- The Fed is Almost Ready

- Japan: The BoJ Surprises by Announcing a New Rate Hike in Addition to its Asset Purchase Reduction Plan

- China Faces Persistent Economic Challenges: Slowing Growth and Stimulus Measures

- Chart of the Week: Normalization of Job Openings in the US

The Fed is Almost Ready

At the conclusion of its monetary policy meeting, the Fed, in a widely expected decision made unanimously by its members, decided to keep its target interest rate range unchanged. The central bank, through its chairman, Jerome Powell, nevertheless left the door wide open for a rate cut in September, a scenario we agree with and which has contributed to the decline in US sovereign rates. The American central bank is now concerned with rising unemployment, rather than just inflation. “If conditions are met, the rate cut could occur as early as the September meeting,” said the Fed chairman. “The general feeling within the committee is that the economy is approaching the moment when it will be appropriate to lower our rates,” he added. This rate cut would be the first since March 2020 when the Covid-19 crisis abruptly halted economic activity, prompting the Fed to bring the cost of borrowing down to zero.

The FOMC said it was “attentive to the risks weighing on both aspects of its mandate,” namely ensuring stable prices and full employment, its officials noted in a statement, mentioning that the unemployment rate “remains low.” These comments mark a significant shift, as in its previous statement, the FOMC only mentioned inflation risks. While the Fed fears beginning to cut rates too soon, which could spark another surge in inflation, it also aims not to do so too late, which could increase unemployment.

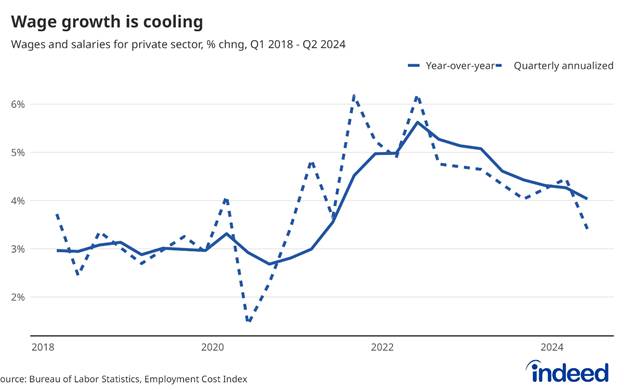

The Fed had raised its main policy rate to the current level, the highest since 2001, to slow down economic activity and curb the high inflation that, in the United States and elsewhere in the world, accompanied the post-Covid economic recovery. This policy has borne fruit, and Jerome Powell has praised “a truly significant drop in inflation.” After a rebound at the beginning of 2024, consumer price increases have resumed their downward trend toward the Fed’s target of 2% annually. They fell to 2.5% year-on-year in June, according to the PCE index, the central bank’s preferred measure.

At the end of August, the Fed will hold its annual central bankers’ symposium in Jackson Hole, a mountain resort in Wyoming. Jerome Powell usually delivers a speech there and could provide more precise information on the anticipated rate cut at the next meeting on September 17 and 18. This meeting will be especially important as it will be the last before the US presidential election on November 5. Republican White House candidate Donald Trump, last February, accused the Fed—independent of political power—of wanting to lower rates to help the Democrats win. “We will never try to make decisions based on the outcome of an election that has not yet taken place,” Jerome Powell said on Wednesday, emphasizing that any Fed decision “before, during, or after the elections, would be based on data, perspectives, and risk balance and nothing else.”

“We never use our tools to support or oppose a political party, a political leader, or a political outcome,” he assured.

We believe that upcoming inflation statistics (for July and August) will continue the trend of recent readings, and the job market will not show any signs of renewed tensions. We think this will be sufficient in the Fed’s eyes to lower its target rates by 25 basis points. We expect this cut to remain more gradual (with a decrease of 25 basis points per quarter until mid-2026). We anticipate two cuts of 25 basis points in September and December this year, while future curves still indicate three rate cuts this year. (See Market Flash: click here)

Sources : X

Japan: The BoJ Surprises by Announcing a New Rate Hike in Addition to its Asset Purchase Reduction Plan

The BoJ decided to raise its key rate by 15 basis points to 0.25%, breaking away from its previous policy of near-zero rates. This decision, made with a majority of 7 voting members out of 9, was driven by the need to control inflation, which has exceeded the 2% target for 27 consecutive months. Despite a slight economic contraction in the first quarter, the BoJ believes that the economy and prices are evolving “in line with its forecasts.” Kazuo Ueda, the BoJ governor, emphasized that this decision was influenced by inflationary risks linked to the yen’s weakness. The central bank stated that it would continue to raise rates if the economy and inflation evolve according to its forecasts. Although the BoJ has already ended its negative interest rate policy in March, it maintains a cautious and conditional approach regarding further hikes.

In addition to raising rates, the BoJ announced a gradual reduction of its sovereign bond purchase program. Monthly purchases, currently set at 6 trillion yen, are expected to be halved by the first quarter of 2026, reaching approximately 3 trillion yen. This reduction mainly focuses on short-term bonds (3 to 5 years), while purchases for maturities over 10 years will remain stable. The BoJ has opted for a gradual approach to minimize disruptions in the Japanese sovereign bond market. A general review of this quantitative tightening is planned for the monetary policy committee in June 2025.

The BoJ’s decision comes in a context of persistent yen weakness, which reached record levels of 150.15 yen against the dollar after the announcement. This depreciation was mainly attributed to the interest rate gap between Japan and the United States, where the Federal Reserve maintains higher rates.

Inflationary pressures due to the importation of energy and food products, exacerbated by the yen’s weakness, also played a key role in the BoJ’s decision.

(See Market Flash: click here). In response, the Japanese government has also taken measures to support the currency, including market interventions. The BoJ slightly revised its economic forecasts, anticipating modest growth of 0.6% for the fiscal year 2024, down from a previous forecast of 0.8%. However, it expects growth to stabilize at 1% for 2025 and 2026. Regarding core inflation, the BoJ expects stabilization around 2%, but forecasts for the fiscal year 2026 have been raised to 2.1%.

USD YEN

Sources : Bloomberg, Richelieu Group

China Faces Persistent Economic Challenges: Slowing Growth and Stimulus Measures

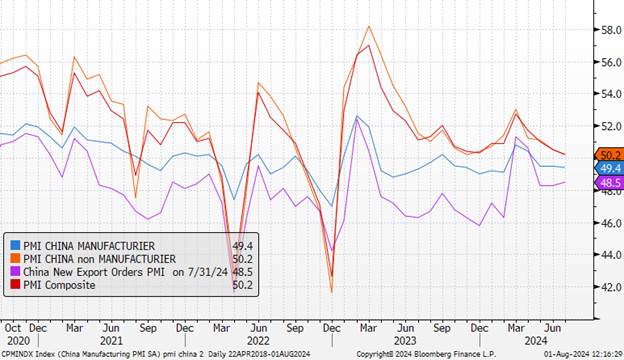

China continues to face significant economic challenges, marked by a persistent decline in manufacturing activity and weakened domestic demand. The recent releases of the Purchasing Managers’ Index (PMI) and the decisions of the Communist Party of China’s Politburo highlight a difficult economic situation that requires thoughtful policy interventions to stimulate growth.

In July, Chinese manufacturing activity contracted for the third consecutive month. According to official PMI indices, the manufacturing index remained below 50, standing at 49.4, indicating a contraction compared to the previous month. This situation reflects weak domestic demand, exacerbated by a persistent real estate crisis and a high unemployment rate. The services sector also shows signs of stagnation. The non-manufacturing PMI index barely maintained growth territory at 50.2, down from 50.5 in June. This general economic weakness is attributed to factors such as declining consumer confidence, slow job recovery, and persistent structural problems in the real estate sector.

In response to these challenges, the Chinese Politburo expressed its intention to further support domestic consumption. During its recent meeting, the CPC emphasized the need to increase household incomes and strengthen domestic demand. However, despite these intentions, no concrete measures were announced, and skepticism persists regarding the effectiveness of these initiatives without a clear and robust stimulus plan. The Chinese government has implemented targeted measures to encourage the purchase of goods such as automobiles and home equipment, but these efforts have not been enough to significantly revitalize demand. Moreover, budgetary constraints, such as significant local public debt, limit Beijing’s ability to launch a large-scale stimulus program.

The real estate sector, a pillar of the Chinese economy, remains a major concern. The government is looking to speed up the sale of unsold homes and complete ongoing construction. However, these measures have been deemed insufficient by many economists, who call for structural reforms to restore investor confidence and boost consumption.

Furthermore, geopolitical tensions with the United States and the European Union add an additional layer of complexity. The Biden administration is considering imposing new restrictions on the export of semiconductors to China, which could hinder the country’s technological development and exacerbate trade tensions.

Economic growth forecasts for 2024 remain uncertain, with an ambitious target of 5% that many consider difficult to achieve without increased support for consumption and investment. The Politburo emphasized the importance of maintaining a stable currency and reducing financing costs, but the impact of these measures could be limited without a large-scale rate-cutting cycle. Efforts are also underway to diversify the economy by focusing on emerging industries such as electric vehicles and green energy. However, these sectors face overcapacity issues that complicate their potential role in stimulating the economy.

Chinese Economic Indicators

Sources : Bloomberg, Richelieu Group

Graph of the week

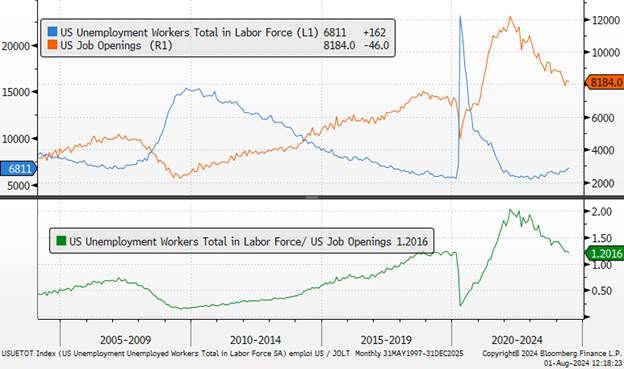

Job openings and hiring data indicate a labor market that continues to loosen: There were 1.2 openings for every unemployed person in June, the lowest in the post-pandemic period. The number of job openings continues to decrease.

Sources : Bloomberg, Richelieu Group