confidently lower interest rates.

Despite market expectations earlier this year of a possible series of seven interest rate cuts in 2024, the Fed has so far kept its benchmark rate in a range of 5.25 to 5.5%, the highest level since 2001. BLS data also showed that consumer prices fell by 0.1% on a monthly basis, compared to economists’ expectations of a 0.1% increase. It was the first time since 2020 that monthly consumer prices had declined. Gasoline prices fell by 3.8% during the month, while the rise in housing costs slowed, both contributing to the overall decline in inflation.

The latest data reinforces Powell’s message to U.S. lawmakers this week that the U.S. economy is no longer “overheating,” with the labor market showing more signs of cooling. Powell emphasized that the Fed’s rate decisions would be made “meeting by meeting” to avoid over-tightening the economy, making a September cut almost certain.

Sources: X, WSJ

French legislative elections: The least bad scenario.

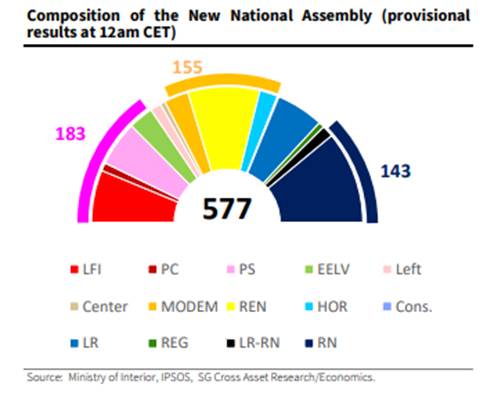

No party or coalition managed to obtain an absolute majority in the National Assembly (289 seats out of 577). The surprise is real with the New People’s Front (NFP) coming in first, albeit far from an absolute majority. A new period of uncertainty opens regarding the French policy to be pursued. The coming weeks will be decisive regarding the formation of the future government. No clear combination allows for an absolute majority. A “very broad centrist” bloc is still mathematically possible, but given the parties’ current stances against compromises, and the parties forming “Ensemble!” refusing to collaborate with both the “National Rally” (RN) and “Unsubmissive France” (LFI), discussions are likely to drag on before the French President decides who to ask to form a government. Our central scenario predicts a government seeking case-by-case compromises (whether technocratic or with a political figurehead), without an absolute majority. This should prevent significant spending measures but also greatly complicate the ability to reduce the budget deficit. The lack of an absolute majority confirms that the balance point for what can be voted on in the coming months is probably center-left.

The risk of a break with the European Union institutions seems averted. As for the future Prime Minister, the appointment will be up to the President of the Republic, who traditionally chooses a member from the National Assembly majority, but he is not bound to do so. The Prime Minister’s appointment is not subject to a confidence vote in the National Assembly. If the various parties forming the broad coalition government fail to agree, Emmanuel Macron could appoint a “technical” government (economists, senior officials, diplomats, public figures). However, this government will need to reach a consensus to avoid a no-confidence motion that would force it to resign.

In any case, as long as another government has not been appointed, Gabriel Attal’s current government can remain in office only to handle current affairs and ensure the continuity of the state.

The 2025 budget, the next major step The next government will face two major deadlines in the fall: the construction of the 2025 Finance Bill and the excessive deficit procedure opened by the European Commission. A coalition government will need to make compromises, which are likely to be rather costly given the weight of the left-wing parties, in order to approve a budget for 2025. France’s latest stability program forecast a deficit reduction from 5.5% of GDP in 2023 to 5.1% in 2024, with an even larger adjustment to 4.1% in 2025. All these targets are now out of reach. An objective of 5% for 2025 would be considered a success.

In any case, France is likely to face another downgrade of its sovereign rating by the main rating agencies in the coming quarters. Meanwhile, financial markets will continue to play their role as a reminder force to limit excessively and unfunded policies.

Chinese inflation is not reassuring

In June, Chinese inflation slowed slightly and more than expected (to +0.2% year-on-year vs. +0.4% expected and +0.3% in May), while core inflation remained stable (at +0.6% year-on-year). On the producer price index (PPI) side, the decline was less pronounced (at -0.8% year-on-year in June as expected vs. -1.4% in May) but still maintained a deflationary trend. Weak prices are explained by weak domestic demand as consumer confidence remains durably depressed due to the difficulties of the Chinese economy (real estate crisis, youth unemployment). While the People’s Bank of China has more room for maneuver to strengthen its monetary easing in this context, the weakness of the yuan combined with the deterioration of the banking sector and the liquidity trap situation limit the authorities’ willingness to act. Indeed, the Chinese currency has depreciated since the beginning of the year against the dollar.

Meanwhile, the combination of weak activity, the real estate market crisis, formerly a growth driver, and high debt, poses a risk for the state to recapitalize banks whose profitability has largely deteriorated, with the most significant being public. Without targeted stimulus on household demand, a return to more dynamic growth remains excluded, especially as China faces increasingly protectionist trade policies from the United States and the European Union, which will weigh on its exports.

Inflation in China

Sources : Bloomberg, Richelieu Group

Chart of the week

Sources : Bloomberg, X