- The European Central Bank maintains Its main interest rate at 3.75%

- Semiconductor Stocks Drop After Trump’s Comments and Rumors of Trade Restrictions with China

- Renewed Confidence for the Fed

The European Central Bank maintains Its main interest rate at 3.75%

The European Central Bank (ECB) has maintained its main interest rate at 3.75%, with President Christine Lagarde stating that the decision on a possible rate cut in September is “totally open” while downplaying concerns about persistent inflationary pressures. The ECB Governing Council’s decision to keep its benchmark deposit rate unchanged was in line with market expectations, amid concerns that geopolitical uncertainty and rapid wage growth would continue to drive prices up. “What we do in September is totally open and will be determined based on all the data we receive,” Lagarde said at a press conference following Thursday’s decision. She added that the Governing Council, which had cut rates in June from a record 4%, had agreed not to provide guidance on future rate decisions.

The ECB stated that it wants more evidence that inflation, which slowed to 2.5% in June after peaking at 10.6% in 2022, is still on track to reach its 2% target by the end of next year. It indicated that recent data “largely support” this scenario, downplaying signs that services inflation could remain high. “Although some measures of underlying inflation increased in May due to exceptional factors, most measures were either stable or down in June,” the Governing Council noted. The eurozone is facing 5% wage growth, with workers demanding compensation for the worst inflation crisis of this generation. However, Lagarde stated that recent wage increases were “not a surprise” and that wages should increase more slowly in 2025 and 2026.

While inflation in the eurozone follows a “disinflationary trajectory,” the ECB will need to maintain high rates. “We will remain in restrictive territory as long as necessary to achieve the target, and we are not yet at the target,” Lagarde stressed. She added that the eurozone economy is expected to have grown at a “slower pace” in the second quarter compared to the 0.3% expansion in the first three months of this year. Growth risks are “tilted to the downside.” ECB members are also concerned about political turmoil, particularly following this month’s election result in France, which raised doubts about whether a new high-spending government in the region’s second-largest economy would drive up inflation. Lagarde emphasized that all eurozone countries will need to adhere to the EU’s new fiscal rules, which require high-debt countries like France and Italy to reduce their budget deficits to 3% over time.

“The set of rules must be implemented and respected,” she said.

She added that there would be no question of changing the 2% target or considering publishing policymakers’ rate expectations in a “dot plot” like the U.S. Federal Reserve.

Sources : Bloomberg, Richelieu Group

Semiconductor Stocks Drop After Trump’s Comments and Rumors of Trade Restrictions with China

Adding to concerns about a sector that has been a driver of gains in the U.S. stock market this year, semiconductor stocks fell sharply after former U.S. President Donald Trump said Taiwan should fund its own defense and reports emerged that the U.S. was considering stricter trade restrictions on chips with China. The tech-heavy Nasdaq Composite Index fell 2.8% on Wednesday, marking its worst day since December 2022. Investors had become accustomed to the relentless good news from tech stocks, so any negativity came as a surprise and triggered panic in the markets. Chipmakers led the declines, with Nvidia down 6.6% and AMD falling 10.2%. In Europe, ASML had its worst day since 2020, dropping 11% following a Bloomberg report that the Biden administration was considering stricter trade restrictions on sales to China by companies, including the Dutch chipmaking equipment manufacturer. This rout wiped out $496 billion in value from the Philadelphia Semiconductor Index (Nvidia, TSMC, and Intel).

These movements reflect increased investor focus on political risk, much higher chances over the past three weeks of Trump winning the U.S. elections, and a continuation of the “very aggressive trading rotation” from large caps to smaller companies. The enthusiasm around AI has led to huge gains in stock prices for companies like Microsoft and Nvidia this year. However, in recent weeks, some analysts and investors have begun to express concerns about how quickly large tech companies will see returns on the tens of billions of dollars they are investing in AI infrastructure. Christophe Fouquet, CEO of Dutch company ASML, a key supplier of high-end chipmaking equipment, said Wednesday that he was confident in the chip industry’s recovery next year, largely due to AI, but admitted there was “a lot of uncertainty” about its pace and shape.

Examples of Semiconductor Stocks (Base 100 on 31/12/2023)

Sources : Bloomberg, Richelieu Group

Renewed Confidence for the Fed

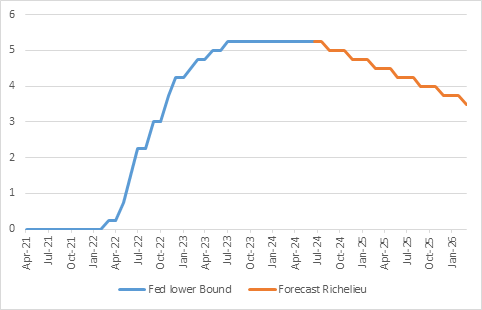

In his first remarks after the encouraging release of the June CPI inflation report, Fed Chairman Jerome Powell expressed greater confidence in the disinflation trajectory towards the central bank’s 2% target. While Powell highlighted the positive direction of the last three inflation figures, he did not mention a timeline for rate cuts. However, given the slowing inflation and easing job market, he stressed the importance of considering the Fed’s dual mandates, related to price stability and full employment. He noted that the risks related to inflation and unemployment were now more balanced.

The U.S. economic activity continues to slow down. The Fed’s Beige Book, which presents the economic developments in the 12 regional Fed districts, indicated that activity had stagnated or declined in five districts (three more than in the last report). The Beige Book’s phrase, “Expectations for the future of the economy are for slower growth over the next six months due to uncertainty related to the upcoming elections, domestic policy, geopolitical conflicts, and inflation,” summarizes the current situation and the Fed’s mindset. Prices and wages continue to evolve modestly, as does employment, with some districts indicating slight improvement in labor supply conditions, labor turnover having decreased, reducing the demand to find new workers. Businesses anticipate continued slowdown in their activity over the next six months due to uncertainty related to the presidential election, domestic policy, geopolitical tensions, and inflation.

Generally, Fed members reiterate the need to wait longer to observe the favorable evolution of statistics before proceeding with a rate cut. We do not expect the Fed to cut interest rates at its next meeting at the end of July. The most important question for this meeting is how much officials are preparing the ground for a cut in September.

Federal Reserve Rate

Sources : Bloomberg, Groupe Richelieu

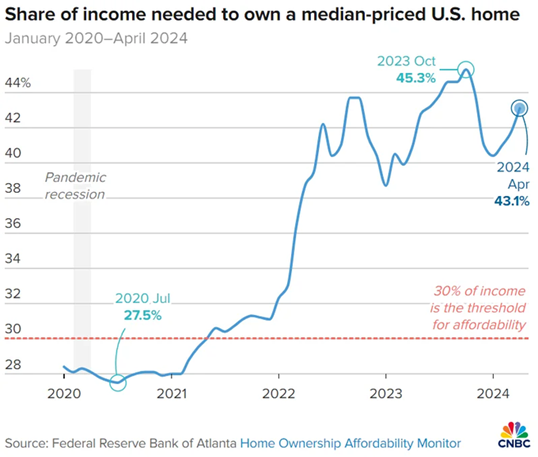

Chart of the Week

For the average American family, it takes about 43.1% of their income to make a purchase with a mortgage loan, given current housing prices and rates. This is a significant increase from the 27.5% in July 2020.